In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)08/17 Report--

On August 16, the China Automobile Circulation Association released the investigation report on the living conditions of National Automobile Dealers in the first half of 2023, and the difficulties and pressures of the automobile back-end market were once again put on the surface. According to the report, the external environment of the automobile market is complicated, the recovery of consumer demand for cars is slow, terminal transaction prices continue to decline, and only 25% of dealers have completed their half-year sales targets in the first half of the year. Although large-scale new car price cuts have brought obvious market increments, but the increments are more from new energy vehicles, the survival pressure of traditional fuel vehicles is significant, and the operating pressure of car dealers has further intensified, leading to the expansion of dealers' losses.

According to data from the Federation of passengers, domestic sales of narrow passenger cars in the first half of 2023 were 9.524 million, an increase of 2.7 percent over the same period last year, of which 3.086 million were new energy passenger vehicles, an increase of 37.3 percent over the same period last year. Generally speaking, the growth rate of new energy vehicles is much higher than that of the overall market, which means that new energy vehicles are the main driving force for the growth of China's car market. Without the stability of new energy vehicles, the overall market may decline.

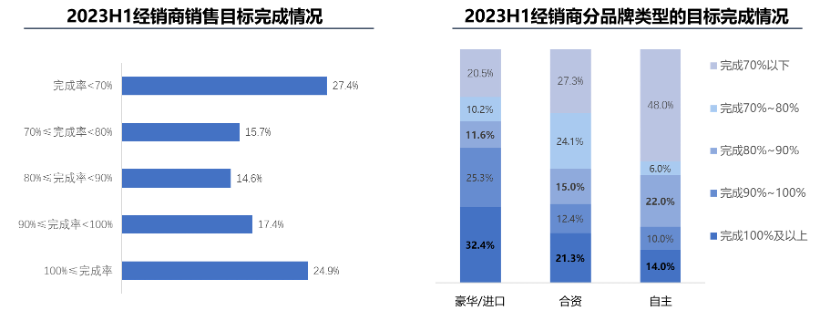

According to data released by the China Automobile Circulation Association, only 24.9% of dealers achieved their semi-annual sales targets in the first half of the year, while 56.9% achieved more than 80% of their targets. Among them, luxury / import brand dealers achieved the target well, 32.4% dealers achieved the annual sales target, while the target completion rates of joint venture brands and independent brand dealers were 21.3% and 14.0%, respectively.

The sales performance of most car dealers fell short of expectations. On the one hand, the excessive annual sales target of manufacturers leads to the imbalance between supply and demand in the automobile market, and multiple factors lead to a number of large-scale and substantial price cuts of new cars, which makes consumers wait and see and restrain the release of consumer demand. On the other hand, the withdrawal of the purchase tax halving policy at the end of the year, which began in June 2022, caused some consumer demand to be overdrawn ahead of time, affecting the automobile market in the first half of the year to a certain extent.

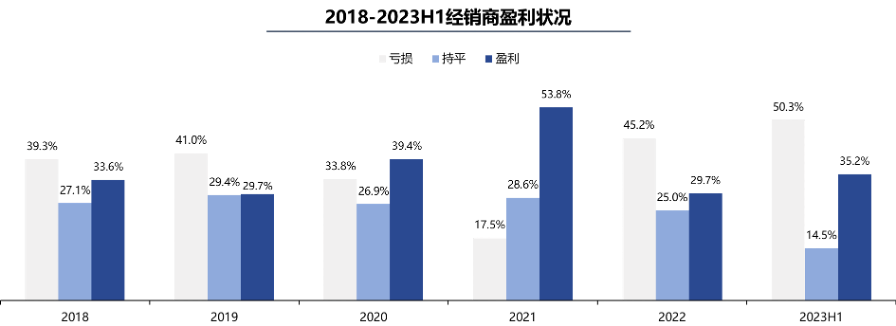

In addition to the fact that most of the dealers failed to meet their annual sales targets, large-scale losses have also become the development status of dealers in the first half of the year, and the overall dealer losses are at a high level in recent years. According to a survey conducted by the association, only 35.2% of dealers made a profit in the first half of the year, while the proportion of loss-making dealers reached 50.3%, and the proportion of break-even dealers was 14.5%. According to the types, the overall profit of luxury / imported brands is good, nearly half of the dealers are profitable, and the loss dealers of joint venture brands and independent brands account for 51.3% and 48.0%, respectively.

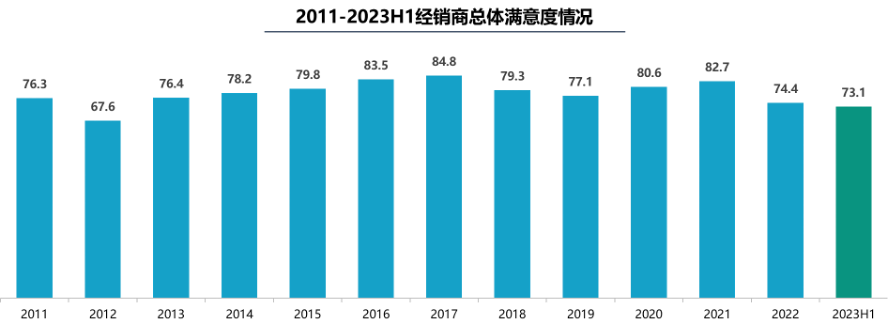

Dealers' satisfaction with the mainframe factory also hit a 10-year low. According to the association, the overall satisfaction score of automobile dealers to the mainframe factory was 74.4 in 2022, the lowest since 2013, but fell to 73.1 in the first half of the year. Dealers are less satisfied with manufacturers' tying of unsalable models, market order, inventory management, and regional marketing and regional management.

At present, with the rapid growth of new energy vehicles, the development of joint venture brands and luxury brands began to appear pressure. A survey conducted by the China Automobile Circulation Association found that dealers believe that in the transition to new energy brands, independent network construction will increase investment. Once the initial product sales are low, it is difficult to support network profits, which requires a lot of brand promotion investment from manufacturers. Otherwise, it is difficult for new brands to occupy the minds of consumers. For the future investment network, dealers still prefer some traditional luxury brands and Toyota brands, while for independent brands, the investment intention is mainly focused on new energy independent brands, such as Deep Blue Automobile, Lanto Automobile and Xiaopeng Automobile.

However, car dealers are optimistic about this year's business performance. At present, the automobile industry is facing difficult challenges, and the government, associations and enterprises are all working hard to promote the recovery of the market. Many promotion fee measures, such as state tax cuts, local government subsidies, and factory support, have a strong pulling effect on the consumer side of demand and accelerate the recovery of the automobile market. With the implementation of the promotion fee policy in all aspects, the business confidence of dealers has gradually recovered, and about 30% of the dealers have raised their annual sales targets in the middle of the year.

Entering the third quarter, the car price war is making a comeback. According to incomplete statistics, since August, more than 10 car companies have announced price cuts for some of their models, including SAIC Volkswagen, Zero Motor, Chery New Energy, SAIC Mingjue, Great Wall Euler, Polar Krypton, Tesla and many other car brands, and market competition has further intensified. Cui Dongshu, secretary general of the Federation of passengers, said that the frontal competition between fuel vehicles and new energy vehicles in this round of price war has entered a relatively gentle state, and the main focus of the competition is on new energy vehicles, especially in pure electric vehicles. The rapid introduction of new products and the slowdown of increment have brought about the pressure of market competition.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.