In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-24 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)02/20 Report--

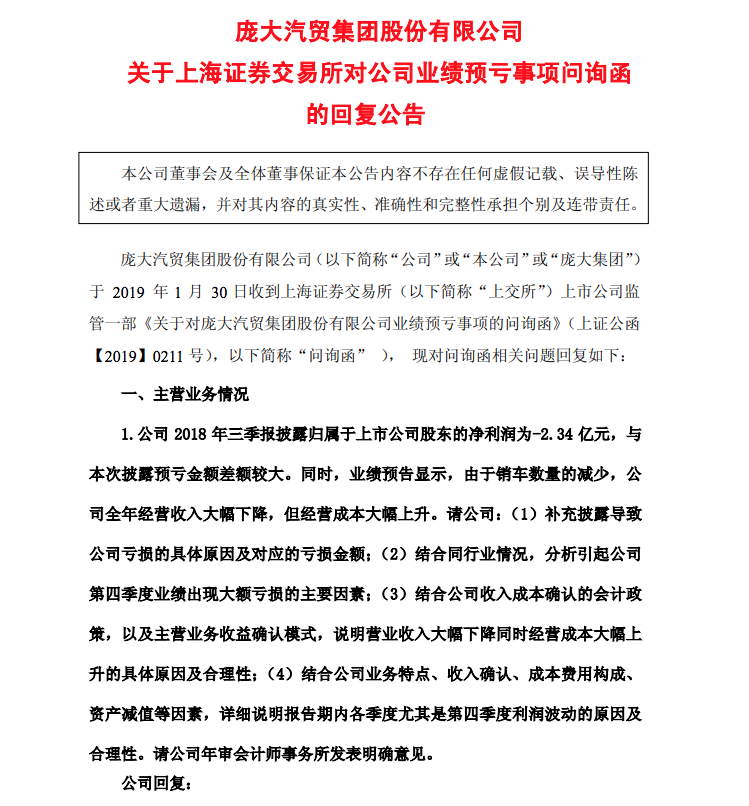

Giant Automobile issued a pre-loss announcement on January 30th, which is expected to lose 6 billion-6.5 billion yuan in 2018. On this issue, the Shanghai Stock Exchange has issued a letter of inquiry on the performance pre-loss of Giant Automobile Trade Group Co., Ltd.

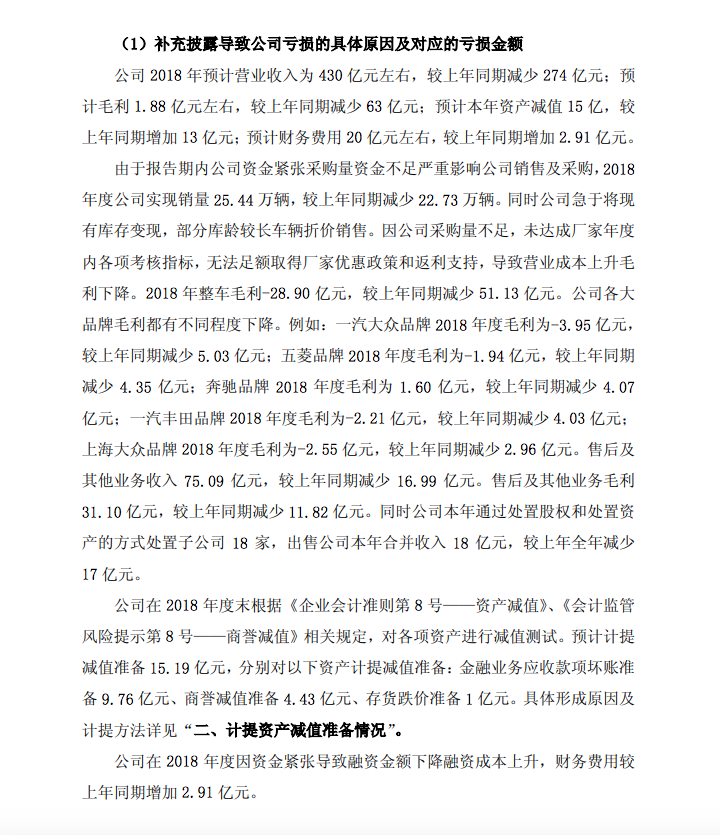

Recently, Giant Automobile officially returned to the Shanghai Stock Exchange. Due to the reduction in the number of cars sold, the company's annual operating income has dropped sharply, but operating costs have risen sharply. Giant said it sold 254400 vehicles in 2018, down 227300 from a year earlier. In addition, due to the company's insufficient procurement, failed to achieve the manufacturer's annual assessment indicators, unable to fully obtain the manufacturer's preferential policies and rebate support, resulting in an increase in operating costs and a decline in gross profit.

According to the pre-loss report released by giant Motor, the company's expected operating income in 2018 is about 43 billion yuan, a decrease of 27.4 billion yuan over the same period last year; its gross profit is expected to be about 188 million yuan, a decrease of 6.3 billion yuan over the same period last year; the asset impairment this year is expected to be 1.5 billion, an increase of 1.3 billion yuan over the same period last year; and the financial expenses are expected to be about 2 billion yuan, an increase of 291 million yuan over the same period last year.

In terms of personnel, large groups have also begun to experience unrest. Five senior executives and one supervisor have resigned since June 2018. From August to September 2018, the two secretaries of the company resigned one month after another. To February 2 and February 14 this year, the giant group issued two more executive resignation announcements.

Huge and poor operation, many of its 4S stores have been changed hands, and even many stores are difficult to operate to the point of closure. Recently, there are media reports that a huge 4S store located on the East fourth Ring Road in Beijing has reflected to reporters that employees' wages have been largely in arrears for four months, and seven employees have filed a labor arbitration to try to recover 140000 wages.

Giant Group is a large-scale automobile marketing enterprise with automobile sales and service as its main business, A-share listed companies, acting for nearly 100 mainstream automobile brands at home and abroad, such as BAIC, BYD, FAW-Volkswagen, Audi, Mercedes-Benz, etc., ranking fourth in the list of China's top 100 auto dealer groups with total revenue of 70.4 billion yuan in 2017.

Giant Group is a well-known listed company of car dealers in China. Its assets have been maintained at more than 50 billion yuan in the past few years and reached a peak of 70 billion yuan in 2015. However, its market value began to decline day by day since 2017. As of the close of trading on February 18, 2019, the secondary market value of the giant group was only 8.8 billion yuan. According to the financial report, the net profit of the giant group belonging to shareholders of listed companies in 2017 was 212 million yuan, down 44.45 percent from the same period last year, while the net profit loss after deducting non-profit was 209 million yuan, down more than 207 percent from the same period last year.

The operation of the huge group has plummeted in 2018. After the emergence of financial pressure, the huge group has done a lot of work to withdraw the funds. The 100% stake in five Mercedes-Benz 4S stores directly or indirectly held by the giant group was sold for 1.25 billion yuan in May 2018. On August 10, the giant group again announced the sale of the 100% equity interests directly or indirectly held by Beijing Resa, Jinan Audi, Jinan Volkswagen, Jinan Ssanglong, Jinan Subaru, Shijiazhuang Guangfeng, Shenyang Guangfeng, Shijiazhuang Hongfeng Guangfeng and 9 subsidiaries of Qingdao Company. In addition to selling assets to withdraw funds, the giant group has also closed a number of its 4S stores one after another.

However, a series of actions of the large group to withdraw funds did not enable it to break through the predicament, but acted too hastily because of the "illegal financing operation" and was put on file by the CSRC for investigation. On July 4, 2018, the giant group announced that it had received the administrative penalty decision of the China Securities Regulatory Commission. Because Pang Qinghua and the giant group failed to truthfully disclose the changes in their rights and interests, the giant group failed to disclose related party transactions in accordance with the regulations and was investigated by the judicial authorities for suspected crimes. The CSRC warned Pang Qinghua and imposed a fine of 900000 yuan. The giant group was warned and fined 600000 yuan.

On July 6, 2018, Pang Qinghua conducted a stock pledge financing business with Minsheng Bank of China Beijing Branch, which is the company's latest disclosure of controlling shareholder pledge financing. 99.98% of Pang Qinghua's shares are already in a state of pledge. By October 2018, there was something wrong with Pang Qinghua's capital chain, and his entire stake in a large group was frozen by different financial units one after another.

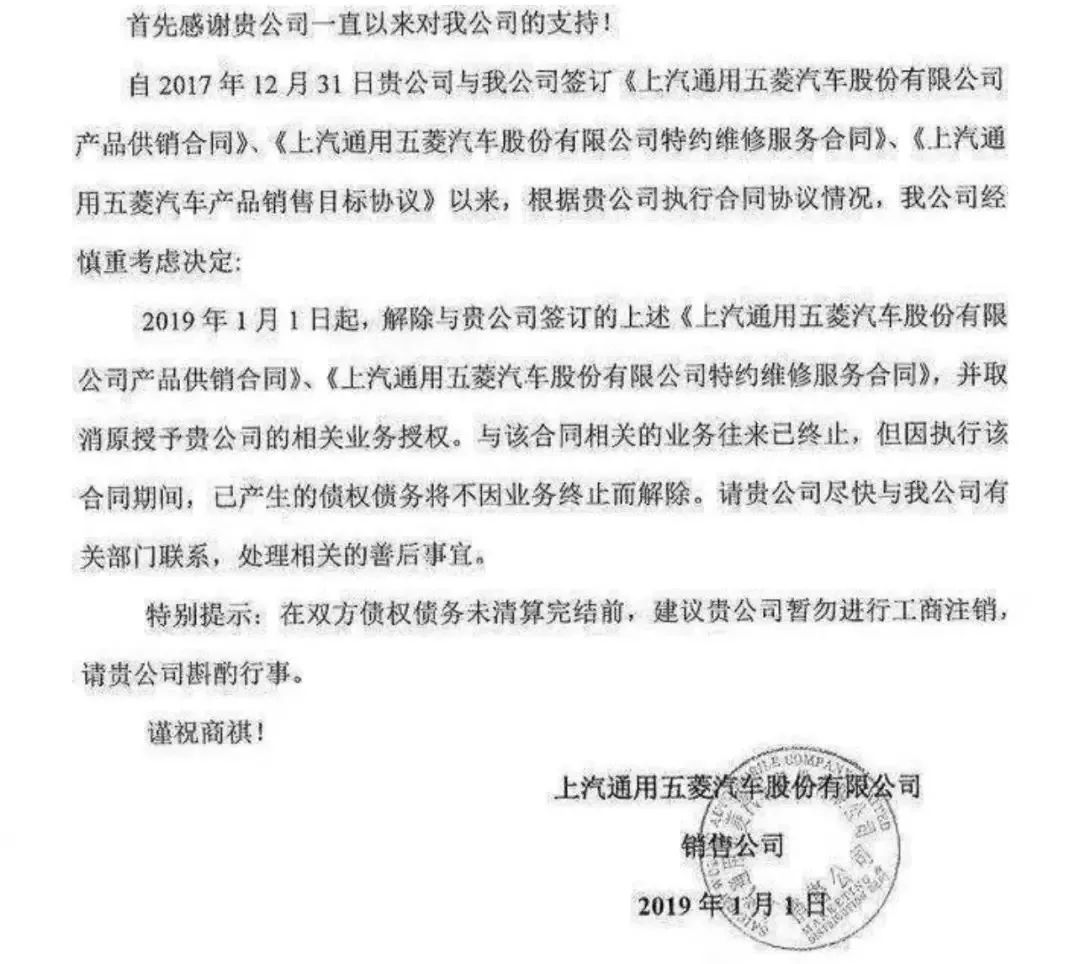

The frequent selling of its businesses did not effectively help giant get back on track, and in this case it was "abandoned" by manufacturers. At the beginning of this year, there was a notice on the Internet. The content shows that SAIC GM Wuling Motors asked to lift the relevant signed agreement with the giant group, and cancelled the relevant business authorization of the giant group's 4S stores. This means that giant will no longer be able to sell its Wuling and Baojun brands, which sell more than 2 million vehicles a year, which has lost another major source of profit.

The company's annual business forecast for 2018 recently disclosed by the giant group shows that the company's annual loss is expected to be 6 billion yuan to 6.5 billion yuan, which will be 7.1 billion yuan to 7.6 billion yuan if recurrent profits and losses are deducted. The operating condition of the huge group last year is obvious to all, and the loss is also expected, but its announcement of a pre-loss of more than 6 billion yuan is still shocking, and even "alarmed" the Shanghai Stock Exchange.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.