In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/08 Report--

On Oct.6, Lucid shares, a new force in American car-making, hit a new low, closing at $5.13, with a total market capitalisation of $11.71 billion. It is understood that Lucid was listed on NASDAQ in July 2021. Its share price rose 10.64% on the first day and closed at US $26.83 per share, with a total market value of more than US $40 billion. Since then, with the tuyere of new energy vehicles, its share price rose as high as US $57.75. Now it has fallen to US $5.13 per share, with a market value of more than 80% and a market value of only US $11.71 billion.

Lucid shares continued to slide, linked to continued sluggish demand for its first production model, the Lucid Air. Lucid is likely to lose $338,000 in EBITDA per vehicle this year, based on deliveries and company results, suggesting its unsustainable business model requires significant scale-up and additional capital, according to the report. Lucid is expected to continue losing money until 2025, increasing pressure to maintain liquidity and access to capital, and any recession could accelerate the loss-making company's destruction.

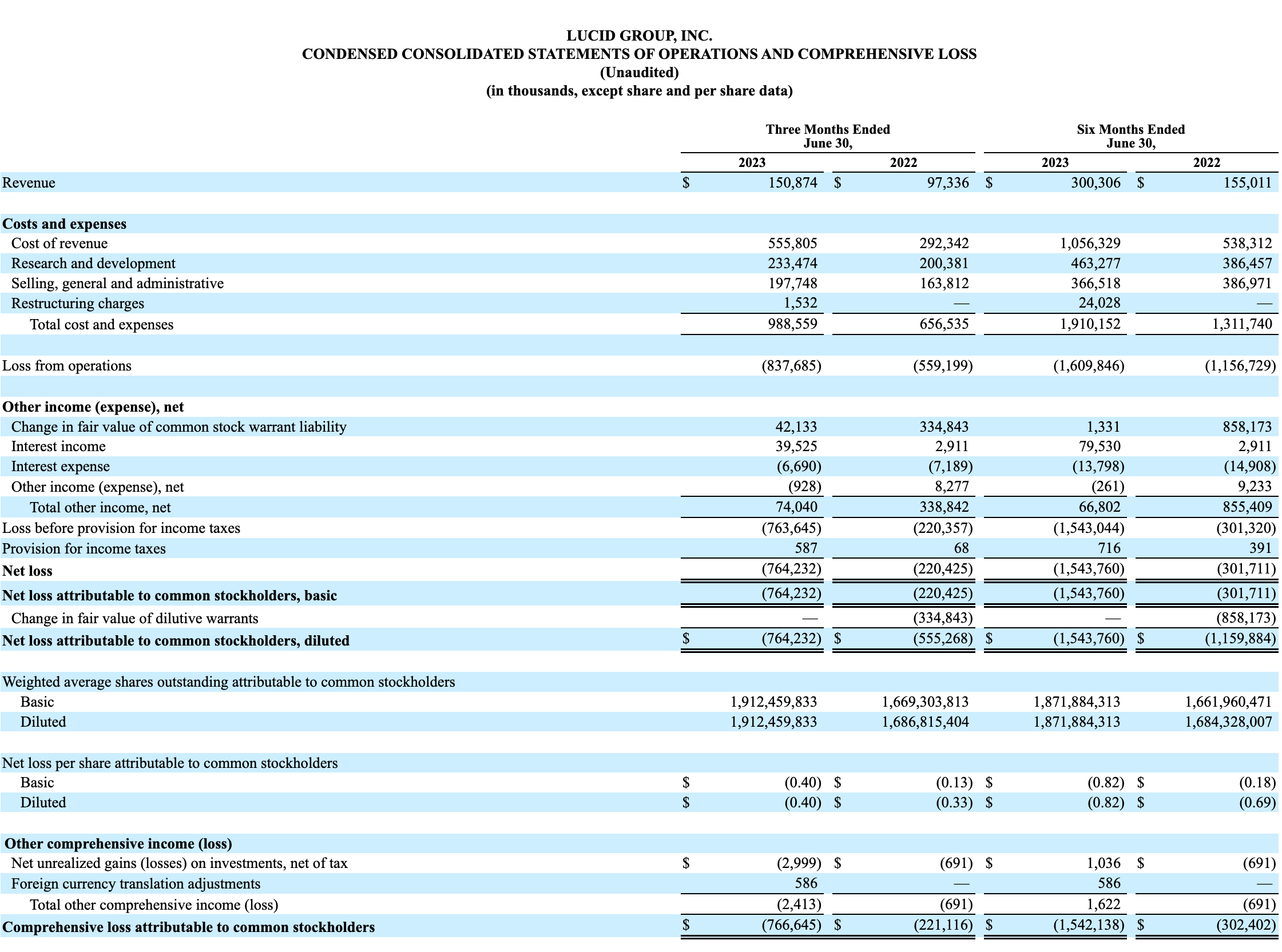

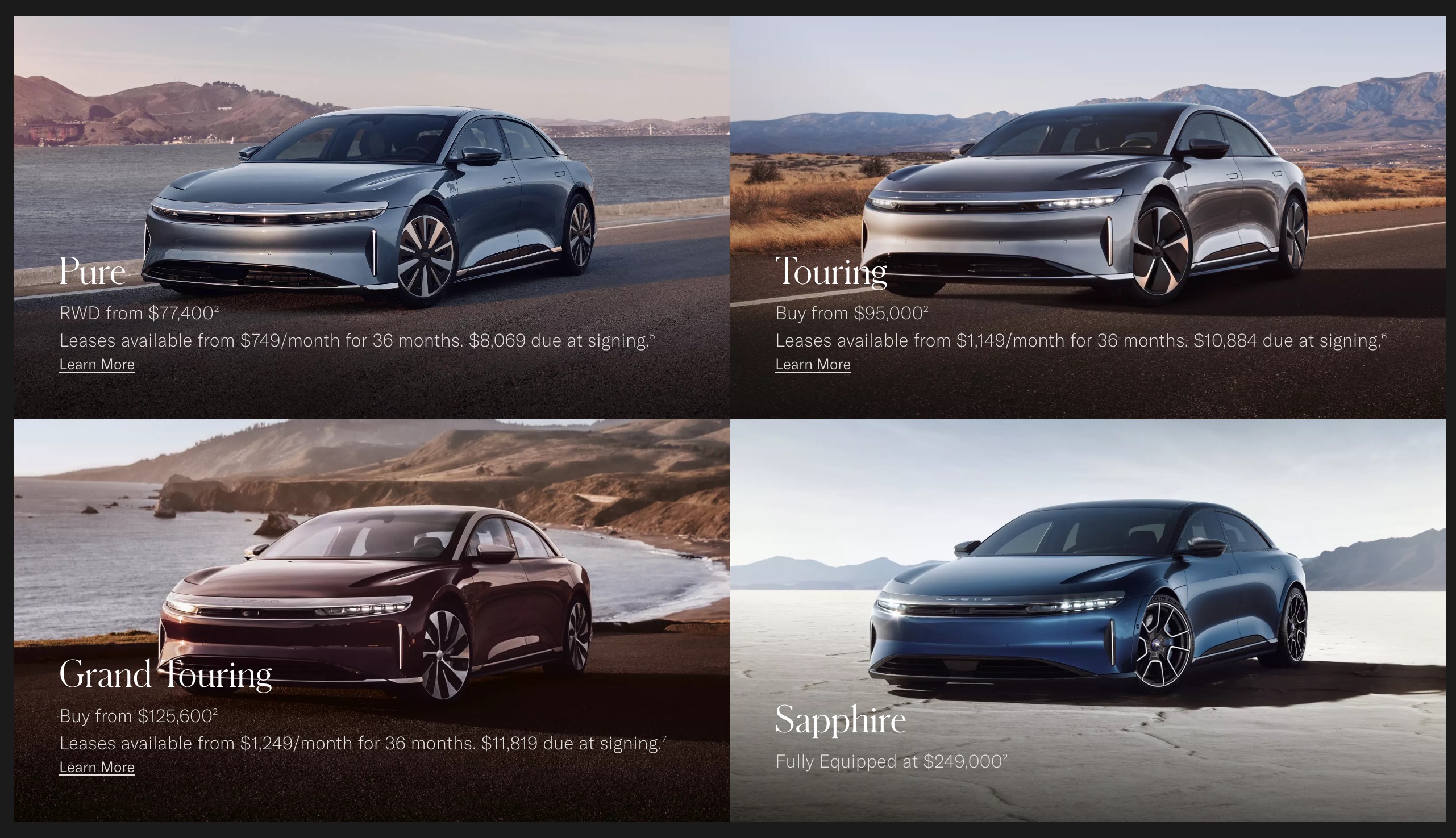

Different from the development of new domestic car-building forces, Tesla is the only one in the American electric vehicle market. Lucid encounters double bottlenecks in sales volume and production capacity in its local development. In the American market alone, Lucid's output is difficult to guarantee delivery, and it is more difficult to export overseas on a large scale. Lucid reported a net loss of $764 million in the second quarter and operating income of $151 million. In terms of sales volume, Lucid delivered 1404 Air models, and the high price may be one of the key reasons for the poor sales of Air models. Since then, Lucid announced that it would reduce the price of Air and expect to boost delivery and market performance with lower prices and gradually increasing production capacity in the third quarter.

Lucid chief engineer Eric Bach said at the 2023 Munich auto show in September that the company was exploring selling electric cars in China, but had not yet decided when to enter the Chinese market. Eric Bach said,"China is the largest automotive market in the world, and every automaker has to or has done in-depth research on the Chinese market. China is likely to become the world's largest and fastest-growing electric vehicle market."

It is easy to enter the Chinese market, but it is especially difficult to survive in the Chinese market. Not surprisingly, Lucid enters the Chinese market in a way that exports vehicles to China for sale, but in the face of Tesla, which has already realized domestic production, its price does not have an advantage. In addition, it is an imported brand, after-sales service and brand marketing promotion are arduous tasks. The electric vehicle brands dominated by BYD and Ai 'an have established a good brand image, and their market share is expanding constantly. Lucid Group needs to find a way to compete with these brands.

Lucid has said it will launch a model for about $50,000, or about 350,000 yuan. "Wei Xiaoli" and other new car-building forces have been laid out in this price range, among which the ideal sales volume has been sold 30,000 units per month, the sales volume of Wei Lai in August is close to 20,000 units, and Xiao Peng also exceeds 10,000 units. These are the "mountains" in front of Lucid.

Lucid currently sells Air Pure for $77,400, or about 565,100 yuan, according to its website, which could cost more than 650,000 yuan if exported to China. In this context, Lucid wants to enter the Chinese market on a large scale difficult to imagine. As Eric Bach says,"If you enter the Chinese market the wrong way, you can make a lot of mistakes." We need to adjust and understand how to enter the Chinese market. What is the pricing strategy? What is the production strategy?"

Lucid's entry into the Chinese market also seems inevitable, bringing Lucid a broader consumer base. Of course, the challenges are particularly fierce. Lucid faces a very different competitive environment from Tesla when it first entered China. Now the market structure of new energy vehicles has been initially stable, and traditional automobile manufacturers 'new energy brands are making efforts. Lucid needs to be prepared for a long battle if it wants a piece of the fierce Chinese market.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.