In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-21 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)06/21 Report--

Prior to this, because the incident of protecting the rights of female Mercedes-Benz owners attracted a great deal of media attention, it not only exposed the attitude of after-sales service and problem handling of automobile brands and their 4S stores, but also exposed the problem of illegal collection of financial service fees in the automobile sales industry. However, after the incident, market regulators interviewed a number of 4S stores, so most stores seem to have cancelled financial service charges.

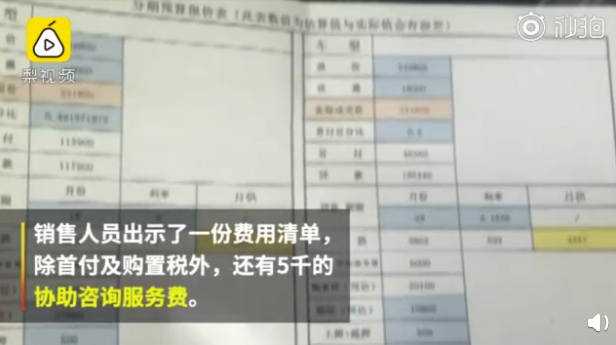

Recently, some relevant media went to the major 4S stores in Zhengzhou to learn that if you want to choose a loan to buy a car, the 4S store also gives different loan methods, but in the list of fees given by the 4S store, you can still see that in addition to the down payment and purchase tax, there is also a "assist information service fee".

When asked what the service charge is, the 4S store salesperson said that the service charge is the handling charge for installments, which used to be called the financial service charge, but now it is changed to the information service charge. He also said that they had not received a notice not to charge this kind of service fee, and that we would charge it as we should outside. This is actually a change of soup and not a change of clothes.

Then learned about a number of 4S stores in Zhengzhou, including a Buick 4S store sales staff said that they will still charge for financial services. If you want a loan to buy a car, you can only get a discount on the car price, but you still have to charge for this service charge.

Zhang Bo, a lawyer at Jichun Law firm, said that in the process of buying a car, the so-called service fee and interest are stipulated by law, and all service fees and interest must not exceed 24% of the annual interest rate. At present, 4S points collect service fees in accordance with the proportion of the total price of the car body, which is also unreasonable. The more relevant content of the service fee is the loan project, not the total price of the car body, and the financial service fee should be charged according to 23% of the loan ratio.

For example, for a car, the down payment is 60%, that is, 180000, and the remaining 120000 and 23% of the interest is the service charge.

Therefore, it is hoped that the whole automobile service industry can give market standards and unify consumption benchmarking as soon as possible under the supervision of relevant departments. And for before because of the "financial service fees" and other issues of concern, and now through a variety of "unknown" fees collected in disguise, the relevant departments should step up efforts to regulate the car sales industry, so that consumers buy cars more at ease.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.