In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)06/03 Report--

Great Wall Automobile is unexpectedly surpassed by new power car companies, and ideal Automobile has become the second car company in China by market capitalization.

According to the latest market capitalization list, at present, the largest car company in China is still BYD, which ranks first with a market capitalization of 738.44 billion yuan, followed by ideal Automobile, a new power car company, whose latest market capitalization is 214.435 billion yuan, surpassing Great Wall Motor to become the second car company in China. The latter's latest market capitalization is $191.707 billion.

Judging from the list, in addition to BYD, ideal Automobile and Great Wall Automobile, other car companies in the top 10 are SAIC (156.792 billion yuan), Changan Automobile (118.566 billion yuan), GAC GROUP (1.106821 trillion yuan), Xilai (89.603 billion yuan), Geely Motor (82.798 billion yuan), Xiaopeng Automobile (48.449 billion yuan) and Cyrus (38.60 billion yuan).

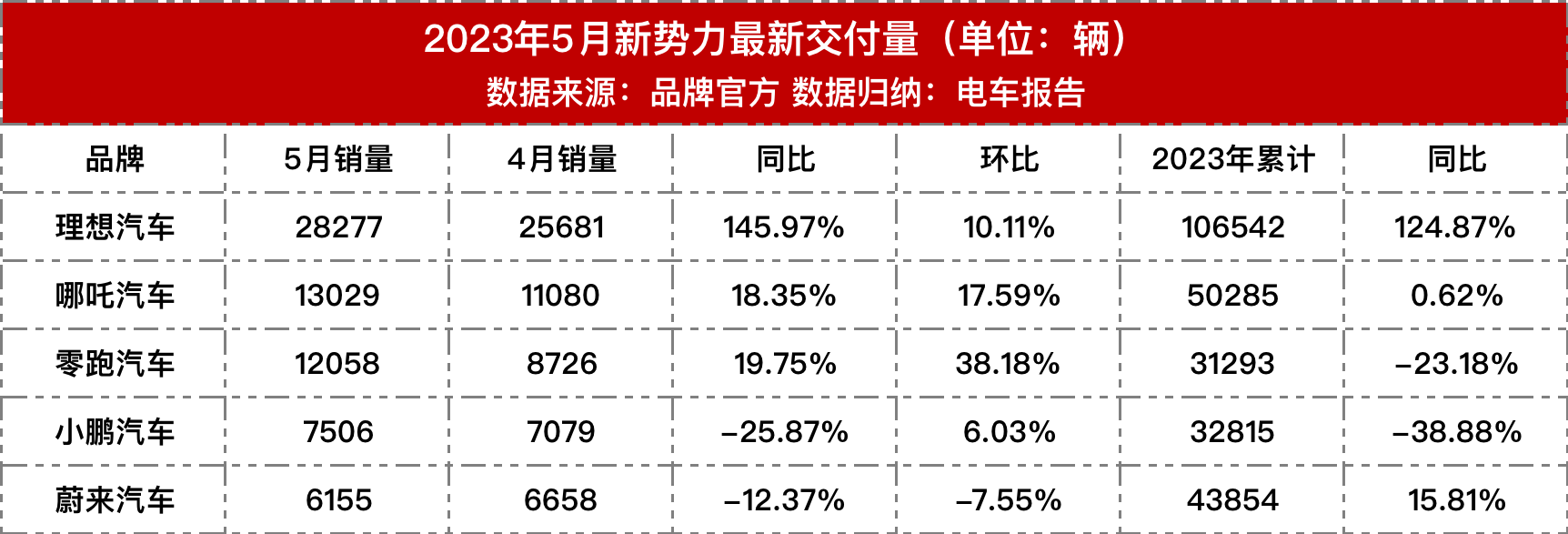

The market value of the ideal car has soared, which may have something to do with its rising market sales. Taking May sales as an example, ideal car once again became a new force in China with the result of 28277 vehicles, an increase of 146.0% over the same period last year and 10.1% month-on-month growth, setting a new record for monthly delivery, while achieving delivery of more than 20, 000 vehicles for three consecutive months. So far, from January to May 2023, the ideal car has delivered a cumulative total of 106542 vehicles, more than double the number of cars sold in the second place (50285).

In sharp contrast, both NIO and Xiaopeng failed the passing line, of which NIO delivered 6155 new cars, down 12.4% from the same period last year, and Xiaopeng delivered 7506 new cars, down 25.9% from the same period last year. From this point of view, NIO + Xiaopeng is even less than half of the ideal car delivery volume. The former "Wei Xiaoli" has parted ways, and the ideal car has dominated the list for a long time, while NIO and Xiaopeng have been at the bottom for many months in a row.

We have to admit that both NIO and Xiaopeng have come to fight against each other. NIO needs to rely on the new "866" to pull back the passing line of 10,000 vehicles sold per month, while Xiaopeng needs to rely on G6 to recover from the decline. Earlier, Li Bin even laughed at himself that if he still sold 10,000 vehicles a month, he would have to look for a job with Qin Lihong, and judging from the performance of the terminal market in NIO, maybe Li Bin and Qin Lihong should prepare their "job application resumes" in advance.

Sales are not as good as ideal cars, which is ultimately reflected in the capital market. At present, ideal Motors' latest share price is $29.44 (market capitalization $30.68 billion), up 25.28% since May 1, while Xiaopeng Motor is $8.44 (market capitalization $7.282 billion), down 11.16% during the period. the stock fell 3.94% during the period. From this calculation, the market value of the ideal car is also far higher than that of the NIO + Xiaopeng car.

As for Great Wall, its market capitalization fell 15.90% in May, the biggest drop among China's top 10 car companies. For comparison, BYD is down 0.86%, SAIC is down 4.96%, GAC GROUP is down 4.23%, and Geely is down 3.28%.

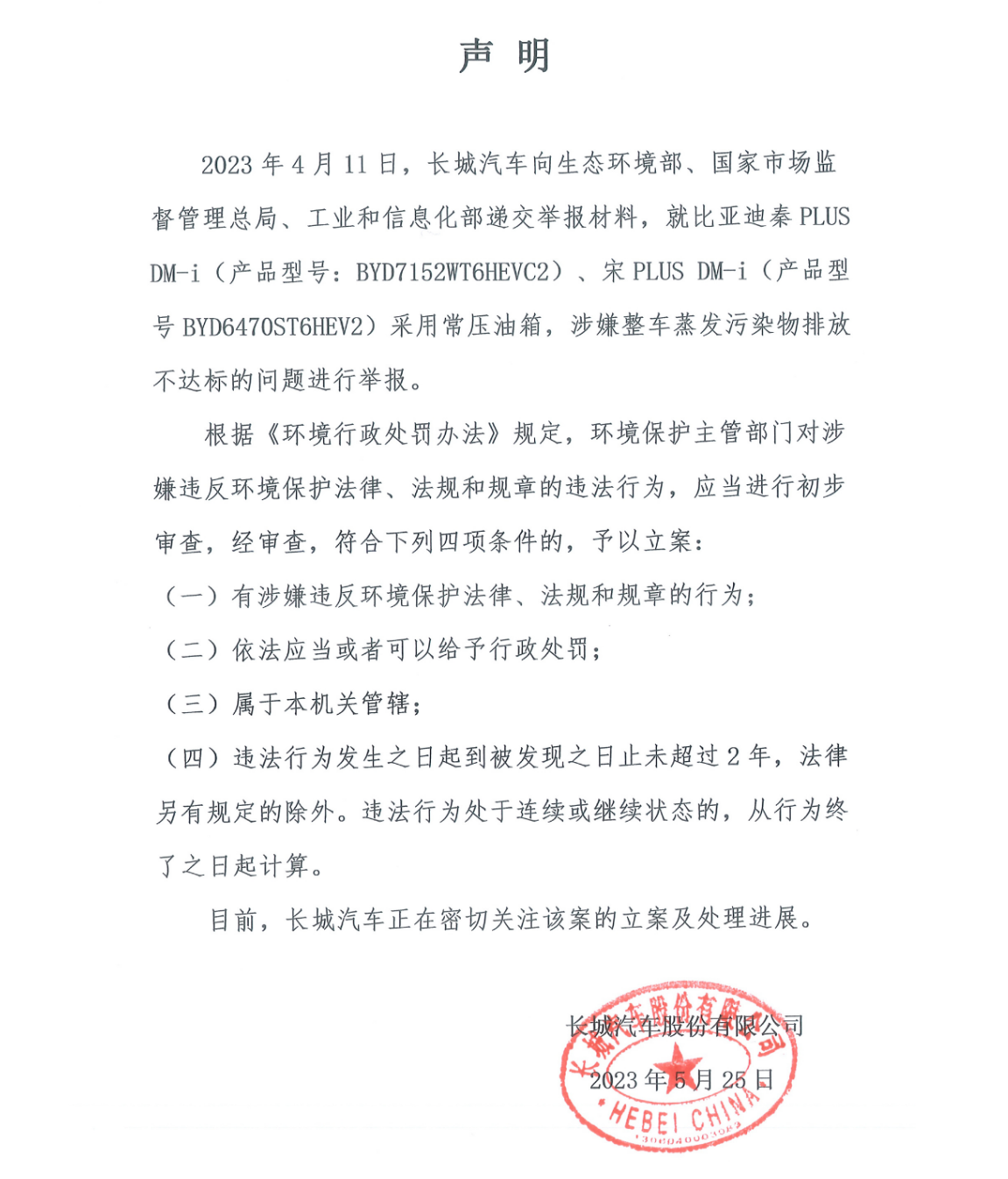

The sharp decline in the market capitalization of Great Wall may have something to do with its reporting of BYD and volatile internal relationships. Great Wall Motor issued a statement on May 25 to publicly report BYD, saying that Qin PLUS DM-i and Song PLUS DM-i used atmospheric fuel tanks on suspicion that the vehicle's evaporative pollutants did not meet the emission standards and did not meet the emission regulations. Later, BYD officials responded to the incident.

As one of the top automakers in China, the fight between BYD and Great Wall does not bode well, not only reflecting the fierce competition in China's auto market, but also highlighting the survival crisis of Great Wall in the domestic market. Industry insiders believe that, "it is a good thing for the industry to supervise each other, but it has been revealed openly and secretly that Great Wall is really in a hurry and has no choice but to publicly counter BYD."

On the day of the report, the share price of Great Wall fell 6.17%, and from the day of the report to the end of the month, the share price fell 12.62%. By contrast, BYD's shares fell 2.41% on the day and 3.71% at the end of the month. At present, Great Wall Automobile reported that BYD was "killing one thousand enemies and losing eight hundred", and some netizens even joked that "shareholders pay for the fight between Great Wall and BYD."

In addition to reporting the incident, the management of Great Wall Motors has changed frequently. On May 24, the media reported that Wen Fei, general manager of the Oula Salon brand, had resigned from the company due to "physical reasons". He was the second marketing general to leave Great Wall after Wang Fengying. The latest news said that he may join Xiaomi Automobile in charge of marketing and report to Lei Jun, but the authenticity of the news can not be confirmed. In addition, Guo Tiefu, general manager of public relations at Great Wall, resigned on May 8 for personal reasons.

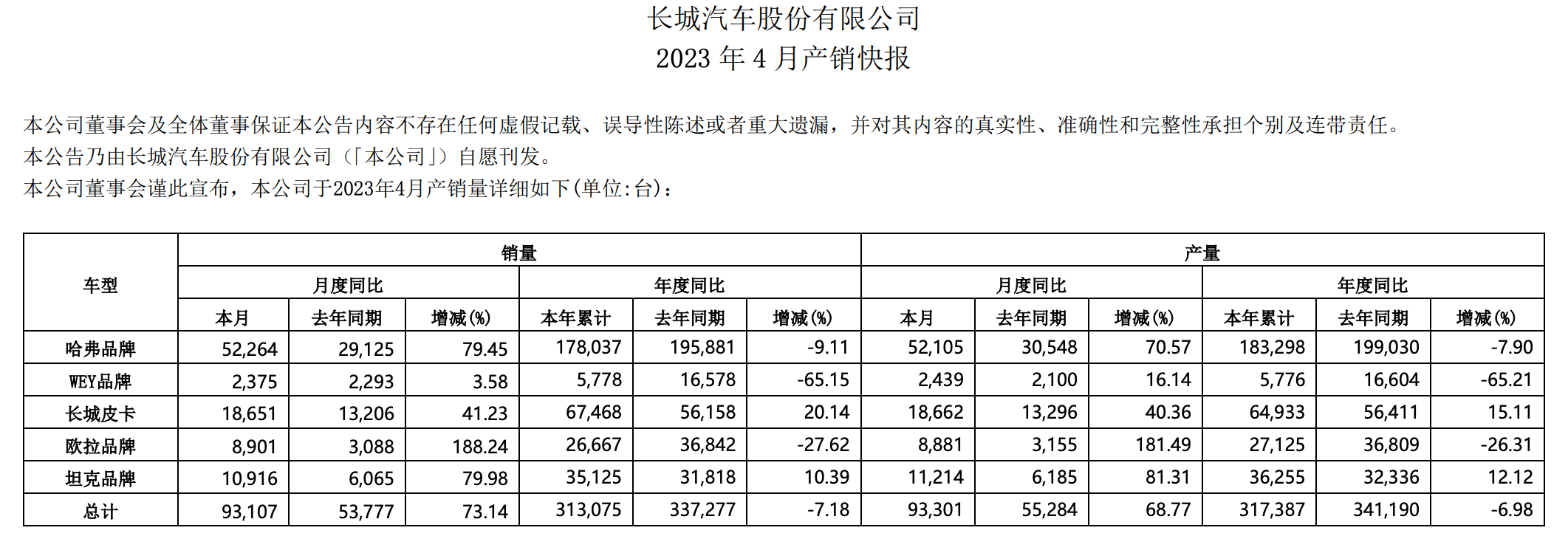

In April, Great Wall sold a total of 93107 vehicles, up 73.14% from 5377 in the same period. Among them, the Harvard brand increased by 79.45%, the tank brand by 188.24%, the Wei brand by 3.58%, and Euler by 188.24%. It should be noted that the surge in Great Wall car sales is mainly due to the suspension of production and sales in many parts of the country due to the epidemic in the same period. Great Wall Motor is expected to grow in the coming months, and the reference value of the data is not high.

Over the past month, Great Wall has launched a number of new cars to compete with the head car company. On the evening of May 9, Harvard Owl Dragon / Owl Dragon MAX officially went on sale. The price range of the former is 13.98-156800 yuan, while that of the latter is 15.98-179800 yuan. The competing model is aimed at the BYD Pro DM-i/PLUS DM-i. On June 1, the new Wei brand mocha DHT-PHEV model was officially put on the market, with a price of 231800 yuan. The main competitors are BYD frigate 07 and ideal L7.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.