In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-21 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)05/13 Report--

On May 12, Evergrande announced that its shareholders' meeting had agreed to sell 47 property projects to China Evergrande and its subsidiaries, meaning Evergrande completed its real estate spin-off and became a pure new energy car company. Evergrande said that after the divestiture of the real estate business, concentrate resources to protect Hengchi's R & D and production, and focus on the new energy vehicle race track, which will help to improve market valuation, gain capital favor, and be conducive to Hengchi's development.

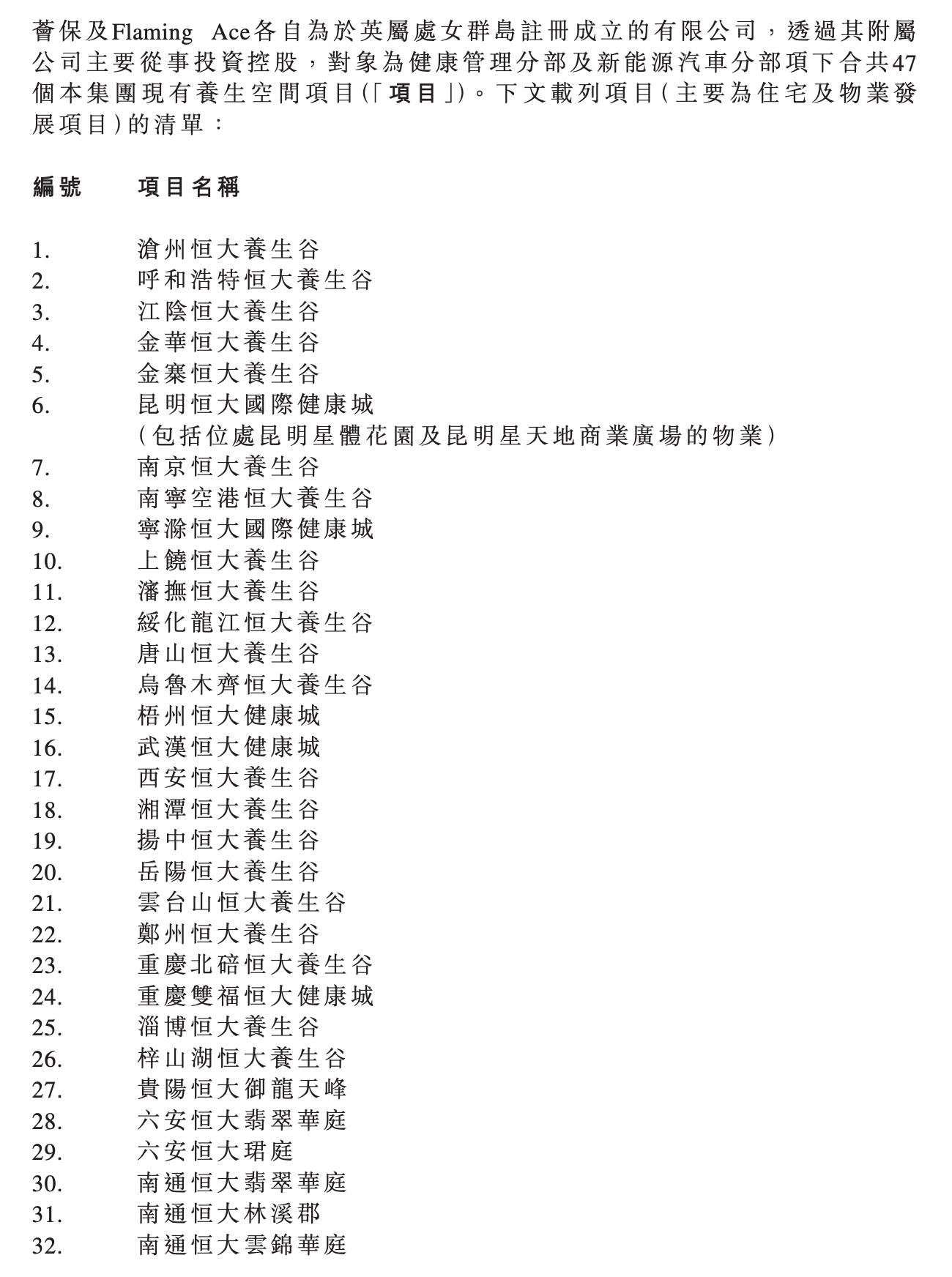

Evergrande and China Evergrande announced on the Hong Kong Stock Exchange that Evergrande entered into a sale and purchase agreement with China Evergrande and an Xin Holdings, a subsidiary of China Evergrande, to sell the enterprise equity composed of two wholly-owned subsidiaries, Huibao, Flaming Ace and their subsidiaries, for a symbolic price of 2 yuan, for 47 health space projects of Evergrande Automobile. It includes 21 Evergrande Health Valley projects located in Cangzhou, Hohhot, Nanjing and Xi'an, 5 Evergrande Health City projects in Kunming, Wuhan and Chongqing, and 21 real estate development projects in Guiyang, Nantong, Shenyang, Zhengzhou and other places.

In this "left-hand-to-right-hand" transaction, although Evergrande did not get cash, it handed over 24.789 billion yuan in debt to the buyer. Evergrande has previously said that if it can seek financing of more than 29 billion yuan in the future, it plans to launch a number of flagship models and is expected to achieve mass production.

In other words, after transferring the relevant liabilities, Evergrande only needs to raise about 5 billion yuan in the future to successfully renew its life. Evergrande needs too much money. In the announcement, Evergrande disclosed that from October 2022 to March 22, 2023, Evergrande delivered a total of 900 Evergrande cars. Due to lack of funds, the Tianjin plant has suspended production and plans to resume production in May, but so far there is no news of resuming production.

In February 2015, China Evergrande acquired a 74.99 per cent stake in New Media Group Holdings Limited for a total consideration of about HK $950 million. After that, New Media Group Holdings Co., Ltd. changed its name to Evergrande Health Industry Group Co., Ltd.

The original main business of Evergrande Health is medical and beauty services and pension services, in which the promotion of pension services is "Evergrande Health Valley". In June 2018, Evergrande Health announced that it would buy 100 per cent of Hong Kong Shiying for HK $6.7467 billion, indirectly acquiring 45 per cent of Smart King, while Smart King wholly owns Faraday Future (FF), a new energy vehicle company. It should be noted that although the original shareholder of FF is only the second largest shareholder of Smart King, it holds nearly 90% of the voting rights. In other words, what Evergrande Health bought is almost the ownership of FF.

The news of Evergrande's acquisition of FF was immediately welcomed by the capital markets, leading Evergrande to rise healthily all the way. Unfortunately, Evergrande and FF only met by chance and parted ways in January 2019. After that, Evergrande chose to work alone, and Xu Jiayin began to dabble in the field of new energy vehicles. Through large-scale acquisitions, he built a whole industry chain of new energy vehicles covering power batteries, power total energy, advanced vehicle manufacturing, car sales and smart charging, and loaded a series of assets into the listed company Evergrande Health one after another.

In August 2020, Evergrande Health changed its name to "Evergrande Automobile" and mainly engaged in new energy vehicle technology research and development, production and sales services (collectively referred to as "New Energy vehicle Division"). And engaged in Internet + community health management, international hospitals, pension and rehabilitation industry and other health management business (collectively referred to as the "health management branch").

In the same month, Evergrande released six new models of Hengchi at the same time in Shanghai and Guangzhou, including Hengchi 1, Hengchi 2, Hengchi 3, Hengchi 4, Hengchi 5 and Hengchi 6. Evergrande aims to "become the largest and strongest new energy vehicle group in the world within five years, and to produce and sell 1 million vehicles a year in the next 3-5 years".

It is worth mentioning that Evergrande derives most of its revenue from its health management division. According to the 2020 report, Evergrande's annual revenue is 15.487 billion yuan, while the revenue of the new energy vehicle sector is only 188 million. Up to now, Evergrande has not disclosed its financial results for 2021 and 2022.

Evergrande's current dilemma is caused by the debt crisis that China Evergrande has been mired in since December 2021. On December 3, 2021, China Evergrande failed to meet its guarantee obligations for a $260 million private bond, resulting in a fire that triggered a cross-default on all outstanding dollar debt.

After the outbreak of the debt crisis, China Evergrande launched overseas debt restructuring and announced the introduction of strategic investors in Evergrande property and Evergrande Automobile. Evergrande strips off its real estate business to get rid of debt at a low price, essentially hoping to attract potential strategic investors with a low burden and pure business identity. However, in the context of its own hematopoietic difficulties and the high debt of the parent company, the outlook for Evergrande looks particularly bleak.

On the evening of May 12, China Evergrande announced that it had received an enforcement notice from the Guangzhou Intermediate people's Court of Guangdong Province on the arbitration award of the Shenzhen International Arbitration Court. China Evergrande, Guangzhou Kailong Real Estate Co., Ltd. (referred to as "Guangzhou Kailong"), and Xu Jiayin, the controlling shareholder and executive director of China Evergrande, are the persons subject to the enforcement notice.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.