In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)06/08 Report--

Zhu Jiang, former vice president of user development and operations, has joined Lucid, a new U.S. car-making force, in charge of the Chinese market, according to interface news reports. Mr Zhu said Lucid was just beginning to prepare to enter the Chinese market.

It is understood that Zhu Jiang left Jidu Automobile in April 2022 and worked for less than half a year. Before joining Jidu Automobile, he served as Chief Operating Officer (COO) of Ford China Electric Vehicle Business Unit, responsible for the operation and management of Mustang Mach-E electric vehicle project marketing, public relations, sales, service and customer experience, and promoted the domestic production of this model. However, Zhu Jiang's tenure at Ford Motor Company was not long.

Zhu Jiang's main work experience is in BMW cars. In 2003, Zhu Jiang joined BMW Brilliance in charge of marketing activities. From 2008 to 2012, he served as BMW MINI Brand Management Director. He was the first Chinese brand director in BMW Group worldwide and later promoted to Vice President of MINI China Brand Management. After leaving BMW in 2013, Zhu joined Lexus and helped Lexus achieve its sales target of 100,000 vehicles in China for the first time in 2016. Zhu Jiang left Lexus in 2017 and joined NIO as vice president of user development. His dominant user experience model created a group of high-viscosity users and became one of the key elements supporting the development of NIO Automobile.

Lucid, formerly known as Atieva, was founded by Xie Jiapeng, former vice president and director of Tesla, and Wen Shiming, a former Oracle executive. At first, Lucid focused on the research and development of battery, electronic control and electric drive technology. It was positioned as the core system provider of new energy vehicles, which can be simply understood as "Intel in the field of new energy vehicles". It is worth mentioning that, in addition to Xie Jiapeng, including Eric Bach, vice president of hardware engineering, Peter Hasenkamp, vice president of supply chain management, and Doreen Allen, director of sales, are all from Tesla, describing Lucid as a "replica Tesla" is not too much.

Like Tesla's early development path, Lucid is positioned as a high-end luxury electric car, with the first production model Lucid Air starting at $87,400. Because most Lucid executives have Tesla backgrounds and the two companies have similar development paths, Lucid was once known as the "Tesla killer." However, Rawlinson believes Lucid is targeting traditional luxury brands, not Tesla.

In July 2021, Lucid was listed on NASDAQ. Its share price rose 10.64% on its first day to close at $26.83 per share, with a total market capitalisation of more than $40 billion. Since then, its share price has risen as high as $57.75 with the tuyere of new energy vehicles, but now it has fallen to $6.4 per share, with a market capitalisation of more than 80%, with a market capitalisation of just $11.739 billion.

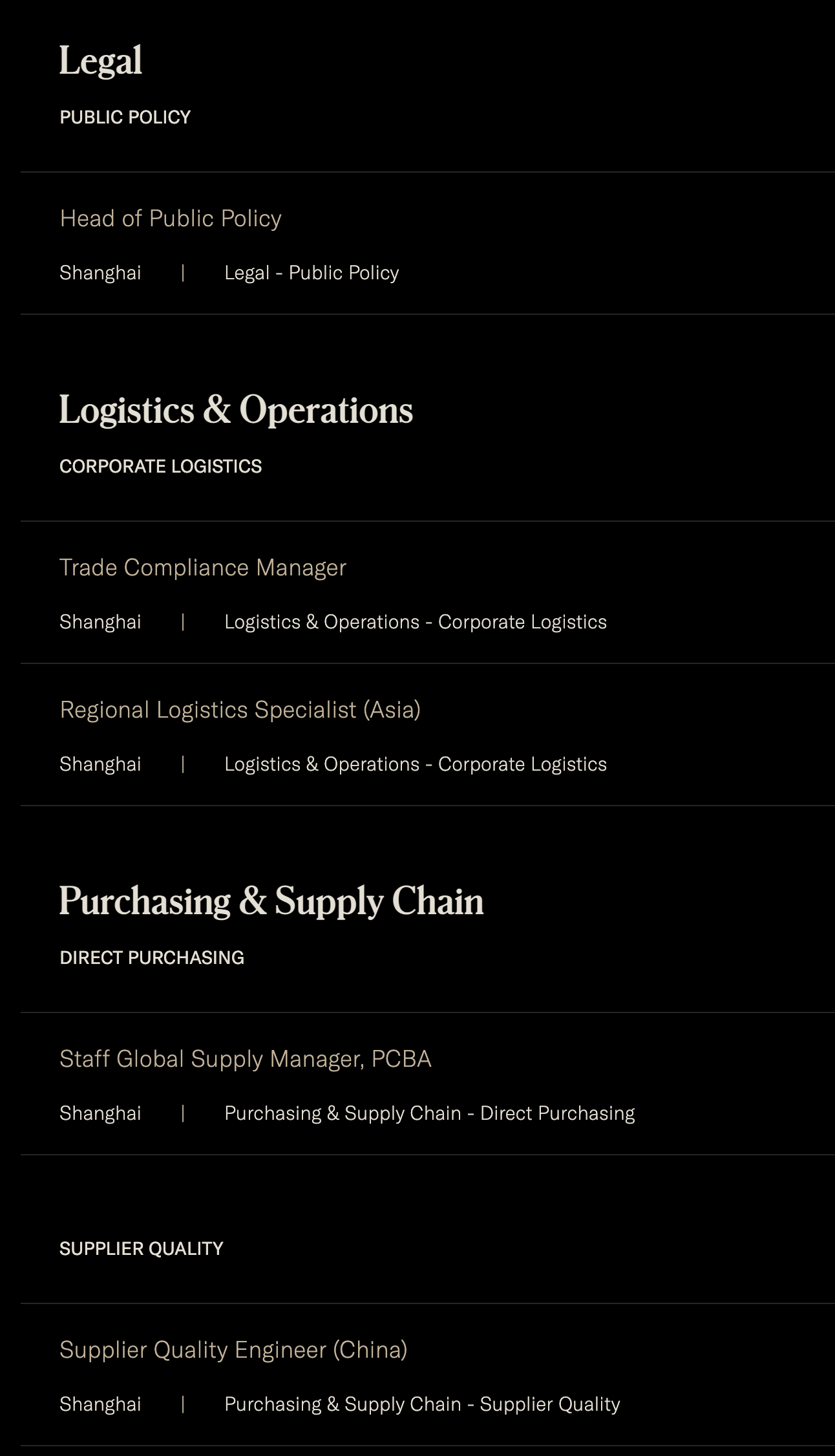

Like Tesla, Lucid has long been eyeing the Chinese market. In November 2022, Lucid said in its earnings report that it planned to enter the Chinese market in 2023. The following month, Lucid began recruiting in China, involving 14 positions in digital informatization, hardware engineering, law, logistics management, supply chain, retail and other fields, but did not disclose the specific number of recruits. Most of the positions require proficiency in Chinese and English or two years or more working experience in Chinese enterprises.

Different from the domestic market, Lucid encounters double bottlenecks in sales volume and production capacity in its domestic development. In the US market alone, Lucid's output is difficult to guarantee delivery, and it is more difficult to export overseas on a large scale. According to Lucid's first-quarter earnings report, the net loss for the reporting period reached $780 million, up sharply from a loss of $81.3 million in the same period in 2022. In March, Lucid revealed plans to lay off 18% of its workforce to save money.

Lucid wants to take root in the Chinese market. The first problem is to launch a model that can be mass-produced locally. The price of Lucid Air, its first production car, is about RMB 610,000 yuan, which is more than Mercedes-Benz EQE and equivalent to NIO ES8 high-end version. In addition to import taxes and fees, the final landing price is not a small amount. Further, Lucid faces a very different competitive environment than Tesla when it first entered China, when Tesla stood alone. Now the car-building power pattern has initially stabilized, and traditional automakers 'new energy brands are making efforts. Lucid needs to be prepared for a long battle if it wants a piece of the fierce Chinese market.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.