In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-18 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)07/27 Report--

Evergrande's report card has finally been made public!

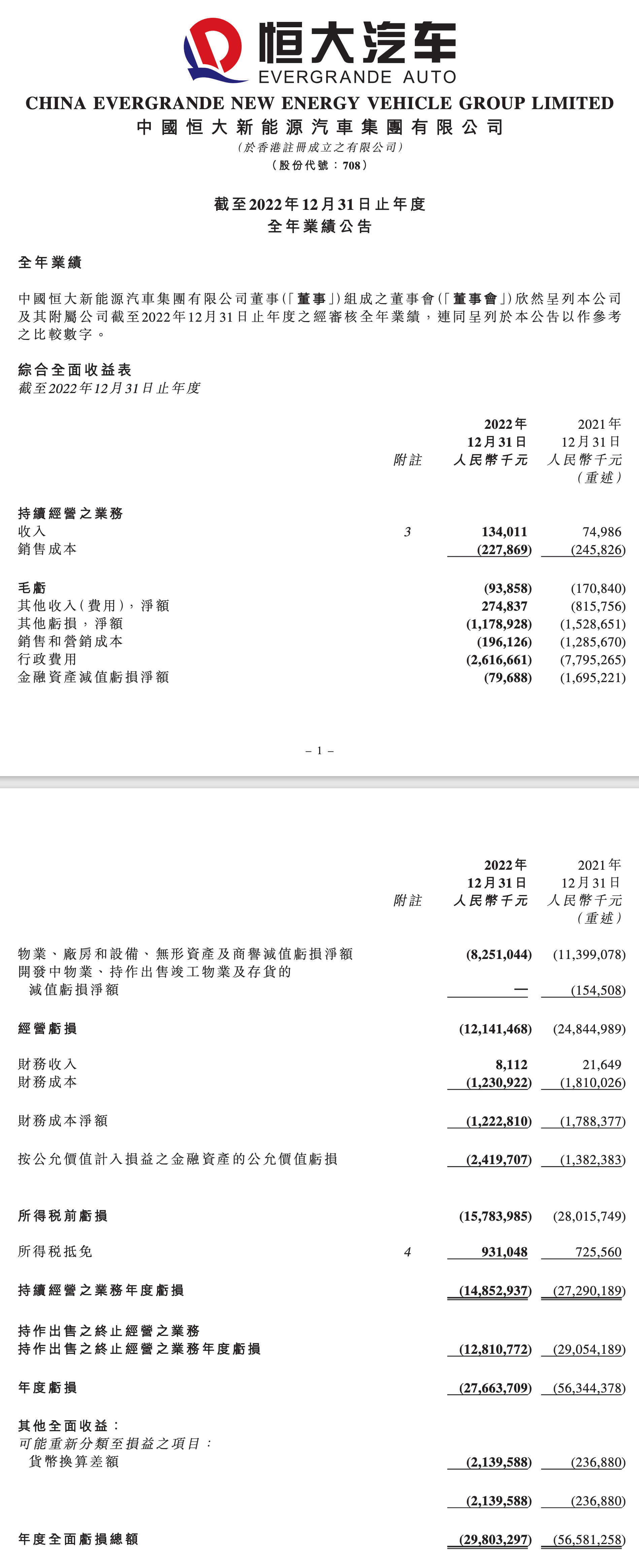

On the evening of July 26, Evergrande issued three consecutive performance reports, including the results for the year ended December 31, 2021, the results for the year ended June 30, 2022, and the results for the year ended December 31, 2022.

The report shows that Evergrande has made huge losses for two consecutive years, with a cumulative loss of 84.008 billion yuan, including a net loss of 56.344 billion yuan in 2021 and 27.664 billion yuan in 2022. As of December 31, 2022, Evergrande had a cumulative loss of 98.906 billion yuan, of which from 2018 to 2020 Evergrande lost 1.429 billion yuan, 4.426 billion yuan and 7.394 billion yuan respectively.

In terms of debt, by the end of 2022, Evergrande's total debt was 183.872 billion yuan, excluding 3.314 billion yuan of prepaid accounts, the debt scale was 180.558 billion yuan, while Evergrande's total assets of 115.22 billion yuan, has been seriously insolvent.

Evergrande stated in its financial report that Evergrande has been controlling its operating and administrative costs through various channels, including, but not limited to, optimizing and adjusting production and human resources, reorganizing its structure according to its divisions, and maintaining close communication with suppliers, customers and banks, etc., committed to attracting new customers and opening up overseas markets to support the sustainable development of the Group's main business. At the same time, the company controls capital expenditure through business and operational restructuring plans.

However, Evergrande also admitted that the continued operation of the Group will depend on the successful implementation and completion of the business and operational restructuring plan, the successful implementation and completion of the financing plan, and the successful generation of operating cash flow and access to additional sources of financing to meet its existing financial responsibilities, commitments and future operating and capital expenditures, and to maintain sufficient cash flow for the Group's operations. Ability to generate sufficient financing and operating cash flow.

Evergrande is a big seller? In August 2020, Evergrande released a total of 6 new cars in Shanghai and Guangzhou, including Hengchi 1, Hengchi 2, Hengchi 3, Hengchi 4, Hengchi 5 and Hengchi 6, but up to now there is only one Hengchi 5 model in mass production. At that time, Liu Yongzhao, president of Hengchi New Energy Automobile Group, praised that "Hengchi 5 is the best pure electric SUV within 300000, and Hengchi's big sales are a foregone conclusion." but in fact, only more than 1000 vehicles were delivered by the end of May.

However, Evergrande is also pushing ahead with the launch of other models. According to Evergrande's latest mass production schedule for new models, Hengchi 6 will be off-line at the end of this year and mass production in the first half of next year, while Hengchi 7 will be off-line in the first half of next year and mass production in the second half of next year.

For Evergrande, it can only increase production capacity to speed up the delivery process, but because of its own situation, even if production capacity is raised, Evergrande still has to consider, who should Evergrande sell its products to?

At present, the competition in the new energy vehicle industry is extremely fierce, and many multinational joint venture brands are struggling, not to mention the heavily indebted real estate cross-border car companies, while returning to the product itself, Hengchi 5 positioning compact pure electric SUV is not expensive compared with the same class of models, and the product configuration is not very poor, not to mention well-known supply chain manufacturers such as Bosch, mainland, Ambofo and Ningde era to participate in the production. However, Hengchi has not formed its own advantages. Hengchi 5's power, range, and auxiliary driving can only be regarded as regular, but it does not have many unique bright spots. Compared with BYD, Tesla and other brand products, it is difficult to show enough competitiveness. In addition, the most important thing is that China Evergrande is heavily in debt, and how to persuade consumers to buy the products of such a company is another big problem that Evergrande needs to face.

At present, Evergrande has suspended its license for 16 months. According to the listing rules, Evergrande faces not only production suspension, high debt, but also the risk of delisting if it is suspended for 18 months.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.