In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)06/03 Report--

Michael Lohscheller, CEO of US electric truck maker Nikola, said in an official document that if its shares still do not meet the Nasdaq minimum bid requirements for a certain period of time, it may carry out a reverse stock split to avoid delisting.

Reverse stock division refers to reducing the number of shares issued by the company to a small number of shares, while the proportion of shares held by shareholders remains unchanged and will not cause losses to shareholders. Lohscheller said that if the Nikola does not comply with the rules during this period, the company will hold a general meeting to vote on whether to carry out a reverse split to raise its share price to more than $1.

Just last week, the US Nasdaq informed the company that it did not meet the minimum bid for continued listing on the exchange and that the stock had been trading below $1 since April 11. Nikola shares closed down 20.27% at $0.615 on the news, the biggest drop since November 2020. As of press time, Nikola's latest closing price was $0.586, with a total market capitalization of $420 million, and its share price has fallen below $1 for 37 consecutive trading days, down 72.87% during the year.

According to Nasdaq regulations, shares of companies listed on the exchange must not trade at less than $1, and delisting notices will be issued if they fall below that price for 30 working days in a row. After that, the relevant company will be given a 180-day buffer period, during which the company's share price will be exempted from delisting if it can be traded above $1 for 10 consecutive trading days.

In 2014, with the help of new energy vehicles, the 32-year-old Trevor Milton founded Nikola, known as Tesla of the car world, because Nikola and Tesla are the name of American inventor Nikola Tesla Tesla. It is understood that the American electric car company Tesla was co-founded by Martin Eberhard and Mark Tapenning. The reason why the founder named the company "Tesla" is in memory of physicist Nikolai Tesla, and Trevor Milton named the company "Nikolai" because Tesla already occupied a large market share in the electric vehicle market at that time. It is worth mentioning that, unlike Tesla, Nikola mainly develops new energy heavy trucks powered by hydrogen fuel cells and batteries.

In 2016, Nikola held a press conference to launch its first hydrogen truck product, Nikola One. Trevor Milton paints a hype about Nikola One's technology, saying the hydrogen truck takes just 15 minutes on a single charge, runs more than 1000 miles on a single charge, and has zero emissions and no pollution. In the same day's press release, Trevor Milton said that Nikola has been ahead of other automakers in technology for 10-15 years, and boasts that it has surpassed Daimler, Volvo and other mainstream truck companies within 1-2 years.

To this end, Nikola is known as the "truck version of Tesla", and with the remarks of Trevor Milton, it has attracted commercial vehicle company WABCO, hydrogen energy equipment manufacturer Nel, photovoltaic manufacturer Hanwha, and so on. These global giants not only reached strategic cooperation with Nikola, jointly carried out technology research and development, but also participated in financing.

After five years of development, an unsold Nikola has been successfully put on the market. On June 3, 2020, Nikola announced a merger with VectoIQ Acquisition Corp. Complete the merger to become the first stock of hydrogen energy heavy truck in the world. Three days after listing, Nikola's share price doubled, with a market capitalization of up to $34 billion, surpassing Ford, a century-old carmaker.

On September 8, 2020, Nikola ushered in another highlight moment when General Motors announced that it had reached a strategic cooperation with Nikola to obtain $2 billion of newly issued common shares of Nikola with equivalent non-cash assets. GM will own 11% of Nikola and can nominate a board member. Affected by the news, GM shares rose 7.93% on the day. Nikola shares soared 40.79%.

Only the other day, Nikola was hit on the head by the short seller. On Sept. 9, 2020, short seller Hindenburg Research released a scathing report on Nikola and its founders. The report points out that Nikola never developed hydrogen fuel technology and cashed out by forging a large number of orders. Even more bizarre, the agency pointed out that the Nikola One displayed by Nikola was not a truck because the car itself did not have power. Hindenburg said that in the official promotional video, Nikola One appears to be able to drive because it is placed on a hillside and glides down by gravity. Nikola made the car model look like it was speeding by adjusting the shooting angle and editing acceleration during the video shooting. Eventually, Nikola pleaded guilty to the charges, and founder Trevor Milton resigned on September 20, 2020.

It's hard to understand that Trevor Milton blew the company's market capitalization to $34 billion based on car models and videos alone, and tricked giants such as Bosch and General Motors into the hole. In fact, it is not only how superb the tricks of Trevor Milton are, but also the excessive touting of the new energy market.

Between 2020 and 2021, Tesla's share price rose from US $23.37 to US $414.50, an increase of 1160.09%, while the share prices of new power car companies, including Xilai, ideal and Xiaopeng, also rose sharply. In this context, global investors are trying to find the next "Tesla", not only Nikola, but also Rivian, Lordstown and many other new energy start-ups are sought after. For now, however, many new energy startups have only chicken feathers left.

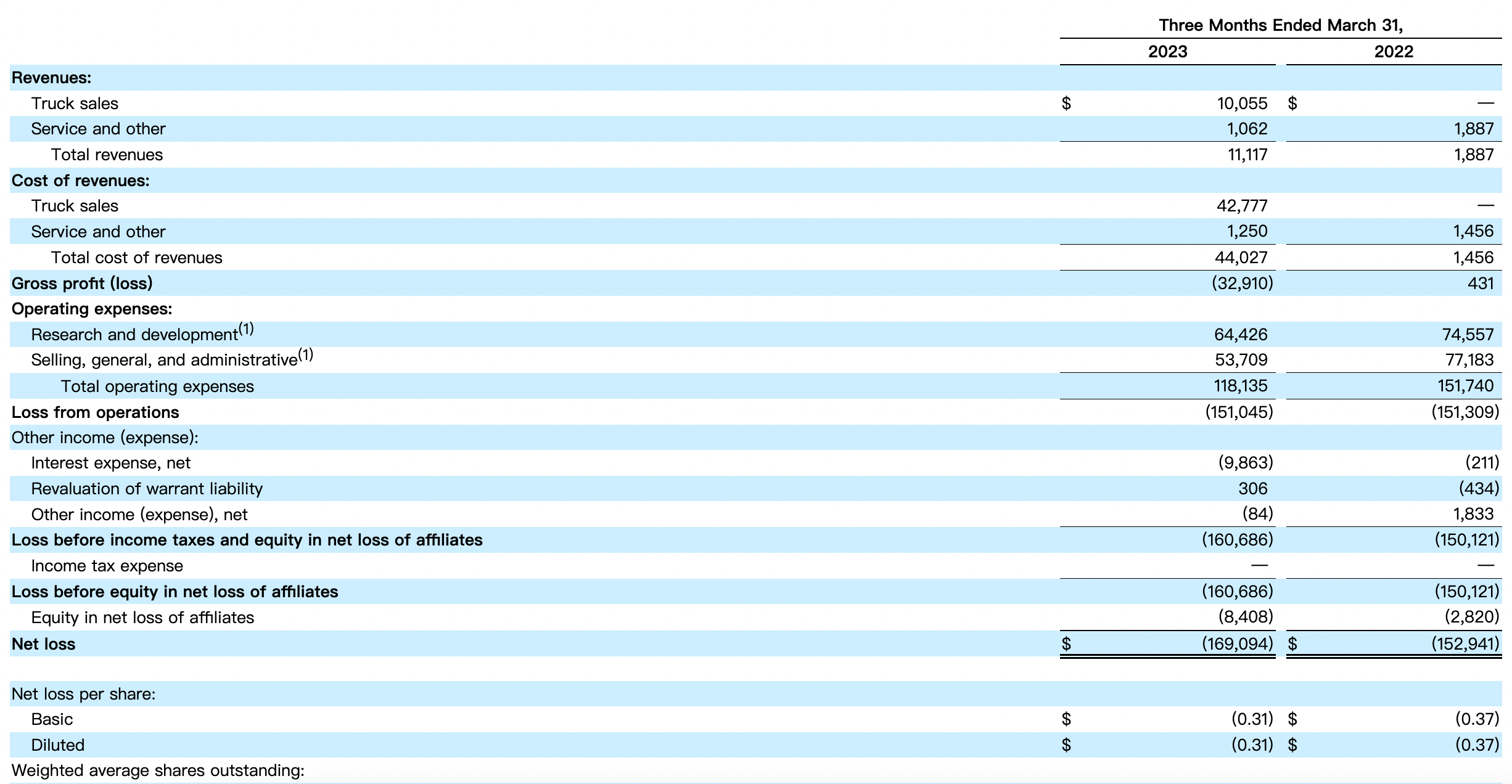

According to the latest financial report, Nikola realized operating income of $45.93 million and a net loss of $784 million in 2022. In 2023, Q1 had operating income of $11.12 million and a net loss of $169 million. As of March 31, 2023, Nikola's remaining cash was $121.1 million, down from $233.4 million at the end of 2022.

Recently, Nikola announced that it would withdraw from Europe and focus on the development of the United States. At the same time, it announced that it would sell its stake in an European joint venture to its long-term partner in exchange for $35 million in cash and 20.6 million Nikola shares. In 2019, Nikola and Iveco formed a joint venture to help Iveco catch up with big European competitors such as Daimler trucks and Volvo. Under the agreement, Iveco will continue to supply chassis and related components to Nikola and will continue to be an investor in the company.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.