In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-23 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)08/19 Report--

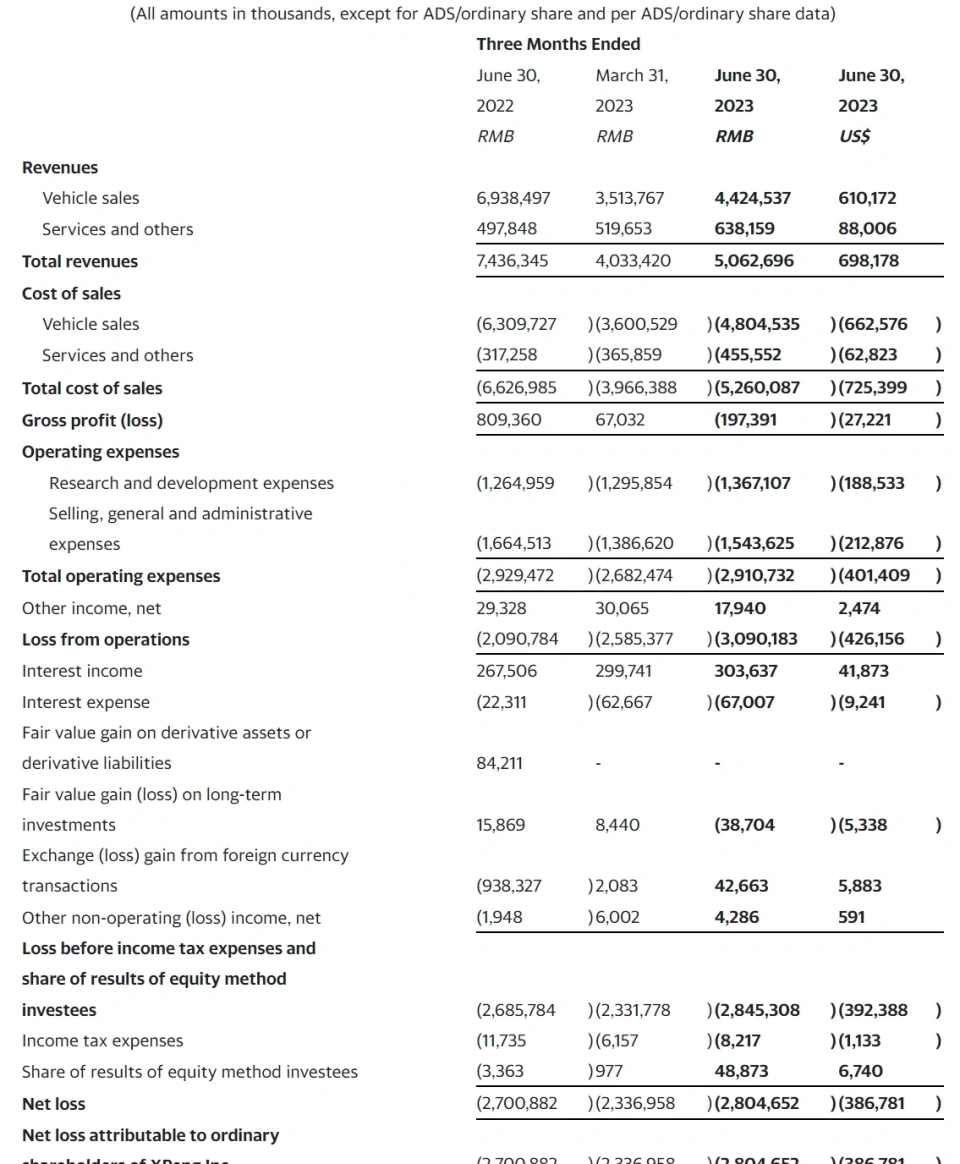

On August 18, Xiaopeng announced its results for the second quarter of this year. According to the financial report, Xiaopeng's total revenue in the second quarter was 5.06 billion yuan, an increase of 25.5 percent compared with 4.03 billion yuan in the first quarter and a decline of 31.9 percent compared with the same period last year. Of this total, the revenue from automobile sales was 4.42 billion yuan, down 36.2 percent from the same period last year and up 25.9 percent from the previous month. Total revenue in the first half of 2023 was 9.09 billion yuan, down 5 billion yuan compared with 14.89 billion yuan in the same period last year.

In terms of sales, Xiaopeng delivered a total of 23200 new cars in the second quarter, an increase of 27.3% compared with 18200 in the first quarter. In terms of net loss, Xiaopeng posted a net loss of 2.8 billion yuan in the second quarter, up 3.8% from the same period last year and 20% from the previous quarter. In terms of gross profit margin, Xiaopeng's gross profit margin was-8.6% in the second quarter, 9.1% in the same period last year, and-2.5% in the first quarter of this year. On the profit side, Xiaopeng's profit margin was negative 8.6% in the second quarter, compared with 9.1% in the same period last year and minus 2.5% in the first quarter.

As for the decline in profits, Xiaopeng said: G3i-related inventory writedowns and inventory purchase commitments lost 4.5 percentage points of negative impact on vehicle profit margins in the second quarter of 2023. In addition, the increase in the promotion of vehicles and the expiration of subsidies for new energy vehicles also have a certain impact on the gross profit margin in the second quarter. As for when profits will become regular, he Xiaopeng, CEO of Xiaopeng Automobile, said: as new products such as the G6 drive a substantial increase in sales, gross profit margins gradually recover, and operational efficiency continues to improve, it is expected to achieve the overall positive conversion of operating cash flow in the second half of 2023.

In terms of R & D expenses, Xiaopeng Motor's R & D expenditure reached 1.37 billion yuan in the second quarter, an increase of 70 million yuan compared with the first quarter. With regard to the increase in R & D costs, officials say it is due to the company's expansion of its product portfolio to support future growth and the development of new models. Xiaopeng's second-quarter sales expenditure was 1.54 billion yuan, down 7.3% from 1.66 billion yuan last year. Officials said the decrease was mainly due to reduced commissions from franchise stores and mobile advertising.

For the forecast of delivery in the third quarter, officials said: based on the current market conditions, the number of vehicles delivered in the third quarter is expected to be 39000-41000 vehicles, and the company expects revenue to reach 85-9 billion yuan in the third quarter, an increase of 67.9% to 77.8% over the second quarter. By the end of the second quarter, Xiaopeng had cash reserves of 33.74 billion yuan, a decrease of about 380 million yuan compared with the first quarter.

Judging from the second-quarter results released by Xiaopeng Motor, the whole is still not ideal. Although in terms of delivery volume, Xiaopeng's delivery volume increased in the second quarter compared with the first quarter, but the loss is also increasing. Cost control has naturally become the focus of Xiaopeng Motor in the second half of the year. He Xiaopeng also said at the financial report meeting: Wang Fengying, the joint vice president, is carrying out cost control on a number of projects and is confident that the overall cost will be reduced by 35% by the end of next year. At that time, the gross profit margin will be significantly improved. And gross profit margin will return to positive value in the fourth quarter of this year.

It is not difficult to see that Xiaopeng hopes to make its gross profit margin positive through G6 sales and the launch of new products, as well as cost control. Prior to this, due to the decline in sales, Xiaopeng has made a series of changes, including a comprehensive adjustment of the internal organizational structure, personnel adjustment and so on. At present, this series of adjustments have had some effect, with relevant data showing that Xiaopeng sold 11000 cars in July, returning to the class of 10,000.

The G6 model, which he Xiaopeng favored, went on sale on June 29th, with a total of five new models with a price range of 20.99-276900 yuan. He Xiaopeng has said that the monthly sales of the G6 is twice that of the P7. It is also said that the G6 will become a popular style in China's 20-300000 yuan new energy SUV market, driving Xiaopeng's total delivery volume to grow much faster than the industry in the third quarter compared with the same period last year and month-on-month, forming the first sales inflection point after its strategy and organization adjustment. Judging from the sales performance of Xiaopeng G6 after its launch, it is OK. Xiaopeng G6 sold 3937 vehicles in July, accounting for 35.76% of Xiaopeng's total sales in July. He Xiaopeng said bluntly that the delivery volume of G6 models will increase significantly, driving the company to deliver more than 15000 units. The fourth quarter will continue to increase the production capacity of the G6, hitting the G6 target of delivering more than 10,000 units, and the company's overall target of delivering 20,000 vehicles a month.

On July 26, Xiaopeng issued a major news, signed a strategic technical cooperation with Volkswagen, the two sides will cooperate to build cars. At the same time, as part of the strategic cooperation, Volkswagen will increase the capital of Xiaopeng by about US $700 million, acquire a 4.99% stake in Xiaopeng at the price of US $per ADS15, and have a seat on Xiaopeng's board of directors as an observer. As for the cooperation with Volkswagen, Xiaopeng Automobile related personnel said: in this cooperation, Xiaopeng provides intelligent driving system, Volkswagen provides engineering design capacity and supply chain, and the two sides share a larger database. Specifically, cooperation with the public is not a "technology licensing fee", but a "technical service fee". Xiaopeng Automobile said that in 2024, Xiaopeng Automobile began to enter the era of technical service income, which is an important inflection point for the company's technological realization.

With Volkswagen's cooperation and a $700 million capital increase, sales of G6 models are also on the rise, and Xiaopeng seems to have a bright future. However, under the background of intensified market competition and Tesla's price reduction, Xiaopeng Motor will still face great challenges. After all, Xiaopeng's own research and development investment is large, sales are low, so far there is no economies of scale, resulting in a huge amount of scientific research investment is not proportional to the total income. Or because Xiaopeng Motor's second-quarter results fell short of market expectations, as of August 18, Xiaopeng Motor Hong Kong shares fell 6.58% to 61 Hong Kong dollars per share, with a total market capitalization of HK $105.6 billion.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.