In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)05/13 Report--

After filing for bankruptcy, Reading is embroiled in lawsuits.

On May 12, "Automotive Industry concern" checked the public information from the sky and learned that Redding Automobile Group Co., Ltd. (hereinafter referred to as "Reading Automobile") newly added information about the person subject to execution, totaling more than 19.25 million yuan. Most of the related cases are sales contract disputes, and the enforcement courts are all Changle County people's Court.

As of press time, there were 26 pieces of information about the person subject to execution of Redding, with a total amount of 92.691403 million yuan.

According to Tianyan check information, Reading Automobile Group Co., Ltd. is located in Weifang City, Shandong Province, established in October 2012. it was formerly known as "Shandong Maillard Energy Power Technology Co., Ltd." and its legal representative is Wang Dejin. The registered capital and paid-in capital are both 100 million yuan, which is mainly engaged in the automobile manufacturing industry. According to SkyEye, Li Guoxin, the sponsor of Reading Automobile Group Co., Ltd., stepped down as a legal person, executive director and general manager of Bidwen Holdings Group Co., Ltd in December 2020.

In 2018, in the context of the general trend of new energy, Reading began to shift from low-speed electric vehicles to the new energy car racetrack. Now, it is clear that Reading has failed to "integrate" into the new energy track.

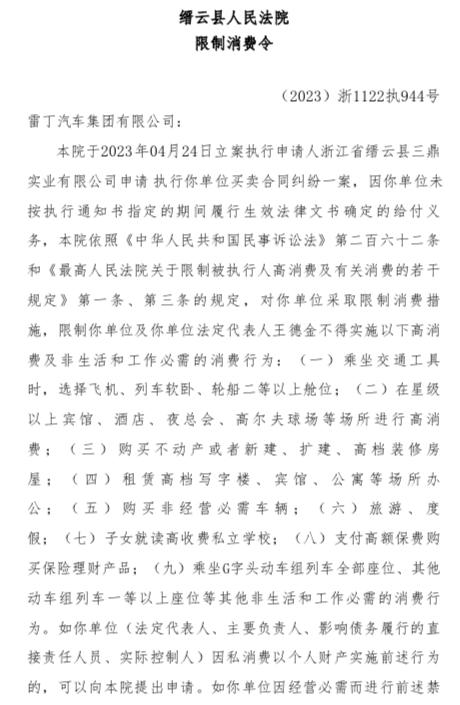

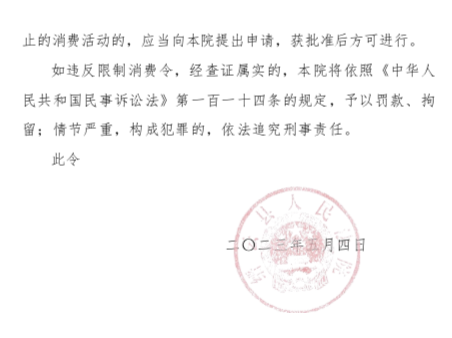

On May 5th, Reading Motor filed for bankruptcy reorganization, the case number is (2023) Lu 0725 Breaking Shen No. 1, and the type of case is "bankruptcy examination case". Both the applicant and the respondent are Reading Automobile Group Co., Ltd. the handling court is the people's Court of Changle County, Weifang City, Shandong Province. At the same time, Reading Motors and company legal person Wang Dejin are also restricted from high consumption. In response to the above news, Redding Automobile related sources told the media: "there is no response at present." Some media contacted Li Guoxin, founder of Reading Motors, for further verification, but the tone of the phone prompt was "the subscriber you dialed is temporarily unavailable."

From the beginning of the year when the founder revealed that the capital chain was broken to now filing for bankruptcy, Reading left chicken feathers, which not only delayed the settlement of dealer payments but also got caught up in a number of lawsuits, according to media reports. a number of interviewed business owners said that Li Guoxin and his family were already in Canada, but the news had not been officially confirmed.

As of the press release, there were 115court announcements of Reading Motors, most of which were disputes over sales contracts, including 33 announcements from May 1 to June 9, 2023; the total amount of execution was 6.581055 million yuan, and the total amount of outstanding performance was 6.577249 million yuan. The proportion of non-performance is 99.9%. The total amount of legal proceedings is 206.2109203 million yuan, the identity of the plaintiff / appellant is 129678.3 yuan, the identity of the defendant / appellee is 206.081242 million yuan; 10 restrictions on consumption orders; 4 final cases, the total amount of execution of the subject matter is 6,581,055 yuan, the total amount of outstanding performance is 6.572.49 million yuan, the proportion of non-performance is 99.9%.

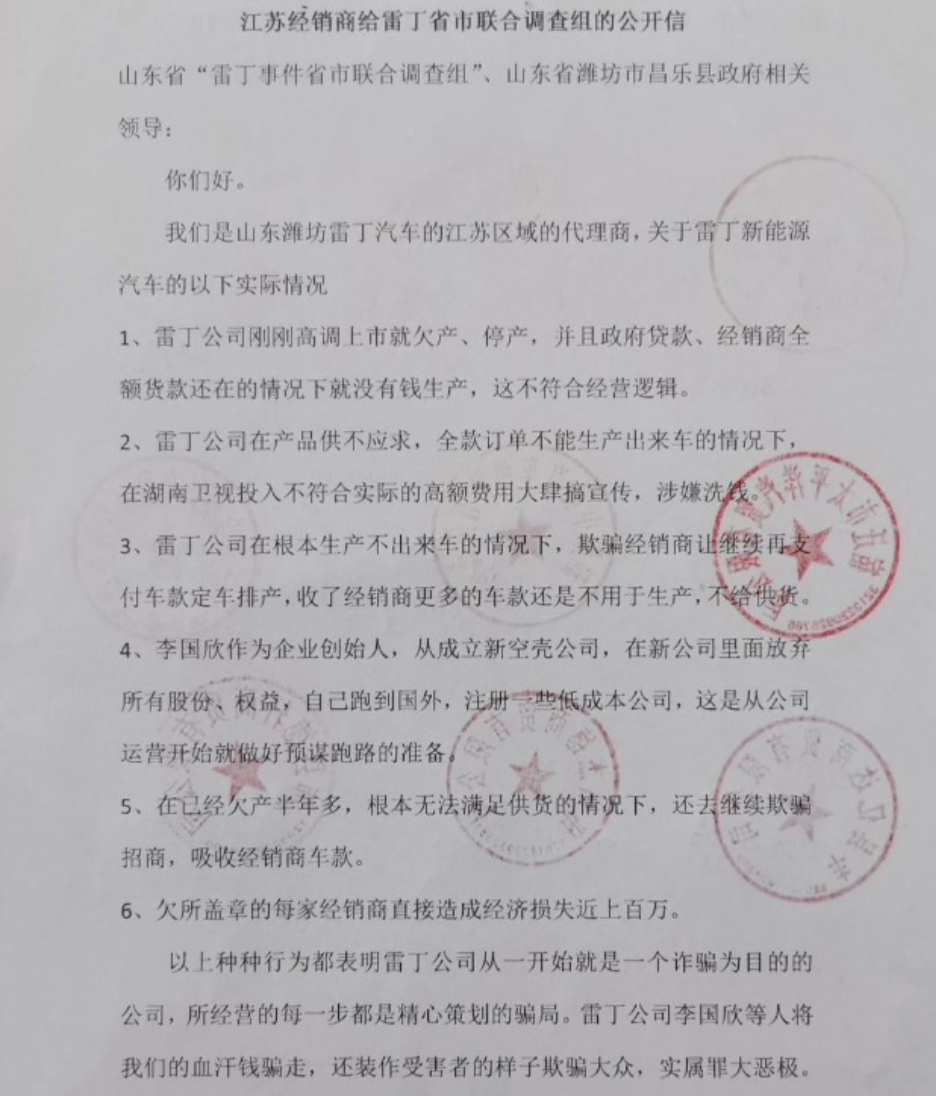

In January this year, the founder of Reading Automobile disclosed on its official Wechat account that the industrial and sales output value of Redding Automobile Group in 2022 was only 2.045 billion yuan, but this content can no longer be viewed. Then in February, Reading was jointly reported by dealers. The Redding dealers jointly signed and sealed the "Open letter from Jiangsu Dealers to the Joint investigation team of Reading Province and City", pointing out that Redding was in production and stopped production soon after it was listed on the market. at the same time, it continues to absorb dealers' money when it is unable to meet the supply, and each dealer with the seal directly causes economic losses of nearly $1 million.

On May 8, 2023, a Reading car dealer in Suqian told the media that after Reading sent more than a dozen Reading Mango cars to it in November 2021, it never received a car and has not received a refund from the Reading car. Another dealer in Xuzhou also said that it has made a cumulative transfer of nearly $1 million to Reading since 2021, and has not received the car, nor can it get the money back. "there were customers who booked cars before, because all the cars were returned."

Now, after a lapse of three months, dealers have failed to wait for the refund of the car, and only bankruptcy news has come.

As a brand transforming from a low-speed electric vehicle to a new energy car track, Reading quickly acquired the production qualification through the acquisition of Shaanxi Qinxing Automobile Co., Ltd. and Sichuan Mustang Automobile Co., Ltd. in 2018 and 2019 respectively. In the year when the acquisition of production qualification was just completed, Reading launched i3, i5 and i9 series pure electric vehicles in a very fast way. Unfortunately, due to lack of competitiveness and other reasons. I series pure electric cars were completely suspended after one year on the market.

In 2021, Reading repositioned its new car and turned to the mini-car market. in May of the same year, Reading's first pure electric mini car, "Reading Mango", with five doors and four seats, was officially launched with a price range of 2.98-54900 yuan, which competed with Hongguang MINIEV and Chery QQ ice cream. In December of the same year, the second model of the Reading mango series, the mango Pro, went on sale in March of the following year. The price range of the car is 3.98-56900 yuan, and it offers a total of 130km and 200km mileage, which mainly competes with the Hongguang MINIEV macaron version.

With the advantage of high performance-to-price ratio of less than 30,000 yuan, the mango series is favored by the market after its launch, with a monthly sales record of 6056, with a cumulative sales of 30400 in 2021, making it into the top 15 of the list of new energy cars. For comparison, Wuling Hongguang MINIEV sold 426000 vehicles in the same year. However, this glorious moment did not last long. In 2022, it was revealed that the middle and senior levels of the company had applied for a voluntary pay cut to survive the crisis, suspected to stop production, both upstream and downstream were initiating "debt recovery" against Reading cars and failing to send cars in arrears with dealers, and so on. This year, the number of new cars insured by Reading was only 7042, down 47.29% from the same period last year, and the market share was 0.13%. Of these, 7024 were sold in Reading Mango and 16 in Reading i3.

According to the China referee Writing website, Reading has so far been ruled to freeze funds many times because of a dispute over the sale and purchase contract. In addition, the total amount of money executed by Reading has exceeded 12 million yuan in November 2022 alone, while in 2023, Reading has become the person subject to execution for a total of 26 times. People in the industry have previously said that if Reading wants to break through the "dilemma", it will either have cost-effective products or leading technology, but it does not have either, and with the announcement of the bankruptcy, Reading has faced a critical moment of life and death.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.