In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-21 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/31 Report--

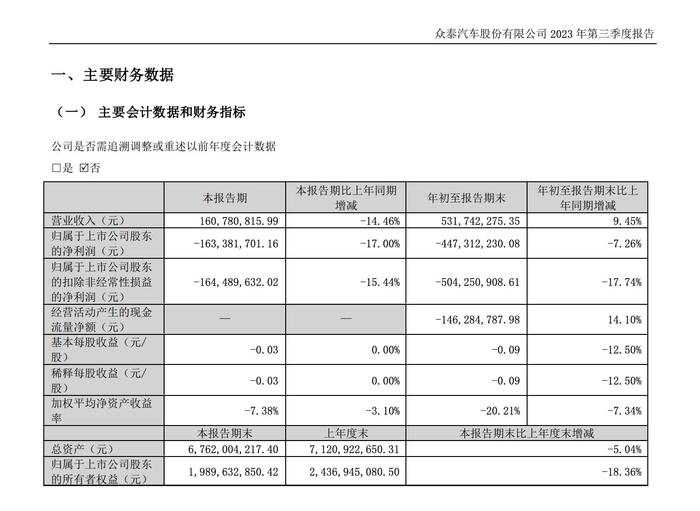

Recently, Zhongtai Automobile released the latest third-quarter results. According to the data, Zhongtai Motor's operating income in the third quarter was 161 million yuan, down 14.46% from the same period last year. In the first three quarters of this year, Zhongtai Motor's cumulative revenue was 532 million yuan, up 9.45% from the same period last year, while the net profit and loss in the third quarter was 163 million yuan, down 17.00% from the same period last year. The cumulative loss of net profit in the first three quarters was 447 million yuan, down 7.26% from the same period last year.

In terms of gross profit margin, Zhongtai Motor's gross profit margin in the third quarter was 2.65%, down 10.32% from the same period last year. In the first three quarters of this year, the gross profit margin was 8.42%, down 1.65% from the same period last year. In terms of net cash flow, in the first three quarters of 2023, the net cash flow of operating activities was-146 million yuan, an increase of 24.0089 million yuan over the same period last year. The net cash flow of fund-raising activities was 157 million yuan, an increase of 174 million yuan over the same period last year, which officials said was mainly due to the impact of cash increases received from other fund-raising activities in the current period. The net cash flow of investment activities was-51.1831 million yuan, compared with 257 million yuan in the same period last year, which officials said was mainly due to the reduced cash flow from other investment activities in the current period.

The free cash flow of Zhongtai Motor in the first three quarters of 2023 was-354 million yuan, compared with-431 million yuan in the same period last year. From the data point of view, although Zhongtai Automobile in the first three quarters of cumulative revenue growth compared with the same period last year, but the results of this financial report is obviously not ideal, after all, the net profit loss continues to expand.

It is worth noting that since Zhongtai announced the formal resumption of production last year, its every move has attracted the attention of the market. According to relevant data, Zhongtai Automobile, formerly known as Huangshan Golden Horse Co., Ltd., was listed on May 19, 2000, with products covering sedan, SUV, MPV and new energy vehicle market segments. Zhongtai holding Group was established in 2003, and at the beginning of 2006, Zhongtai Automobile realized the whole vehicle production through Chengdu Xindi Automobile Company. After 2006, it successively launched Zhongtai 2008, T600, Zhongtai SR9 and other models. Because the Zhongtai SR9 model is very similar to the Porsche Macan, it became popular as soon as it was launched, with sales peaking at 333100 vehicles in 2016.

However, without the support of core technology, it is doomed not to last long. Zhongtai's sales fell to 154800 in 2018 and 116600 in 2019. In 2020, Zhongtai Motors fell into a crisis, its production and operation business almost pressed the pause button, and a number of subsidiaries and parent companies were liquidated.

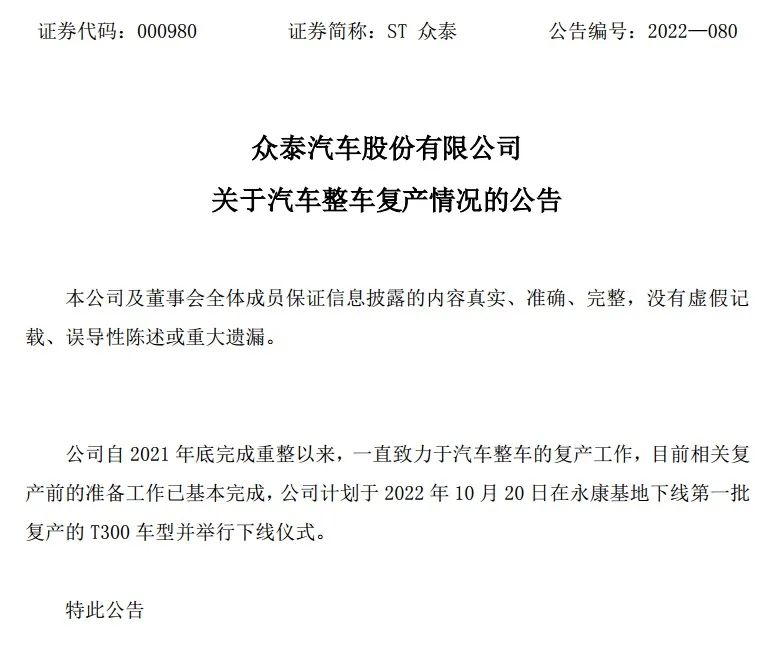

In 2021, because Zhongtai Motor was unable to pay off its due debts, Jinhua Intermediate people's Court ruled to accept the reorganization according to law on the application of creditors, and appointed the manager to carry out all kinds of restructuring work. On September 30, 2021, according to the judge's vote, Jiangsu Shenshang holding Group Co., Ltd. was finally confirmed as the restructuring investor. On October 9 of the same year, Zhongtai Automobile restructuring investors were finally identified as Jiangsu Shenzhen Merchants, Shanghai Tianqi and Hunan Zhibo as the second-ranking restructuring investors of the company. On October 27th, Zhongtai announced that 2 billion yuan of restructuring funds have been put in place, the funds will be used to pay restructuring costs, pay off debts, and take advantage of industrial synergy to help Zhongtai Automobile restore the national sales network as soon as possible. On December 28, 2021, Zhongtai received the Civil order of Jinhua Intermediate people's Court, confirming the completion of the implementation of the Zhongtai Automobile restructuring Plan. However, after Zhongtai announced bankruptcy restructuring, it is also trying to return to the market track as soon as possible. In January last year, Zhongtai announced the acquisition of Shanghai Junqu Automotive Technology Co., Ltd., and in July of the same year, the Zhongtai T300 completed the declaration in the Ministry of Industry and Information Technology. On October 18, 2022, Zhongtai issued a "notice on the resumption of vehicle production" and officially announced a strong return. On October 20, 2022, Zhongtai Automobile launched the overseas production line of the first batch of T300 models, and announced that the 2023 T300L would be launched to the domestic market at the same time, with a price of 59800.

However, the effect of these efforts is minimal. Relevant data show that Zhongtai's cumulative sales in the first half of this year were only 652. In order to boost sales growth, Zhongtai Motor has also set its sights on overseas markets. In December 2022, the new Zhongtai T300 overseas version was released. Since January this year, the overseas version of T300 has been delivered to Middle East countries and regions one after another. In December 2022, Zhongtai Motor successfully signed an exclusive distribution and service agreement with Lexi International Trade (Yongkang). The two sides agreed to sell 10000 T300 overseas versions in specific countries and regions of the Middle East from 2022 to 2023, with an estimated amount of 692 million yuan. On June 26, according to the official WeChat account of Zhongtai Automobile, 500 overseas versions of Zhongtai T300 were loaded and sailed at Zhongtai Automobile Yongkang Base and sent to the Middle East market.

In the domestic market, a new small pure electric car U2 was launched in February this year and started pre-sale. Officials have said: at present, it is mainly U2 and other new energy products, and through the transformation of the production line, raising funds and other measures to speed up the full production of U2. The development of new energy intelligent network connected cars will focus on four passenger cars, including three pure electric large and medium-sized SUV models and one pure electric sedan model. It is good to have ideas, but the huge losses also make Zhongtai's situation very bad, because it is difficult to cover its short-term debt in terms of its financial position. Relevant data show that as of June 30, Zhongtai auto currency funds are 850 million, short-term loans are 1.246 billion, and non-current liabilities due within one year are 285 million yuan.

In addition, although the return of Zhongtai has announced the resumption of production for nearly a year, but from its one-year progress, it is still relatively slow. The automobile industry is a highly competitive industry, and it is not up to you to come slowly. As BYD Wang Chuanfu said, the process of electrification is accelerating. Now it is not big fish eating small fish, but fast fish eating slow fish. There is not much time left for Zhongtai Motor.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.