In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)08/15 Report--

Following July 27, Evergrande announced the official resumption of trading, Evergrande yesterday ushered in good news, the successful introduction of Middle East capital, access to a glimmer of life.

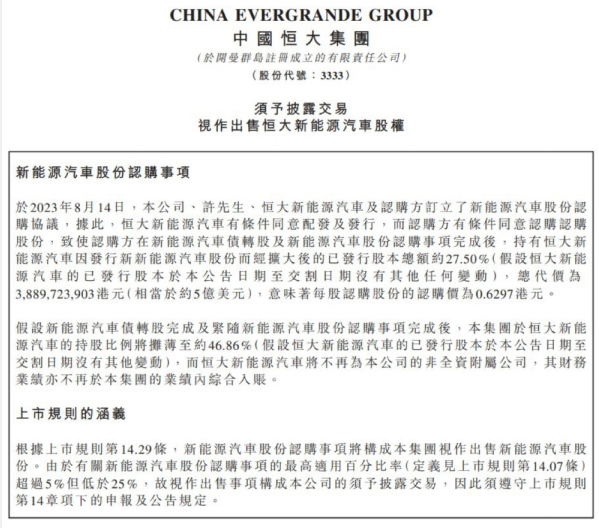

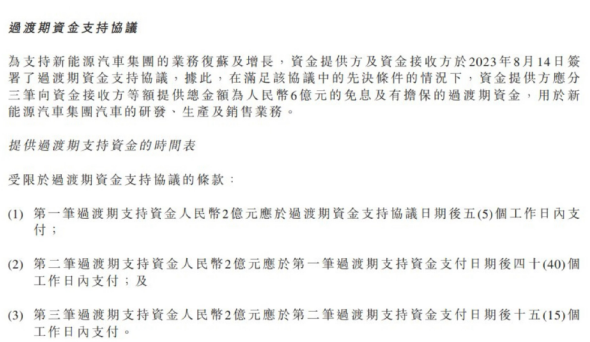

On August 14, Evergrande announced that it had received the first strategic investment of 500 million US dollars from Newton Group. At the same time, it said that in order to support the recovery and growth of the New Energy vehicle Group, the two sides signed a transitional financial support agreement. In accordance with the requirements of the agreement, subject to meeting the prerequisites in the agreement, Newton Group will provide 600 million yuan of interest-free and guaranteed transitional funds for Evergrande's R & D, production and sales business. The transitional funds will be divided into three payments, with the first Rmb200m paid within five days after the support agreement. As for the cooperation between the two sides, Evergrande said that holding hands with Middle East Capital will effectively solve the financial difficulties faced by Evergrande Automobile Development. With its advanced technology accumulation, intelligent manufacturing base, excellent product quality and global supply chain system, Evergrande will make every effort to promote the production and sales of Hengchi 5 and quickly occupy the market. and further promote Hengchi 6, Hengchi 7 and other new model research and development and mass production.

Newton also said in a statement that the two sides have reached an agreement to invest 500 million US dollars in Evergrande's strategy to accelerate the company's development in the field of electric vehicles. The proposed transaction is expected to be completed in the fourth quarter of 2023, subject to a number of conditions, including, but not limited to, the entry into force of the debt restructuring of Evergrande Group, confirmation of debt repayment plans by a number of Evergrande New Energy Group creditors and approval from relevant regulators and shareholders. In addition, Newton said in a statement that it would help Evergrande develop overseas markets and export 30,000 to 50,000 Hengchi vehicles to the Middle East market each year. Or affected by the news, Evergrande closed at HK $1.73 per share, up 1.76%, with a total market capitalization of HK $18.76 billion.

Giving money and helping to open up overseas markets makes people curious about the background of the big financier Newton Group. According to relevant information: Newton Group is an electric car company located in Dubai, United Arab Emirates, and was previously an Econic company in Tianjin, China. Its founder Wu Nan, who is also from China, established Tianjin Tianqi Group Co., Ltd. in 2016, and its controlling shareholder is Econic (Tianjin) Investment Co., Ltd. In 2018, Econic New Energy vehicle settled in Zhaoqing, Guangdong Province. In 2019, seven concept models were unveiled at the Shanghai Auto Show, and Tianqi Meiya was acquired for nearly $870 million in the same year. In addition, Econic hired Bi Fukang, co-founder of Baiteng, as CEO in 2019, but Bi Fukang left less than half a year after taking office to join FF founded by Jia Yueting.

According to Econic's earlier plans, its first product, the Econic Seven Series, will be launched in 2019 and two new cars built on the same platform as the Econic Seven Series will be launched in 2021 and 2022, respectively. However, due to the epidemic and financing problems, there has been little news about the brand after 2019.

When consulting the data of Econic, the automobile industry found that in 2020, Econick was listed as the executor of bad faith for many times, and its founder, Wu Nan, was also restricted by the court many times. Tianjin Tianqi Group Co., Ltd., the main business body behind Aikonick, has also been adopted by the court as a "consumption restriction order" five times in a row. Since 2021, Econick's assets have been sealed up and detained by the court many times because of labor disputes, vehicle rental contract disputes, sale contract disputes, private loan disputes and other reasons. Disappeared for nearly two years, in April 2021, Econic announced that it had won strategic investment from Zhengwei Group, one of the world's top 500 enterprises, and AutoX, a self-driving car brand, and reappeared in public view. In 2022, Econick moved his headquarters to the United Arab Emirates and changed its name to Newton. Listed on NASDAQ in November of the same year, Jinhua local state-owned assets and the royal family of Abu Dhabi all participated in the investment.

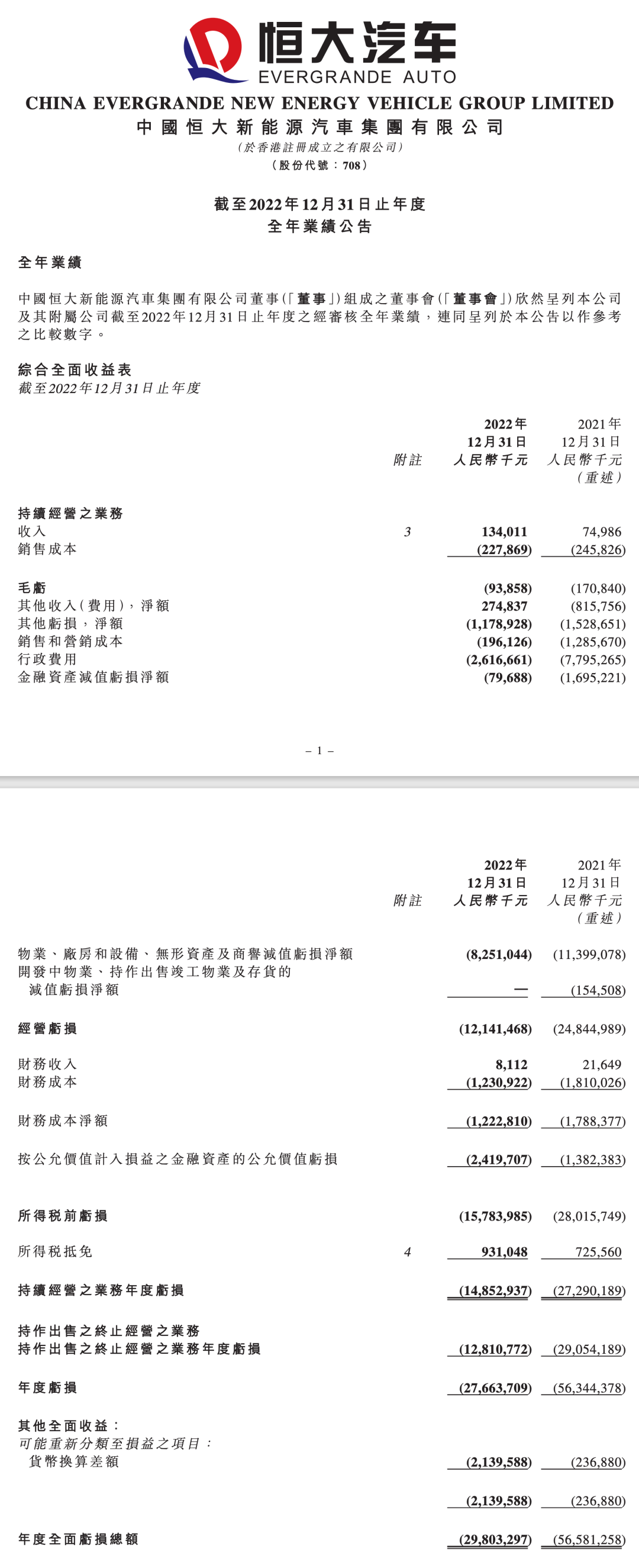

This cooperation is undoubtedly a glimmer of life for Evergrande and has become a "lifesaver" for Evergrande. According to the financial results released by Evergrande earlier, Evergrande's current financial state is insolvent. By the end of 2022, Evergrande had a cumulative loss of 98.906 billion yuan. From 2018 to 2022, the losses were 1.429 billion yuan, 4.426 billion yuan, 7.394 billion yuan, 56.344 billion yuan and 27.664 billion yuan respectively. By the end of 2022, the total debt of Evergrande is 183.872 billion yuan, excluding 3.314 billion yuan of prepaid accounts, the debt scale is 180.558 billion yuan, while Evergrande's total assets is 115.22 billion yuan, which is obviously seriously insolvent. Due to lack of funds, Evergrande issued a notice on April 24 that the Tianjin factory suspended production of Hengchi 5 until May 23.

At present, Evergrande has only one Hengchi 5 mass production listed on the market, according to the sales data of Hengchi 5, it is far from enough to cover Evergrande's huge losses. The financial crisis is obviously a difficult problem that Evergrande must face in the process of building cars, but from the current situation of Evergrande, only normal operation and mass production of more new cars can get out of the predicament, which naturally means that a lot of "capital" investment is needed. This time, with the strategic investment of Newton Group, Evergrande can indeed resume normal operations for the time being. However, in the end, we have to change from "blood transfusion" to "hematopoiesis". If Evergrande's own products cannot be recognized by the market, the road behind it is still very difficult.

In addition, there is still a question mark over how Newton will come up with this strategic fund. According to the 2022 results released by Newton Group, as of December 31, 2022, Newton Group itself held about $211.9 million in cash and cash equivalents, of which restricted cash was $146000. How can we invest 500 million US dollars in Evergrande strategically with this amount? In addition, the auto industry focused on looking at Newton's annual report for the three years from 2020 to 2022 and found that Newton's revenue in the past three years was zero, while the net profit and loss of Newton in the same period was $12.65 million, $13.06 million and $41.25 million, respectively.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.