In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)05/13 Report--

The giant group, once hailed as "China's largest car dealer", has released a series of warnings to the outside world that its shares may be terminated.

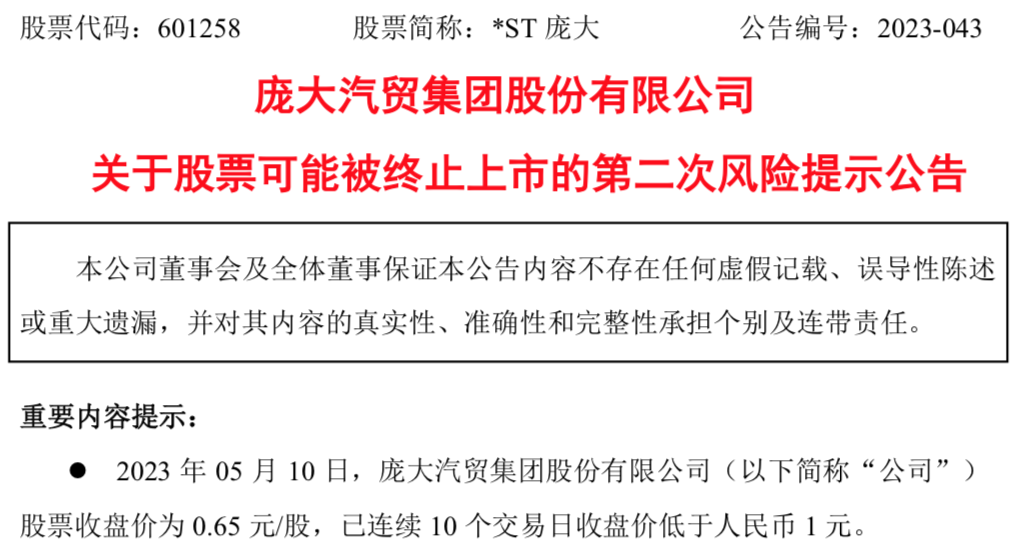

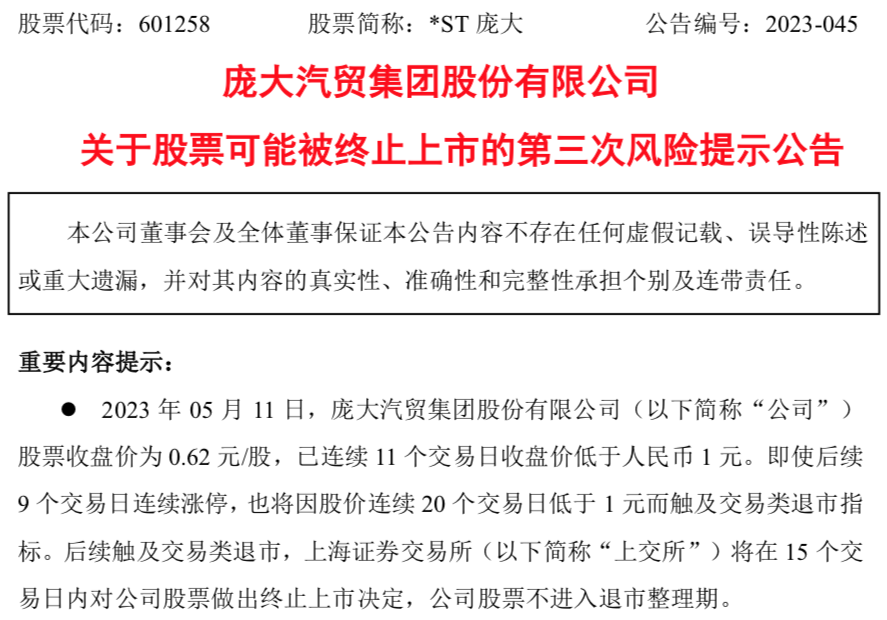

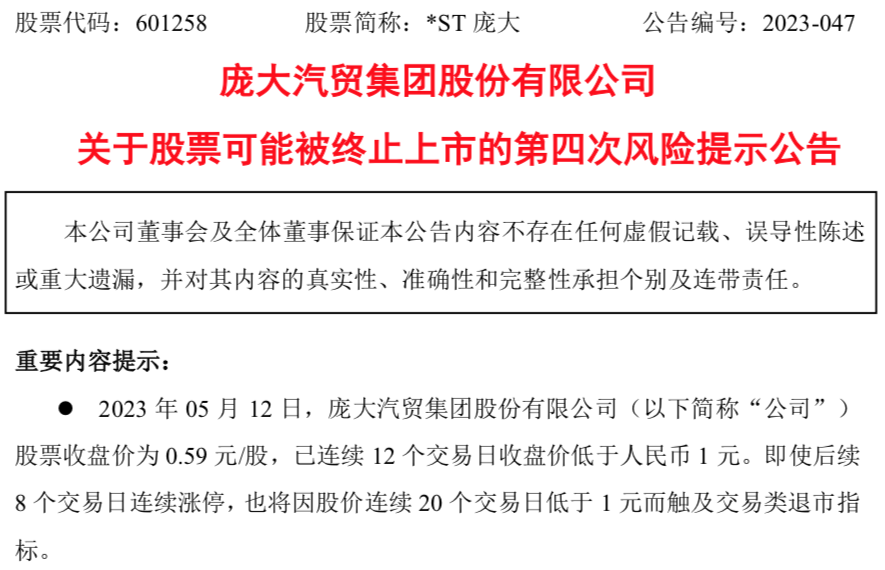

From May 11 to May 13, 2023, the huge Group issued three risk warning announcements on the possible termination of the listing of stocks. They are the second risk warning announcement on the possible termination of the listing of stocks, the third risk warning announcement on the possible termination of the listing of stocks, and the fourth risk warning announcement on the possible termination of the listing of stocks.

The announcement shows that on May 10, the shares of Giant Automobile Trade Group Co., Ltd. (hereinafter referred to as "the company") closed at 0.65 yuan per share, which has been lower than 1 yuan for 10 consecutive trading days; on May 11, the company's shares closed at 0.62 yuan per share, which has been lower than 1 yuan for 11 consecutive trading days. Even if the trading limit rises continuously for the next 9 trading days, it will hit the trading delisting target because the share price is less than 1 yuan for 20 consecutive trading days. When it comes to trading delisting, the Shanghai Stock Exchange (hereinafter referred to as "Shanghai Stock Exchange") will make a decision to terminate the listing of the company's shares within 15 trading days, and the company's shares will not enter the delisting period; on May 12, the company's shares closed at 0.59 yuan per share, which has been lower than 1 yuan for 12 consecutive trading days. Even if the trading limit rises continuously for the next 8 trading days, it will hit the trading delisting target because the share price is less than 1 yuan for 20 consecutive trading days.

In accordance with the provisions of paragraph 1 of Article 9.2.1 of the Stock listing rules, the Shanghai Stock Exchange will decide to terminate the listing of the company's shares in any of the following circumstances, including listed companies that only issue A-shares in the Stock Exchange, the cumulative stock trading volume achieved through the exchange's trading system is less than 5 million shares for 120 consecutive trading days, or the daily closing price of the stock for 20 consecutive trading days is less than RMB 1 yuan.

In fact, as early as April 22, the giant group issued a "risk warning notice on the possible termination of the listing of shares", indicating that the company is at risk of delisting.

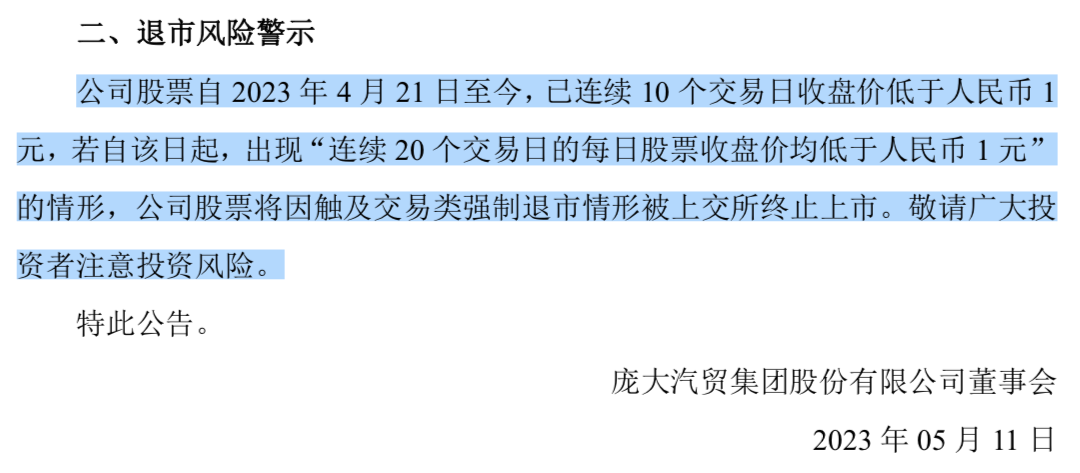

It is not clear whether the giant group has issued three risk warning announcements in succession, which means that the giant group has entered the countdown to delisting. However, the giant group stressed in a "clarification announcement" issued on May 11 that the company's shares have closed below RMB 1 for 10 consecutive trading days since April 21, 2023. In the case of "the daily closing price of the stock for 20 consecutive trading days is less than RMB 1 yuan", the listing of the company's shares will be terminated by the SSE due to the compulsory delisting of the trading class. Investors are invited to pay attention to the investment risk.

In addition, on April 28, CSRC (Special General Partnership) issued the 2022 Annual Audit report, which was unable to express its opinions. According to Rule 9.3.2 (3) of the Stock listing rules, the company's shares will be delisted risk warning. CSRC (Special General Partnership) issued a negative internal control audit report of 2022. According to Rule 9.8.1 (3) of the Stock listing rules, the company's shares will be subject to other risk warnings. The company's stock will implement the delisting risk warning on May 5, 2023, and the short name of the stock will be changed from "huge group" to "* ST huge".

It should be noted that as the first stock of former car dealers, in addition to the depressed share prices, the performance of large groups is also worrying.

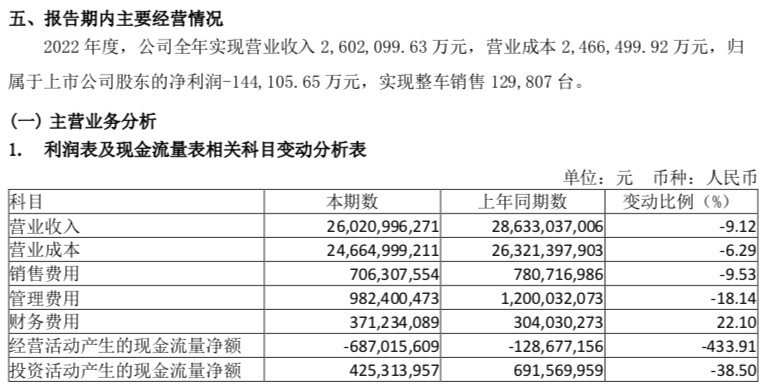

On April 29th, the giant group released its 2022 results. According to the data, the huge group achieved revenue of 26.021 billion yuan in 2022, down 9.12% from the same period last year, with a gross profit margin of 5.21% and a net profit of 1.403 billion yuan. The net cash flow generated by operating activities was a loss of 687 million yuan and the asset-liability ratio reached 53.11%.

Data show that earlier, the giant group is known as the "king of 4S stores", is one of the largest car dealers in China. Tianyan check public information shows that the huge group is located in Tangshan City, Hebei Province, founded by Pang Qinghua, founded in March 2003, with registered capital and paid-in capital of 10.22722507 billion yuan, and the legal representative is Huang Jihong. It is an enterprise mainly engaged in the rental industry, mainly engaged in Mercedes-Benz, FAW Audi, FAW Volkswagen, FAW Toyota and Subaru and other more than 30 passenger car brands.

In April 2011, the giant group was listed on the Shanghai Stock Exchange, with a market capitalization of 36 billion yuan at the beginning of the listing, becoming the "first share of China's automobile trade", which is also the peak of the group's career development. In 2014, the giant group began to sell new energy vehicles, becoming the earliest new energy vehicle dealer in China, but then lost the title of "king of 4S stores" due to poor management.

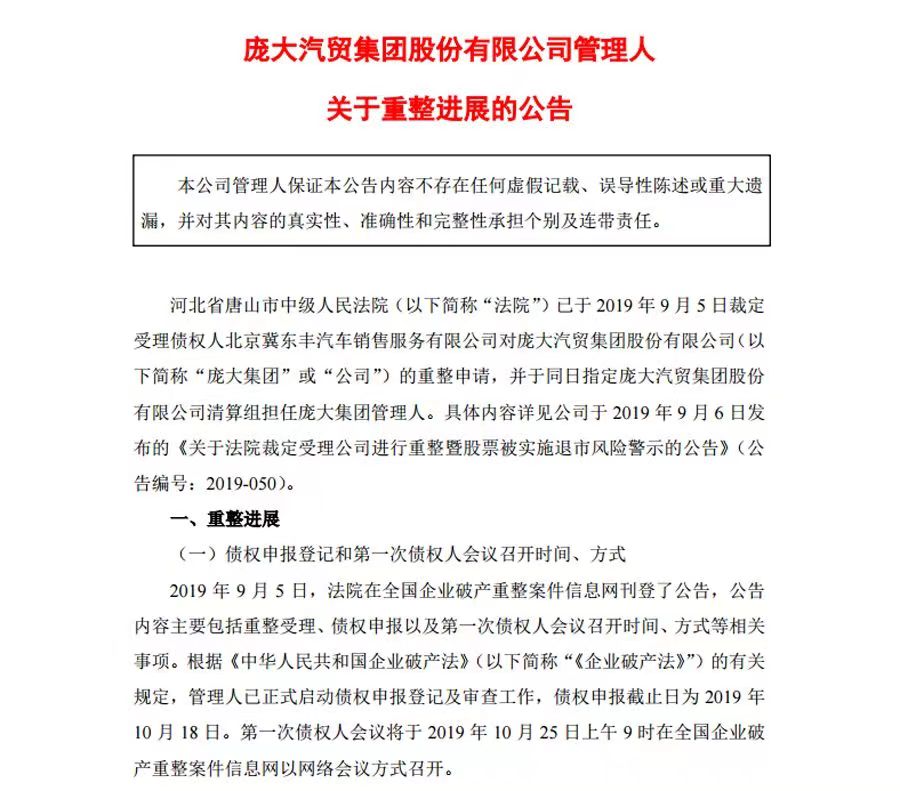

Starting from 2017, the performance of the giant group entered the downward channel, and the giant group encountered liquidity shortage difficulties in that year, and in 2019 it directly fell into huge losses, and was finally applied for restructuring by creditors because it was insolvent. Data show that from 2017 to 2019, the giant group deducted non-net profits of-2.09,68.41 and-4.052 billion yuan respectively. Pang Qinghua resigned as chairman in 2019 because of heavy losses. In May of the same year, the giant group filed for bankruptcy reorganization because it failed to repay its maturing debts.

The large group completed the bankruptcy reorganization in December 2019. After the bankruptcy reorganization was completed, the large group frequently relied on the sale of subsidiaries to achieve a rebound in profits. In December 2020, the giant group sold its subsidiaries twice, one of which was worth as much as 571 million yuan. The shares of five subsidiaries of the giant group, including Binzhou Star, Zibo Tyrannosaurus Rex, Qinhuangdao Lixing, Qingdao Zhongji and Harbin Zhongji, were packaged and transferred to Tianjin Zhongyuan Star Investment Co., Ltd. Then, in June 2022, the huge Group again transferred all its shares in Cangzhou Giant Industrial Co., Ltd. to Tianjin Zhongyuan Star. The transfer price was determined by the audit report, the evaluation report and the mutual consultation of both parties. The transfer price is 342 million yuan. The transfer price is used to offset the loan of Beixing (Tianjin) Automobile Co., Ltd., a subsidiary of the company and a related party of the transferee. The profit from the deal is expected to be about 195 million yuan.

As the former car dealer "king of 4S stores", the early giant group itself had excellent "qualifications". As early as 2010, it became the largest car dealer in China, with more than 1000 car 4S stores at its peak. According to statistics, in 2012, the giant group had 1429 operating outlets in 28 provinces, municipalities, autonomous regions and Mongolia, including 754 4S stores. In addition, the market capitalization of the giant group exceeded 50 billion in 2015, but by 2021. The huge group has only 283 outlets left, and its market capitalization has shrunk severely.

Although it has been nearly four years since the bankruptcy restructuring was completed, the large groups have been unable to reverse the deteriorating situation. According to the financial report data, the revenue of the company from 2020 to 2022 is 27.386 billion yuan, 28.633 billion yuan and 26.02 billion yuan respectively, the net profit is 580 million yuan, 898 million yuan and-144 million yuan respectively, and the net profit of returning mother is 187 million yuan,-389 million yuan and-155 million yuan respectively. In addition, the data show that from 2019 to 2022, the number of operating outlets of the huge group is 402,329,283 and 267 respectively, showing a trend of reduction year after year; in terms of sales, vehicle sales reached 141000, 141400 and 129800 respectively from 2020 to 2022, which also showed a downward trend year by year, that is to say, today, both the operating network and automobile sales of the huge group are declining.

As new energy vehicles become the development trend of the automobile industry in the future, under the background of accelerating replacement of fuel vehicles by new energy vehicles, traditional car dealers will face greater challenges. According to the relevant provisions of the "Stock listing rules", if the par value of the shares of the giant group is less than 1 yuan for 20 consecutive trading days, the exchange can terminate the listing of its shares. As the former king of the industry, the giant group is now on the verge of delisting, and the answer may soon emerge.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.