In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)06/21 Report--

On June 20th, Xilai announced a share subscription agreement with CYVN Holdings, an Abu Dhabi investment agency. According to the agreement, CYVN Holdings will make a total strategic investment of about $1.1 billion to Wei through the transfer of new shares and old shares.

It is understood that CYVN Holdings is a majority-owned investment institution owned by the Abu Dhabi government, focusing on strategic investment and layout in advanced and intelligent mobile travel areas, and is committed to working with global industry leaders in this field. In addition, CYVN's chairman, Jassem Al Zaabi, is also Abu Dhabi's finance minister and serves as vice chairman of the central bank, vice chairman of sovereign fund ADQ, and director of sovereign fund ADIA and oil company ADNOC.

Under the agreement, CYVN will issue 8.469 million additional Class A common shares at a price of US $8.72 per share (the weighted average price of Class A common shares on the NYSE for seven consecutive trading days prior to June 19, 2023), with a total investment of US $738.5 million, which is expected to be completed in early July 2023. After the private placement of new shares and the transfer of existing shares, CYVN will hold about 7.0 per cent of the issued and outstanding shares of Xilai. Upon completion of the investment transaction, CYVN will have the right to appoint a director to the company's board of directors. At present, the latest US stock price of Xilai is US $9.36, with a total market capitalization of US $15.78 billion.

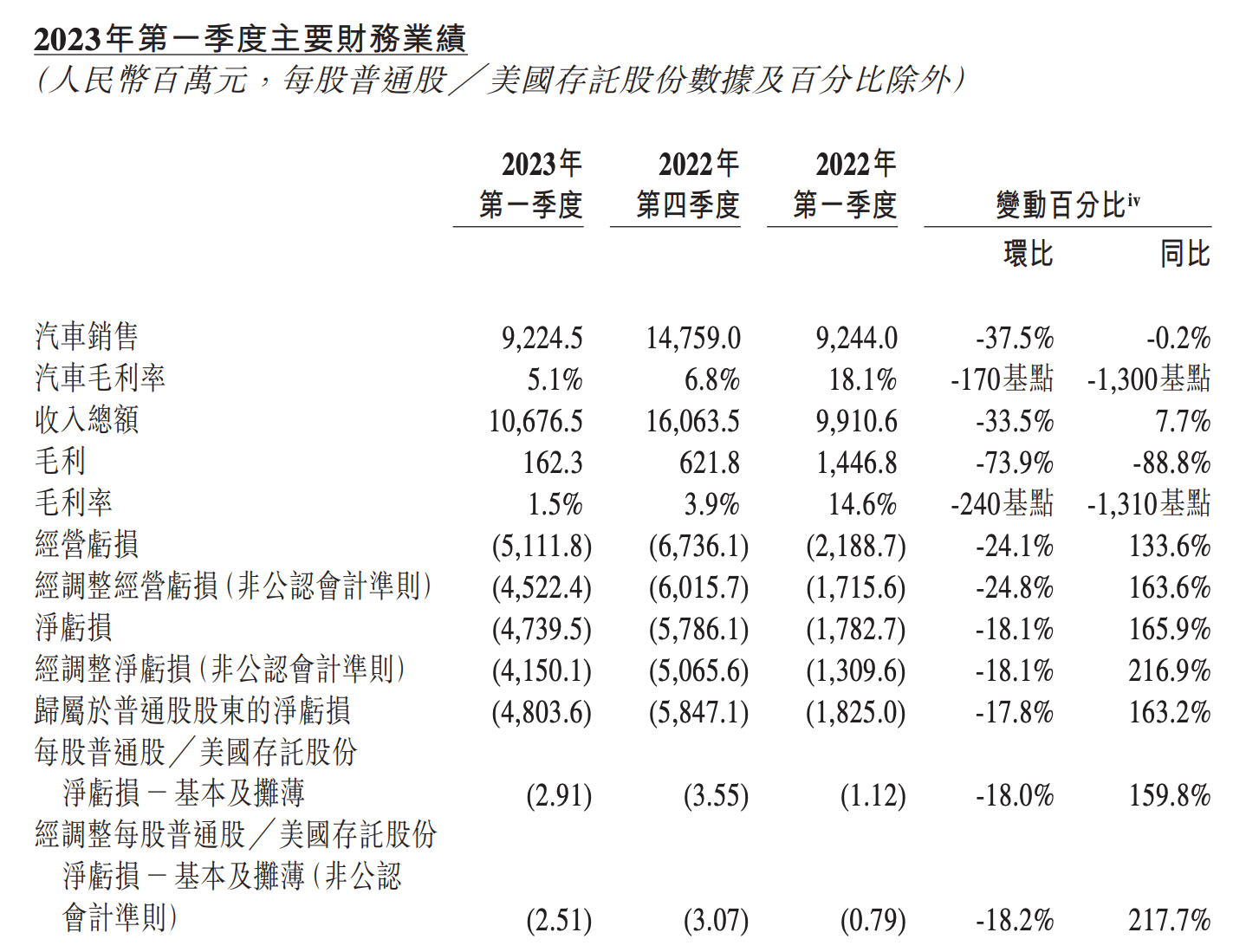

On June 9, NIO announced its financial results for the first quarter of 2023, showing that during the reporting period, NIO realized operating income of 10.68 billion yuan, an increase of 7.7% over the same period last year, of which vehicle sales revenue was 9.22 billion yuan, down 0.2% from the same period last year; a net loss of 4.74 billion yuan, an increase of 165.9% over the same period; in addition, the gross profit margin for the first quarter was 1.5%, compared with 14.6% for the same period, and the gross profit margin for cars was 5.1%, compared with 18.1% for the same period.

According to the financial results released by NIO, although revenue has achieved positive growth for 12 consecutive quarters, reaching 10.68 billion yuan, it is lower than the market expectation of 12.28 billion yuan. At the same time, the loss is also further expanding, with a net loss of 4.74 billion yuan in the first quarter, an increase of 165.9% over the same period last year. Li Bin said, "as far as the current situation is concerned, the break-even schedule has to be pushed back. I hope it can be postponed within a year." Previously, in the March earnings call, Li Bin also optimistically predicted that the main brand business of NIO would be profitable in the fourth quarter of this year, and the whole company was expected to break even in 2024.

Since the beginning of this year, only ET5 and ES7 have been delivered on the new platform, while other models are either waiting to be released or waiting for delivery. among them, the new ES6 will be launched on May 24 and ET5 Touring on June 15. Data show that a total of 43854 new cars were delivered from January to May, an increase of 15.81 percent over the same period last year.

At a media conference on the eve of the 2023 Shanghai auto show, Li Bin joked with users that if he sold 10, 000 vehicles a month, he would have to look for a job with Qin Lihong. At the media communication meeting on June 12, Li Bin had a new explanation for the problem of "looking for a job." "(now looking for a job) other people don't want us. Let's do a good job later and continue to work until (a month) 20,000."

It is worth mentioning that investment institutions in the Middle East are particularly favored by the new energy vehicle industry. Not long ago, the Saudi Ministry of Investment and Chinese Express signed an agreement worth 21 billion Saudi riyals (US $5.6 billion) to set up a joint venture engaged in automobile research and development, manufacturing and sales. It is understood that on the same day, Saudi Arabia and China signed more than 10 billion US dollars in investment agreements in the areas of technology, renewable energy, agriculture, real estate, metals, tourism and health care, of which the agreements signed between Saudi Arabia and Chinese Express accounted for half of the total investment.

In 2018, the Saudi Public Investment Fund (PIF) invested US $1 billion in Lucid of the United States, and Lucid announced that it would build the first international car assembly plant in King Abdullah Economic City, and the Saudi Public Investment Fund (PIF) is currently the largest shareholder of Lucid. In addition, McLaren and Aston Martin are also PIF investment projects. In December 2022, Chinese car-making new force Skyline Motor announced the establishment of a joint venture with Saudi local Sumou Holding to jointly invest in the construction of local factories to produce new energy vehicles, with an annual production capacity of about 100000 new energy vehicles.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.