In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-18 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)08/10 Report--

For Evergrande, which has entered the field of new energy vehicles for more than a year, it is still facing losses.

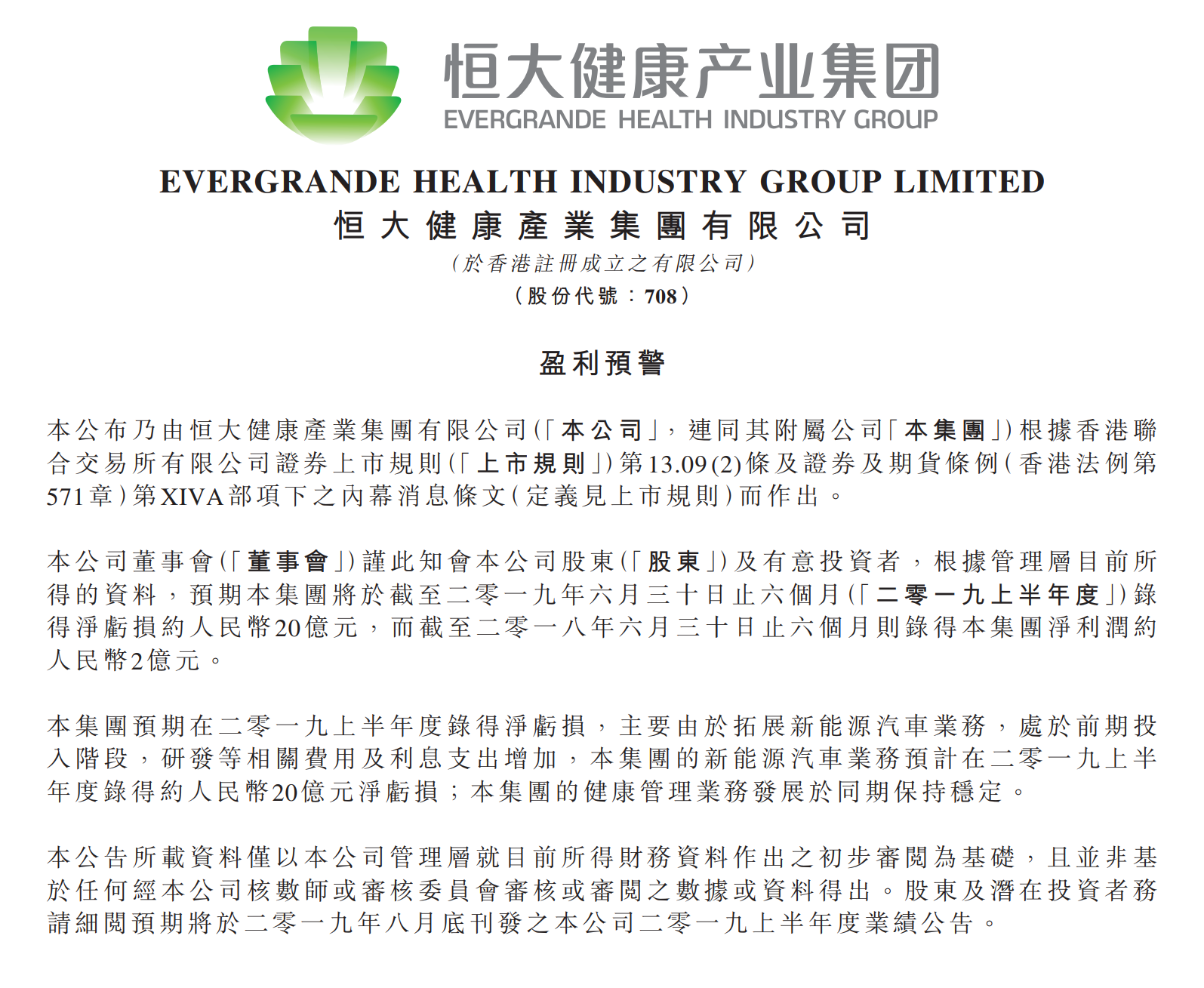

Evergrande Health issued a profit warning at around 23:00 on the evening of August 9, before the half-year results were announced. according to information currently available to management, the company is expected to have a net loss of about 2 billion yuan and a net profit of about 200 million yuan in the first half of the year.

For the main reason for the loss, Evergrande said that due to the expansion of new energy vehicle business, it is in the early investment stage, research and development and other related expenses and interest expenses have increased. But Evergrande Health stressed that despite losses in the new energy vehicle business, the development of the health management business remained stable.

The new energy vehicle business is a new field that Xu Jiayin officially entered in June 2018. Xu Jiayin announced that he and Jia Yueting would jointly build the car, but four months after the union, the two sides announced their separate ways on the last day of 2018.

However, Xu Jiayin, who suffered many troubles, did not give up, and the automobile industry began a series of acquisitions.

At the same time, Evergrande also lost money. In 2018, Evergrande Health lost 1.7 billion yuan on the new energy vehicle business, with a net profit of 300 million yuan and an overall loss of 1.4 billion yuan. This figure will continue to expand in 2019, according to the current trend, Evergrande Health's loss is expected to reach 1.8 billion yuan in the first half of this year.

Since the beginning of 2019, Xu Jiayin has announced six shares in companies related to the automobile industry.

On January 15th Evergrande invested $930 million to acquire a 51 per cent stake in NEVS, a global electric car company based in Sweden, and won a majority of board seats.

On January 24th, Evergrande New Energy Power Technology Co., Ltd., a wholly owned subsidiary of Evergrande, entered Shanghai Carney New Energy, a power trolley company, with 1.059 billion yuan, and became the largest shareholder with a shareholding ratio of 58.07%.

Evergrande bought a stake in Swedish supercar company Koenigsag for 150 million euros on January 29th. Evergrande said that the project company set up by Evergrande and Sweden will be committed to the research, development and production of the world's top new energy vehicles.

On March 15, Evergrande announced that it had entered into an equity transfer agreement with Lv Chao, chairman of Tianjin Tianhai synchronous Group Co., Ltd., Hubei Tete Mechanical and Electrical Co., Ltd., and Hubei Tete Mechanical and Electrical Co., Ltd., and the company acquired 70% of the shares of Tate Mechanical and Electrical Co., Ltd for 500 million yuan. The company holds all the shares of e-Traction of the Netherlands.

On May 30th, Evergrande subsidiary NEVS and British hub motor company Protean signed an agreement in London, Evergrande acquired the company wholly by way of merger, and Protean will be merged into Virtue Surge, a subsidiary of NEVS.

On June 29, Evergrande's first new energy vehicle, Guoneng 93, went offline in Tianjin. At present, new energy vehicles, real estate, culture and travel, and health are listed as the four major business sectors of Evergrande Group.

Since the second half of last year, Evergrande has invested a huge amount of money and successively reached cooperation with Swedish car NEVS, supercar company Koeniger, Shanghai Carney New Energy, Kangtai Machinery and other companies to build a relatively complete closed loop of the whole industry chain covering vehicle R & D and manufacturing, power battery, motor electric control, and so on.

From the perspective of the characteristics of the new energy vehicle industry, it is a capital-intensive industry, especially the huge investment in technology research and development will cause many car companies to face the problem of loss in the early stage. At present, the new forces of car building are basically in a state of loss, and Tesla, a new car maker who went on the market in 2010, has not yet made an annual profit. Evergrande believes that the huge R & D investment will further consolidate Evergrande's technological advantage in car building.

In the current depressed environment of the car market, new energy vehicles are still regarded as the trend of future development. according to the forecast of the China Automobile Association, sales of new energy vehicles are expected to be about 1.5 million in 2019, an increase of 19.4% over the same period last year. According to Evergrande's official data, Evergrande's sales reached 322.3 billion yuan from January to July this year, and is expected to reach 600 billion yuan for the whole year. Evergrande said that with the mass production of new models, the new energy vehicle business will promote the rapid development of Evergrande new energy.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.