In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)05/19 Report--

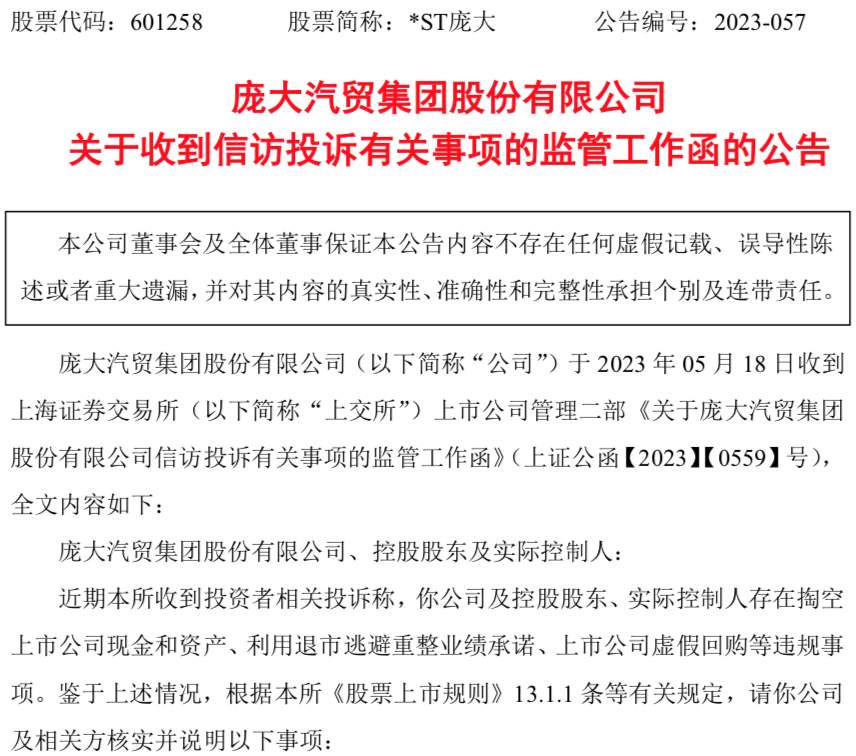

On May 19th, * ST announced that Giant Automotive Trade Group Co., Ltd. (hereinafter referred to as "Giant Group") received the second Department of Management of listed companies on the Shanghai Stock Exchange (hereinafter referred to as "Shanghai Stock Exchange") on April 24, 2023. Letter of inquiry on the repurchase of shares of Giant Automobile Trade Group Co., Ltd. On May 18, 2023, I received the Supervision work letter of the second Department of the Management of listed companies of the Shanghai Stock Exchange on matters related to the complaint of Letters and visits of Giant Automobile Trade Group Co., Ltd.

According to the announcement, the Shanghai Stock Exchange has received complaints from investors that huge groups, controlling shareholders and actual controllers have committed violations such as hollowing out cash and assets of listed companies, using delisting to evade performance commitments, and false repurchases of listed companies, including, but not limited to, Huang Jihong, the actual controller of the company, who is suspected of occupying funds of listed companies in disguise through potential related parties. The board of directors of the company deliberated on the purchase of complete vehicles and spare parts from Zhongtai Automobile Co., Ltd., controlled by Huang Jihong, the actual controller, with a total amount of no more than 1 billion yuan, suspected of encroaching on the interests of the controlling shareholders, etc.

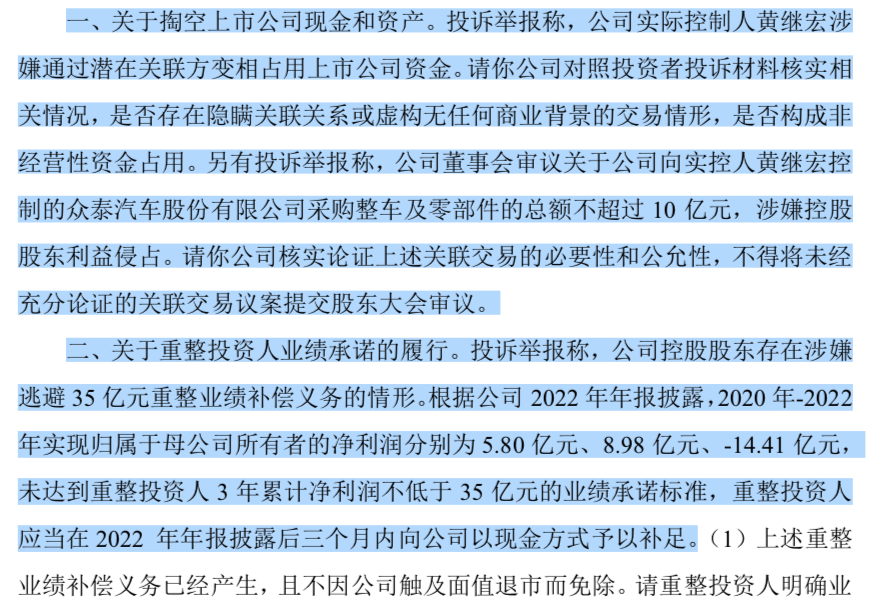

In addition, the Shanghai Stock Exchange also said that the controlling shareholders of the huge group are suspected of evading 3.5 billion yuan in restructuring performance compensation obligations. According to the 2022 annual report of the giant group, from 2020 to 2022, the net profits attributed to the owners of the parent company were 580 million yuan, 898 million yuan and-1.441 billion yuan respectively, which did not meet the performance commitment standard of not less than 3.5 billion yuan in the three-year cumulative net profit of the restructuring investors. the restructuring investor shall make up to the company in cash within three months after the disclosure of the 2022 annual report.

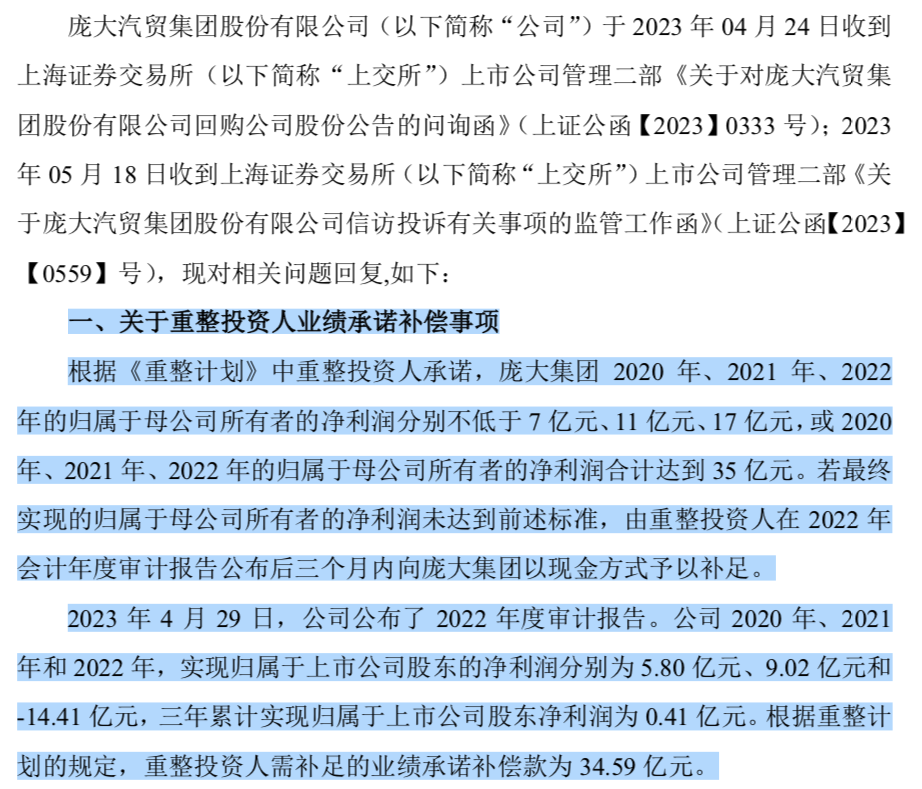

In response, the giant group responded that according to the investor commitment of the reorganization plan announced by the giant group, the net profit of the giant group belonging to the owner of the parent company in 2020, 2021 and 2022 was not less than 700 million yuan, 1.1 billion yuan and 1.7 billion yuan respectively, or the total net profit belonging to the owner of the parent company in 2020,2021 and 2022 reached 3.5 billion yuan. If the final net profit attributable to the owner of the parent company does not meet the above criteria, the restructuring investor shall make up to the large group in cash within three months after the publication of the audit report for the fiscal year 2022.

On April 29, the giant group released its 2022 audit report to the public. The data show that the net profits attributed to shareholders of listed companies in 2020, 2021 and 2022 are 580 million yuan, 902 million yuan and-1.441 billion yuan respectively, and the cumulative net profits attributed to shareholders of listed companies in three years are 41 million yuan. According to the provisions of the reorganization Plan, it means that the huge group has not reached the standard of performance commitment for restructuring investors. The announcement shows that the compensation for performance commitment to be made up by restructuring investors is 3.459 billion yuan.

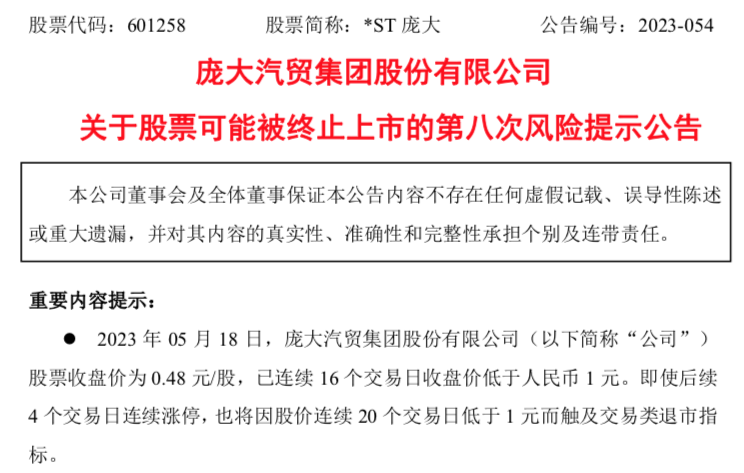

In addition to the above news, during the period from May 11 to May 19, 2023, * ST issued a number of risk warning announcements one after another to remind investors of the risk that the listing of stocks may be terminated. According to the latest "eighth risk warning announcement on the possible termination of the listing of shares", on May 18, 2023, the shares of the giant group closed at 0.48 yuan per share. Since April 21, 2023, the closing price has been lower than RMB 1 for 16 consecutive trading days. even if it goes up by the limit for the next 4 trading days, it will hit the trading delisting target because the share price is below 1 yuan for 20 consecutive trading days, that is to say, * ST has locked its face value in advance and delisted.

Data show that from May 16 to May 18, * ST closed with a cumulative deviation of more than 12% for three consecutive trading days. According to the large Group, so far, there is no material information that should be disclosed but not disclosed that may have an impact on the trading price of the company's shares by the company's controlling shareholders and actual controllers, including, but not limited to, significant asset restructuring, share issuance, acquisition of listed companies, debt restructuring, business restructuring, divestiture and asset injection.

In response to the news that huge is on the verge of delisting, Zhongtai Motors also made it clear: "although the company and the giant group are the same actual controller, they are two companies operating independently, and the delisting of the huge group has no impact on the normal production and operation of the company."

Huge Group was founded in March 2003 by Pang Qinghua, a national automobile dealer group with automobile sales and after-sales service as its main business. mainly engaged in Mercedes-Benz, FAW Audi, FAW-Volkswagen, FAW Toyota and Subaru and other more than 30 passenger car brands.

On April 28, 2011, the giant group was listed on the Shanghai Stock Exchange. at the beginning of its listing, the market capitalization reached 36 billion yuan and became the "first share of China's Auto Trade". Since then, it has launched a large-scale expansion, with 1429 outlets in 2012, including 754 4S stores. In 2014, the huge group began to sell new energy vehicles, becoming the earliest new energy vehicle dealer in China, but then lost the title of "king of 4S stores" due to poor management, and even faced a financial crisis. Large groups have suffered from liquidity shortages since 2017 and have directly fallen into huge losses in 2019. Data show that from 2017 to 2019, non-net profits deducted by large groups were-2.09,68.41 and-4.052 billion yuan, respectively. Although the large group took positive measures during this period, it finally declared bankruptcy reorganization in May 2019 and completed the bankruptcy reorganization in December of that year because of insolvency.

As the former first stock of car dealers and the "king of 4S stores" of car dealers, although it has been nearly four years since the completion of the bankruptcy restructuring, the giant group has been unable to reverse the deteriorating situation. According to the financial report data, the revenue of the company from 2020 to 2022 is 27.386 billion yuan, 28.633 billion yuan and 26.02 billion yuan respectively, the net profit is 580 million yuan, 898 million yuan and-144 million yuan respectively, and the net profit of returning mother is 187 million yuan,-389 million yuan and-155 million yuan respectively.

In addition, in addition to poor performance, the operating outlets of large groups and the performance of car sales are also worrying. Data show that from 2019 to 2022, the number of operating outlets of the giant group is 402,329,283 and 267 respectively, showing a trend of reduction year after year. As a comparison, in 2012, the giant group had 1429 operating outlets in 28 provinces, municipalities, autonomous regions and Mongolia, of which 754 were 4S stores. In addition, the market capitalization of the giant group exceeded 50 billion in 2015, but by 2021, the giant group has only 283 distribution stores, and its market capitalization has shrunk even more. In terms of sales, from 2020 to 2022, vehicle sales reached 141000, 141400 and 129800 respectively, which also showed a downward trend year by year. That is to say, today, both the operating outlets and car sales of the huge group have declined.

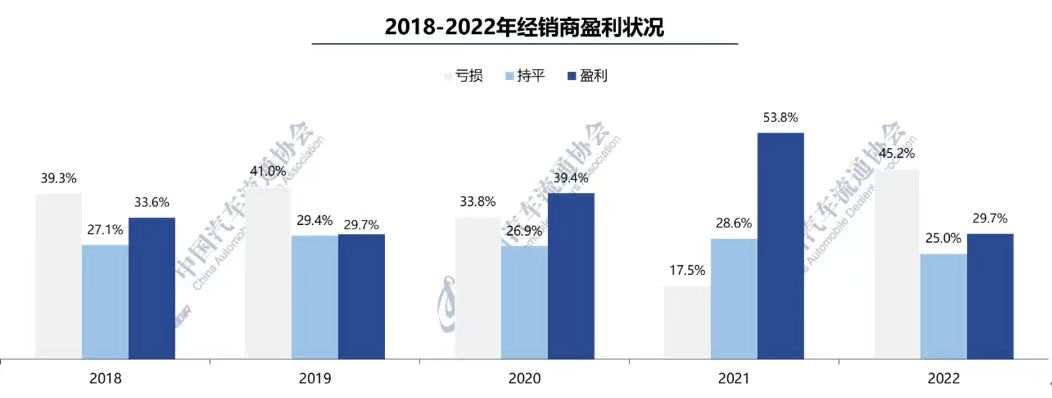

The huge group, the former king of the industry, is now on the verge of delisting. However, the giant group is only a microcosm of the current situation of most car dealers. According to the National Automobile Dealers Survival Survey report 2022 released by the China Automobile Circulation Association, the proportion of dealers who lost money in 2022 accounted for 45.2%, an increase of 27.7% over 2021.

At present, the huge Group has cancelled the "proposal on the estimated quota of daily related transactions with the related party Zhongtai Automobile Co., Ltd. 2023" in the 2022 annual shareholders' meeting. With regard to the reasons for the cancellation of the bill, the giant group said that the 25th board of directors of the company examined and passed the "motion on the estimate of the quota of daily related transactions with the related party Zhongtai Automobile Co., Ltd in 2023." after communicating with the related party Zhongtai Automobile Co., Ltd., it is considered that the amount and method of the transaction need further negotiation. Earlier, * ST announced that Ms. Liao Chaohui, a director, resigned as a director of the company and a member of the strategy committee of the board of directors for personal reasons. Ms. Liao Chaohui will no longer hold any position in the company after her resignation.

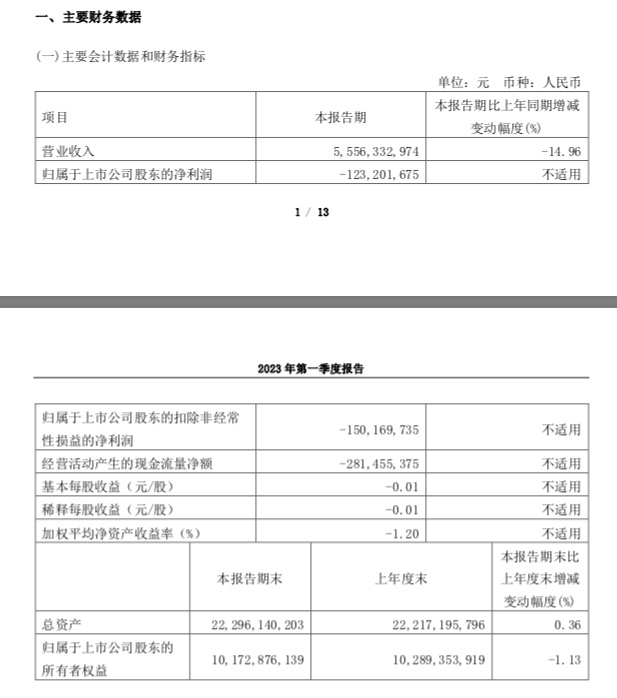

According to the latest financial report of the giant group, in the first quarter of 2023, the company's operating income was 5.556 billion yuan, down 14.96% from the same period last year; the net profit attributable to shareholders of listed companies was-123 million yuan; and the net profit belonging to shareholders of listed companies after deducting non-recurring gains and losses was-150 million yuan.

As of May 19, Beijing time, * ST had a huge market capitalization of 4.705 billion yuan.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.