In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/16 Report--

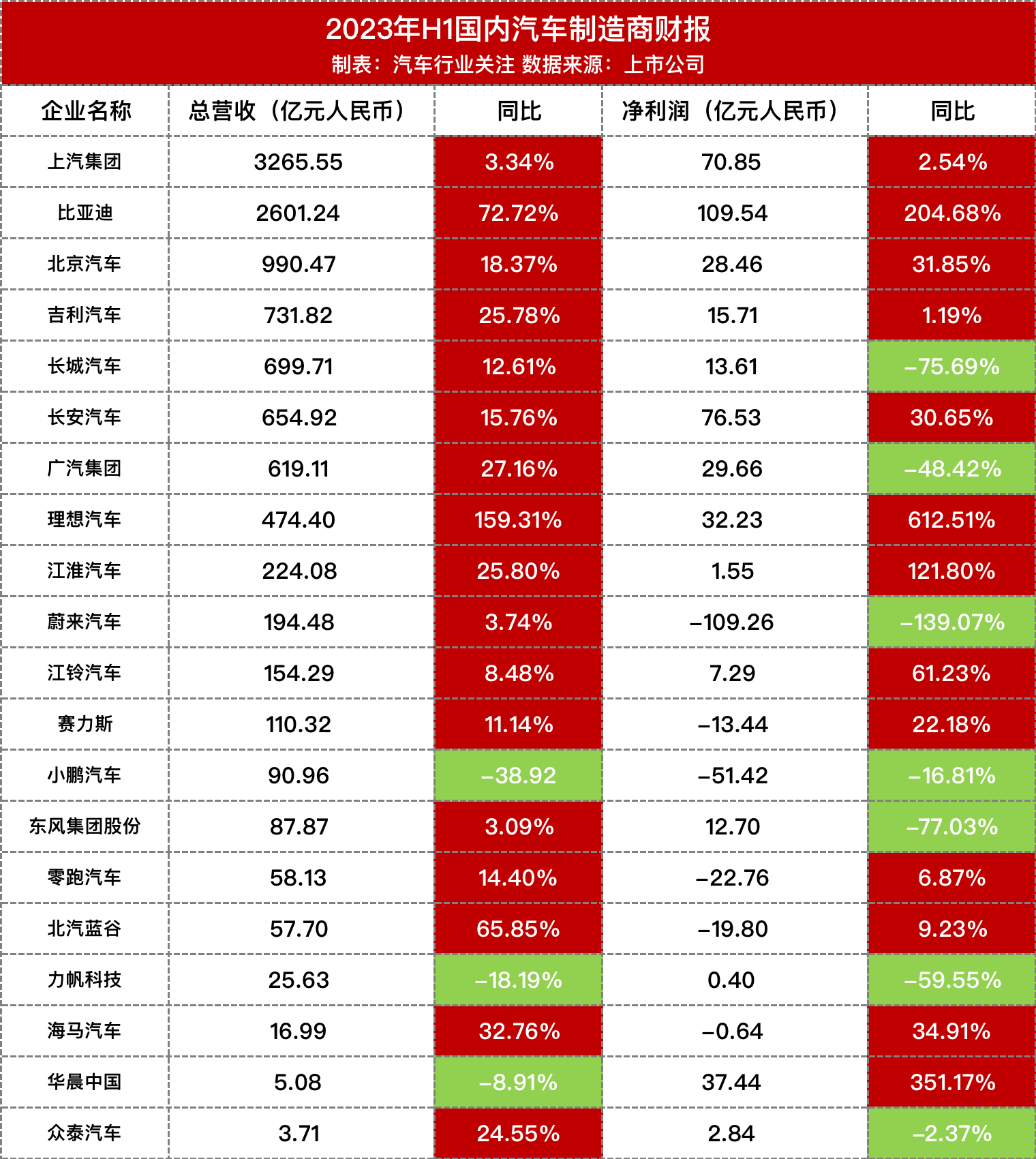

Recently, domestic automobile companies have released H1 financial results in 2023. Among the annual reports of 20 A / H-share listed companies listed in the "Automotive Industry concern" statistics, BYD became the most profitable car company in the first half of the year, with a net profit of 10.954 billion yuan. Xiaopeng Automobile and Lifan Technology have both seen a decline in revenue and profit, especially Xiaopeng Automobile, whose net loss is more than 5 billion yuan.

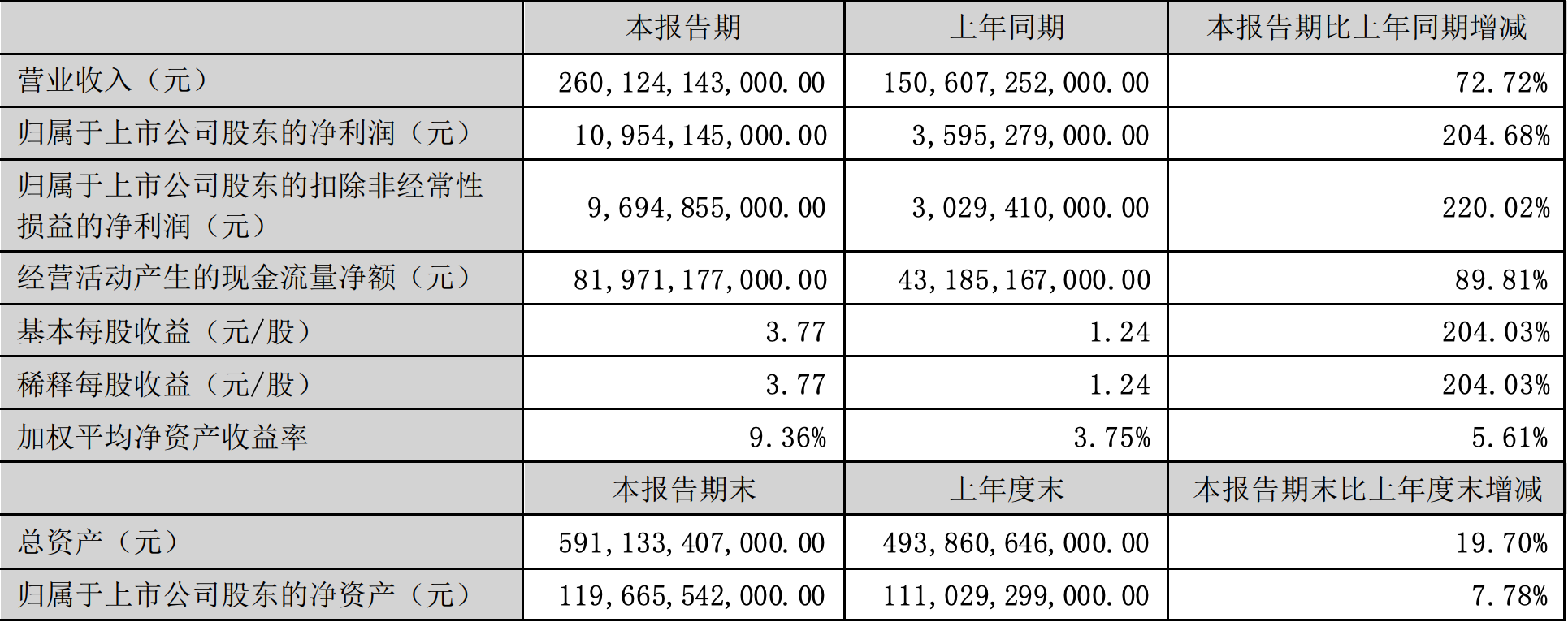

As the largest car company in China by market capitalization, BYD's performance is also the brightest. In the first half of 2023, BYD's operating income was 260.124 billion yuan, an increase of 72.72% over the same period last year, and its net profit was 10.954 billion yuan, an increase of 204.68% over the same period last year. According to the data, although BYD's operating income is far lower than that of SAIC, it is the most profitable car company in China, surpassing SAIC's net profit of 7.085 billion yuan with an advantage of more than 3 billion yuan.

BYD's sharp increase in profits is related to its strong performance in the car market. Official figures show that BYD sold 1.2556 million vehicles in the first half of 2023, up 94.25 percent from a year earlier, including 616800 pure electric vehicles, up 90.66 percent, and 631400 plug-in hybrid models, up 100.66 percent from the same period last year.

According to the data, BYD's gross profit margin for cars and related products in the first half of the year was 20.67%, higher than Tesla's 17.9%. At the beginning of 2023, Tesla was the first to start a price reduction. Domestic Model 3 hit a record low after a sharp price reduction, which led to an increase in sales, but the price reduction promotion also led to the decline of Tesla's gross profit margin, which fell to 18.2%. In the process, BYD led sales growth by launching the champion version, and with the sharp improvement of scale effect and supply chain management, the gross profit margin of cars increased to 20.67%.

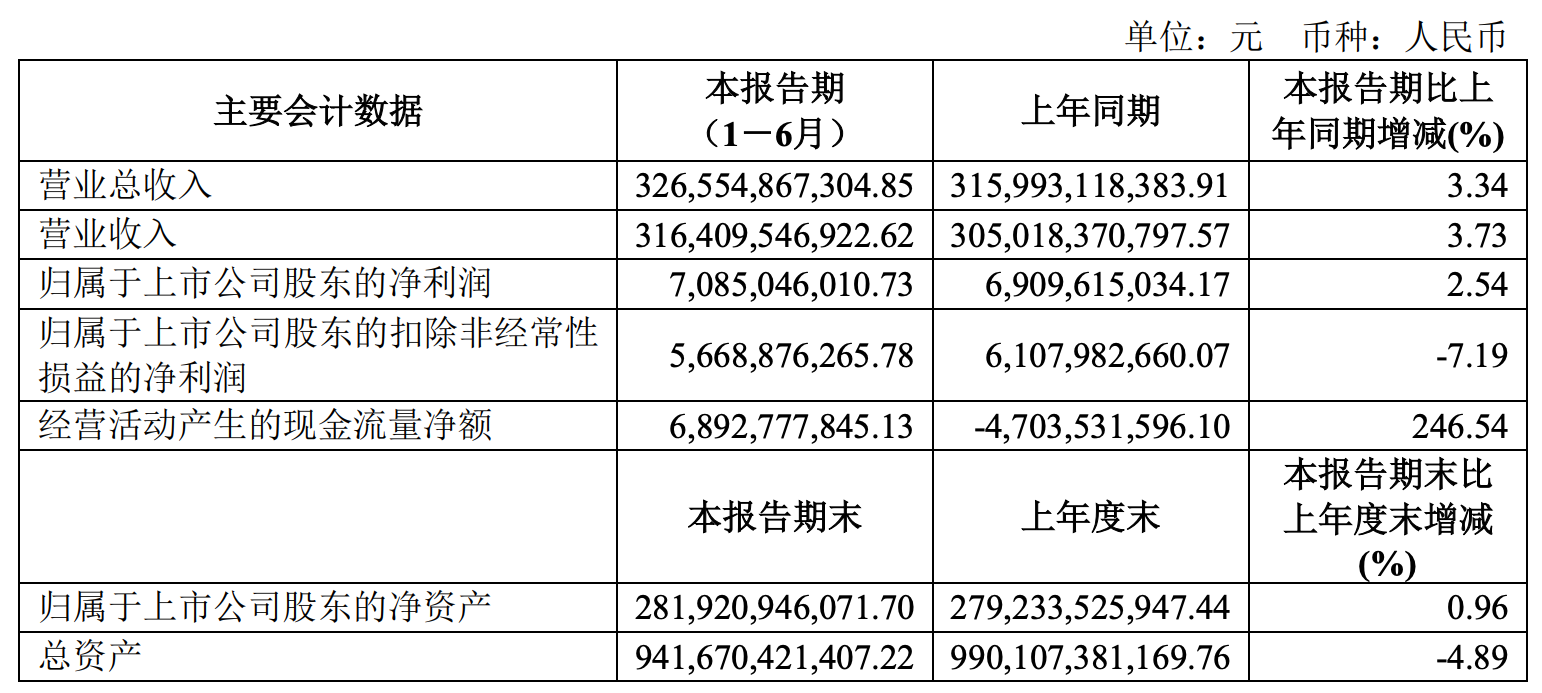

SAIC is still the largest carmaker in China, but that doesn't mean it's the most profitable. In the first half of 2023, SAIC's operating income was 326.555 billion yuan, up 3.34% over the same period last year, and its net profit was 7.085 billion yuan, an increase of 2.54% over the same period last year.

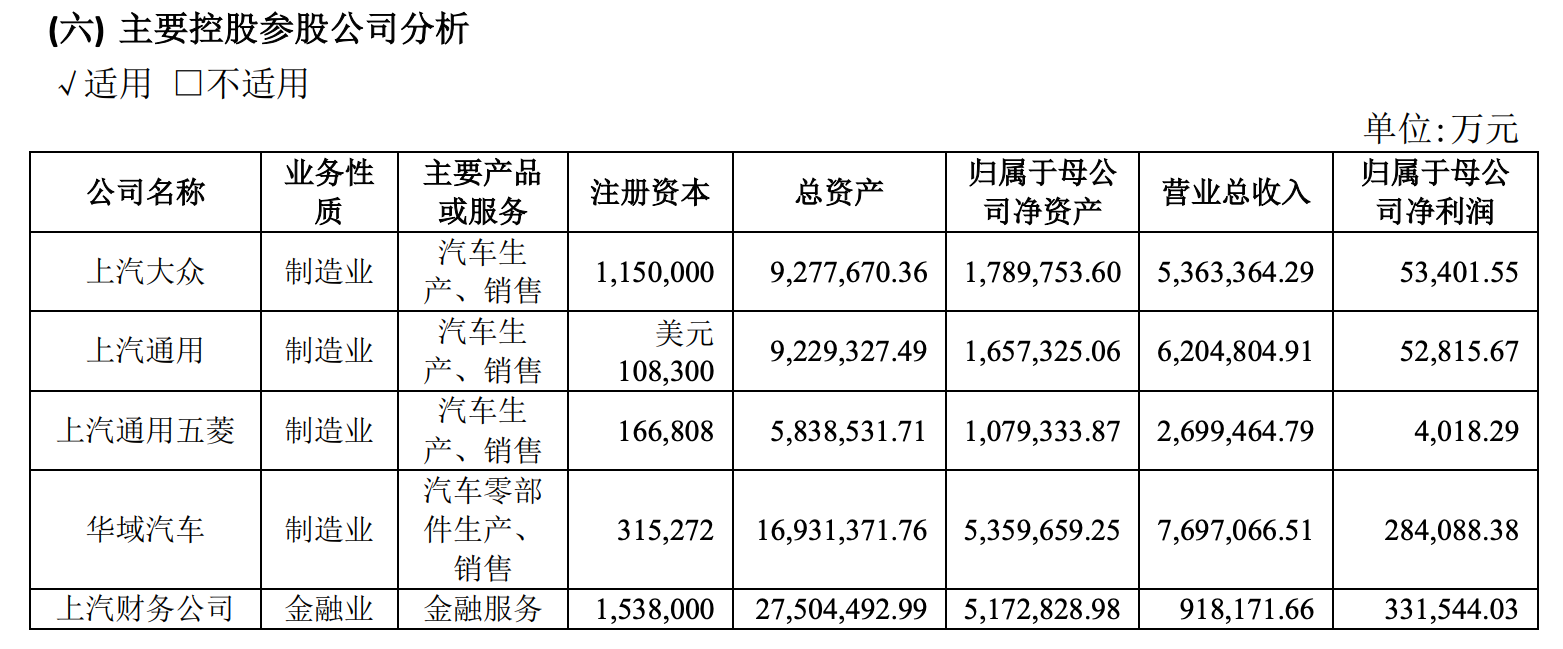

Under the cruel knockout stage of the industry, joint venture brands are losing their pricing power in the Chinese market. SAIC owns two major joint ventures of SAIC-Volkswagen and SAIC-GM, but its development in the domestic market has been weak, with SAIC-Volkswagen net profit of 534 million yuan, down 14.30% from the same period last year, and SAIC-GM net profit of 528 million yuan, down 76.84% from the same period last year.

In addition to SAIC, other weak joint venture brands include GAC GROUP, Changan Automobile and Dongfeng Motor Group, such as GAC GROUP. GAC GROUP's investment income during the reporting period was about 5.448 billion yuan, a decrease of about 3.05 billion yuan over the same period last year, mainly due to the decline in the profits of Japanese joint ventures. Data show that GAC-Honda sales fell 18.89% in the first half of the year compared with the same period last year, while GAC-Toyota fell 9.48%, and GAC-Mitsubishi is currently in a state of suspension.

In terms of profitability, Great Wall is not performing well. According to the financial report, the total revenue of Great Wall Motor in the first half of the year was 69.971 billion yuan, an increase of 12.61% over the same period last year, while the net profit of its parent was 1.361 billion yuan, down 75.69% from the same period last year. Great Wall Motor said that the company deepened its transformation to new energy and intelligence, adjusted its product structure, increased investment in brand and channel construction based on the launch of new products in 2023, while persisting in R & D investment in new energy and intelligence, as well as reduced exchange rate gains.

At a time when the head enterprises are making a lot of money, new energy companies, including Ulai, Xiaopeng, Zero, BAIC Blue Valley, and Selis, are still unable to escape the "curse" of losses, and ideal Automobile has become the first profitable new power company.

Starting from the fourth quarter of 2022, ideal Automobile has turned losses into profits, taking the lead in getting rid of losses in "Wei Xiaoli". In the first half of 2023, the net profit of ideal Automobile was 3.244 billion yuan, which has exceeded that of most domestic car companies, such as GAC GROUP's 2.966 billion yuan, Great Wall Motor's 1.361 billion yuan and Geely's 1.571 billion yuan.

NIO suffered the worst losses of all car companies, with a net loss of 10.926 billion yuan, an increase of 139.08 per cent over the same period last year. There are signs to follow. In the first half of the year, the R & D expenditure of NIO was 6.42 billion yuan, accounting for 33.0% of the revenue. Although the R & D expenditure is far less than the ideal car, the proportion is the highest among the "Wei Xiaoli". In the first half of the year, the cumulative delivery volume of Xilai increased by 7.35% to 54600 vehicles compared with the same period last year, and the out-of-control pace of product iterative updates was the main reason why its sales fell short of market expectations, but this was also expected by Li Bin.

Compared with the ideal car and Wei Lai, Xiaopeng's performance can be said to be miserable. You know, Xiaopeng Motor is a new force in the first half of 2022, crushing ideal cars and Xilai, but Xiaopeng Motor, which was once high-light, was in deep trouble in the first half of the year and became the only enterprise with a negative gross profit margin. In the first half of the year, Xiaopeng's total revenue was only 9.096 billion yuan, down 38.92 percent from the same period last year. The net loss was 5.142 billion yuan, up 16.81% from the same period last year. The most unexpected is the gross profit margin. Xiaopeng's gross profit margin in the first half of the year is-1.43%, which is the only company with a negative gross profit margin in "Wei Xiaoli". What is even more frightening is that its car gross profit margin has fallen to-5.90%. It is understood that Xiaopeng's gross profit margin has been declining since 2022 Q1.

Although there are still challenges in the overall automotive industry, there are also new driving forces for the growth of multiple industries in the financial reports of listed auto companies: the rapid development of new energy vehicles promotes the rapid growth of the performance of automotive companies, and the increase in R & D investment. the improvement of the level of intelligence leads to an increase in bicycle gross profit; self-research chips, batteries and other accelerated vertical integration to resolve the pressure on the supply of spare parts; automobile export has become a new increment of listed automobile companies.

After entering the third quarter, the intensive listing of domestic new cars and price wars occur one after another, the prices of joint venture fuel vehicle brands continue to decline, and independent new energy brands participate in the market competition in the way of increasing quantity without price increase, resulting in the loss of competitive advantage of joint venture brand models. On the whole, the price war in the automobile industry is difficult to extinguish in a short time, which is the result of the competition between new energy vehicles and fuel vehicles, between new forces and traditional car companies, and between independent brands and joint venture brands. The "Golden Nine and Silver Ten" has arrived, and the competition for sales among major car companies will be more intense. Measures such as price reduction, incremental no price increase, and the introduction of more entry-level models to lower the threshold may become the new normal in September, and the pressure of competition among car companies will also increase.

In order to achieve the quarterly sales target, the sales pace of dealers will be accelerated and the promotion will be intensified. In the short term, the price war is indeed the magic weapon to improve sales, but in the long run, it puts forward new tests for manufacturers' brand premium, cost dilution and system maintenance. in the future, if car companies want to win competition, core innovation ability is the key to win.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.