In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)08/30 Report--

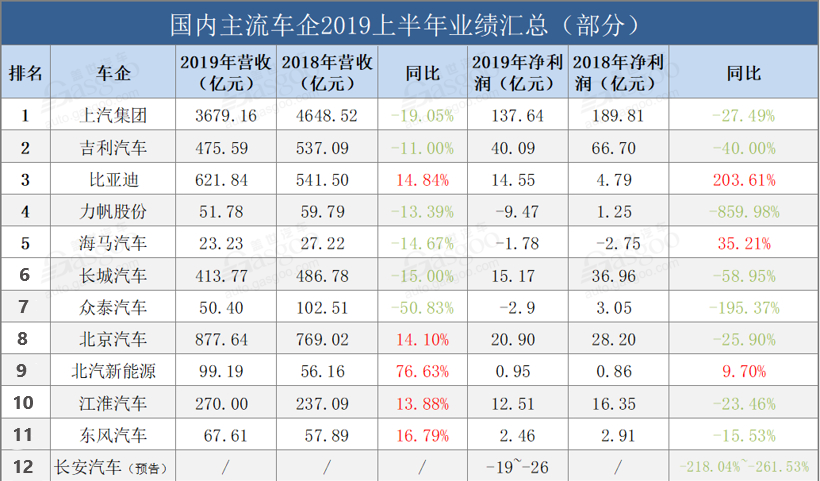

According to statistics from the China Automobile Association, in the first half of this year, a total of 12.132 million cars were produced and 1232.3 vehicles were sold in China, down 13.7% and 12.4% respectively from the same period last year. Among them, passenger car sales in the first half of the year were 10.127 million, down 14.0% from the same period last year, and the decline began to narrow from January to May. Sales of cars, SUV and MPV fell 12.9%, 13.4% and 24%, respectively.

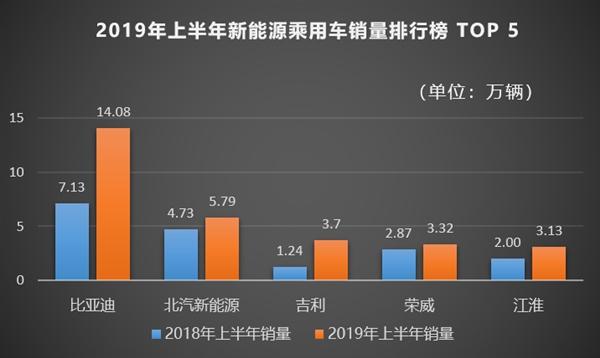

According to the recent financial data released by enterprises, it is a mixed blessing. BAIC New Energy and BYD have achieved growth with the help of new energy vehicles, while Haima has lost money but slowed down from last year. In addition, other car companies have different degrees of knowledge, and even some car companies face the risk of delisting due to successive losses in sales and performance. Next, let's take a look at the specific performance of these going out:

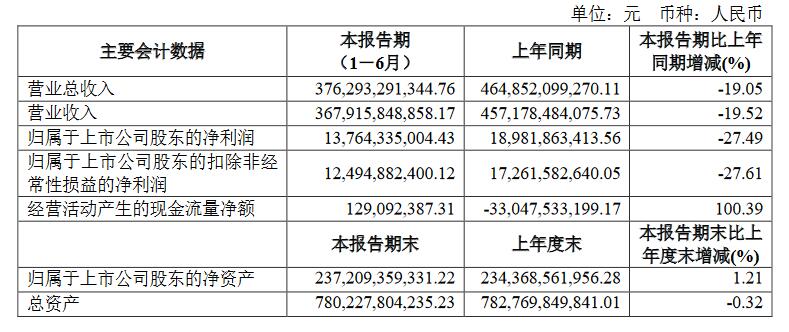

1. SAIC Group: net profit was 13.764 billion yuan, down 27.49% from the same period last year.

On August 29th, SAIC released its results for the first half of 2019, showing total revenue of 376.293 billion in the first half of the year, down 19.05 per cent from a year earlier, while net profit fell 27.49 per cent and 27.51 per cent from a year earlier.

Not only that, SAIC's car sales also fell, with sales of 2937296 vehicles down 16.62 per cent from a year earlier, compared with 466539 in June, down 15.97 per cent from a year earlier, and 9.3 per cent in July.

All in all, the decline in revenue and sales of SAIC in the first half of the year is obvious, mainly due to the overall depression of the auto market: the downward pressure on the macro-economy, the switching between the fifth and sixth countries, and the decline in subsidies for new energy vehicles, which has continued the depressed trend since the second half of 2018, while weak consumption growth has had a certain impact.

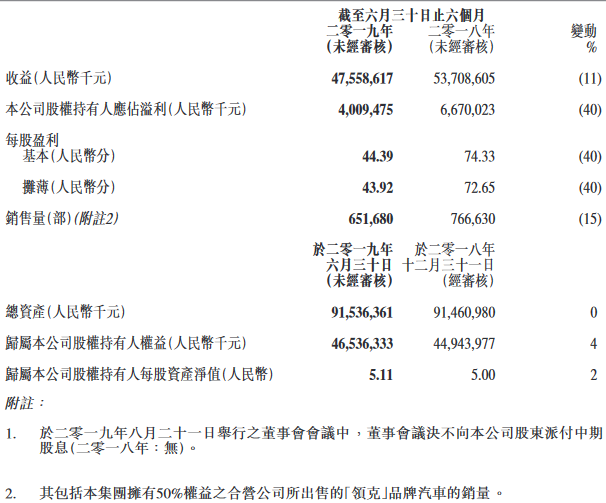

2. Geely Automobile: the total revenue in the first half of the year was 47.559 billion yuan, and the net profit fell by 40% compared with the same period last year.

On August 21, Geely released its first-half 2019 results. According to the performance report, Geely's revenue in the first half of the year was 47.558 billion yuan, down 11% from the same period last year, while net profit was 4.009 billion yuan, down 40% from the same period last year. The total revenue is slightly higher than the previous market estimate of 45.92 billion yuan, and the net profit is slightly lower than the market estimate of 4.04 billion yuan.

In terms of sales, Geely Group sold a total of 651700 new cars in the first half of this year, down 15% from a year earlier. Given the lower-than-expected market performance in the first half of this year and the continued uncertainty in the Chinese car market in the second half of this year, Geely lowered its full-year sales target by 10 per cent to 1.36 million in July from the original target of 1.51 million. According to the latest data, 55 per cent of the target has been achieved in the first seven months.

3. BYD: double increase in revenue and profit profit growth is expected to narrow in the third quarter

On August 21, BYD released its performance report for the first half of 2019, with operating income of 62.184 billion yuan, an increase of 14.84% over the same period last year, and a net profit of 1.455 billion yuan belonging to shareholders of listed companies, an increase of 203.61% over the same period last year.

BYD said that new energy vehicles continued to sell well in the first half of this year, and sales and revenue continued to maintain strong growth, leading to a sustained and rapid increase in group revenue and profits. Official figures show that BYD sold 228100 vehicles in the first half of 2019, up 1.59% from a year earlier, of which 145700 new energy vehicles were sold, up 94.5% from a year earlier, substantially leading the industry's growth rate of 49.6%.

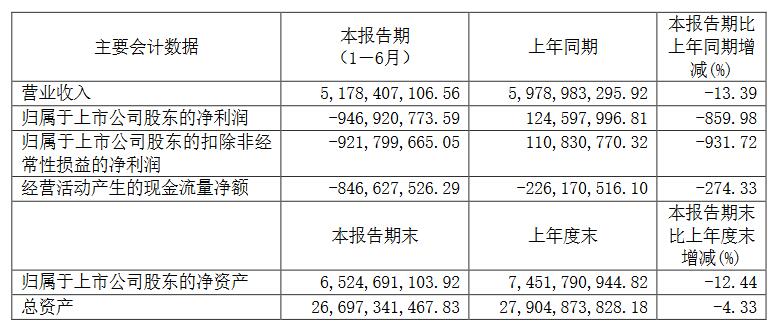

4. Lifan shares: the amount of loss increases the net profit of about-947 million yuan

On the evening of August 22, Lifan released a semi-annual report with a net loss of more than 900 million yuan, and also carried out a series of personnel adjustments, such as a change of general. According to the data, the company's operating income in the first half of 2019 was 5.178 billion yuan, down 13.39 percent from the same period last year, while the net profit was 947 million yuan, compared with a profit of 125 million yuan in the same period last year, down 859.98 percent from the same period last year.

With regard to such a great change in performance in the middle of the year, Lifan said in the announcement that, first of all, changes in the external market environment affected the company's production and marketing, resulting in a substantial decline in production and sales and a decrease in gross profit; secondly, due to the difficulties in the financing environment, the company's funds were tight. In order to maintain production and operation and maintain the company's credit, the company actively raised financing through multiple channels, resulting in an increase in financing costs and losses. Finally, the relocation of the company's passenger car base affects the production plan and the reduction of the availability of some equipment, resulting in asset impairment.

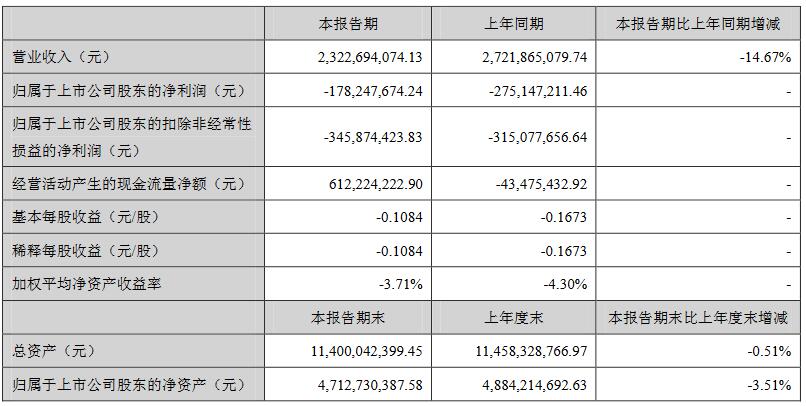

5. Haima Motor: the operating income is 2.323 billion and the net profit is 97 million yuan less than last year.

On August 23, Haima released its results for the first half of 2019. According to the report, the company's cumulative sales in the first half of the year were 14425, down 65.16 percent from the same period last year; sales revenue was 2.323 billion yuan, down 14.67 percent from the same period last year; and the net profit belonging to shareholders of listed companies was-178 million yuan, reducing losses by 97 million yuan compared with the same period last year.

In fact, due to successive losses in 2017 and 2018, Haima Motor was warned of the risk of delisting by the Shenzhen Stock Exchange in April and changed to * ST Haima. Under multiple pressures, the company even reached the point of "selling houses and rescuing cars", and founder Jingzhu was forced to return to the stage. For Jingzhu, the biggest challenge is to solve the sales problem of seahorse cars.

Since its annual production and sales peaked at 217000 in 2016, Haima's sales have declined year by year, selling only 14000 in the first half of this year, less than the monthly sales of some of the best-selling cars on the market.

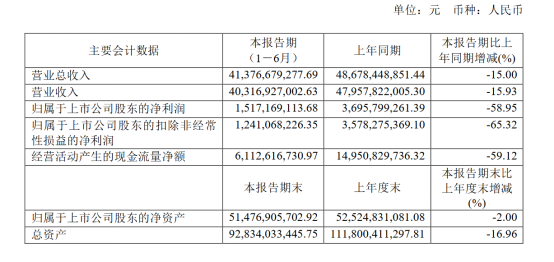

6. Great Wall Motor: the total revenue exceeded 40 billion yuan and the net profit decreased by 58.95% compared with the same period last year.

On August 26th, Great Wall released its 2019 half-year results. The financial report shows that the total operating income in the first half of the year reached 41.377 billion yuan, and the market share further increased. Of this total, the income from the business related to Great Wall auto parts was 3.916 billion yuan, an increase of 38.61% over the same period last year.

On the sales side, global sales totaled nearly 500000 vehicles in the first half of the year, up 4.7 per cent from a year earlier. Of this total, overseas markets exported 26000 vehicles, an increase of 16.77 percent over the same period last year. In terms of sales of Great Wall brands, the Harvard brand sold more than 350000 vehicles, an increase of 8.5% over the same period last year.

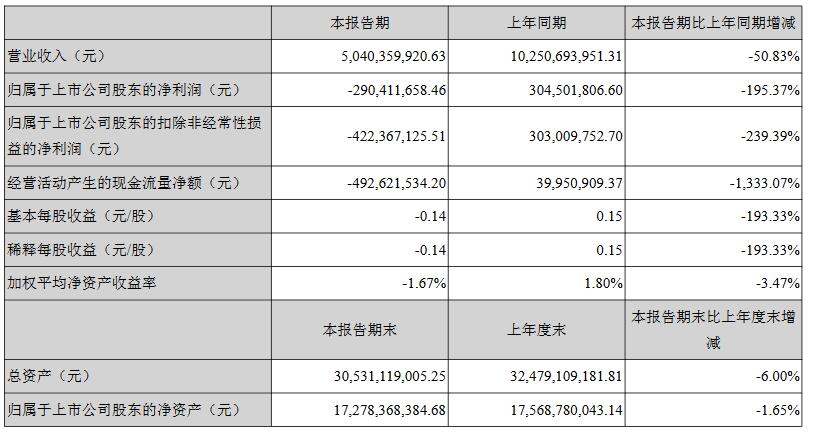

7. Zhongtai Automobile: a loss of 290 million yuan, down 195.37% compared with the same period last year.

On August 26, Zhongtai Motor released its financial report for the first half of 2019. According to the report, the company's operating income in the first half of the year was 5.04 billion yuan, down 50.83% from the same period last year, while the net profit attributed to shareholders of listed companies was a loss of 290 million yuan, down 195.37% from the same period last year.

The official explanation for the decline in performance is that in order to comply with the development trend of automobile intelligence, networking, electrification and sharing, the company maintains intensive investment in new products, new technologies, new businesses, etc., in order to enhance the competitiveness of products. At the same time, due to the addition of new forces in car building and the price competition strategy of traditional competitors, the competition in the industry is becoming increasingly fierce, which is caused by the rise in promotion costs and changes in sales structure brought about by the fierce market competition.

8. Beijing Automobile: net profit affected by Korean cars dropped 25.9% year on year.

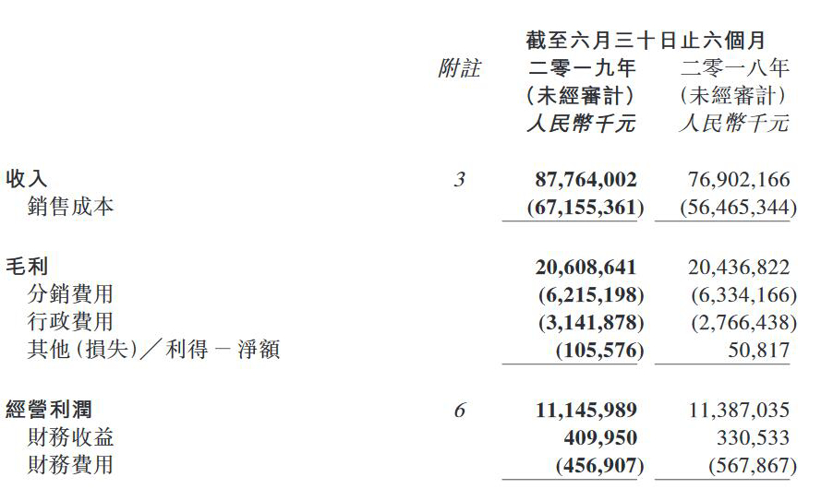

In the first half of this year, BAIC achieved operating income of 87.764 billion yuan, up 14.1 percent from the same period last year, while net profit was 2.09 billion yuan, down 25.9 percent from the same period last year, Beijing Automobile announced on Aug. 26.

The announcement pointed out that BAIC's revenue growth is mainly due to the increase in sales of Beijing Mercedes-Benz and Beijing's own brands. The decline in profits is due to the impact of intensified competition in the domestic passenger car industry and the overall downturn in the Korean car market for Beijing Hyundai and related supporting enterprises.

9. BAIC New Energy: revenue increased by 9.9 billion compared with the same period last year.

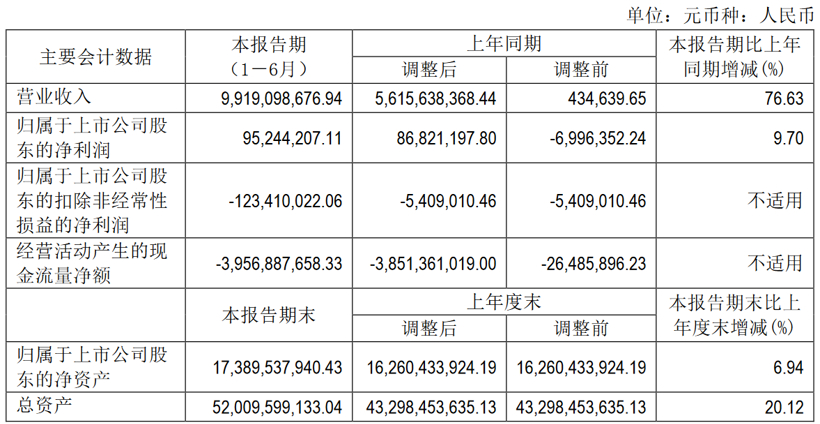

On August 27, BAIC Langu released its 2019 semi-annual report. According to the report, BAIC Langu achieved revenue of 9.9 billion yuan in the first half of this year, an increase of 76.63 percent over the same period last year, and a net profit of 95.24 million yuan, an increase of 9.7 percent over the same period last year.

BAIC Langu said in an announcement that the production and sales of new energy vehicles maintained a growth trend in the first half of 2019 despite a decline in the overall development trend of the automotive industry. In the first half of 2019, the company sold 65159 vehicles, an increase of 21.57% over the same period last year. Nevertheless, there is still a big gap between BAIC New Energy and its target of 220000 vehicles set at the beginning of the year.

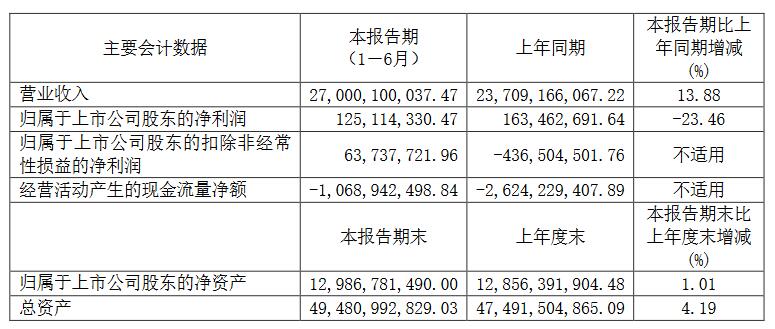

10. Jianghuai Automobile: revenue of 27 billion yuan net profit decreased by 23.46% compared with the same period last year.

On August 27th, Jianghuai Automobile released its 2019 semi-annual report, which showed that the company achieved operating income of 27 billion yuan, an increase of 13.88 percent over the same period last year, and a net profit of 125 million yuan belonging to shareholders of listed companies, down 23.46 percent from the same period last year. After a huge loss last year and a huge fine for emissions fraud this year, Jianghuai Motor has suffered a great loss of vitality.

In fact, this is the third year in a row that Jianghuai Automobile reported a decline in net profit compared with the same period last year. Jianghuai Automobile's financial results in the past two years show that its net profit continues to decline. Its net profit fell 62.83 per cent year-on-year to 432 million yuan in 2017 and plunged 282.02 per cent to a loss of 786 million yuan in 2018, the worst net profit since 2010.

In addition to the decline in performance and sales, JAC also faces a fine of 170 million for failing to meet emission standards this year, which will directly reduce the company's net profit in 2019.

11. Dongfeng Motor: revenue increases and profits decline will face the risks of three major industries in the future.

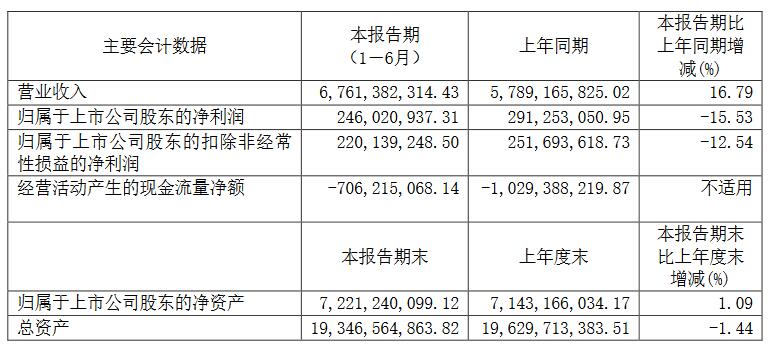

According to the 2019 half-year report released by Dongfeng Motor, Dongfeng Motor's operating income in the first half of the year was 6.761 billion yuan, up 16.79 percent from the same period last year, while the net profit belonging to shareholders of listed companies was 246 million yuan, down 15.53 percent from the same period last year.

In terms of sales, Dongfeng sold 80,000 vehicles in the first half of 2019, an increase of 14.64% over the same period last year. Dongfeng Motor said in its financial report that the technological upgrading and cost reduction of new energy commodities, the control of new energy core components resources, and the reserve of technical personnel will be the focus of Dongfeng Motor's work in the future.

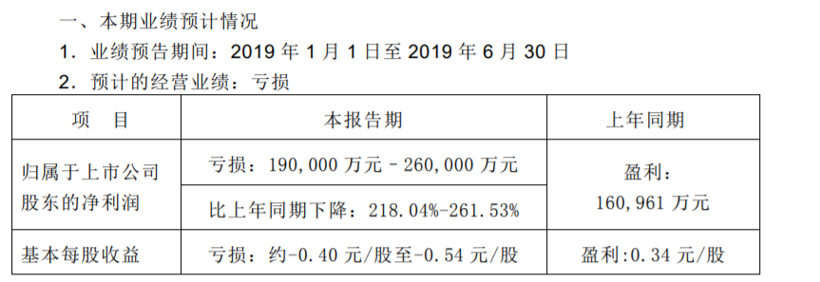

12. Changan Automobile: the maximum loss in the first half of the year is expected to be 2.6 billion yuan.

Changan Motor issued a forecast for the first half of 2019 on July 15, with an estimated loss of 1.9 billion to 2.6 billion yuan, a net profit of 1.6 billion yuan compared with the same period last year, down 218.04 percent and 261.53 percent from the same period last year. This is the first time that Changan Automobile has suffered an advance loss in the semi-annual report since its listing. Changan Automobile is also the only loss-making enterprise among the four major listed automobile groups.

At the same time, Changan Automobile disclosed in the first half of the performance forecast that the main reason for the decline in the company's overall performance during the reporting period was the "impact of the decline in sales."

2/3 of the year 2019 has passed, and due to the grim market, many car companies have lowered their annual sales targets. So far, the overall decline in automobile production and sales has not changed fundamentally, and the competition will be more severe. In addition, the decline of new energy subsidies, the formal implementation of the sixth national emission regulations, the uncertain economic environment brought about by the Sino-US trade war, the decline of news confidence and other factors are all great challenges for automobile companies.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.