In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/29 Report--

Faraday Future (Faraday Future) shares closed at a new low on Sept. 29, falling 5.11% to $1.30. The day before, Faraday Future shares closed down 44.31%, the lowest since the Nasdaq IPO closed in July 2021. Over the past two days, Faraday's future share price plummeted 49.42%, once again facing falling below the $1 delisting mark.

On Aug. 17, Faraday Future announced that at a special shareholders' meeting, shareholders had approved a proposal to empower the company's board of directors to carry out a reverse equity split of the company's issued common stock, between 1:2 and 1:90. If a partnership is implemented, it will increase the number of authorized and unissued common shares. Prior to that, Faraday's future share price remained below $1, well below the Nasdaq listing standard. Affected by the news, Faraday's future share price soared 25.57% on the same day to close at $0.28 per share, with a total market capitalization of $409 million.

After the partnership, Faraday's future share price returned to more than $1, but it has continued to fall since then. On Aug. 17, Faraday's future share price was $22.00, but it had fallen to $1.30 as of the latest trading day, plunging 92.58% in just 30 days, leaving a market capitalization of just $24.18 million, the lowest since Faraday's future IPO went public.

On the news, Faraday announced on September 27th that the company has signed an agreement for the issuance and sale of ATM shares, under which the company can issue and sell Class A common shares with a total value of not more than US $90 million from time to time through underwriting agents.

On the same day, Faraday also released a letter from Matthias Aydt, global CEO of FF, to all shareholders in the future. Faraday has invested about $3 billion (21.9 billion yuan) in the future over the past nine years, delivering three FF 91 2.0 Futurist Alliance vehicles in the third quarter, the letter said.

After nine years of building the car and burning 3 billion dollars, Faraday was finally delivered in the future.

On August 14th, Faraday Future announced the official delivery of the first FF 91 2.0 Futurist Alliance to the first user, and held a delivery ceremony for the first user of the new car, which was delivered by founder Jia Yueting himself. It should be noted that the user is not an ordinary consumer, but "Private Collection Motors", one of the largest luxury car dealers in Southern California.

The second owner of the FF 91 2.0 Futurist Alliance, the national luxury real estate agent tycoon Jason Oppenheim, delivered the Jason agent's yacht marina mansion in Newport Beach, California. The third owner of FF is Hollywood star agent Kelvin Sherman, who officially received his FF 91 2.0 Futurist Alliance at FF's "919 developer AI Co-creation Festival", which was held at FF headquarters in Los Angeles.

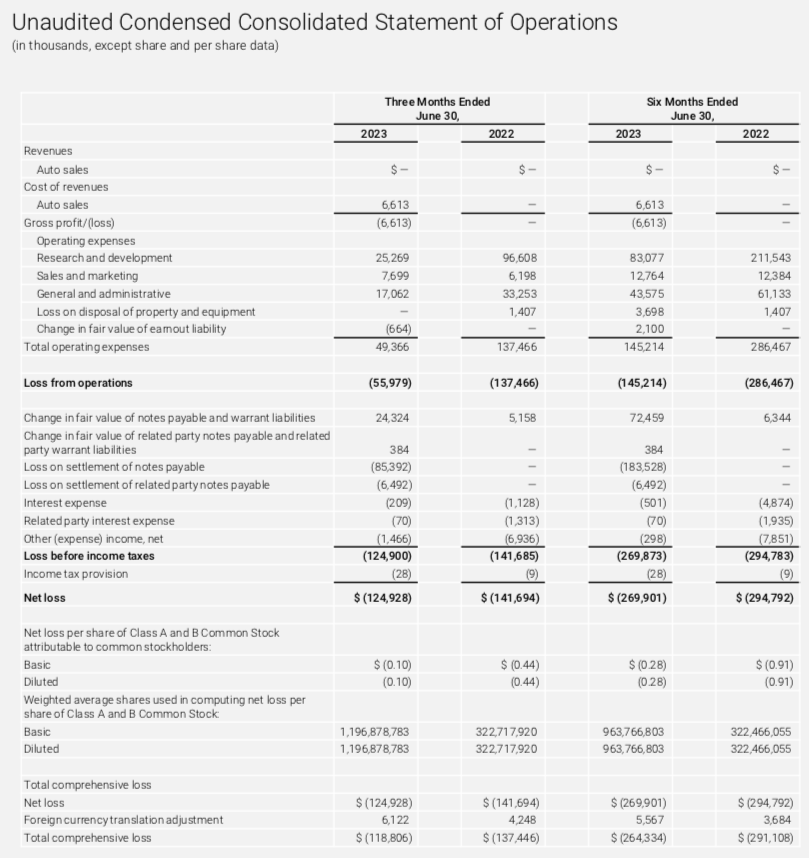

Although FF has been delivered, it is still short of money. The results showed that FF lost $270 million in the first half, down from $295 million in the same period. FF's loss narrowed due to lower research and development and operating costs, as well as partly offset by the higher non-cash market capitalization method recorded in the second quarter of this year for secured convertible notes and warrants settlement. Obviously, such achievements will not satisfy the capital markets. FF shares tumbled 17.6 per cent after the earnings announcement.

As of June 30, 2023, Faraday's future cash flow was $180 million, according to the financial report. Therefore, if FF wants to make a new round of delivery, it still needs to rely on financing, and how much money FF needs to solve the delivery problem is not clear, nor is it certain that Faraday will have a future.

2023-when new energy vehicles enter a new stage, production capacity and delivery become the most important yardstick, and the delivery of FF 91 does not stimulate the capital market as much, so how to continue to be recognized by the capital market is a constant consideration for FF. At present, the market knockout stage has begun, and the withdrawal of any automobile company is the final result of the market reshuffle. This is also the reason why Jia Yueting is facing an awkward situation. With the improvement of the penetration of new energy vehicles, the current market has changed from the seller to the buyer's market, and consumers have the final decision.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.