In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)07/18 Report--

Evergrande finally handed over its own account book.

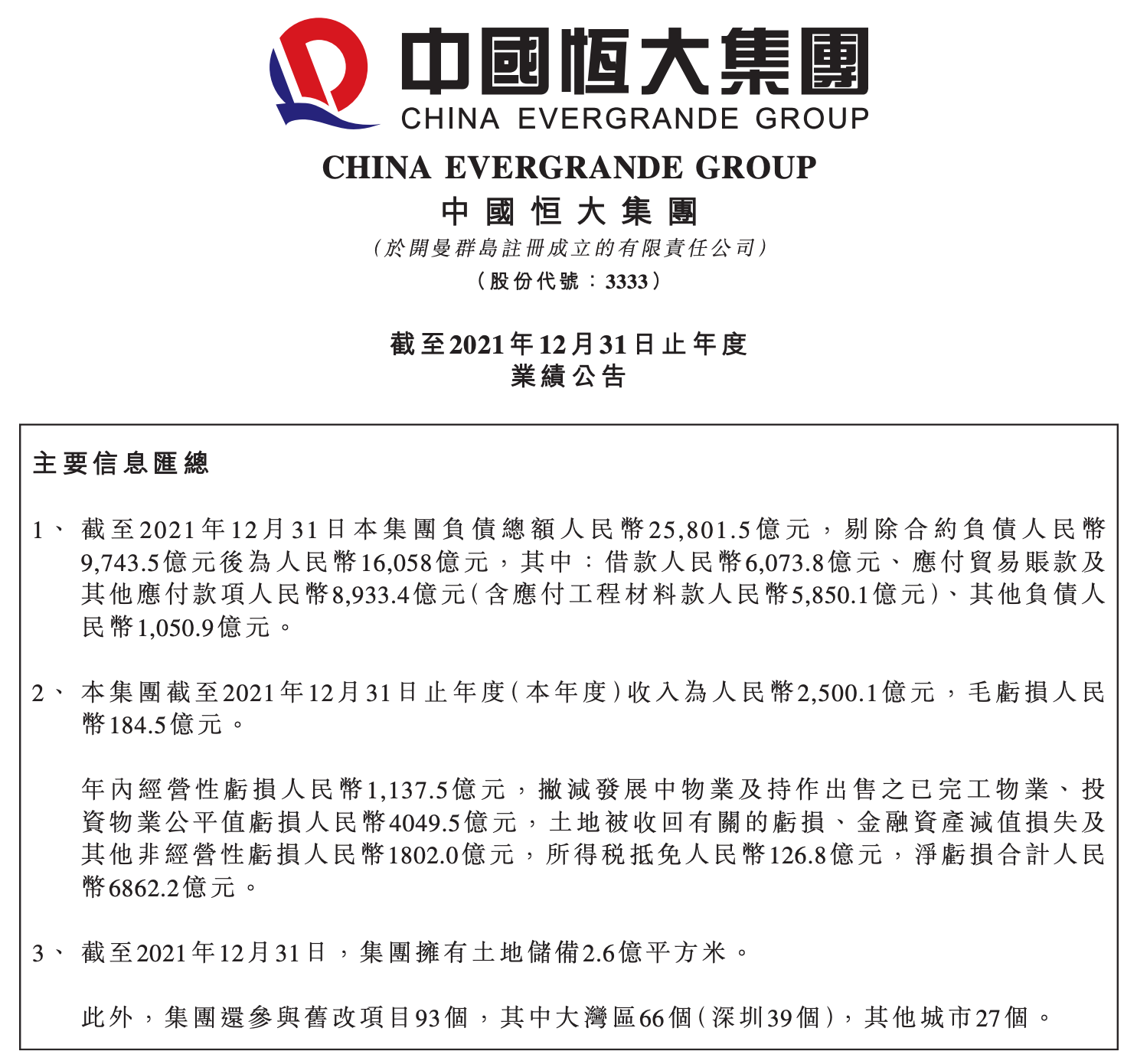

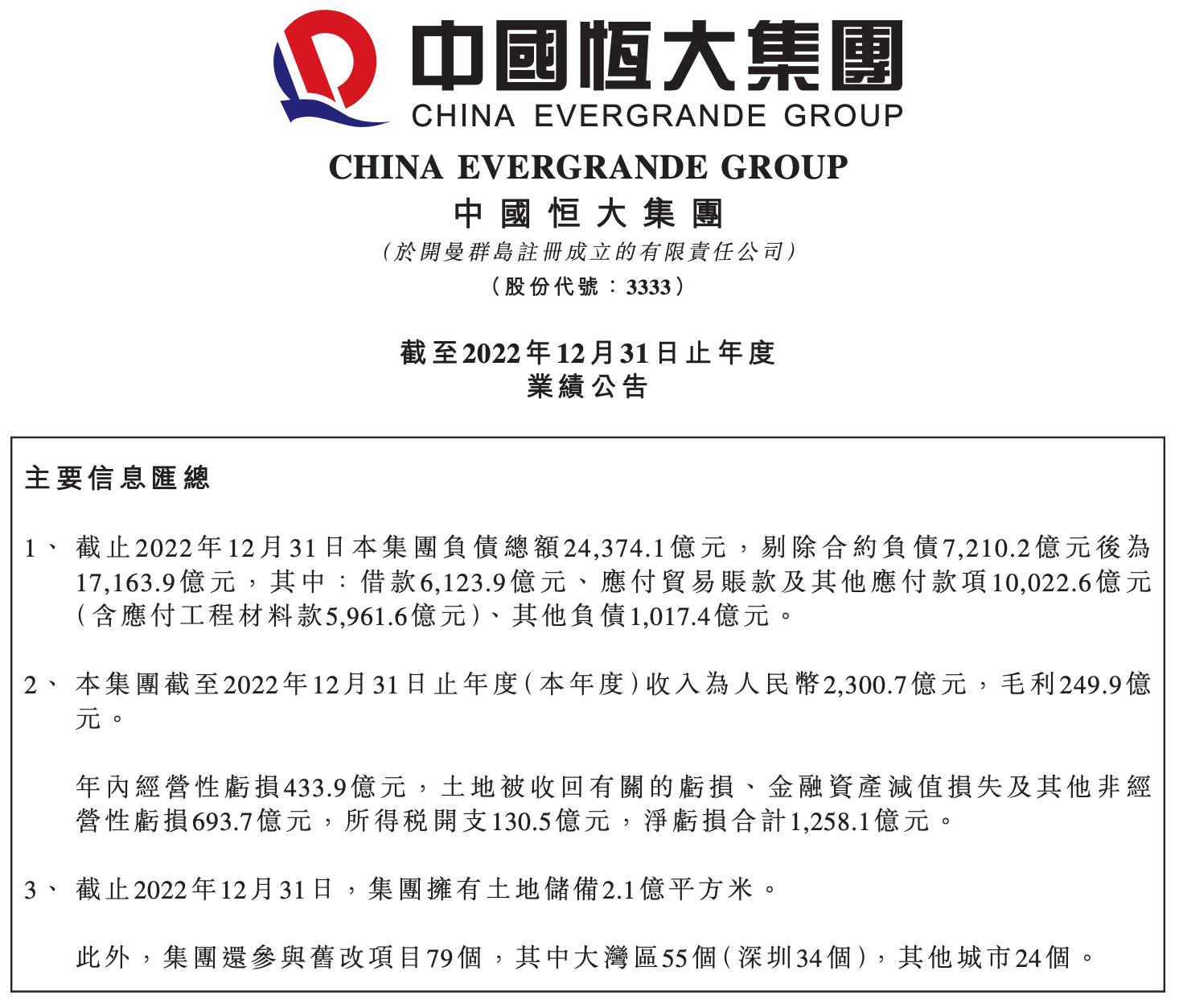

On the evening of July 17, China Evergrande issued three consecutive performance reports, including the results for the year ended December 31, 2021, the results for the year ended June 30, 2022, and the results for the year ended December 31, 2022.

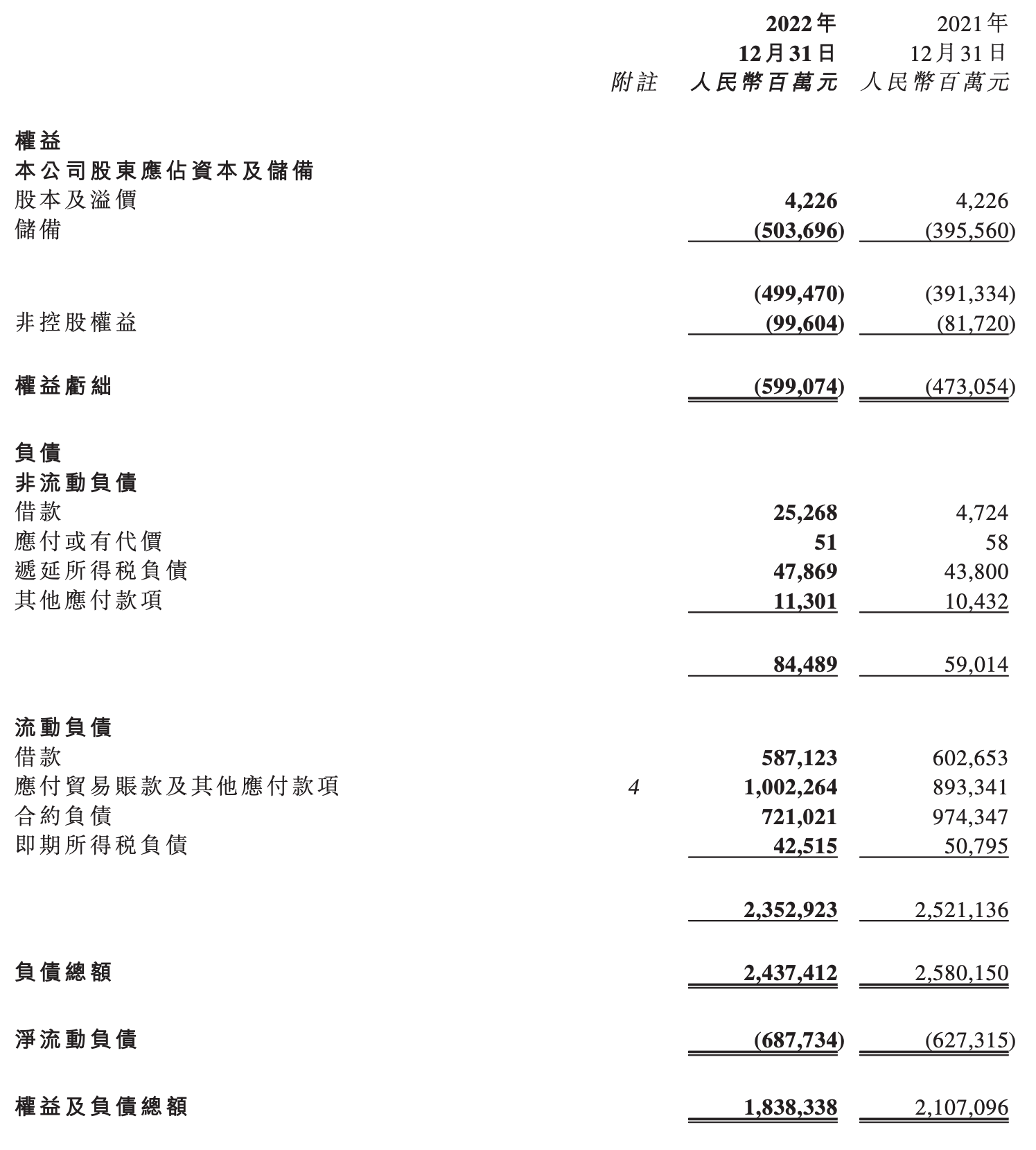

The report shows that China Evergrande suffered huge losses in 2021 and 2022, with a cumulative loss of 812.03 billion yuan, of which the net loss in 2021 was 686.22 billion yuan, of which the profit and loss attributable to the company's shareholders was 476.035 billion yuan, and the non-controlling equity loss was 210.184 billion yuan. The net loss in 2022 was 125.81 billion yuan, of which 105.914 billion yuan was attributed to the company shareholders and 19.9 billion yuan in non-controlling equity.

How much does Evergrande owe? As at December 31, 2022, the total liabilities of the Group were 2.43741 trillion yuan, which was 1.7164 trillion yuan after excluding 721.02 billion yuan of contract liabilities, which was 1.6058 trillion yuan higher than that of excluding contract liabilities in 2021, an increase of 110.59 billion yuan over the same period last year. Of this total, 612.39 billion yuan was borrowed, 1.00226 trillion yuan was payable for trade accounts and other payables (including 596.16 billion yuan for engineering materials), and 101.74 billion yuan for other liabilities.

How many assets does Evergrande have? By the end of 2022, China Evergrande had total assets of 1.84 trillion yuan and was insolvent. Although the total liquid assets are 1.66519 trillion yuan, accounting for an absolute proportion, the property projects under development have 1.13608 trillion yuan, and the cash and cash equivalents are only 4.334 billion yuan. At a time when the group is besieged on all sides, the liquidity of non-cash equivalents is insufficient. According to China Evergrande, as of December 31, 2022, the group has a land reserve of 210 million square meters. China Evergrande said that the huge high-quality land reserve is a solid foundation for the group to pay off debts gradually and return to normal operation.

It is worth mentioning that for the two annual reports, Shanghai Baicheng, an external auditor of China Evergrande, said that it was "unable to express its opinion". The reason is that "the uncertainty of China Evergrande's future cash flow raises significant doubts about the group's ability to continue to operate. And "the financial information provided by China Evergrande is insufficient to be satisfied with the relevant opening balances and comparative figures", and "these significant uncertainties about the basis of continuing operations have a significant cumulative impact on the potential cumulative impact of the consolidated financial statements, so that it is impossible to express an opinion".

Evergrande said that in 2022, the company actively promoted the work of Baojiao building to achieve the full resumption of 732 Baojiao building projects, with a total of 301000 buildings for the whole year. At the same time, Evergrande achieves mass production and delivery of Hengchi 5 models. In view of the fact that the deposit pledge of about 13.4 billion yuan of Evergrande property was enforced by the relevant banks, the company set up an independent investigation committee to investigate and further strengthen internal control management. At the same time, the company steadily advanced the formulation of the cross-border foreign debt restructuring plan and obtained the approval of the Hong Kong High Court to postpone the winding-up petition hearing.

Looking to the future, Evergrande said that the company will make every effort to ensure the steady and orderly progress of key work such as Baojiao building, do a good job in the continuous operation of new energy vehicles, property services, and other sectors, and explore the efficient disposal and effective activation of the company's core assets. steadily promote risk resolution.

According to the latest disclosure of China Evergrande, from January to May 2023, the group realized contract sales of 33.767 billion yuan, with a contract sales area of 4.9258 million square meters. As of May 31, 2023, more than 1000 new energy vehicles have been delivered.

At present, Evergrande and Evergrande property in China have reissued annual reports, and Evergrande Automobile Annual report is scheduled for July 26. In addition, trading in Evergrande, Evergrande property and Evergrande Automobile shares will be suspended from 9: 00 a.m. on March 21, 2022 and will continue to be suspended until further notice.

Under the listing rules, any securities whose ownership has been suspended for 18 consecutive months will be delisted, and China Evergrande's deadline will expire on September 20, 2023.

If China Evergrande wants to resume trading, the disclosure of financial statements is a prerequisite that must be met. According to the previous disclosure of China Evergrande, the company's conditions for resumption of trading must meet a number of provisions, including: 1, the disclosure of all unannounced financial results, and to resolve any audit reservations; 2, the pledge guarantee of 13.4 billion yuan of Evergrande property was enforced by the relevant banks to conduct an independent investigation, publish the results of the investigation and take appropriate remedial measures.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.