In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)05/22 Report--

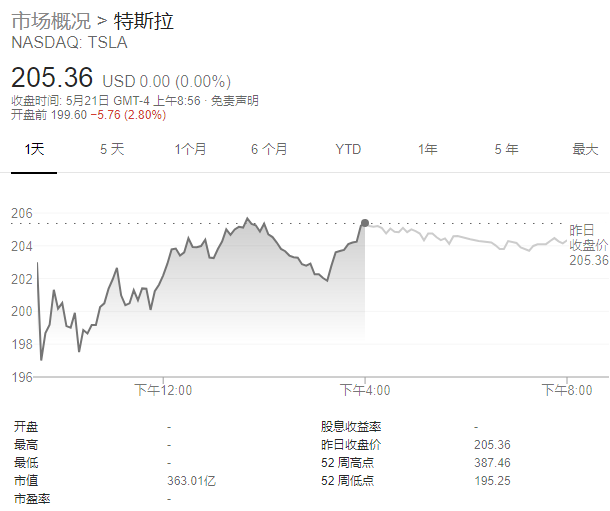

Since Tesla's "spontaneous combustion" and "self-driving out of control caused a car accident" and other incidents, the stock price has not performed very well in the market since this year. After months of decline, Tesla's share price has reached a two-year low, and its market capitalization has lost nearly half of its value compared with August last year, but this is not the worst-case scenario.

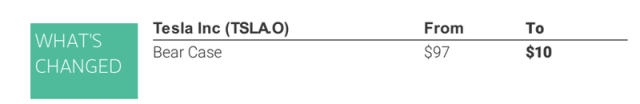

According to foreign media reports, Adam Adam Jonas, an analyst at Morgan Stanley, cut his pessimistic forecast for Tesla's share price from $97 to $10 in a report released yesterday. The worst-case scenario means the stock is down about 95 per cent from Monday's closing price of $205.36.

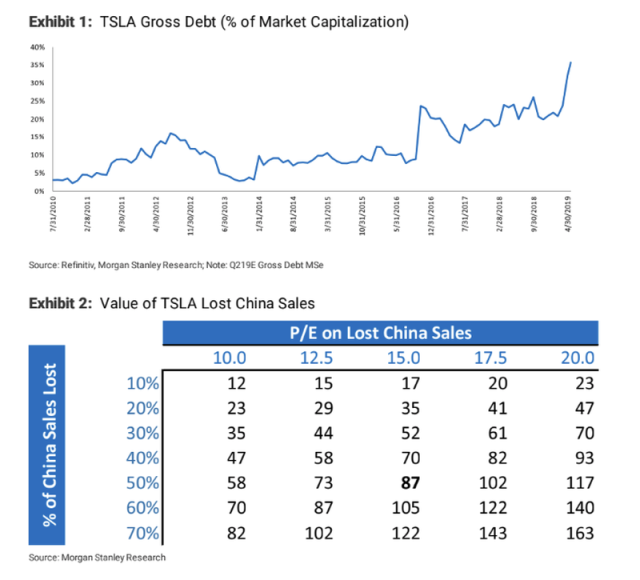

"the sharp slowdown in demand this year has led to a significant decline in the company's ability to raise its own funds through free cash flow," Jonas said. " Tesla's share price is driven by market demand for its products, cash flow generation and capital market access, which have not been particularly strong so far. The company is facing signs of slowing demand as competitors invest more in electric vehicles. In addition, the company faces cash flow and manufacturing problems, as well as its prospects in the Chinese market.

The report also said that demand may be the core of the problem facing Tesla, while overseas markets outside China may have "oversaturated" demand for Tesla's products. In order to develop new demand, Tesla should actively explore the Chinese market, and providing low-cost SUV may also be an option.

Tesla's financial situation deteriorated further in the first quarter. At the end of the quarter, the total amount of cash and equivalents on his account was US $2.68 billion, which was another US $1.6 billion compared with the level of US $4.28 billion at the end of last year. This is largely affected by the maturity of a $920 million convertible bond. Morgan Stanley analysts believe that Tesla's current market demand situation has been unable to support the company's current operating scale.

Since the beginning of this year, Tesla's share price has fallen by 40%. In order to boost investor confidence, Tesla specially held an investor event on autopilot before the release of the first quarter results. Explain to the outside world its vision of subverting the current transportation system through autopilot, and announced that there will be 1 million fully self-driving Tesla electric vehicles on the road next year, but this is an unrealistic grand description. Investors have responded with practical actions in the market.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.