In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)06/27 Report--

Recently, there is a piece of news that "from July 1, the vehicle purchase tax law will be implemented, and the car purchase tax will rise" has attracted the attention of the media.

In order to stimulate car sales, many car dealers publicize to the outside world: at present, the actual purchase tax for the purchase of a new car worth 100000 yuan is about 8600 yuan, and after the implementation of the new policy, the purchase tax will be increased to 10,000 yuan. Some even say that the current car purchase tax rate is 8.5%, after the implementation of the tax law, the tax rate will be 10%, and the tax will increase.

In this regard, the relevant person in charge of the second Branch of Wuhan Taxation Bureau of the State Administration of Taxation said that the tax rate and calculation method of car purchase tax have not changed substantially after the implementation of the car purchase tax law, let alone lead to an increase in purchase tax. The idea of paying more tax on cars is misleading. Please don't be fooled by rumors.

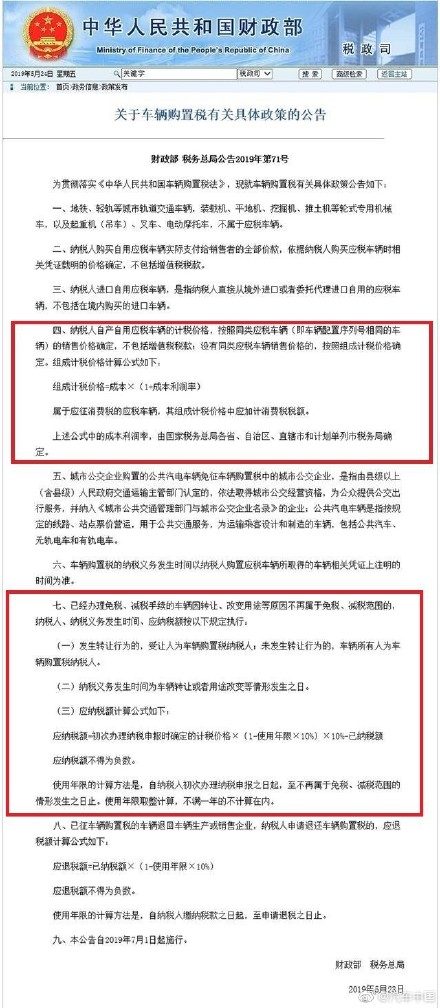

The car purchase tax Law makes it clear that the taxable price for taxpayers' purchase of taxable vehicles for their own use is the full price actually paid by the taxpayer to the seller, excluding VAT tax. The tax rate on car purchase is 10%. Abolish the minimum taxable price system.

That is, after the implementation on July 1, "the biggest change is to determine the tax rate and calculation method of vehicle purchase tax in legal form." After the implementation of the car purchase tax law, not only the overall tax burden has not increased, but the tax burden of some vehicles may also be reduced.

For example, motorcycles with no more than 150 milliliters will no longer be taxed, and owners can save hundreds of yuan. Moreover, with the abolition of the minimum taxable price system, some vehicles sold at promotional or reduced prices may save a lot of car purchase tax according to the decline in actual prices.

Before July 1st, according to the current interim regulations on car purchase tax, the taxable price of a new car with an invoice price of 100000 yuan does not include value-added tax, therefore, the taxable price of car purchase tax is the invoice price / (1 + VAT 13%) = 88495.58 (yuan). Then multiply the car purchase tax rate by 10%, and the final car purchase tax is 8849.56 (yuan).

After the implementation of the car purchase tax law on July 1st, since the taxable price still does not include VAT tax, and the 10% tax rate remains unchanged, the final invoice price of 100000 yuan is also 8849.56 yuan.

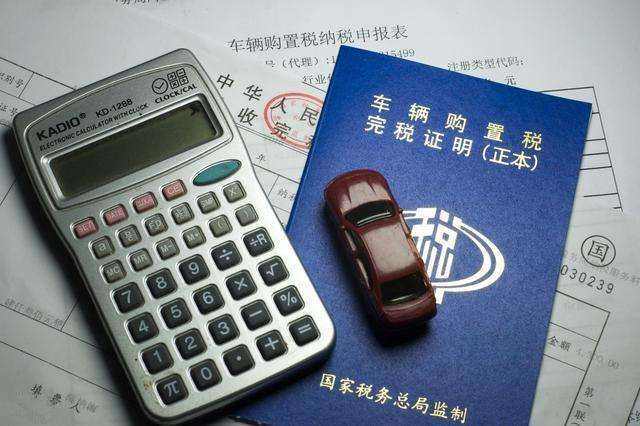

Since June 1, tax departments and vehicle management departments of public security organs have jointly implemented the application of electronic vehicle purchase tax payment information for vehicle registration, which means that taxpayers no longer need to provide paper vehicle purchase tax payment certificates when handling vehicle registration business, but can handle vehicle registration business only by confirming tax payment electronic information by vehicle management departments of public security organs.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.