In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/17 Report--

On Sept. 14, Saudi Arabia flew 10 drones to bomb the world's largest crude oil processing facility in Abqaiq, as well as the Khurais oil field, the country's second-largest oil field. After claiming responsibility for the 14 drone attacks on two facilities of the Saudi National Oil Company (Aramco), the Houthi forces in Yemen threatened on the 16th that the next round of attacks on Aramco could be carried out at any time. The United States still insists on pointing the finger at Iran. Iran refuted it again, saying it was a deception by the United States.

Professor Randy Larsen, a former dean of the National War Academy with a US military background, immediately commented: "the importance of this incident may be comparable to the Pearl Harbor incident."

The attack on the 14th was not the first attack on the Saudi Arabian Bugeg oil processing plant, the world's largest crude oil purification plant. In 2006, terrorists tried unsuccessfully to attack Bugeg with vehicles loaded with explosives, but oil prices still rose by more than $2 a barrel.

Prince of Saudi Arabia and Energy Minister Abdulaziz bin Salman confirmed that the attack on oil facilities "destroyed" about half of Saudi Arabia's daily crude oil production, and the government will use crude oil reserves to fill the gap. In the short term, Saudi Arabia will use inventory depletion to ensure supply. If Saudi Arabia uses 5000 to 60 million barrels of crude oil stocks to maintain its supply, it will be able to maintain normal crude oil exports for 15 to 20 days without a recovery of 5.7 million barrels per day. If the supply recovery time is extended, the International Energy Agency and the United States will release strategic reserves as soon as possible to maintain a short-term balance between supply and demand. This means that Saudi Arabia will produce nearly 5.7 million barrels of crude oil a day, or about 5 per cent of the world's daily oil production. It is rare for so much crude oil production capacity to be disrupted in the short term. It was the worst oil outage in the history of the kingdom. It is important to note that Saudi Arabia accounts for 10% of the oil fields, pipelines and port systems of crude oil countries in the world. The incident also reduced Saudi ethane and liquefied natural gas supplies by about 50 per cent.

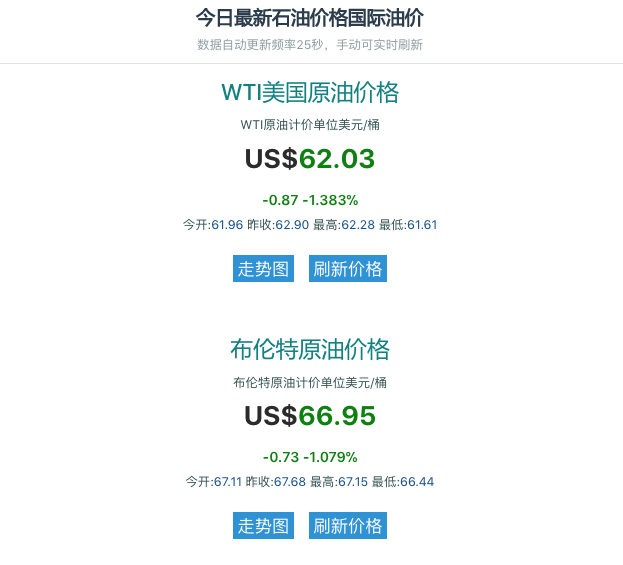

As a result, international crude oil futures prices rose strongly on Sept. 16, with WTI up about 15 per cent to $63.34 a barrel and Brent up about 19 per cent to $71.95 a barrel, with both WTI and Brent having their biggest one-day gains since 1991.

The Wall Street Journal of the United States reported that due to the slowdown in the global economic recovery and the recent continuous decline in international oil prices, the reduction in Saudi oil production due to the attack had a severe impact on the market, and even caused a certain degree of panic. In addition to oil prices, share prices of precious metals, commodities and oil companies also rose across the board.

Analysts say that if Saudi production cuts are limited to one week, oil prices could rise by about 10%. If it takes more than six weeks, the price of Brent crude will stand above $75 or even $80, and if it lasts longer, the relationship between international oil supply and demand will be further distorted.

The latest oil price from the crude oil price network is 11:00 on September 17, 2019.

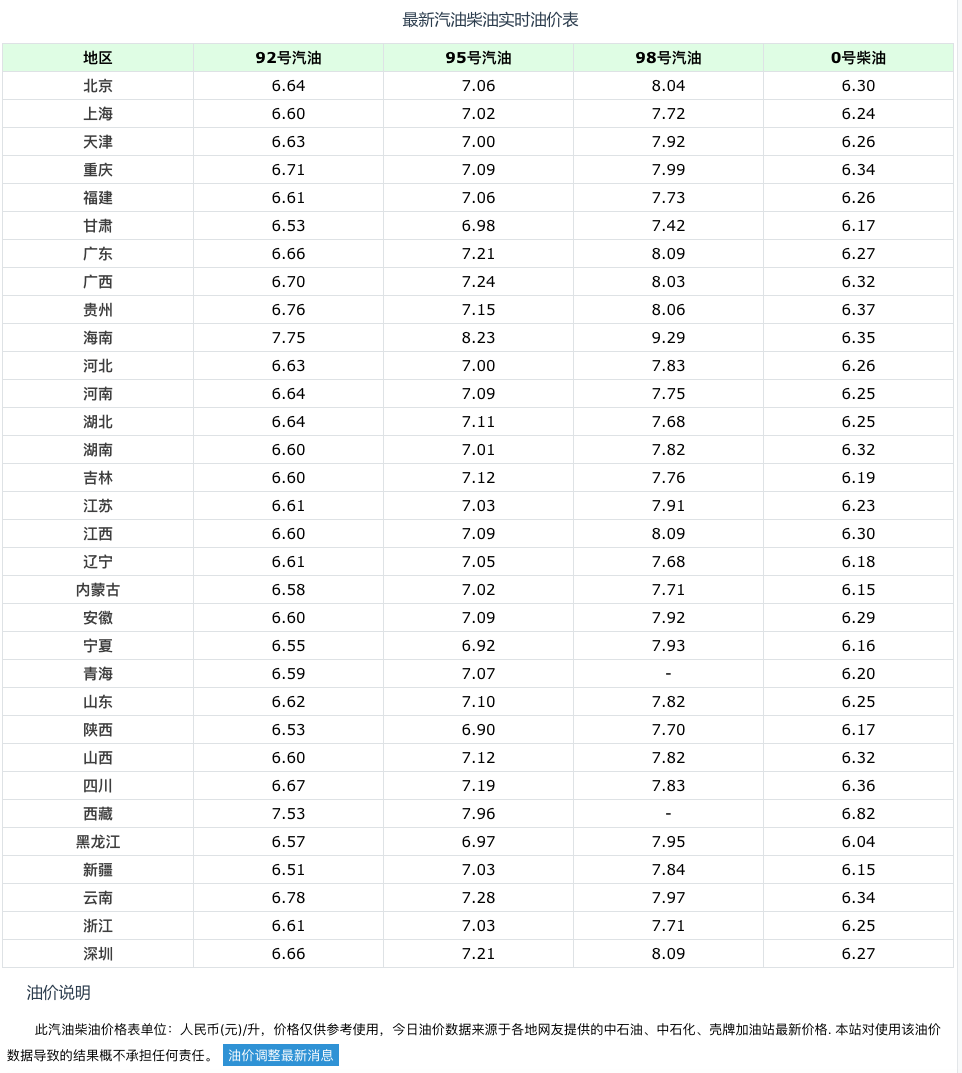

The price of refined oil may rise.

So far this year, around the changes in international oil prices, China's domestic refined oil prices have been adjusted 18 times, with increases slightly more than downward adjustments, including gasoline prices up 240 yuan per ton and diesel prices up 245 yuan per ton. On Wednesday, a new round of gasoline and diesel price adjustment window will open again.

Li Yan, an oil analyst at Longzhong Information, believes that the price of oil products in China will be affected by unexpected events in Saudi Arabia. He mentioned that the international oil price included in the formula for calculating refined oil prices published by the National Development and Reform Commission has risen significantly. "although the rise in international oil prices is quite obvious today, we do not rule out the fact that there is market speculation, and this rise will not last, so it will not have much impact on the price of terminal oil products."

Li Yan also said that China has always attached great importance to strategic oil reserves, and its reserves are gradually increasing. "there is an international standard to measure whether a country's oil reserves are adequate, that is, to be able to meet 90 days of demand, that is, relatively mature oil reserves. China is very close to this goal. " Li Yan said that China's current oil reserves are sufficient to cope with the negative impact of emergencies similar to those in Saudi Arabia.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.