In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)06/22 Report--

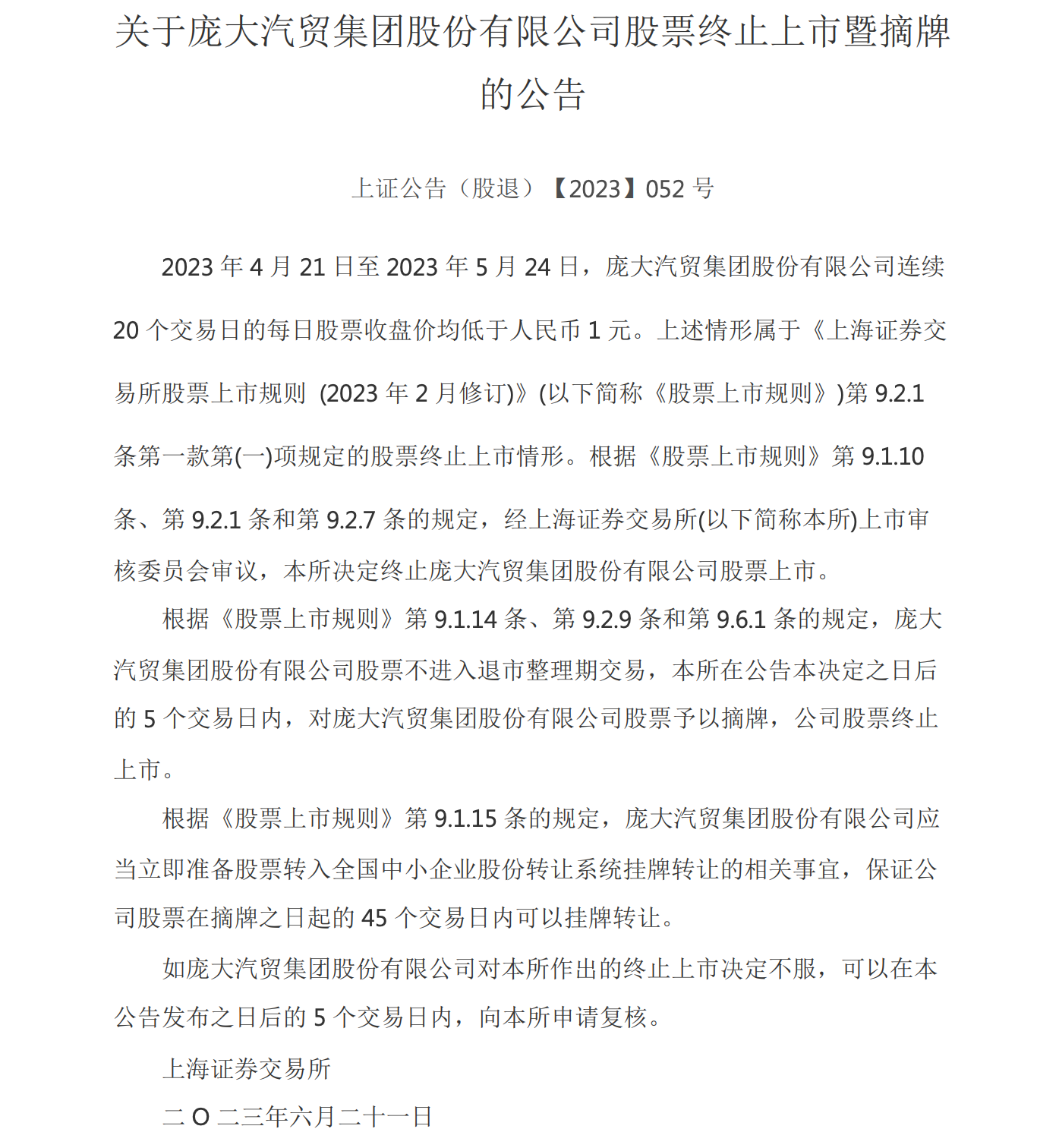

On June 21, *ST issued an announcement saying that the Company received the Decision on Termination of Listing of Shares of Pangda Automobile Trade Group Co., Ltd. issued by Shanghai Stock Exchange, and Shanghai Stock Exchange will delist the shares of the Company on June 30,2023, terminate the listing of the shares of the Company and not enter the delisting consolidation period trading.

Before the suspension, from April 21 to May 24, *ST huge 20 consecutive trading days of stock closing prices were lower than 1 yuan, and out of 15 days 14 limit market, the lowest share price fell to 0.4 yuan/share. According to the regulations, Shanghai Stock Exchange shall delist the listed company's shares within 5 trading days after the announcement of the decision to terminate the listing of the listed company's shares, terminate the listing of the company's shares, and do not enter the delisting consolidation period for trading.

Pangda Group was founded on March 3, 2003. It is a large-scale automobile marketing enterprise mainly engaged in automobile sales service. In 2010, it became the largest automobile dealer in China and was called "King of 4S Store". In April 2011, Huge Group was listed and traded on Shanghai Stock Exchange, becoming the first auto trade group in China to list six A shares. At its peak, it once had more than 1400 4S stores with a market value of more than 50 billion yuan.

After 2018, huge groups began to have hidden worries. In that year, the huge group encountered short-term liquidity difficulties and suffered huge losses, and due to serious shortage of funds, inability to realize property and other reasons, it was unable to pay off due debts, lost obvious solvency possibility, and was finally applied for reorganization by creditors. According to the restructuring plan, the total liabilities of the huge group amounted to 27.28 billion yuan. Subsequently, Pang Qinghua, founder and former controlling shareholder of the huge group, sold shares to the three reorganization parties and gave up control of the company.

However, bankruptcy reorganization also failed to usher in a new life. In May 2019, Pangda Group announced bankruptcy reorganization. In September 2019, the Intermediate People's Court of Tangshan City, Hebei Province, ruled to accept the reorganization application for the huge group. A week later, the huge group released news to the outside world, confirmed Shenzhen Business Group and other three reorganization intention investors. In December 2019, Shenzhen Shenshang Holding Group Co., Ltd.(hereinafter referred to as "Shenshang Group"), Shenzhen Yuanwei Asset Management Co., Ltd.(hereinafter referred to as "Yuanwei Assets") and Shenzhen National Transportation Technology Group Co., Ltd.(hereinafter referred to as "National Transportation") were identified as restructuring investors.

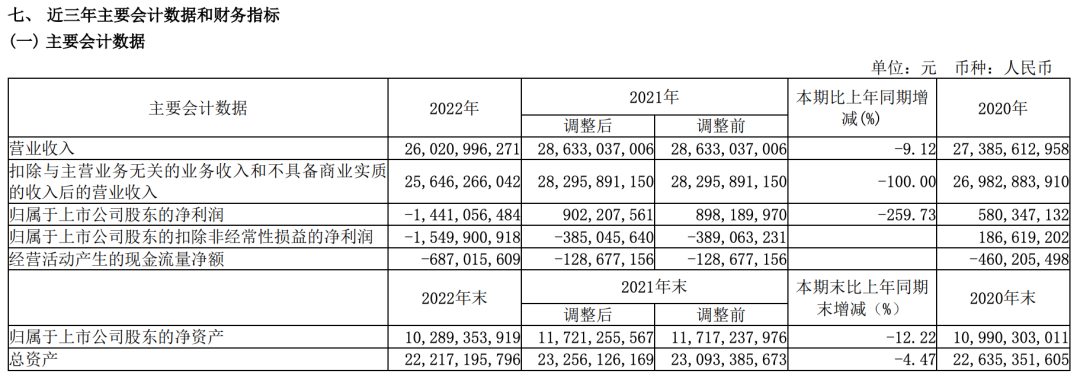

According to the Restructuring Plan, the restructuring investors promised that the total net profit attributable to the owners of the parent company of the huge group from 2020 to 2022 would reach 3.5 billion yuan. If the aforesaid criteria are not met, the restructuring investor shall make up for it in cash to Pang Da Group within three months after the publication of the audit report for the fiscal year 2022. However, from 2020 to 2022, the net profits attributable to the owners of the parent company were RMB 580 million, RMB 898 million and RMB-1.441 billion respectively, far from meeting the commitment requirement of RMB 3.5 billion in total. So far, *ST has not issued a detailed announcement on performance compensation.

During this period, the huge management team was completely changed. Huang Jihong, the newly appointed chairman, was the president of Shenshang Group, and Liu Xianghua, the director and secretary of the board of directors, was the executive president and vice president of national transportation capacity of Shenshang Group.

According to the information disclosed by Shanghai Stock Exchange, some investors revealed that Huang Jihong, the actual controller, was suspected of occupying the funds of listed companies in disguised form through potential related parties. The total amount of vehicles and parts purchased by the Company from Zhongtai Automobile Co., Ltd. controlled by Huang Jihong was not more than 1 billion yuan.

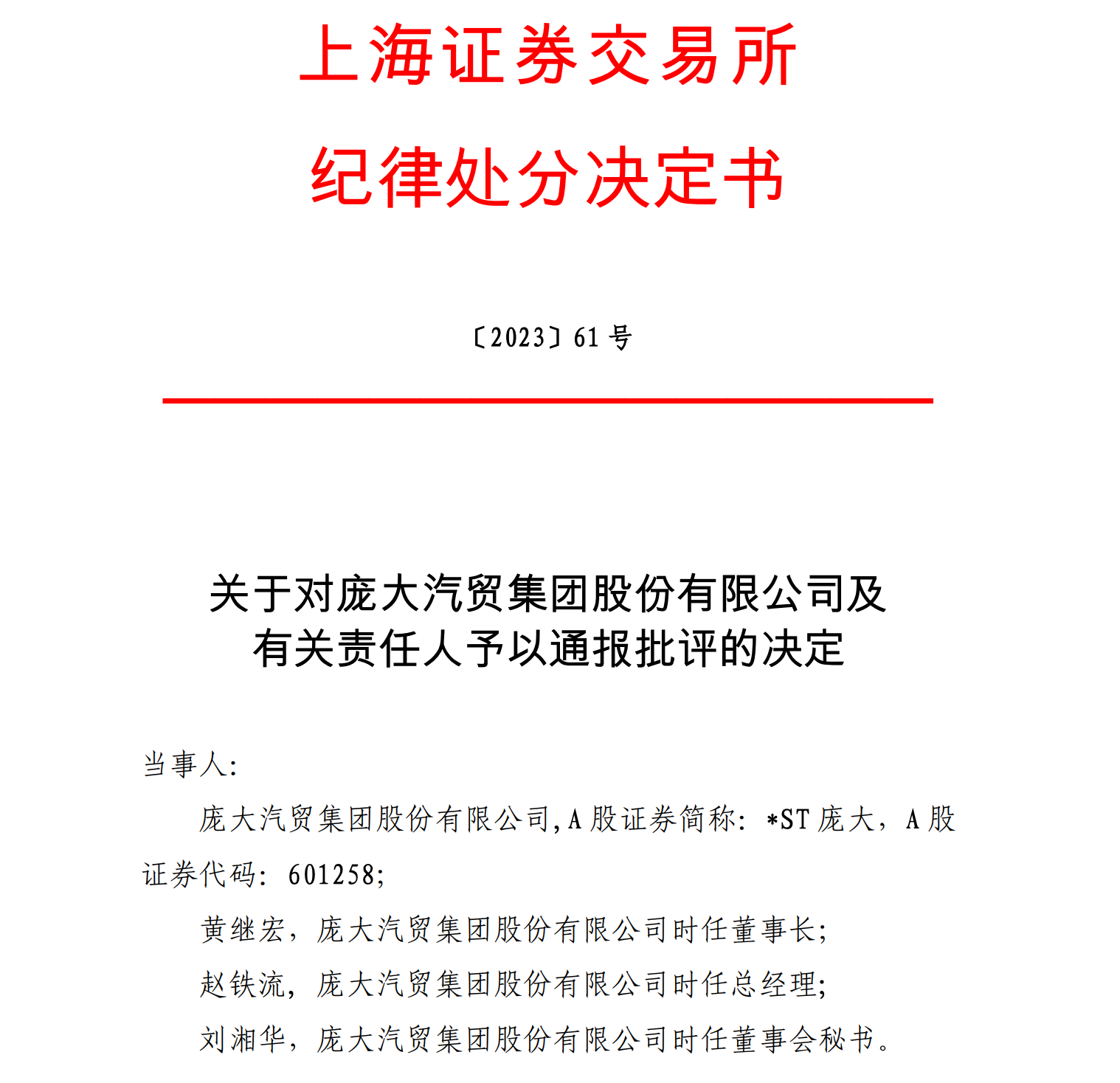

On May 19, Hebei Securities Regulatory Bureau decided to issue warning letters and administrative supervision measures against Huang Jihong, General Manager Zhao Tieliu and Liu Xianghua. On May 26, China Securities Regulatory Commission (CSRC) filed an investigation into *ST Huge on the grounds of suspected information disclosure violations. On June 2, *ST Huge and relevant responsible persons received the disciplinary decision issued by Shanghai Stock Exchange. Huang Jihong, then chairman of Pangda Automobile Trade Group Co., Ltd., Zhao Tieliu, then general manager, and Liu Xianghua, then secretary of the board of directors, were criticized in a notice due to the fact that many litigation matters were not disclosed in time and the performance forecast was not disclosed accurately.

It is understood that the largest shareholders of Pangda Group and Zhongtai Automobile are subordinate enterprises of Shenzhen Shenshang Holding Group Co., Ltd., and the actual controllers are Huang Jihong.

On June 1, Zhongtai Automobile issued an announcement saying that Huang Jihong applied to resign as chairman and director of the company due to personal reasons, and resigned as a member of the strategy committee and nomination committee of the board of directors of the company. After resigning from the relevant position, Huang Jihong will not hold any position in the company.

In response to the above actions, Shenzhen Stock Exchange issued a letter of concern to Zotye Automobile, requesting to explain whether *ST Huge transferred benefits to the company and other relevant information. The Letter of Concern requires Zhongtai Automobile to verify and explain all kinds of transactions between the Company and *ST in the last three years and the first period; it requires Zhongtai Automobile to explain whether the proposal of *ST to cancel the review of related transactions with the Company has caused significant adverse impact on the Company in combination with the current orders in hand of the Company. So far, Zotye Automobile has not replied to the relevant content.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.