In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)05/18 Report--

Zhejiang Geely Holdings Group Co., Ltd. (hereinafter referred to as "Geely Holdings") announced a further cooperation agreement with British ultra-luxury performance brand Aston Martin Lagunda International Holdings (hereinafter referred to as "Aston Martin").

Aston Martin said Geely Holdings had pledged about £234 million to acquire about 42 million existing common shares of Aston Martin from Yew Tree Investment Group and to subscribe for about 28 million new shares, increasing its stake in Aston Martin to 17 per cent. According to the cooperation agreement, Geely Holdings has completed the increase of its stake in Aston Martin. After this increase, Aston Martin's shareholders include Yew Tree Investment Group, Saudi Arabia's Public Investment Fund, Geely Holdings and Mercedes-Benz. Geely Holdings Super Mercedes-Benz has become the third largest shareholder of the Aston Martin brand, while Yew Tree Investment Group remains the largest shareholder with a shareholding of about 21%.

Before the successful acquisition last year, Geely Holdings offered an olive branch to Aston Martin twice in 2015 and 2020, both of which ended in failure. Geely did not give up its interest in Aston Martin despite the industry's belief that there were underlying reasons or differences between the two sides in terms of business philosophy. Geely acquired Aston Martin on September 30, 2022, when Geely Holdings announced that it had completed its 7.6 per cent stake in Aston Martin, followed by news that Geely wanted to increase its stake in the company to 10 per cent.

Subsequently, Lawrence Strol, executive chairman of Aston Martin, and his Yew Tree investment group have invested about 50 million pounds in recent months, significantly increasing their shareholding in Aston Martin from about 19% to 28.29%, with an increase of 9.29%. Industry insiders believe that the move is a counteraction against Geely Holdings's acquisition of Aston Martin.

Although Geely became the fourth-largest shareholder after Canadian billionaire Lawrence Stroll, Saudi sovereign fund PIF and Mercedes-Benz after buying a 7.6 per cent stake in Aston Martin, Geely did not get a board seat at that time and did not have much say. With this increase, it means that Geely will have more dominance. Geely Holdings said: "the decision to increase our stake in Aston Martin reflects our confidence in the company's growth prospects, technology and management team." After the increase, Geely Holdings will have the right to appoint a non-executive director to the board of directors of Aston Martin, while having an observer seat on the board.

Auto Industry focus learned from the Aston Martin website that the Aston Martin brand was originally named Bamford & Martin Ltd., founded in the UK by Lionel Martin Martin and Robert Banford in March 1913. It is a well-known sports car manufacturer. Models currently on sale in China include the two-door sports car Vantage, DB11, DBS and four-door off-road model DBX.

As a century-old ultra-luxury car brand, Aston Martin has a longer history than Ferrari, Lamborghini and Maserati, but since its establishment in 1913, Aston Martin has changed hands many times and has gone bankrupt seven times. Data show that in 1947, British entrepreneur David Brown (David Brown) bought Aston Martin; in 1994, David Brown sold Aston Martin to Ford Motor, becoming a wholly owned subsidiary of Ford; in 2007, Ford sold most of its stake to a consortium led by British racing company Prodrive. In December 2012, Italian private equity fund Investindustrial announced a £150 million investment to acquire a 37.5% stake in Aston Martin, and Aston Martin listed on the London Stock Exchange in October 2018.

However, since the listing of the London Stock Exchange, Aston Martin has not had an easy life, even in the quagmire of losses. Between 2019 and 2021, Aston Martin lost £104 million, £466 million and £189 million respectively, with a cumulative loss of £759 million over three years, according to financial data. As for Aston Martin who rejected Geely twice, why did he agree to it the third time? Industry insiders believe it may be related to Aston Martin's continued losses. in addition, the Chinese market is Aston Martin's fastest growing market. Aston Martin's global sales increased by 82% to 6178 vehicles in 2021, according to data. Aston Martin's sales in China rose 206 per cent year-on-year, a record high.

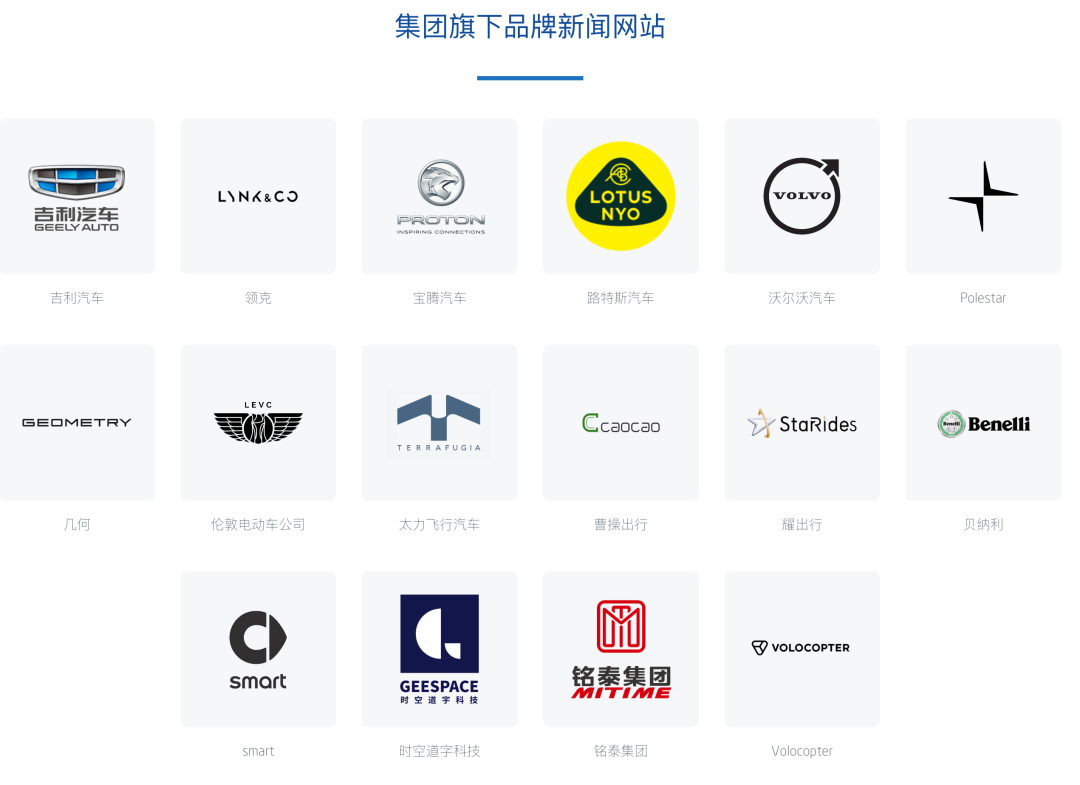

Geely Holdings, on the other hand, was founded in 1986, but as one of the largest auto groups in China, Geely Holdings is known as a "global buyer" and has greatly expanded its territory in the auto industry through "buyout". So far, Geely Holdings Group has set up a number of automotive brands, including Geely, Lecker, Polar Krypton, Geometry, Volvo, Polestar, Proton, Lutes, London Electric vehicles, long-distance New Energy Commercial vehicles, Taili Flying vehicles and other brands. As for Geely Holdings' acquisition of Aston Martin, industry insiders believe that the acquisition of Aston Martin may not enable Geely Holdings to achieve a positive cash flow in a short period of time, but the cooperation between the two sides can enhance Geely's image around the world to a certain extent.

Wholesale sales of Aston Martin rose about 4 per cent year-on-year to 6412 vehicles in 2022, with DBX sales accounting for 50 per cent of total sales, according to the data. According to the latest financial report, Aston Martin's operating income in 2022 rose 26 per cent year-on-year to £1.38 billion; gross profit rose 31 per cent to £451 million, but operating loss widened to £118 million from £74 million in 2021. Aston Martin said it was mainly due to supply chain and logistics disruptions and revealed that the company's profitability was expected to improve significantly this year or be able to achieve positive free cash flow in the second half of the year. Geely Holdings and Aston Martin further strengthen cooperation may help Aston Martin reverse the loss situation.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.