In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-23 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/18 Report--

Cai Zhihua, the company's controlling shareholder and actual controller, and Liu Hongxia, the shareholder, transferred 16.68% of the shares of the company to Hunan Hengpa Power Partnership at a transfer price of 29.1 yuan per share and 513 million yuan in the transfer price, Dazhi Technology said in an announcement on Sept. 16. and 41.2% of the company's share voting rights are unconditional and irrevocable to permanently authorize Hengpali to exercise.

It is worth noting that Dazhi Technology said in the announcement that in the industrial areas such as new energy hydrogen power batteries encouraged by the national policy, select the appropriate actual transferor, the new energy power battery assets controlled by the actual controller will be injected into the listed companies in accordance with the prescribed procedures.

Hengpa Power said it did not rule out putting forward a clear plan for the sale, merger, joint venture or cooperation with others of the assets and business of the listed company or its subsidiaries in the next 12 months, or a restructuring plan for the listed company to buy or replace assets.

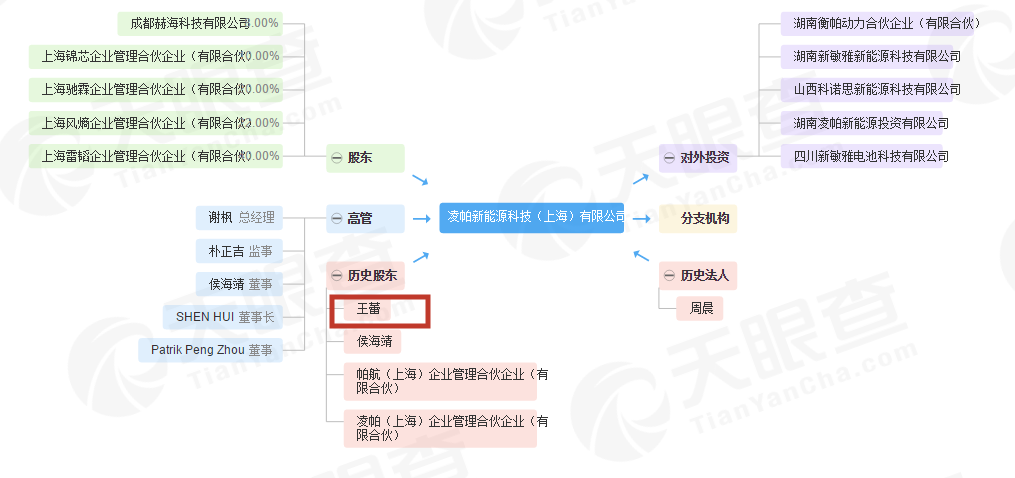

According to Tianyan check information, Hengpa Power was established on July 30 this year, and its main shareholder and legal representative is Lingpa New Energy Technology (Shanghai) Co., Ltd. In addition to Wang Lei, two Lingpa New Energy executives also work at Weima Automotive Technology Group Co., Ltd.

Wang Lei, the second largest shareholder of Weima Automobile, holds an 11.73% stake in Weima Wisdom Travel Technology (Shanghai) Co., Ltd., and is the supervisor of Weima Automotive Technology Group Co., Ltd.

Dazhi Technology said that this change of rights and interests is based on the transferee's recognition of the value of the listed company and its promising development prospects. After the completion of this change of rights and interests, the transferee will enhance the value of the listed company in accordance with the principles conducive to the sustainable development of the listed company and the interests of all shareholders.

Industry insiders believe that Weima has the possibility of backdoor listing, its listing can be more convenient to raise funds. Weima belongs to the leading enterprise in the new power of car building in China, but because the subsidy of the whole new energy vehicle industry is decreasing, the competition is becoming more and more fierce. Although Weimar takes the lead in mass production, the technology still needs to be strengthened.

In view of the doubt that the controlling shareholder of Dazhi Technology, the out-of-control person and the backdoor listing, Weima Automobile has no plans to go public at present. The change of shareholders of Weima is a strategic adjustment aimed at accelerating the rapid development of the company and achieving the ultimate goal. Weima Motor and Lingpa New Energy are two independent companies. Weima does not participate in and influence the daily operation and decision-making of Lingpa New Energy. The acquisition of Dazhi Technology Company is the decision of Lingpa New Energy, and it is also a personal behavior of company executives for some senior executives to participate in Lingpa New Energy investment.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.