In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-16 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)08/19 Report--

According to the website of the Shanghai United property Exchange, FAW proposed to transfer 73.7% of the shares of the Ninth Institute of Machinery, with a base price of 695.18 million yuan. The information disclosure will begin on August 12, 2019, and will expire on September 6, 2019.

The data show that the operating income of the ninth machinery institute in 2018 is 1.153 billion yuan, the operating profit is 99.9798 million yuan, and the net profit is 77.9543 million yuan. As of May 31, 2019, the hospital's operating income is about 254 million yuan, operating profit is about 42.4068 million yuan, and net profit is about 377.31 million yuan. It can be seen that the ninth mechanical hospital maintains a good revenue capacity.

However, the amount of debt of the ninth institute of machinery is relatively high. In 2018, the total assets of the Nine Institute of Machinery were about 1.469 billion yuan and the total liabilities were about 1.03 billion yuan. In the first half of this year, the total assets of the ninth hospital of machinery were about 1.384 billion yuan and the total liabilities were about 907 million yuan. The amount of debt is again and again close to the total assets.

It is generally believed that for enterprises, the appropriate level of asset-liability ratio should be maintained at 40% to 60%. It can be seen that the ninth machinery hospital, which now has a debt ratio hovering beside the 70% warning line, has become a "time bomb" in the eyes of FAW shares.

On the other hand, from the weak profitability of FAW cars and the annual losses of FAW Xiali, it is hard to believe that FAW shares still have sufficient cash flow to maintain the status quo.

Among the many companies controlled by FAW shares, the most well-known are FAW cars and FAW Xiali. The former makes frequent losses, and the sale of Red Flag assets is a drop in the bucket. In 2018, FAW had revenue of 26.244 billion yuan, down 5.94 percent from a year earlier, and net profit fell 44.88 percent to 155 million yuan, nearly halving compared with 2017, according to official figures.

The latter is on the brink of death all the year round. According to the financial report, in 2018, FAW Xiali achieved revenue of 1.125 billion, down 22.50% from the same period last year; net profit was 37.3084 million yuan, but the net loss after deducting non-recurrent profit and loss was as high as 1.263 billion. It is worth mentioning that the net profit of tens of millions of FAW Xiali that year was the investment income gained from the sale of its final 15% stake in FAW Toyota. However, the 2.5 billion yuan in exchange for 15 per cent equity did not fill the huge loss hole of FAW Xiali.

Too much debt has been owed before, and the future profit outlook is uncertain. In order to clear the obstacles and hidden dangers of development, it is only natural for FAW shares to get rid of such burdened assets as Machinery Ninth Hospital.

Since Xu Liuping was transferred to FAW Group, FAW Group has set off an unprecedented storm restructuring from departments to subsidiaries, and frequent asset sales have been questioned by the industry to prepare for the overall listing.

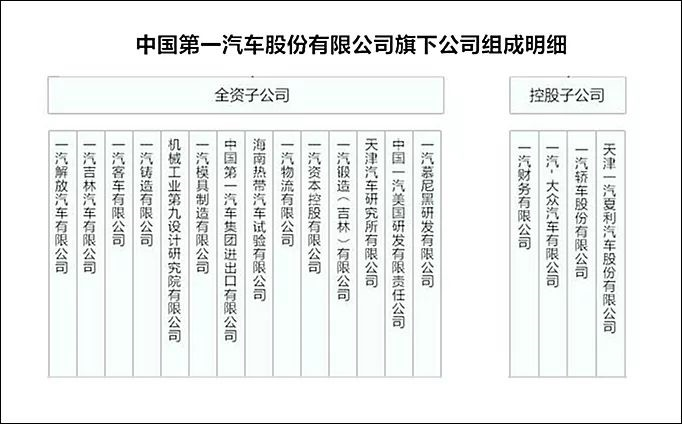

Some analysts believe that FAW shares as the listing platform of FAW Group passenger car business, it is also expected to get rid of the asset burden such as Machinery Nine Hospital. Since the beginning of this year, FAW Jilin and FAW Jiefang, the wholly owned subsidiaries of FAW, and the holding subsidiary FAW sedan have changed frequently. The FAW share transfer of 73.7% of the shares in the Ninth Institute of Machinery may also be part of the FAW Group's reform plan.

"at present, it is not clear whether FAW shares sold shares in the Nine Institute of Machinery to prepare for the overall listing, and there are too many aspects involved." Cui Dongshu, secretary-general of the National passenger car Market Information Association, pointed out to time Finance that this move by FAW is a good thing. In the context of the declining automobile market, production capacity is reduced, market demand is also decreasing, and the role of the Ninth Machinery Institute will no longer be obvious.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.