In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/22 Report--

The administrator of Pangda Group has officially started the declaration, registration and examination of creditor's rights. The declaration date is as of October 18,2019. The first creditor meeting will be held in the form of network meeting on October 25,2019 on the National Enterprise Bankruptcy Reorganization Button Information Network.

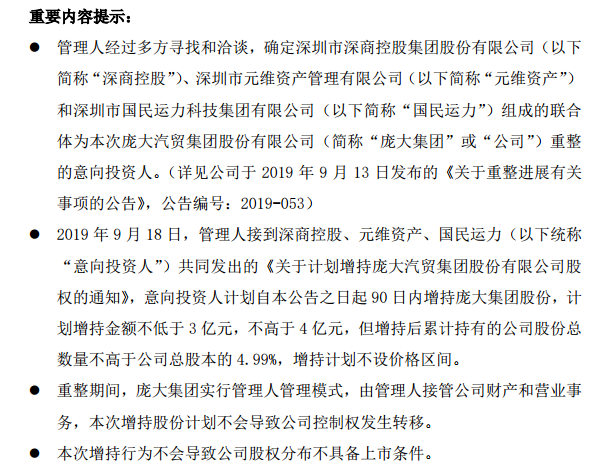

According to the announcement previously issued by Huge Group, Shenzhen Shenshang Holding Group Co., Ltd., Shenzhen Yuanwei Asset Management Co., Ltd. and Shenzhen National Transportation Technology Group Co., Ltd. form a consortium to increase the shares of Huge Group within 90 days from the date of announcement, with the increase amount between 300 million yuan and 400 million yuan, but the number of shares held is not higher than 4.99% of the company. There is no price range for the increase plan.

In addition, the giant group also said that in addition to increasing its stake, the intended investor and the giant group are also actively promoting their work in other businesses.

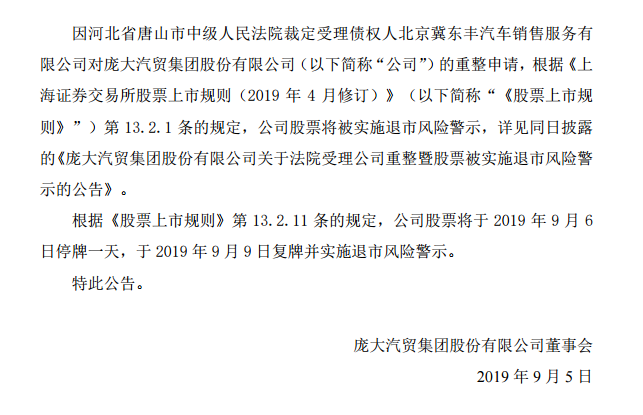

It is understood that in May this year, Jidongfeng Group applied to the court for reorganization of the huge group because it was unable to repay Beijing Jidongfeng's 17 million yuan loan on schedule due to the emergency of funds of the huge group. On September 5, the huge group officially issued an announcement saying that the court accepted Beijing Jidongfeng's reorganization of the group, and the failure of reorganization faced the risk of bankruptcy and delisting. On September 9, the huge group was given delisting risk warning, and the stock was changed to *ST huge. On the first day of the resumption, 2.7 million running orders were limited by one word. After that, there was a limit for four consecutive days. On September 17, the limit fell again, and on September 19, there was a limit.

The sharp rise in the share price of the giant group actually reflects the current situation of the giant group, with hope and certain worries about the prospect of restructuring.

The huge group is ST, and the unsuccessful restructuring will face the risk of delisting. Based on the uncertainty about the future of the group, the group's shares will change. After that, three investors increased their holdings of huge group shares, the group's restructuring road was a little more positive, and the stock changed again.

In addition, whether the main business of the three investors and the business of the huge group complement each other has also caused some concern. In addition, the huge group holds a 40% stake in Subaru China, which is Subaru's largest agent in China. This time, the huge group has also been exposed to rumors of breaking up with Subaru.

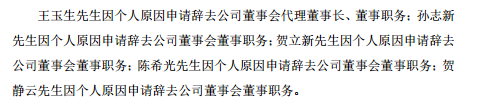

At present, the restructuring of huge groups still faces many uncertainties. On September 17, the senior management of the huge group changed hands. Many directors within the group announced that they would resign as chairman for personal reasons, and at the same time, new directors and independent directors were added. Most of these new directors and independent directors came from three prospective investors of the huge group.

At present, whether the huge group can "come back to life", the biggest problem is the capital problem, but two consecutive years of losses, coupled with loans, led to the group into bankruptcy crisis, the restructuring of the huge group is still full of unknown.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.