In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)07/30 Report--

According to Tianyanchao data, a number of industrial and commercial changes have taken place in Jiangling Holdings Co., Ltd. Aichi Automobile Co., Ltd. which has reached a cooperation agreement has been added as a shareholder of Jiangling Holdings, and Aichi Motor has become the largest shareholder of Jiangling Holdings, with a shareholding ratio of 50%. The registered capital of Jiangling Holdings has also increased from 1 billion yuan to 2 billion yuan, and its business scope has added "R & D, production and sales of new energy vehicles".

At the same time, Xu Jun, co-president of Aichi Automobile, will succeed Zhang Baolin, president of Changan Automobile Co., Ltd., as the legal representative of Jiangling Holdings. In addition, a number of Aichi executives settled in Jiangling Holdings. Fu Qiang, co-founder of Aichi Motor, was newly added as vice chairman, while Xu Jun, Cai Jianjun, executive vice president of Aichi Motor, Qiu Xiaochuan, and Chen Rui, executive vice president of Aichi Automobile, were added as directors. Gu Feng, co-founder and CEO of Aichi, replaced Zhang Jian as chairman of the board of supervisors.

At present, Aichi has launched three models: U5, Gumpert Nathalie and U7 ion, among which the U5 was unveiled at the Shanghai Auto Show in April this year. According to the previous plan, the Aichi U5 will be launched in the second half of the year, the new car NEDC will be extended to the 503km, and an optional energy package will be installed to further increase the 120km mileage.

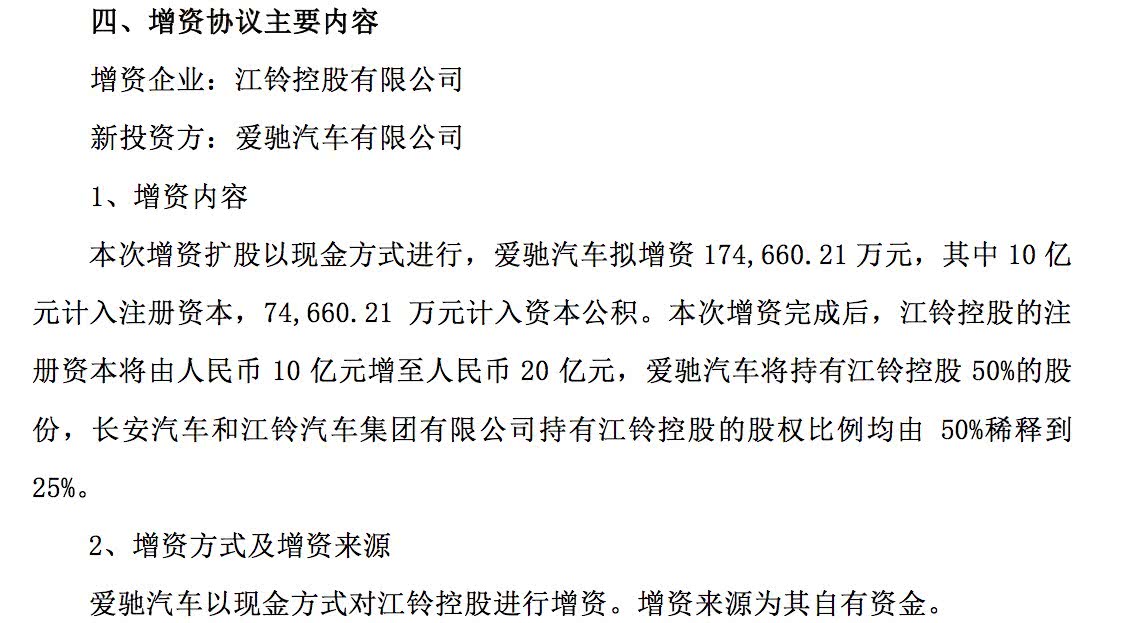

In June this year, Changan Automobile announced that the company's joint venture Jiangling Holdings Co., Ltd. intends to introduce strategic investors to increase capital. The capital increase and share increase is carried out in the form of cash. Aichi Motor plans to increase its capital by 1.747 billion yuan, of which 1 billion yuan is included in the registered capital and 747 million yuan in the capital reserve. After the completion of this capital increase, the registered capital of Jiangling Holdings will be increased from 1 billion yuan to 2 billion yuan, Aichi Motor will hold a 50% stake in Jiangling Holdings, and Changan Automobile and Jiangling Automobile Group Co., Ltd. will both dilute their shareholdings from 50% to 25%.

In April this year, the former Jiangling Holdings separated the original company into two new companies, the former is Jiangling Investment, which mainly produces Jiangling brand cars, and the latter is Jiangling Holdings (survival company), which mainly produces Lufeng brand cars. in other words, the capital increase of Aichi Motor is obtained from the car manufacturing qualification of Lufeng brand.

The cooperation between traditional car enterprises and new car enterprises has become more and more frequent in recent years. Traditional car enterprises are facing market pressure and overcapacity. Although new car enterprises have abundant funds, they do not have the qualification to build cars. The cooperation between the two sides can achieve complementary resources and take what they need. More can drive the transformation of enterprises. And with the mass production deadline approaching, Aichi obviously needs to solve the problem of production qualification urgently.

After the car manufacturing qualification of Jiangling Holdings is officially obtained in Aichi, its first mass production model Aichi U5 can be put into production. In the second half of 2019, Aichi finally got on the last bus of the new car-building movement. In the face of the subsidy environment of serious decline, its living environment is not optimistic. However, winning the qualification of building a car can also be regarded as a basis for future development.

As for Lufeng Automobile, as the SUV market has entered the integration period, the fuel vehicle market has entered an inflection point, and the market layout direction has turned to intelligent and new energy vehicles. If it is not transformed, the subsequent development of Jiangling Holdings in the SUV market will continue to become more difficult, while the entry of Aichi Automobile may, to a certain extent, boost the development vitality and operational efficiency of Lufeng Automobile, and transform to the direction of new energy and intelligence.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.