In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-21 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/19 Report--

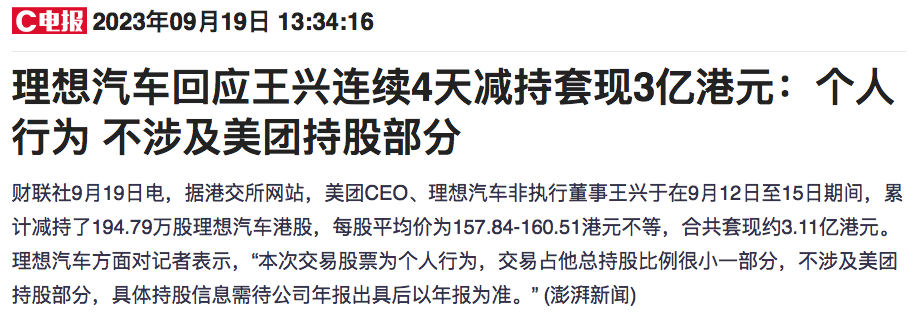

Meituan founder and CEO Wang Xing recently high-frequency "withdrawals" from the ideal car once again attracted the attention of the automobile industry. According to the equity disclosure of the Stock Exchange, Wang Xing, CEO of Meituan and non-executive director of ideal Motors, reduced his holdings of ideal cars for four consecutive days last week. From September 12 to 15, Wang Xing reduced his holdings of 1.9479 million shares, with an average price ranging from 157.84 to 160.51 Hong Kong dollars, cashing out a total of about 311 million Hong Kong dollars (about 290 million yuan).

After this reduction, Wang Xing still holds 384 million ideal shares, down from 21.89% to 21.79%.

In response, ideal Automobile responded: "this trading stock is a personal behavior, accounting for a very small proportion of his total shareholding, does not involve Meituan shareholding part, the specific shareholding information needs to wait for the company's annual report to prevail."

Although Wang Xing himself did not disclose the reasons for the frequent reduction of ideal cars, the industry believes that this move may be related to Meituan's financial situation. Meituan's revenue in 2022 rose 17.7 per cent year-on-year to 114.7 billion yuan, but its net loss widened 67 per cent to 4.38 billion yuan, according to the financial report. By the end of 2022, the net cash flow generated by Meituan's business activities was negative 6.65 billion yuan, down 153 per cent from the same period last year. The industry speculates that Wang Xing may hope to increase the capital reserves of himself and Meituan by cashing out his ideal car shares. Of course, this is only speculation in the industry that the reason for the reduction of the ideal car stake still needs to be confirmed by the official announcement.

It should be noted that this is not the first time Wang Xing has reduced his ideal car one after another. During the period from March 20 to 30 this year, Wang Xing reduced his ideal car holdings nine times in 10 days, reducing a total of 3.933 million ideal car shares, cashing out a total of about 420 million Hong Kong dollars (about 368 million yuan). Wang Xing did not explain his frequent cash-out behavior at that time, while ideal Automobile responded: "recently, Wang Xing sold shares during the window, and the specific number of shares is subject to the DI form of Wang Xing file (DI form refers to the Disclosure of interests form). The trading stock is a personal behavior, and the transaction accounts for a very small proportion of Wang Xing's total shareholding, which does not involve Meituan's shareholding part. the specific shareholding information will prevail after the company's 2022 annual report. "

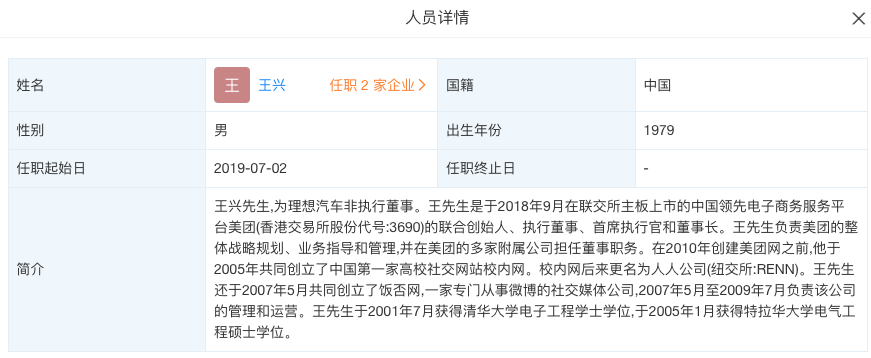

Wang Xing, founder and CEO of Meituan, first took up the position of non-executive director of ideal Automobile in July 2019. At that time, ideal Automobile had just acquired production qualification through acquisition and was in a lack of funds. Wang Xingzheng was the dignitary who provided timely help to ideal Automobile, and then became one of the important investors of ideal Automobile.

Looking at the financing process of ideal car, Wang Xing has a close relationship with ideal car. Data show that in August 2019, ideal Motor received $530 million in round C financing, of which Wang Xingling personally contributed $285 million (about RMB 1.961 billion), while also famous for Meituan's Dragon Ball Capital contributed $15 million. In July 2020, ideal Motor received a financing of US $550 million from D-round, which was also led by Wang Xing, with Meituan leading the investment of US $500 million (about RMB 3.44 billion), that is to say, strategic financing before the listing of ideal Automobile. Wang Xing and Meituan both invested in ideal cars many times. Since then, ideal Automobile has been listed in US stocks, and Wang Xing has once again increased its investment in ideal Automobile, of which Wang Xing subscribed to US $30 million and Meituan subscribed to US $300m. At that time, according to the ideal Automobile prospectus, Wang Xing was the second largest shareholder of ideal Automobile, accounting for 14.5% of the shares. So far, Meituan and Wang Xing have invested a total of 1.15 billion US dollars in ideal cars several times.

In addition, Wang Xing's relationship with ideal car not only stays at the investment level. Before that, Wang Xing created momentum for the ideal car many times when the ideal car was listed, and even bought an ideal ONE himself, and said bluntly: "finally, I like to mention an ideal ONE, which can replace the original Volvo XC90 and Tesla Model S." In addition, Wang Xing also said publicly that he was optimistic about the ideal car. in October 2022, Wang Xing also forwarded the delivery report of the ideal car for September, and issued a post saying: "as promised, the ideal car L9 with a price of 459800 will be delivered in the first month of over 10,000, specifically 10123. For the past two or three decades, the leader of China's high-end car market has been German BBA (Mercedes-Benz, BMW, Audi), and the next two or three years will depend on Li Weihua (ideal, Lulai, Huawei). No matter which company wins, China will win.

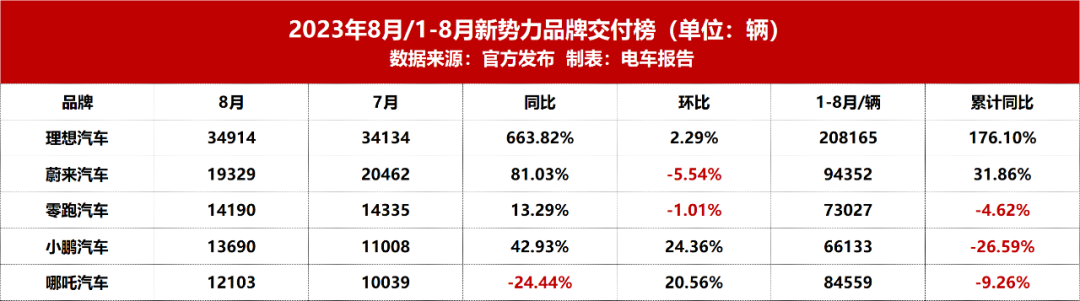

At present, both monthly sales and annual cumulative sales of ideal cars are far higher than those of other car companies. Data show that a total of 208165 new cars were delivered in the first eight months of this year, an increase of 176.10 percent over the same period last year, of which 34914 were delivered in August, an increase of 663.82 percent over the same period last year.

The gradual rise in sales has also given ideal car more confidence. To this end, ideal Motor Chairman Li Xiang gave a higher KPI. Li Xiang said at the earnings meeting in the second quarter of this year that he would challenge the target of selling 40, 000 vehicles a month in the fourth quarter of this year.

Or affected by the above news, as of September 19, Beijing time, ideal Motor Hong Kong shares were at 149.4 Hong Kong dollars per share, with a total market capitalization of 297.2 billion.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.