In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)08/11 Report--

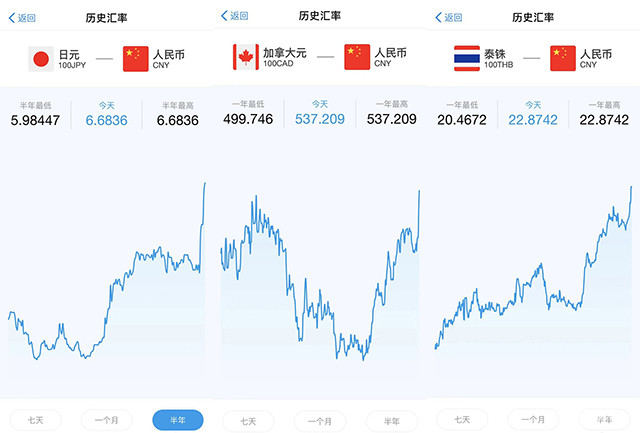

A few days ago, the plunge of the RMB triggered a subsequent devaluation of foreign exchange in many countries, and the bilateral closing price of the RMB against the US dollar broke 7, the lowest level since the global financial crisis in 2008.

Although this is expected by the market, it still brings some psychological impact. For the automobile industry, which is closely related to import and export, the impact is not small. Then the RMB "breaking 7" means that the exchange rate of the US dollar against the RMB has risen, resulting in a rise in the cost of imported cars and a reduction in the cost of export cars. Does this mean that the price of an imported car is about to rise?

"the RMB 'exceeds 7 yuan, which has a lot to do with the imported car market." Wang Cun, senior manager of SAIC Automobile Marketing Department, believes that the cost of imported cars will increase.

According to the calculation of imported models with a price of 300000 yuan, generally speaking, the purchase price of brand dealers is 60%, that is, 180000 RMB. By calculating the exchange rates of RMB against the US dollar at 180000 and 6.8 per cent, respectively, it is calculated that imported cars purchased with 180000 RMB will bear about 2.8 per cent additional purchase costs when the exchange rate falls by 3 per cent.

However, unlike the reaction of car companies when tariffs were adjusted in the past, no car company has publicly said that it has adjusted the price of its models because of exchange rate fluctuations. "We will adjust prices from time to time according to changes in tariffs and exchange rates, but we have not received any notice of price adjustments so far."

As for car import, it is already a buyer's market, but now it is still in the doldrums. with the tightening of automobile consumption, combined with the bargaining power of dealers and consumers in the transaction, it is difficult for dealers to transfer costs to consumers. Therefore, the extra burden needs to be borne by both dealers and consumers.

At present, the vast majority of manufacturers say they have no plans to raise prices, with the exception of Tesla. Tesla officially announced that the prices of all series of models on sale in China in September were raised due to the recent sharp fluctuations in the exchange rate of the renminbi against the US dollar.

For the vast majority of brand dealers enter the car from domestic agents, through RMB settlement, if the manufacturer does not raise the guidance price, the price will remain unchanged, and the loss of exchange rate adjustment will be borne by the manufacturer.

Therefore, Wang Cun believes: "RMB 'breaking 7' will not cause a change in the price of imported cars in the short term." Because for large mainframe factories, there is a corresponding exchange rate hedging mechanism, so it will not immediately cause price fluctuations in the terminal market, but will have a greater impact on the parallel imported car market without the corresponding exchange rate hedging mechanism. "

In addition to affecting the imported car market, the fluctuation of the RMB exchange rate is also closely related to car exports.

With the continuous improvement of the quality and competitiveness of Chinese automobile brands, more and more automobile enterprises regard going abroad as an important layout in strategic development. In the era of RMB "breaking 7", enterprises that are willing to go out will speed up this process. Guangzhou Automobile, Great Wall, Chery and Geely have made some achievements in going overseas.

Cao he also believes: "the adjustment of car prices is affected by many factors, especially in the context of the overall car market recession, car companies will not easily adjust prices." Because of the long cycle of the import and export car market, changes in the market should not be measured by a day's change in the exchange rate. "

When the domestic market is not as expected, car exports play a certain role in improving cash flow and inventory. A flexible RMB exchange rate is by no means a bad thing for China's large automobile groups in the medium and long term, and their ability to manage and control global exchange rate fluctuations will evolve, which is a necessary skill for Chinese car companies to go out.

The devaluation of the RMB does not seem to be a good thing, but some analysts believe that the previous exchange rate of the US dollar against the RMB has reached more than 6.9, and there is no essential difference between the macroeconomic fundamentals reflected in theory and the "broken 7". It's just that people's general sensitivity to integer prices may have an impact on the understanding of economic operation.

As for enterprises, they should deal with exchange rate fluctuations rationally and have the ability to adapt to exchange rate fluctuations of various countries, and a more flexible local currency is only the beginning of adaptation. At the same time, it should also be noted that at present, the RMB exchange rate may depreciate or appreciate, and two-way floating is the norm. "

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.