In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/19 Report--

Recently, when talking about the progress of the company's IPO, Zhang Yong, CEO of Naga, revealed that Naga raised 10 billion yuan last year and has several billion yuan this year. Currently, it has 10 billion yuan in its account and is in no hurry to IPO. At the same time, it is pointed out: now the market is so cold, you can't get too much when you go public, and the probability of listing is relatively high, so there is 10 billion on the account, so you don't have so many impulses to go public in a hurry, and you have enough money to go public step by step.

In fact, news of Naga's IPO has been reported since the beginning of this year, and in September, a person familiar with the matter revealed to the media that Naga is still making early preparations for IPO and is preparing preliminary filings to the Hong Kong Stock Exchange. It has entrusted China International Capital Corporation and Morgan Stanley in charge of its planned initial public offering (IPO) in Hong Kong, which may raise up to $1 billion through IPO. On August 29th, Nashi announced that it had completed a total of 7 billion yuan in crossover round financing. Some industry insiders have pointed out that the Crossover round is usually an equity investment for enterprises to IPO faster.

On September 1st, Nashi Automobile officially announced that it would invest 3.2 billion yuan to set up an international headquarters in Hong Kong. It is planned to gradually invest about 3.2 billion yuan in the next five years to build an intelligent R & D center with an area of more than 40, 000 square feet and the big data Center, and is expected to employ nearly 600 R & D personnel. At the same time, Naxi will also seek a $200 million equity investment plan in Hong Kong. Nashi said the move will help the company move into a new phase of global technology enterprises. At that time, some people in the industry pointed out that Nahu would go to Hong Kong this time or prepare for its listing in Hong Kong.

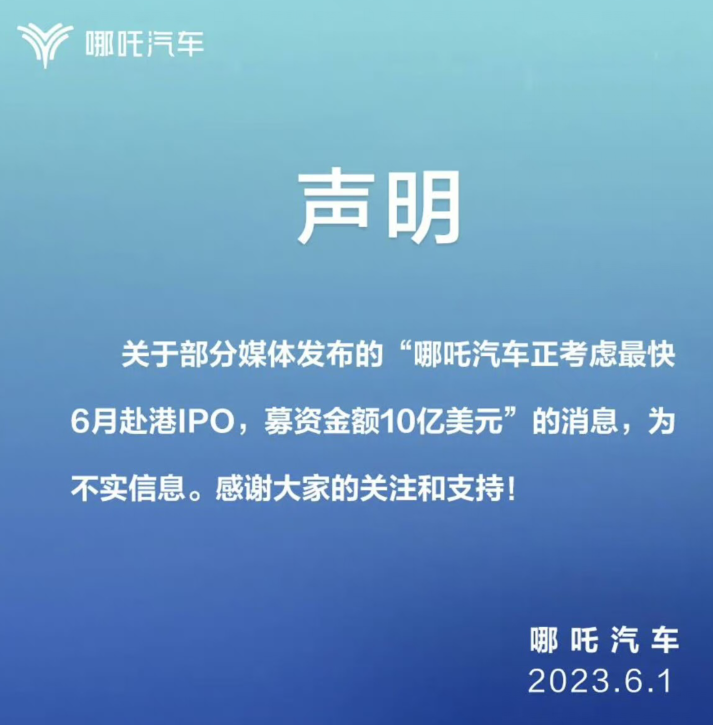

In early June, there was also news in the market that Hezhong New Energy vehicle, the parent company of Naji Automobile, had listed Agricultural Bank of China International and China Bank International as financial services institutions responsible for listing, and would submit a US $1 billion Hong Kong IPO application this month. At that time, in response to the news, Nahu issued a statement in response: the news is false information. It is worth noting that as early as July 2020, Naha announced that it would start the listing declaration of Kechuang Board, and planned to complete the listing in 2021. However, under the requirements of Science and Technology Innovation Board's new policy, the censorship of the "science and technology content" of listed companies has been strengthened, leading to the termination of Science and Technology Innovation Board's listing plans. In February 2022, it was also rumored that Nahan would be listed in IPO and planned to be listed in Hong Kong. At that time, with regard to the listing, Naha Automobile also said that it was not known yet, and that the news would be released as soon as possible.

Although officials have denied IPO at present, it is undeniable that the car will start IPO in the future. after all, car construction will require a steady stream of money. For the new energy vehicle industry, it needs a lot of capital investment. Zhang Yong, CEO of Nezha Automobile, said earlier: "Enterprise development needs a lot of money, and it is false to say that we are not short of money. Even companies that have been listed and raised money also need to refinance. For enterprises, the more money, the better." At present, Nashi car is still in the stage of high loss. Relevant data show that from 2020 to 2022, the net losses of Naha were 1.321 billion yuan, 2.908 billion yuan and 6.919 billion yuan respectively, with a cumulative loss of 11.14 billion yuan in three years.

In order to reverse the loss situation, Naha car also changed its style last year and began to lay out high-end models. In July 2022, Nahan launched its high-end Negro S model, hoping to reverse losses. However, the model did not sell well after its launch, with only 2003 units sold in the first month. In April this year, it launched a new sedan car Nahan GT, a new car positioning pure electric coupe, a total of four models, with a price of 17.88-226800 yuan. Unfortunately, the two models with high-end layout did not produce the desired results. Zhang Yong has said that Nezha S will sell more than 10,000 vehicles a month within six months, 20, 000 vehicles a month within a year, and Naga GT has a monthly sales target of 5000 vehicles. However, neither of the two cars has achieved the desired effect that Zhang Yong said.

With the intensification of market competition, it is not difficult to see that the pace of the car IPO may also be delayed. After all, since 2023, the sales performance of Naha car is not very eye-catching, or can not meet the expectations of capital or market, and it is also difficult to go public. Relevant data show that Nashi car sales in September were 13211, down 26.63% from a year earlier. From January to September, cumulative sales were 97770, down 12.07 per cent from a year earlier. In addition, with the fierce competition in the new energy vehicle market, there are also some concerns in the capital market about the valuation of the new energy vehicle industry, which may cause investors to be cautious about the listing of NEV.

Of course, for IPO, the automotive industry is concerned that the possibility of a follow-up IPO is still very great. After all, if you want to develop in the longer term, you need to expand the scale. In other words, more money is needed to continue to invest. Some people in the industry also pointed out that the new forces of domestic car building are now in the process of looking for survival opportunities, and a good place to be listed on the market is to get financing channels and financial support, which is very critical for the new forces of car building.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.