In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-24 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)06/26 Report--

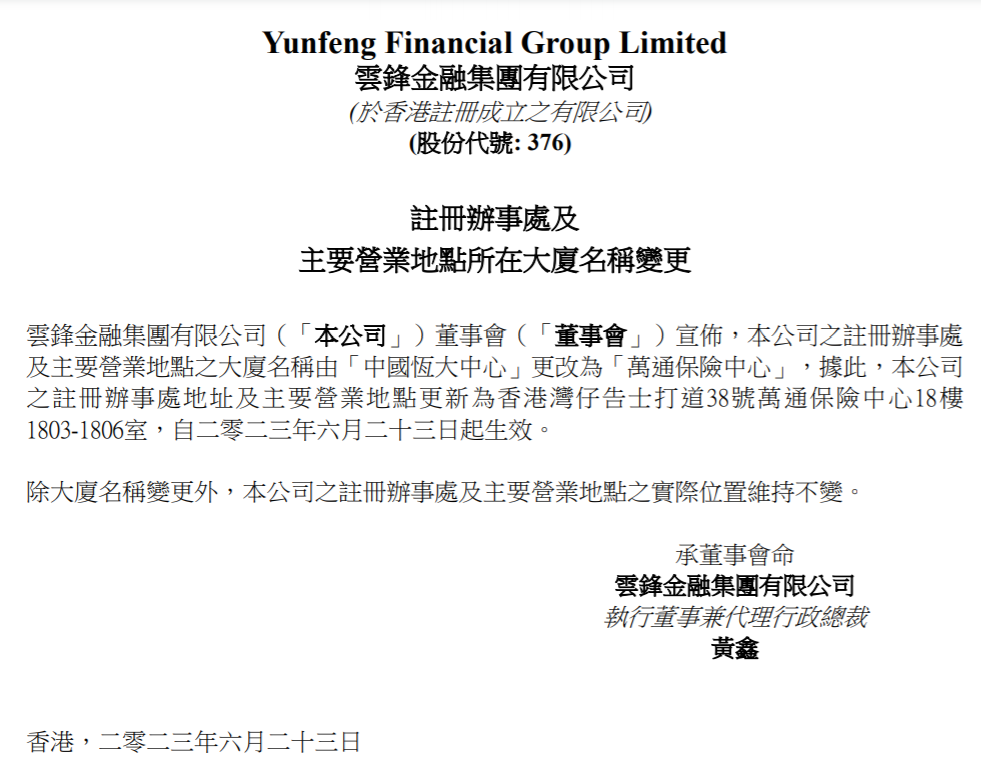

Recently, Yunfeng Finance issued an announcement on the change of the name of the building where the registered office and principal place of business are located. According to the announcement, the name of the registered office and principal place of business of Yunfeng Financial was changed from "China Evergrande Center" to "Vantone Insurance Center", and the address of the registered office and principal place of business of the Company were updated to Rooms 1803-1806, 18th Floor, Vantone Insurance Center, 38 Gloucester Road, Wanchai, Hong Kong, with effect from 23 June 2023.

At the same time, the official said that except for the change in the name of the building, the physical location of the company's registered office and principal place of business remained unchanged.

It is understood that the building is located in Wan Chai, a prosperous area of China Hong Kong. It is one of the important landmarks on both sides of Victoria Harbour, close to Admiralty and Wan Chai MTR stations in Hong Kong. It has 26 floors and covers an area of 2138.8 square meters. The former name of China Evergrande Center in Hong Kong is "American Metrohm Building", which is the headquarters of Chinese real estate. In 2015, high-spirited Xu Jiayin bought American Vantone Building from Chinese Real Estate for HK $12.5 billion, and renamed it China Evergrande Center the following year. According to relevant data, Evergrande Real Estate ushered in a high light period in 2016, with sales exceeding 200 billion yuan in that year, ranking second only to Vanke and ranking second in China.

At present, the brand of China Evergrande Center has been replaced with a new brand with the name of "Vantone Insurance Center". Relevant information shows that Vantone Insurance belongs to Yunfeng Finance, which was jointly founded by Ma Yun and Yu Feng and listed in Hong Kong shares in 2015. The principal business scope of YF Life Insurance in Hong Kong is long term insurance in the management of life and annuity, investment-linked long term, permanent health and retirement plans.

It should be noted that due to Evergrande Group's financial crisis in recent years, China Evergrande Center in Hong Kong is also regarded as a high-quality asset of Evergrande Group. As early as 2018, Evergrande mortgaged the whole building and raised HK $12 billion.Due to the lack of funds, the building was sold several times. In August 2021, it was reported that Evergrande offered HK $15.6 billion to seek an intended receiver. After contacting Yuexiu Real Estate, the price dropped to HK $10.5 billion, but the transaction was not finally negotiated.

At the end of July 2022, it was reported that Li Ka-shing's Changshi Group submitted a tender, valuing the building at about HK $9 billion, which was HK $3.5 billion less than the earlier purchase price of Xu Jiayin, and still failed to sell. In September 2022, according to public documents disclosed in China Hong Kong, China Evergrande Center has been taken over by the receiver appointed by CITIC Bank International, a subsidiary of CITIC Bank, a creditor.

In October 2022, the media reported that China Evergrande Center Building was being sold exclusively by Savills, with the tender closing date of 31 October 2022. In fact, this building is of great significance to Evergrande Group. Its location at the heart of Hong Kong's politics, commerce, tourism and transportation can greatly enhance the Group's position and image in Hong Kong and internationally, with strong brand influence. The renaming of the building now also means that Evergrande Group has not been relieved of the huge debt pressure it faces and has to reduce its huge debts by selling and splitting assets.

In fact, Evergrande Group's development in recent years has not been satisfactory. In order to reverse the crisis, Evergrande regards the new energy automobile business as a lifesaving straw. In October last year, Xu Jiayin, chairman of Evergrande, announced strategic adjustment. Evergrande will realize the industrial transformation from real estate to new energy vehicles in the next 10 years, forming an industrial pattern dominated by new energy vehicles and supplemented by real estate. It is planned to achieve annual sales of more than 1 million vehicles by 2025 and annual sales of more than 5 million vehicles by 2035.

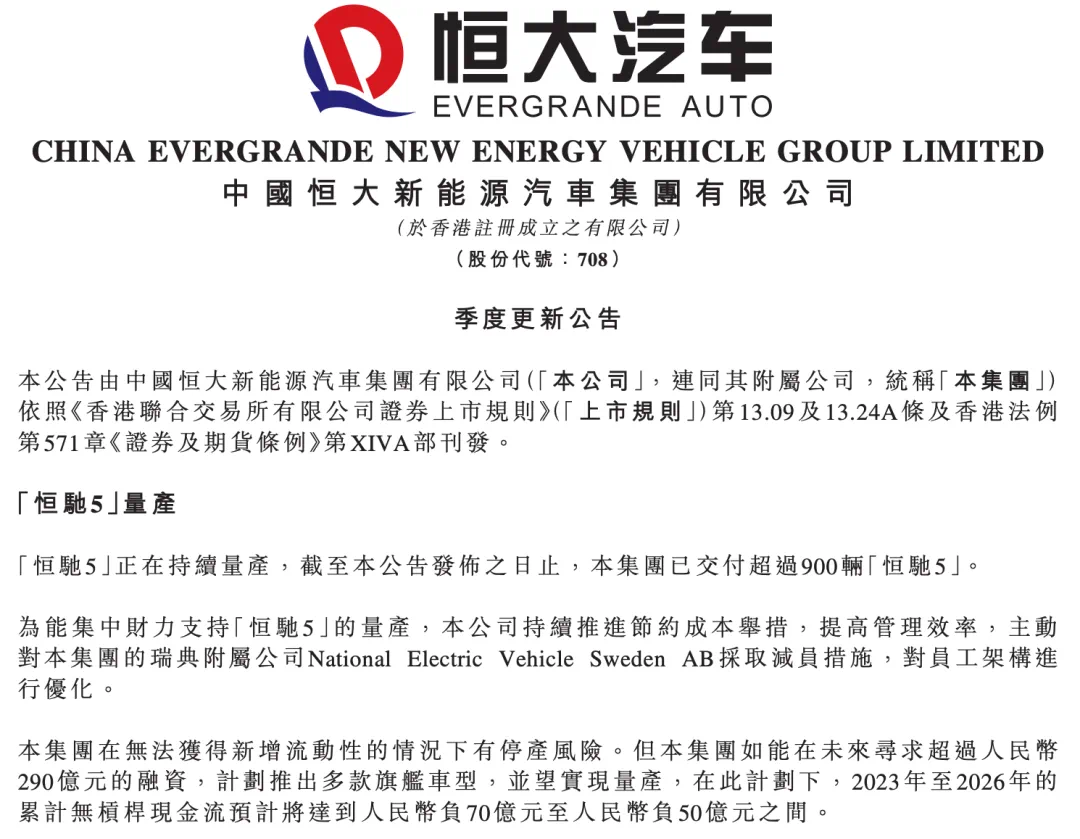

As the first mass production car of Evergrande Automobile, Hengchi 5 naturally assumes the role of "Savior". However, due to the influence of parent company, the development of Evergrande Automobile has also been restricted. In April, it was reported that Evergrande stopped production completely due to insufficient funds. Subsequently, Evergrande Automobile issued an announcement saying that after delivering 900 vehicles, due to insufficient funds, the Tianjin factory suspended the production of Hengchi 5. However, in the latest quarterly update announcement, Hengchi 5 resumed production in May and had delivered more than 1000 vehicles by the end of May. However, the official said: Evergrande is still facing difficulties in fund shortage at present, and is continuously promoting cost-saving measures, actively exploring financing channels and trying its best to maintain the Group's continuous operation.

In order to build cross-border vehicles, Evergrande has invested a large amount of money to mass produce Hengchi 5. However, although Hengchi 5 has been mass produced, its sales volume is not remarkable. According to the official data of more than 1000 vehicles, Evergrande Automobile is far from enough to save its parent company. Relevant data show that by the end of April 2023, Evergrande Group has accumulated about RMB 272.479 billion yuan of outstanding due debts (excluding domestic and overseas bonds) involved by the Issuer. By the end of April this year, the issuer's overdue commercial tickets accumulated about 245.987 billion yuan.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.