In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/21 Report--

On April 5, Evergrande announced that the strategic investment of Newton Group was terminated, and no further progress had been made in the previously proposed transaction and the revision of the terms of the debt-to-equity swap. In short, Evergrande has lost its financier, and its $500m (3.55 billion yuan) investment ended in failure.

The termination of the deal between Evergrande and Newton may have been foreboding. In fact, on January 1 this year, Evergrande announced that the share subscription agreement between Evergrande and Newton Group and the debt-for-equity swap agreement, originally scheduled to expire on December 31, 2023, have expired. At the time, Evergrande said that although the agreement had expired, Evergrande, Newton and other interested parties were still negotiating key terms of these deals, suggesting that a new agreement or revision of the original agreement was still possible. Before that, in October 2023, Evergrande also announced that Newton had suspended its obligations under the share subscription agreement.

The deal between Evergrande and Newton Group began on August 14, 2023, when Evergrande announced that it had received Newton's first strategic investment of US $500 million (RMB 3.55 billion). Newton's stake in Evergrande accounts for 27.5% of the total number of common shares issued. According to the agreement, subject to meeting the prerequisites in the agreement, Newton will provide 600 million yuan of interest-free and guaranteed transitional funds for Evergrande's R & D, production and sales business. The money is also seen by the outside world as "life-saving money" for Evergrande, and it is believed that getting this investment will save Evergrande.

According to the latest financial report, Evergrande's revenue in 2023 was 1.34 billion yuan, an increase of 900.03% over the same period last year, while shareholders accounted for a loss of 11.995 billion yuan, reducing losses by 56.64% over the same period last year. As of December 31, 2023, the cumulative losses and shareholders' losses of Evergrande were 110.841 billion yuan (98.906 billion yuan in 2022) and 37.693 billion yuan (68.651 billion yuan in 2022) respectively. As of December 31, 2023, Evergrande has total auto assets of 34.851 billion yuan and liabilities of 72.543 billion yuan, including 26.484 billion yuan of loans, 43.012 billion yuan of trade and other payables and 3.047 billion yuan of other liabilities. In other words, Evergrande has become insolvent. As of December 31, 2023, Evergrande's cash and cash equivalents are 129 million yuan, and the cash flow is expected to last at least 12 months.

Now, the collapse of Evergrande's $500m (3.55 billion yuan) investment means life will be harder for Evergrande, and Evergrande's only mass-produced model, the Hengchi 5, has stopped production several times.

In the announcement of its financial results on March 27, Evergrande said that due to external and internal factors, production and sales fell short of expectations, the company was facing operational difficulties, and business activities such as research and development, production and sales, as well as the stability of its workforce were affected. As of December 31, 2023, the Tianjin manufacturing base produced Hengchi 5 according to market demand, with a total production of 1700 vehicles and a total delivery of more than 1389 vehicles. Recently, due to financial reasons, the group arranged for some personnel to have a holiday and Tianjin factory suspended production.

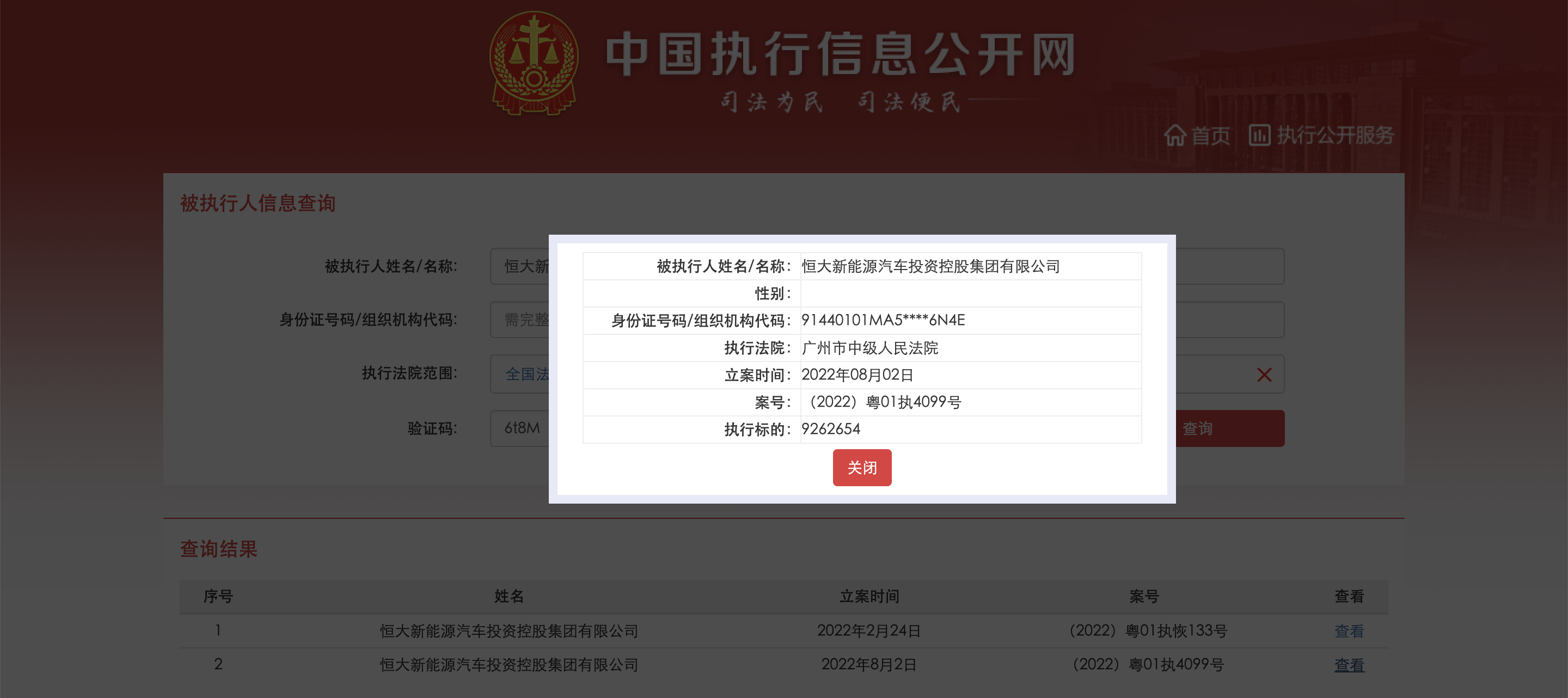

For Evergrande, which is losing a lot of money, getting $500 million may be a drop in the bucket. But to some extent, although the strategic investment of Newton Group is far from being able to pull Evergrande out of the quagmire that is mired in financial crisis, Evergrande itself does not have the ability to make blood, and this money can indeed alleviate Evergrande's urgent needs. Evergrande has previously stressed that holding hands with Middle Eastern capital will effectively solve the financial difficulties facing Evergrande's development, so Newton's strategic investment is also considered to be Evergrande's only vitality. Now Evergrande has lost 500 million US dollars (about 3.55 billion yuan) of investment, its position will also be very dangerous. To make matters worse, Liu Yongzhao, president and executive director of Evergrande Motor, was detained according to law on January 8 on suspicion of breaking the law and committing a crime. In addition, Xu Jiayin, chairman of the board of China Evergrande, and du Liang, general manager of Evergrande Wealth, were also taken compulsory measures.

At present, "how to solve the financial pressure" is still an urgent problem for Evergrande, but there are few options in front of Evergrande, and it will be very difficult for Evergrande to survive.

Or affected by the above news, Hong Kong stock Evergrande Motor fell 4.23%, with a total market capitalization of HK $2.7 billion.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.