In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)06/10 Report--

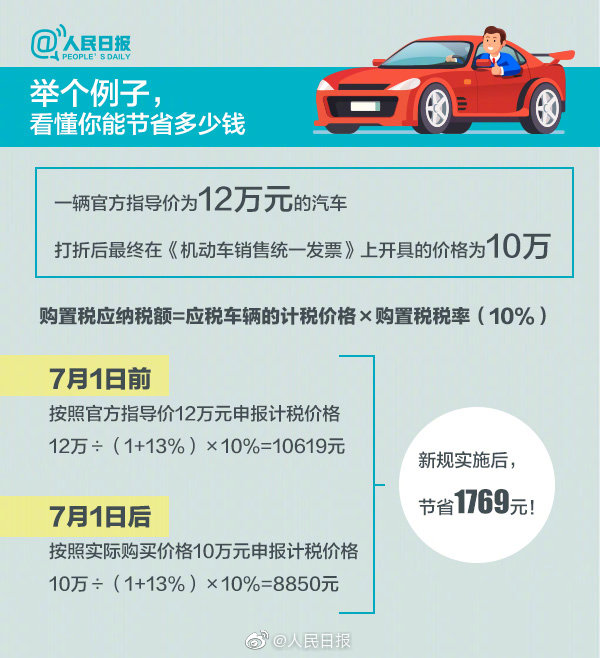

On May 23 this year, the Ministry of Finance and the State Administration of Taxation issued a specific new policy on vehicle purchase tax. at a sudden glance, the content is basically unchanged, and the tax rate for consumers to pay vehicle purchase tax on new cars is still 10%. However, it was clear at 01:10 that from July 1, 2019, the tax deductible for consumers buying vehicles will depend on the "amount actually paid", excluding VAT tax.

So, what is the difference between this "actual payment" and the previous one, and how much money can be saved by buying a car after the new rules are implemented?

A few days ago, CCTV financial officials interpreted that the implementation of the new "vehicle purchase tax Law" in July can further reduce the cost of car purchase.

In the past, when consumers bought new cars, the actual transaction price of most vehicles was lower than the manufacturer's guidance price, and the principle of paying tax was to pay tax in accordance with the manufacturer's guidance price. However, according to the new policy of the vehicle purchase tax Law, which came into force on July 1, the tax payable by consumers to buy vehicles will depend on the actual amount paid, which is commonly known as the transaction price of naked cars.

The content of the announcement is clear, "all the price actually paid to the seller by the taxpayer for the purchase of taxable vehicles shall be determined on the basis of the price stated in the relevant documents when the taxpayer buys the taxable vehicle, excluding VAT tax."

It must be a great benefit that the new policy can reduce the cost of buying cars for consumers. Industry insiders said that consumers pay vehicle purchase tax according to the actual payment, which does not include value-added tax, which reflects the convergence of vehicle purchase tax base and value-added tax base.

In the interview, a salesperson at a 4S store said: before, the national tax had a minimum reserve tax price, which was not announced, so many consumers had doubts about how much the purchase tax was in their minds about the purchase of this car. resulting in many customers do not understand, or even complaints. After the implementation of the new method, customers will find it more reasonable.

The following is People's Daily's official interpretation of the implementation of the new policy on vehicle purchase tax: for a car with a guide price of 120000, the actual ticket price after the discount is 100000, and the purchase of the new deal after July can save 1769 yuan!

Lang Xuehong, deputy secretary general of the China Automobile Circulation Association, explained, "before, it was a cross-file purchase tax, which was based on the grade given by the manufacturer's guidance price and across the nearest file according to the car purchase price." Now the tax is calculated according to the amount actually paid. At present, there is a terminal discount on vehicle prices, so the taxes and fees paid by consumers should be reduced. "

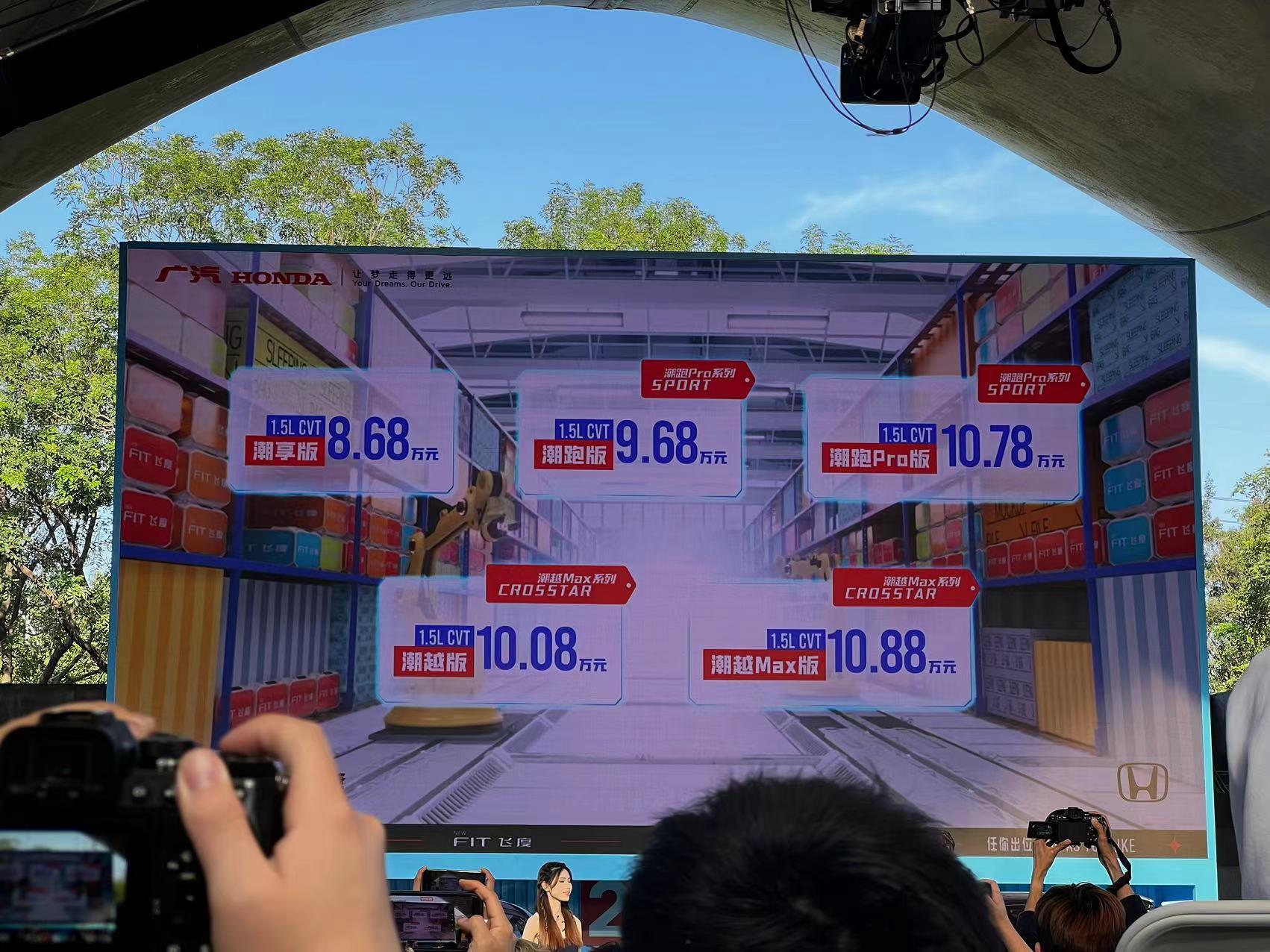

At the same time, Lang Xuehong also pointed out that some of the best-selling models on the market will be sold at a higher price, so consumers will pay higher purchase taxes.

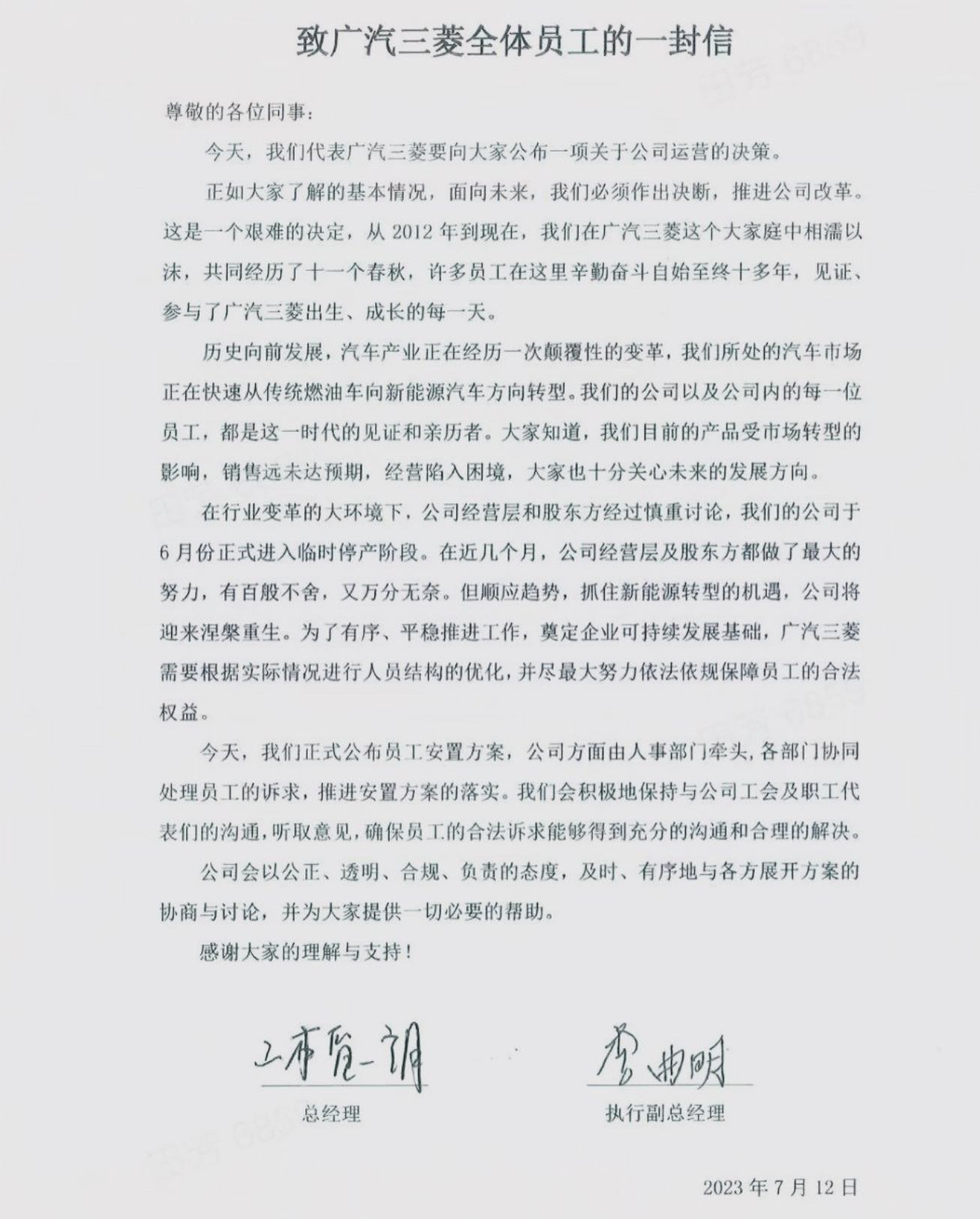

China's auto market has been in a downturn since 2018, and almost all car brands have experienced varying degrees of decline in sales, coupled with the fact that all the vehicles in stock must be sold out before the sixth national standard, which is officially implemented in July. As a result, the terminal price of cars has dropped greatly recently. After July, the sixth State and the new purchase tax officially landed, and the market trend tends to be stable, which should also help to boost car sales.

According to a comprehensive understanding, the above situation is "in principle". In the past, when consumers bought cars, part of the situation was to pay the corresponding purchase tax according to the manufacturer's guiding price, while some were in accordance with the minimum reserve tax price of the national tax, but this price was not disclosed, and now they pay the tax directly according to the transaction price of naked cars, which has become more transparent. As for how much consumers can pay less, it may be a little, but it is not as much as the algorithm in principle.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.