In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)07/30 Report--

After the decline in sales, the qualification for land sales and the freezing of shares, Lifan Motor was also sued by auto parts suppliers and financial companies for a huge sum of money, demanding a payment of more than 1 billion yuan.

A few days ago, Wanan Science and Technology announced that its wholly-owned subsidiary Zhejiang Zhuji Wanbao Machinery Co., Ltd. had submitted a civil complaint to the people's Court of Zhuji City, Zhejiang Province on July 22, requiring Chongqing Lifan passenger car Co., Ltd., a subsidiary of Lifan Co., and Beibei Branch of Lifan Automobile to pay about 6.0757 million yuan.

Wanan Technology Bulletin said that since 2007, Lifan passenger cars, Lifan passenger cars Beibei Branch continued to purchase brakes, clutch pumps, vacuum booster and other auto parts from Zhuji Wanbao. Since last year, Lifan passenger cars, Lifan passenger cars Beibei branch failed to pay on schedule, the company's default behavior has caused Zhuji Wanbao losses. As of the prosecution of Japanese sail passenger car, Lifan passenger car Beibei branch owed a total of 6.0757 million yuan, still not fully paid.

The more than 6 million yuan recovered by Wanan Technology is only a small part of it, and Lifan Motor has also been sued by other companies for a total of 1.423 billion yuan.

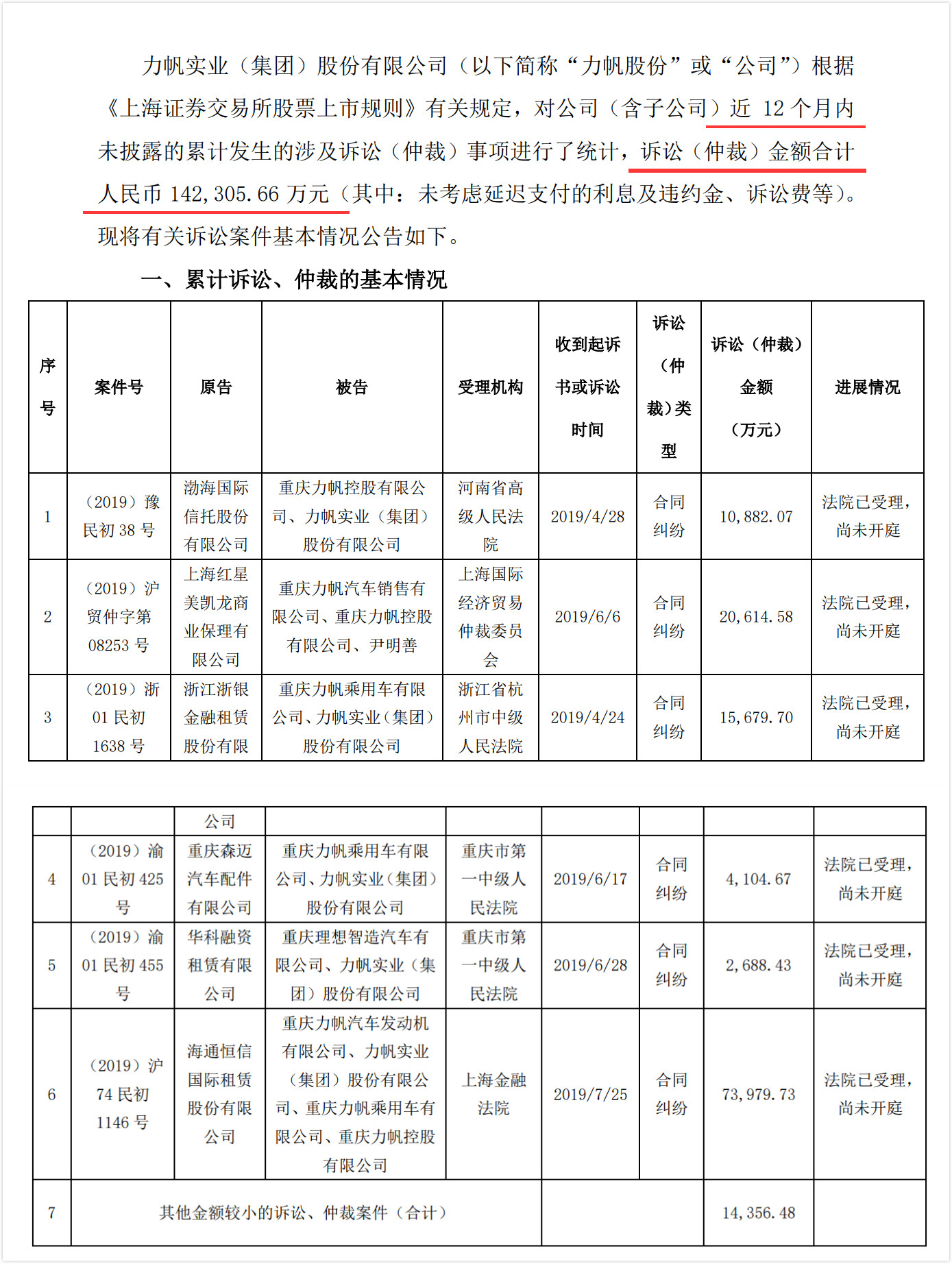

According to the announcement issued by Lifan shares on July 26th, the cumulative amount of litigation (arbitration) not disclosed by Lifan shares in the past 12 months reached 1.423 billion yuan. Many companies, including Bohai International Trust, Shanghai Hongxing Macailong Commercial factoring, Chongqing Senmai Auto parts and so on, are "creditors" of Lifan shares.

Compared with Lifan's performance report, these more than one billion yuan of claims almost overwhelmed Lifan. According to the performance report, Lifan achieved a net profit of 253 million yuan in 2018 and a loss of 2.149 billion yuan after deducting non-recurrent profit and loss. According to the financial report for the first quarter of 2019, Lifan's operating income in the first quarter was about 2.25 billion yuan, down 31.07% from the same period last year; the net profit of shareholders belonging to listed companies was about-97.2 million yuan, down 257.56% from the same period last year.

Selling cars has almost become an unprofitable business, obtaining funds through land sales and qualification, and "selling household property" has also become the main way for Lifan to make a profit. Lifan issued an announcement in February 2018, selling two assets, namely, the subsidiary Chongqing Lifan Automobile Co., Ltd. transferred to ideal Automobile at a price of 650 million yuan; in addition, Lifan also sold the production base of the original 150000 passenger car project to Chongqing Liangjiang New area Land Reserve renovation Center for about 3.315 billion yuan.

To make matters worse, as sales fell, Lifan dealers protested to Lifan headquarters in May to recover losses. Liangfan authorized dealers said that in recent years, Lifan has launched few new products, poor research and development capabilities, and failed to keep up with the pace of the market, resulting in losses for many dealers, the most serious of which are 2 million a year. Lifan also sold 55% discounts on vehicles to unauthorized dealers, thus disrupting and impacting the price system of 4S stores and crushing them directly.

Dealers are dissatisfied, suppliers collect debts, and sales are dismal. In the context of China's overall car market downturn, Lifan is beset with difficulties and faces unprecedented operating pressure. Data show that in the first half of this year, Lifan accumulated sales of about 20800 traditional passenger cars, down 62.55% from the same period last year, while new energy vehicle sales were only 1257, down 60.66% from the same period last year.

Some analysts believe that Lifan has missed valuable opportunities in many aspects, such as product research and development, brand promotion, or the development of new energy vehicles.

Lifan Group started from the motorcycle market in 1992, was founded by founder Yin Mingshan at the age of 53, entered the passenger car industry in 2006, and finally used 200000 yuan of capital to build Lifan into an industrial group with revenue of more than 10 billion yuan. Set and scientific research and development, automobile, motorcycle and engine production and sales. Until November 2017, Yin Mingshan, 79, founder and chairman of Lifan Motor, officially announced his retirement.

Lifan as an independent old car company, the road of development is full of ups and downs, and now there are operational problems, we need to concentrate resources to seek self-help, so as to tide over the difficulties. Otherwise, it will face the reshuffle of the automobile industry.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.