In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-23 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)05/28 Report--

P.p1 {margin: 0.0px 0.0px 0.0px 0.0px; text-align: justify; font: 16.0px 'PingFang SC'; color: # 323333}

P.p2 {margin: 0.0px 0.0px 0.0px 0.0px; text-align: justify; font: 16.0px 'PingFang SC'; color: # 323333; min-height: 22.0px}

P.p3 {margin: 0.0px 0.0px 0.0px 0.0px; font: 16.0px 'Microsoft YaHei'; color: # 2b2b2b}

P.p4 {margin: 0.0px 0.0px 0.0px 0.0px; font: 16.0px 'PingFang SC'; color: # 323333; min-height: 22.0px}

P.p5 {margin: 0.0px 0.0px 0.0px 0.0px; text-align: justify; font: 16.0px Arial; color: # 323333; min-height: 18.0px}

Span.s1 {font-kerning: none}

Span.s2 {font: 16.0px Arial; font-kerning: none}

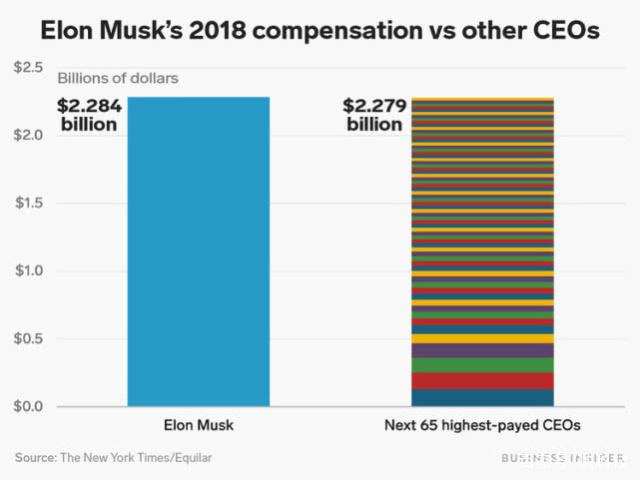

Recently, it was reported in foreign media that Tesla CEO Musk was the highest-paid CEO in 2018. Last year, Musk earned as much as $2.284 billion, more than the other 65 competitors combined. Musk's salary, which comes mainly from stock options, increased by nearly 4575% in 2018.

CEO pay on the list rose by an average of 16.4 per cent in 2018 and about 9 per cent in 2016. Their average salary is about 277 times less than that of top managers. In second place was Discovery's CEO David Zaslav (David M.Zaslav), who earned $129 million in 2018, much less than Musk.

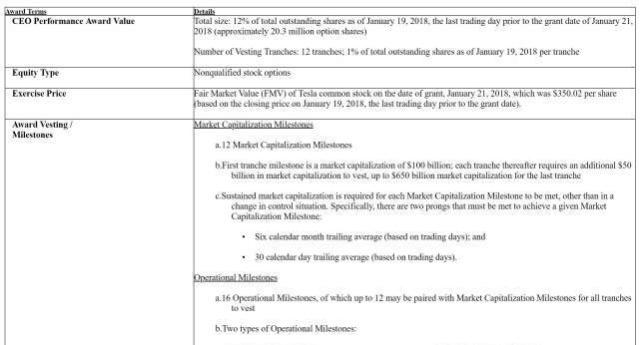

But shortly after the list was released, Tesla issued a statement denying that Musk, the company's CEO, had received such a high salary in 2018. "Elon actually earned zero salary from the company in 2018, and any other reports are incorrect and misleading," the statement said. Unlike other CEO, Elon does not receive any salary from the company, no cash rewards, and no shares that are released over time.

His only salary is a fully risk-linked, specially designed reward that can only be awarded after a milestone has been reached, such as raising Tesla's current market capitalization of about $40 billion to $100 billion. So all Elon's compensation is directly linked to the long-term success of Tesla and shareholders, and his equity related to his performance in 2018 does not belong to him. "

In March 2018, Tesla's board of directors voted to approve a 10-year CEO incentive plan with a total incentive value of US $2.6 billion. According to the description of the plan, the $2.6 billion incentive is divided into 12 batches, each of which requires CEO to meet established milestones, which are divided into market capitalization targets and operational targets.

The incentive plan makes it clear that only when the market capitalization target and the operating target are met at the same time can the board of directors agree to the corresponding incentive share issue.

At present, Tesla's market capitalization is less than 35 billion US dollars, which is more and more distant from achieving the goal of 100 billion US dollars market capitalization. Tesla's current business operation still faces severe challenges. Tesla lost $702 million in the first quarter of 2019, largely due to poor sales, and total revenue and electric vehicle sales in that quarter were lower than expected.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.