In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-24 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/17 Report--

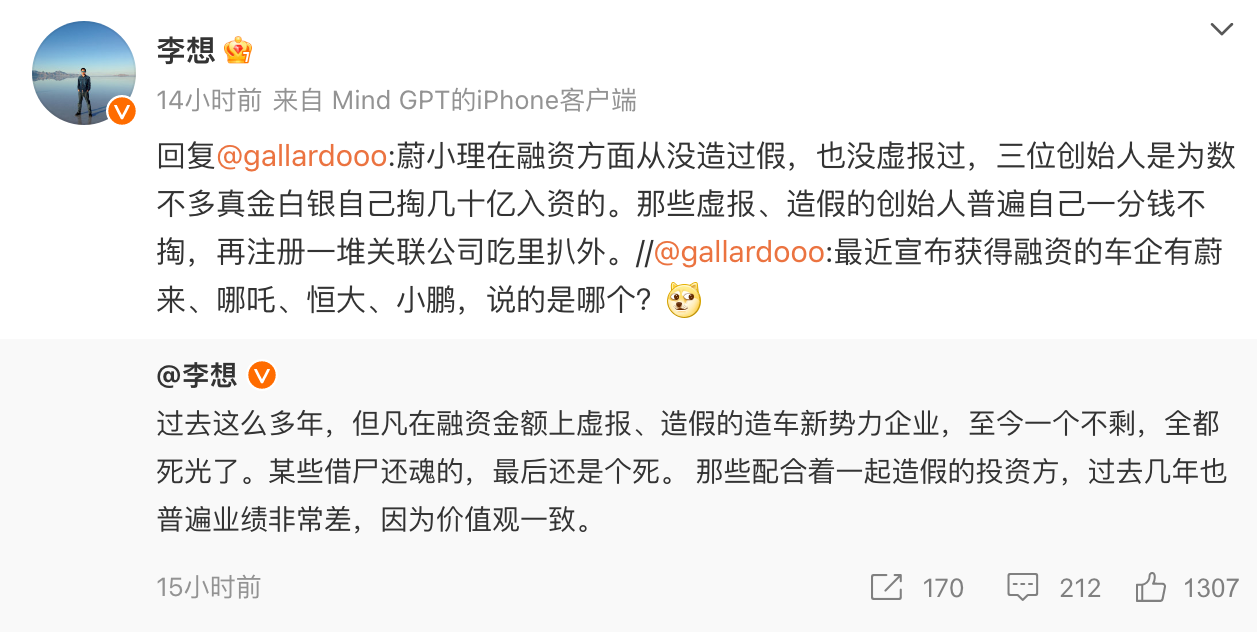

Li, chairman and CEO of ideal Automobile, said on Weibo on Sept. 16, "in the past so many years, all the new car-making enterprises that misstated or falsified the amount of financing have died. Some people who come back to life from the dead end up dead. Investors who work together to cheat have generally performed very poorly in the past few years because of the same values. "

As for Li Xiang's statement, some netizens asked, "which of the car companies that have recently announced access to financing are NIO, Nezha, Evergrande and Xiaopeng?" Li wants to forward the comment, "Wei Xiaoli has never faked or falsely reported in terms of financing. The three founders are one of the few founders who have invested billions of dollars of their own money." Those false reports and fraudulent founders generally do not pay a penny, and then register a bunch of related companies to eat inside and outside. "

Netizens have different views on which car company Li wants to allude to, but more comments point to Weimar.

Weimar was once one of the leading companies of the new power. it was founded in January 2015 by Shen Hui, former director and vice president of Geely Holdings Group, former senior vice president and chairman of Volvo Automotive in China. rich experience in the automotive industry has won the support of all kinds of capital for Weima Automobile, including SAIC, Tencent Investment, Sequoia Capital China, Baidu and other enterprises. From 2017 to 2022, Weima Automobile intensively completed 12 rounds of financing in Amurd, receiving about 35 billion yuan from the primary market, making it the new car-building force with the largest amount of financing before IPO, while Wei Xiaoli at that time did not raise more than 20 billion yuan before IPO.

In September 2018, EX5, the first mass production car of Weimar, was put on the market. In 2019, Weimar delivered 12799 vehicles for the whole year, second only to NIO and ranked second among the new forces. However, under the background that the sales of new power car companies have soared, Weima Motors is in a deep operational crisis. From 2019 to 2021, Weimar sold a total of 78900 new cars, with a total loss of 13.632 billion yuan in three years, equivalent to an average loss of more than 170000 yuan per car.

Combined with Weimar's past experience, it is almost dependent on external financing "blood transfusion" to survive. For this reason, Weima Motor, which is short of money, will spare no effort to seek listing financing in order to resolve the current business crisis. According to the prospectus, as of March 2022, the company's cash and cash equivalents totaled only 3.678 billion yuan. If you can't go public in time and get new capital injection, the money won't last long.

Weimar sought IPO a long time ago, and successively applied for listing on the Kechuang Board and the Hong Kong Stock Exchange, but all of them ended in failure, so Weimar set its sights on backdoor listing.

On January 11, APOLLO disclosed a major acquisition announcement that the company intends to acquire the entire issued share capital of WM Motor Global Investment Limited, a wholly-owned subsidiary of Weimar Holdings Limited (hereinafter referred to as "Weimar"), for US $2.023 billion (about HK $15.854 billion) and will settle the matter by allocating 28.8 billion shares at HK $0.55 per share.

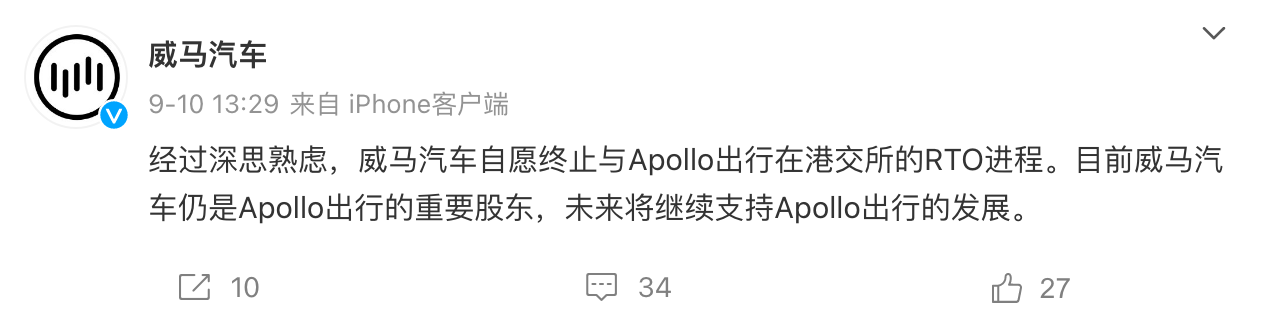

However, just when the outside world thought that Weimar could successfully go public through backdoor listing, APOLLO suddenly announced the termination of the RTO process on Sept. 10, which meant that Weimar had been planning for as long as eight months, and the plan of backdoor listing through reverse takeover ended in failure.

Just when the outside world thought that Weimar might really come to an end, on September 11, Happy Motors suddenly announced that it had signed a non-binding letter of intent with Weimar to acquire 100% of its shareholders. Oddly enough, Weimar did not synchronize the message. It is understood that Happy Automobile is a used car dealer, landed on Nasdaq in May 2019, and then set up a new energy vehicle department in August 2021, shifting from used car distribution to new energy vehicle manufacturing, while the financial situation of Happy Automobile is not optimistic. Since 2019, the stock price has been in the doldrums and even was on the verge of delisting and delisting.

With the car building entering the second half, the capital threshold needed by the new power enterprises is getting higher and higher. In order to ensure that there are sufficient funds to support R & D and expansion, many car companies are seeking IPO to solve the financial problems, such as Naxi Automobile, Avita, Guangzhou Automobile Ean, Polar Krypton Motor and so on are seeking secondary market listing.

But it also requires enough market competition, whether it is Avita, Ean or polar krypton, the shareholders behind it are extremely

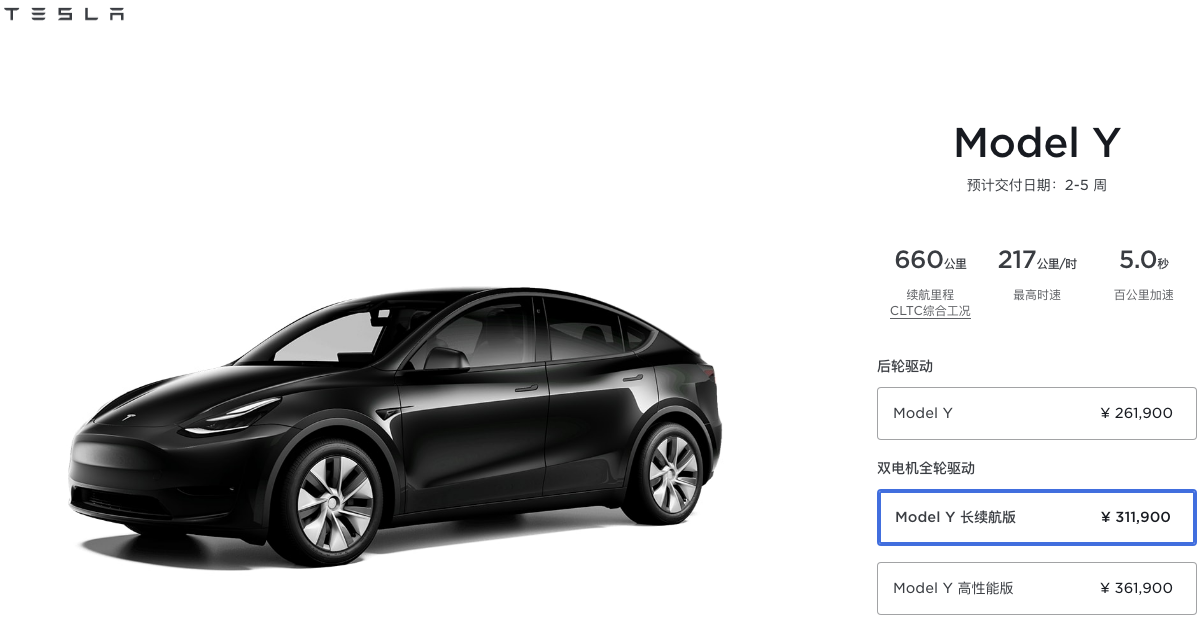

Think about it, even if Happy Motors acquires Weima Motors, what about it? Car building is an extremely expensive industry, and so far only Tesla and ideal cars have made profits, while Ulay and Xiaopeng have been in a state of loss for many years. BAIC Blue Valley and Cyrus in traditional cars are also losing money, while Happy Automobile, as a used car dealer, under the background of not optimistic funds and high debt ratio, it is very difficult for Happy Automobile to enter the new energy industry. As for Weimar, it is more like a new power company abandoned by the times, its products lack technological innovation, and its operating condition has been above the warning line for a long time. From this point of view, happy car + Weima car, it seems that the market is also difficult to give optimistic expectations.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.