In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-21 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/26 Report--

A rumor triggered a sharp move in NIO's share price.

On the evening of September 25, there were rumors that NIO was considering raising about $3 billion due to widening losses and had contacted investors from the Middle East. The financing is likely to take place in the first half of next year and is still under negotiation.

Affected by this news, NIO U.S. stocks fell more than 7% before trading.

Subsequently, NIO issued an announcement saying that the company had noticed speculation in the media that NIO was considering raising funds from investors. NIO said that apart from the convertible senior bond issue completed on September 25, the company currently does not have any reportable financing activities. By the close of U.S. stocks, NIO's share price decline narrowed, down 2.11% to close at $8.35.

Before that, NIO had announced a number of financing.

On June 20, NIO Automobile announced the signing of a share subscription agreement with Abu Dhabi investment agency CYVN Holdings. According to the agreement, CYVN Holdings will make strategic investments totaling approximately US $1.1 billion to NIO through targeted new shares and transfer of old shares.

Under the agreement, CYVN will issue 8.469 million Class A common shares at a price of $8.72 per share (i.e., the weighted average price of Class A common shares on the New York Stock Exchange for seven consecutive trading days prior to June 19, 2023), with a total investment of $738.5 million, which is expected to be completed in early July 2023. CYVN will hold approximately 7.0% of the issued and outstanding shares of NIO after the private placement of new shares and the transfer of old shares. Upon completion of the investment transaction, CYVN will have the right to appoint a director to the board of directors of the company.

On September 19, NIO announced plans to issue $1 billion convertible bonds. After the announcement, NIO shares fell 17 per cent and the company's total market capitalisation shrank to less than $15 billion. On the 25th, NIO announced that it had completed the issuance of $1 billion convertible senior bonds, including $500 million due in 2029 and another $500 million due in 2030.

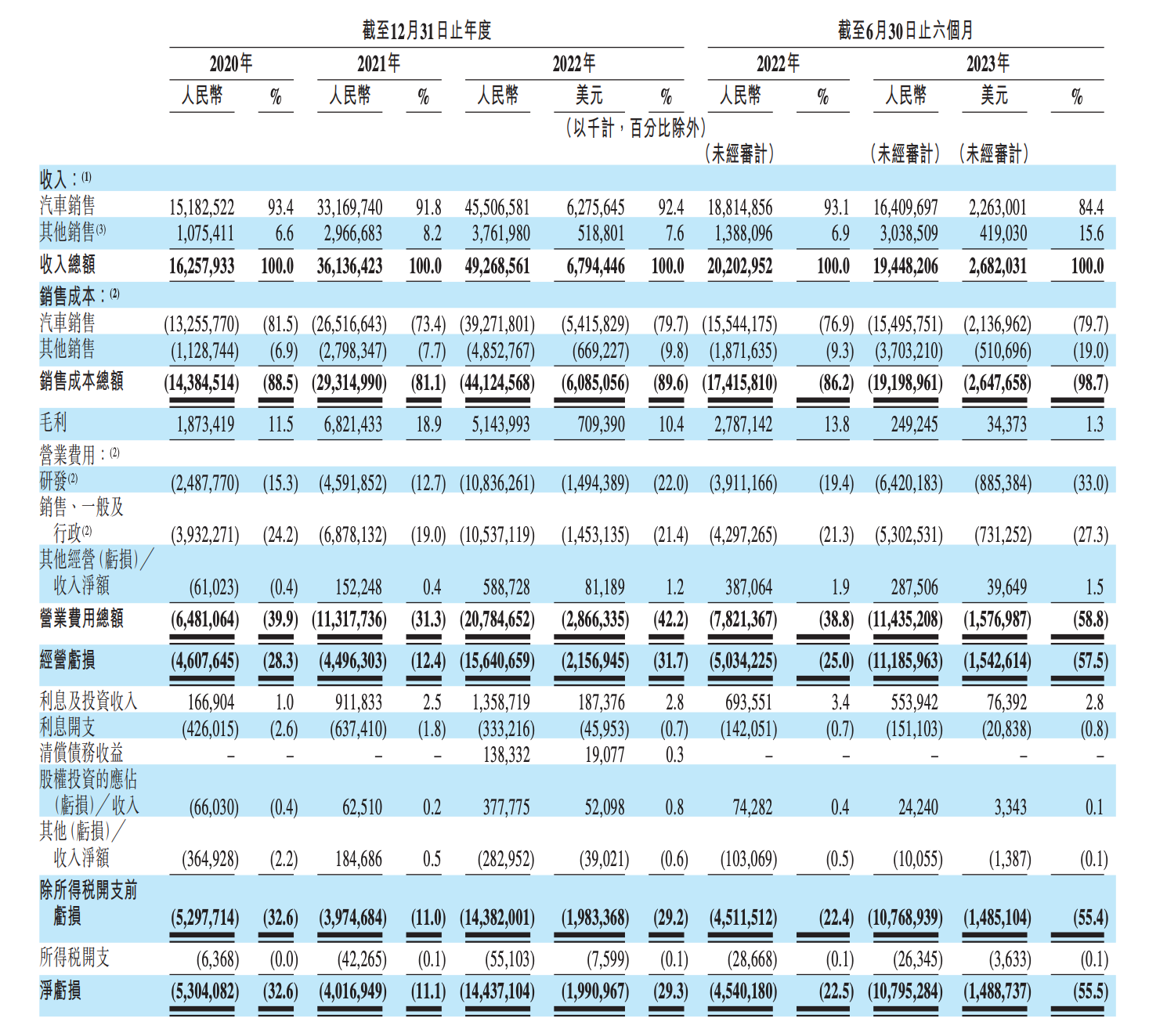

So far, Wei Lai has not made a profit, and the losses continue to expand.

Financial report shows, In the first half of the year Wei Lai total revenue 19.448 billion yuan, Net loss 10.926 billion yuan. There are also signs. In the first half of the year, the cumulative delivery volume of NIO increased by 7.35% year-on-year to 54,600 vehicles. Although the delivery volume increased, it was far lower than the market expectation. The out-of-control of product iteration update rhythm was the main reason why its sales volume fell short of market expectation, and this was not the first time NIO suffered sales decline due to product iteration. At the same time, cash flow is getting smaller. As of June 30,2023, NIO cash reserves amounted to RMB 31.5 billion yuan.

Despite huge losses, NIO is still investing heavily in battery and charging infrastructure and research and development. On September 21, NIO released its own brand mobile phone NIO Phone, priced at 6499-7499 yuan. Li Bin said, NIO mobile phone is not because mobile phone companies are building cars, nor because NIO car does not make money to sell mobile phone profits, but NIO users need a seamless connection with NIO car mobile phone. Perhaps for NIO, NIO mobile phone is not a mobile phone, but a tool to provide NIO owners with more experience, but also to master the ecological initiative, but should also consider clearly, NIO mobile phone exactly how many NIO users pay.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.