In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/25 Report--

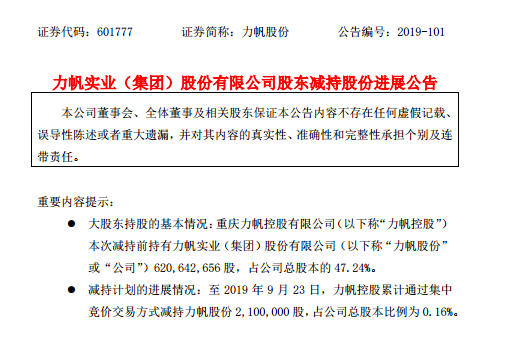

On September 24th, Lifan shares issued an announcement revealing that Chongqing Lifan Holdings Co., Ltd. held 620642656 shares of Lifan Industrial Co., Ltd before the reduction, accounting for 47.24% of the company's total share capital.

As of September 23, 2019, the company's major shareholder, Chongqing Lifan Holdings Co., Ltd., has reduced its holdings of 2100000 Lifan shares through centralized bidding, accounting for 0.16% of the company's total share capital.

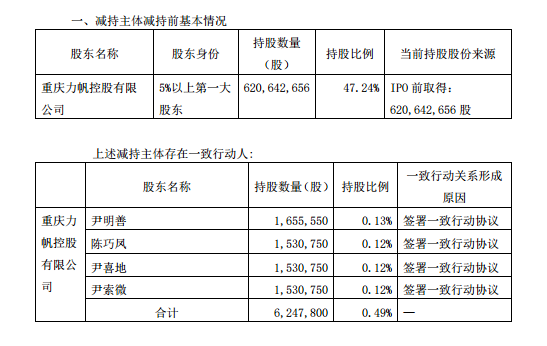

There are consistent actors in this reduction, which are Yin Mingshan, Chen Qiaofeng, Yin Xidi and Yin Suowei. Except Yin Mingshan's shareholding ratio is 0.13%, the other reduction subjects are all 0.12%.

In June this year, Lifan shares received the notice of judicial freezing and judicial transfer of shares held by China Securities Registration and Clearing Co., Ltd. Shanghai Branch. About 604 million shares held by Lifan Holdings were frozen for a period of three years.

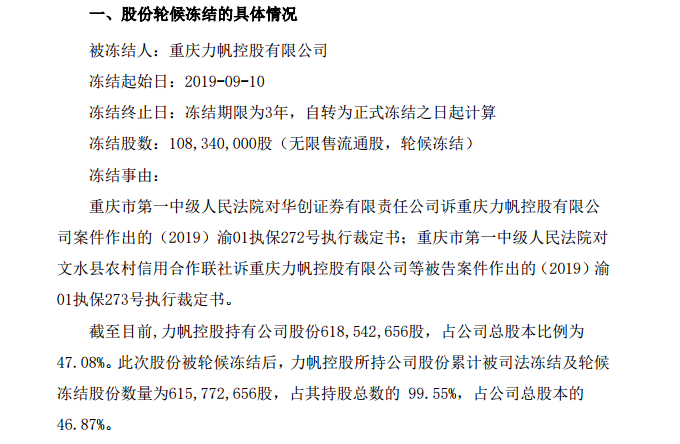

In September this year, Chongqing No. 1 Intermediate people's Court issued an order on the case of Huachuang Securities Co., Ltd. V. Chongqing Lifan holding Co., Ltd., and Chongqing No. 1 Intermediate people's Court on Wenshui County Rural Credit Cooperation Association v. Chongqing Lifan Holdings Co., Ltd., and other defendant cases.

The ruling said that from September 10, some of Lifan shares held by Lifan Holdings were frozen on the waiting list, with about 108 million shares frozen for a period of three years.

After the ruling, Lifan Holdings held 618542656 shares, accounting for 47.08 per cent of the company's total share capital. After the shares were frozen on the waiting list, the cumulative number of shares held by Lifan Holdings was judicially frozen and the number of shares frozen on the waiting list was 615772656, accounting for 99.55 per cent of its total shareholdings and 46.87 per cent of the company's total share capital.

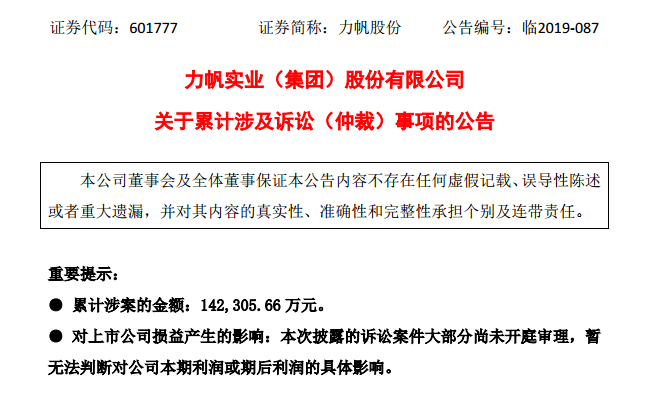

Before the two shares were frozen, Lifan shares had already been "entangled with lawsuits". It is understood that in July this year, the company (including subsidiaries) accumulated undisclosed matters involving litigation (arbitration) in the past 12 months totaling 1.423 billion yuan. In addition, according to incomplete statistics, the book balance of current liabilities of Lifan shares in 2018 is as high as 18.78 billion, while current assets are 13.429 billion in the same period.

Affected by many aspects, Lifan car sales are also difficult to look directly at. According to the data, from January to August, the company sold 21633 traditional passenger cars, down 68.94 percent from the same period last year, and 1675 new energy vehicles, down 66.12 percent from the same period last year. Sales of motorcycles were 405400, down 13.62% from the same period last year.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.