In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)05/29 Report--

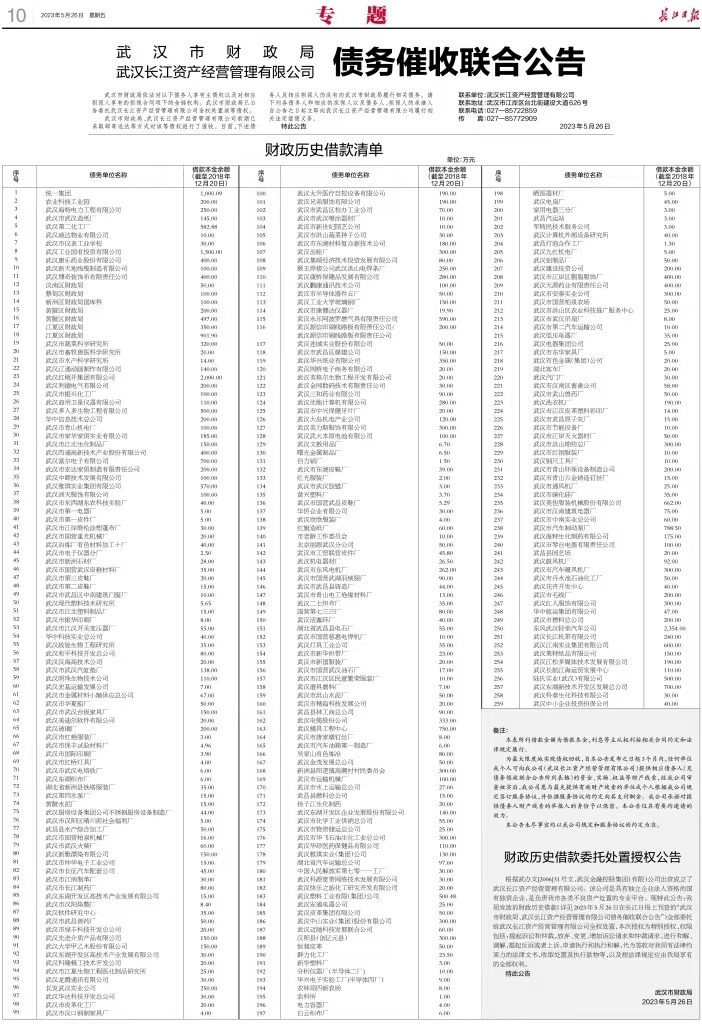

On May 26, Wuhan Finance Bureau and Wuhan Yangtze River Asset Management Co., Ltd. issued a joint notice on debt collection in the Yangtze River Daily, requiring 259 enterprises and units to repay outstanding debts by the end of 2018. The announcement details the names of 259 debt units and the principal balance of loans (by the end of 2018). The amounts owed by these enterprises and units vary, ranging from more than 10,000 to more than 10 million, with a total amount of more than 100 million yuan. Among them, Dongfeng Wuhan Light Automobile Company owes the most, with the principal of 23.54 million yuan, accounting for about 8% of the total debt.

It is understood that the Yangtze River Daily was the newspaper of the Central China Bureau of the CPC Central Committee and the Wuhan military Control Commission, and was later changed to the organ of the Wuhan Municipal CPC Committee. Auto Industry concern was unable to see the above content when consulting the May 26 electronic edition of the Yangtze River Daily.

The above announcement did not disclose the reasons for borrowing funds and investment of the above-mentioned units and other important information. However, "strengthening the management of financial loans and preventing the risks of financial funds" published on the official website of Wuhan Audit Bureau in 2021 pointed out that when auditing the budget implementation and other financial revenues and expenditures of various units, it was found that many units had the behavior of financial borrowing. financial borrowing shows the characteristics of long account age, large scale and complex use. People in the industry said that due to the impact of the epidemic, tax cuts and other factors, Wuhan's financial revenue has been greatly affected in recent years. This time, many of the arrears listed by the Wuhan Municipal Finance Bureau were lent early, which is a "problem left over from history", so it is also difficult to collect.

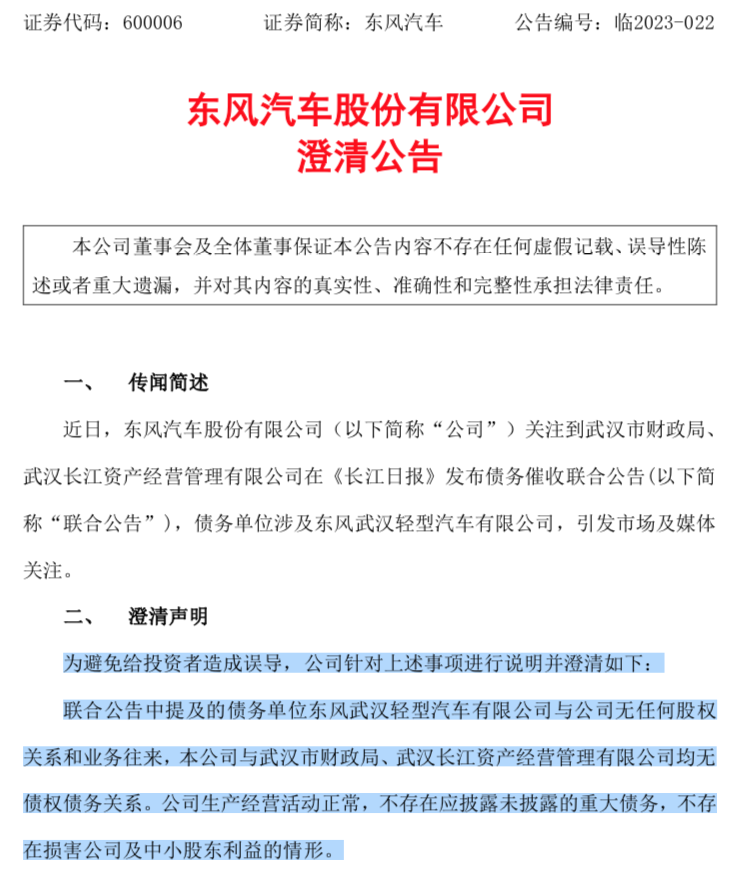

In response to the debt of Dongfeng Wuhan Light Automobile Company by Wuhan Finance Bureau, Dongfeng Motor Co., Ltd. issued a clarification notice on the morning of May 29.

The contents of the announcement show that recently, Dongfeng Automobile Co., Ltd. (hereinafter referred to as "the company") paid attention to the joint announcement of debt collection issued by Wuhan Finance Bureau and Wuhan Yangtze River Asset Management Co., Ltd. in the Yangtze River Daily (hereinafter referred to as the "joint announcement"). The debt unit involves Dongfeng Wuhan Light Automobile Co., Ltd., which has attracted market and media attention. In order to avoid misleading investors, the company explains and clarifies the above matters as follows: Dongfeng Wuhan Light Automobile Co., Ltd., the debt unit mentioned in the joint announcement, does not have any equity relationship or business relationship with the company. the Company has no creditor-debt relationship with Wuhan Finance Bureau and Wuhan Changjiang Asset Management Co., Ltd. The production and operation activities of the company are normal, there is no major debt that should be disclosed, and there is no situation that harms the interests of the company and minority shareholders.

According to Tianyan information, Dongfeng Wuhan Light Automobile Co., Ltd. was established on April 24, 1991. its legal representative is Liu Huiwen, with a registered capital of 19.699 million yuan. It is an enterprise mainly engaged in automobile manufacturing, including automobile and accessories manufacturing, automobile and accessories sales, etc.

On March 29, 2023, the legal representative of the company was changed from Wang Yong to Liu Huiwen; on April 3, 2023, the business term of the company was changed from April 24, 1991 to April 24, 2023 to long-term. Earlier, the investor (competent department) of Dongfeng Wuhan Light Automobile Company also changed on November 21, 2014, when Wuhan Industrial State-owned holding Group Co., Ltd. withdrew, and the investor was changed to Wuhan Industrial Group Co., Ltd. At present, the competent department of Dongfeng Wuhan Light Automobile Company is Wuhan Yawei Enterprise Trusteeship Co., Ltd.

According to the enterprise annual report information released by Tianyan, Dongfeng Wuhan Light Automobile Company will be closed from 2015 to 2020 and closed from 2021 to 2022. Among them, in 2022, the number of urban workers' basic pension, basic medical insurance, maternity insurance, unemployment insurance and industrial injury insurance paid by Dongfeng Wuhan Light Automobile Company was 26, while the number from 2020 to 2021 was 42.

In addition, the company has not disclosed information about its assets to the outside world for many years, and the last time it was released was the annual report in 2017. that year, the company's total assets were 8.11 million yuan and its total liabilities were 36.1 million yuan. In other words, the company has been insolvent in 2017, and the company has not made public the relevant information since then.

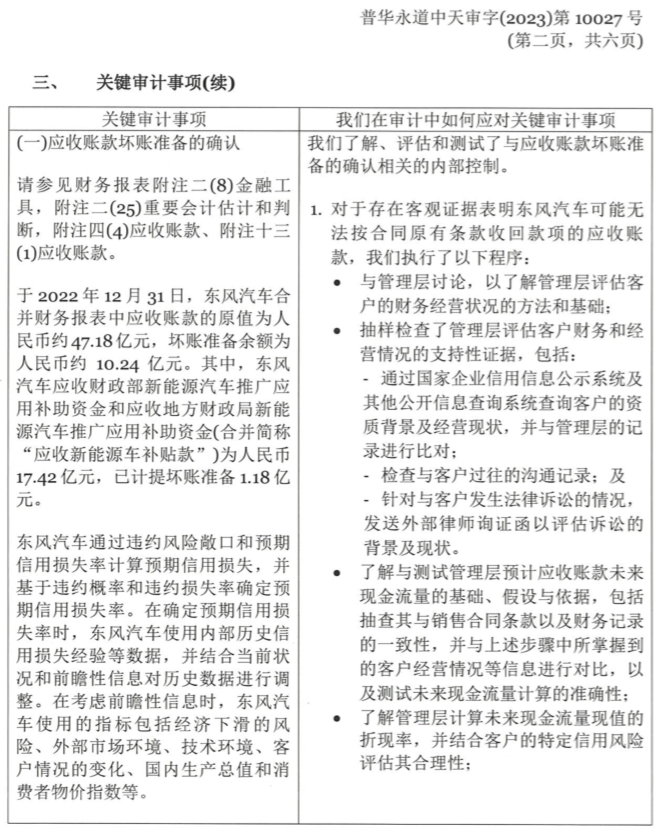

According to the 2022 financial statements and audit report of Dongfeng Motor Co., Ltd., published on the website of the "Shanghai Stock Exchange", as of December 31, 2022, the original value of accounts receivable in the consolidated financial statements of Dongfeng Motor was 4.718 billion yuan. The balance of provision for bad debts is about 1.024 billion yuan. Among them, Dongfeng Motor received a total of 1.742 billion yuan from the Ministry of Finance's subsidy funds for the promotion and application of new energy vehicles and the local finance bureau's subsidies for the promotion and application of new energy vehicles, with a provision of 118 million yuan for bad debts.

In March this year, Dongfeng Group launched a large-scale price reduction and aroused widespread concern. Its brands including Dongfeng Citroen, Dongfeng Peugeot, Dongfeng Nissan, Dongfeng Honda, Dongfeng Fengshen and other brands all launched car purchase subsidy policies, among which Citroen C6 models had the greatest preferential treatment. Citroen C6 co-creation models and C6 comfortable models with the original guidance price of 211900 yuan and 226800 yuan were subsidized up to 90, 000 yuan. Subsidies for other C6 models range from 40, 000 to 46000 yuan, and the price cut suddenly increased sales of Dongfeng Citroen C6 models to 1259 in March, but only 326 in April, down 74.10% from a month earlier.

Dongfeng Wuhan Light Automobile Company has once again attracted market attention because of its debt collection by Wuhan Finance Bureau. Although Dongfeng Motor has issued a clarification announcement, it may be affected by the news. Dongfeng Motor shares closed at 5.58 yuan per share, down 1.76%, with a market capitalization of 11.16 billion yuan. The phone numbers announced by Dongfeng Wuhan Light Automobile Company are unanswered.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.