In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/17 Report--

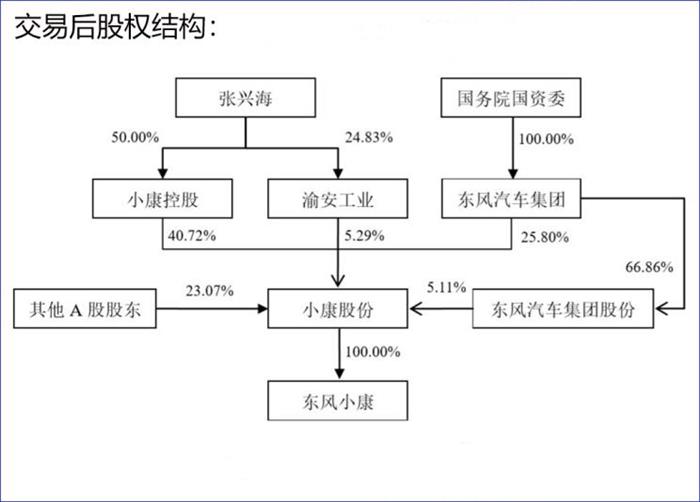

Xiaokang shares announced that the company will issue shares to acquire the 50% stake in Dongfeng Xiaokang held by Dongfeng Group, while Dongfeng Motor Group will acquire 25.8% of Xiaokang shares. Before this transaction, the listed company already held a 50% stake in Dongfeng Xiaokang, a holding subsidiary. In this transaction, the listed company intends to buy its 50% stake in Dongfeng Xiaokang from Dongfeng Automobile Group by issuing shares. After the completion of this transaction, the listed company will hold a 100% stake in Dongfeng Xiaokang.

It is worth noting that on November 18, 2018, Xiaokang shares launched a restructuring plan, which will issue additional shares to Dongfeng Motor Group to buy its 50% stake in Dongfeng Xiaokang, with a transaction price tentatively set at 4.83 billion yuan. In July this year, Xiaokang shares applied to the Securities Regulatory Commission to withdraw the asset trading application documents and planned to adjust the restructuring plan. This announcement is an adjusted restart.

According to the announcement, according to the restructuring plan, according to the issue price of 11.76 yuan per share and the purchase price of 3.85 billion yuan, a total of 327.381 million shares were issued to the other side of the transaction. At the same time, this transaction does not involve raising matching funds. After the completion of issuing shares and purchasing assets, Zhang Xinghai will indirectly control 46.01% of the voting rights of Xiaokang shares through Xiaokang Holdings and Yu'an Industry; Dongfeng Automobile Group will directly and indirectly hold 30.92% of the voting rights of the listed company. Zhang Xinghai is still the actual controller of Xiaokang shares.

It is understood that Dongfeng well-off was founded in 2003, by Dongfeng Motor Group and well-off shares 50-50 holding. Dongfeng Xiaokang's main business is the development, production and sale of Dongfeng brand multi-purpose passenger vehicles, minivans and minibus products and auto parts. Xiaokang shares said that after the completion of this deal, Dongfeng Motor Group will become a strategic investor in Xiaokang shares, which is more conducive to the combination of the two sides.

In view of this asset restructuring, Xiaokang shares believe that the acquisition of shares in profitable holding subsidiaries will help to further strengthen its control over core high-quality vehicle assets, improve the decision-making efficiency of internal management and optimize the allocation of group resources.

It is understood that in the first half of this year, Xiaokang shares achieved operating income of 7.684 billion yuan, down 26.49% from the same period last year; net profit was-281 million yuan, down 218.81% from the same period last year. The company continues to invest in new energy vehicle business in the first half of the year, and already has leading technology, market competitive products and advanced intelligent manufacturing capability. the company's first high-end new electric product, SF5, will be mass-produced and sold in 2019, as well as mass production of popular electric vehicles E3 and economical electric vehicles E1. At the same time, the company continued to speed up the layout of intelligent factories in the first half of the year, and in March, the well-off Power Intelligent Factory was put into production; in April 2019, Chongqing Liangjiang Intelligent Factory was officially put into production.

In the second half of the year, in addition to the mass production and sales of SF5, E3 and E1, the company will further continue to focus on the research and development of the core technology and product platform of new energy vehicles, especially the R & D and industrialization of the electric EV.R platform, forming differentiation advantages.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.