In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-21 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/28 Report--

Chery plans to introduce new investors into the mixed reform project by means of capital increase and share expansion. It is reported that during the listing pre-announcement period of Chery Automobile Capital Increase and Share Expansion Project, two interested parties (private placement) have paid 5 billion yuan of intention gold. According to Chery listing pre-announcement, paying earnest money has the competitive advantage of delisting.

Two intended investors are Tengxing Yangtze River Delta and Qingdao Wudaokou Fund. When there are two or more qualified investors, comprehensive evaluation will be adopted. Among them, the qualified intention party who pays 5 billion yuan earnest money will get 10 points in the comprehensive evaluation, which has the competitive advantage of delisting. At the same time, the comprehensive strength and financial strength of the investor, future development strategic planning, resource synergy ability, etc. will also be included in the evaluation.

According to Chery listing pre-announcement, unqualified intention investors will deduct 1 billion yuan from the earnest money as liquidated damages to Chery Holdings. This means that if the two private placements pay 5 billion yuan of intention, at least one private placement will face the risk of losing at least 1 billion yuan.

This is Chery's second capital increase. On September 25 last year, Chery Automobile announced the capital increase and share expansion project for the first time, but until December 20 of that year, the project failed to introduce suitable strategic investors, and finally, the project was forced to terminate by reaching the upper limit of 4 extensions.

According to Chery's "Strategy 2025" development plan, the enterprise will carry out a series of layouts in new products, new technologies, new energy, intelligent interconnection + driverless, brand building, high-end international market, etc. in the future. However, for the "four modernizations" transformation of automobiles, each of new energy, driverless and car networking is a research and development of "burning money".

However, Chery, whose capital situation is not ideal, has an asset-liability ratio much higher than the industry level, and Chery has to start capital increase and share expansion again. Data show that as of June this year, Chery Holdings lost 155 million yuan, market value assets of 90.417 billion yuan, but total liabilities reached 68.5 billion yuan, net assets less than 22 billion yuan; Chery Automobile lost 1.37 billion yuan, total assets 83.08 billion yuan, liabilities as high as 62.29 billion yuan, asset-liability ratio reached 75%.

Due to the loss of performance, Chery wants to list in China and has not reached the threshold, and the way to raise funds from the secondary market is blocked. Through the issuance of loans and corporate bonds, Chery's overall debt ratio in 2017 will be directly pushed up to 80%.

On September 2 this year, the capital increase and share expansion project was restarted. Compared with last year's projects, the total amount of funds raised by Chery Holdings and Chery Automobile decreased from no less than 8.33 billion yuan and 7.91 billion yuan respectively to no less than 7.53 billion yuan and 6.82 billion yuan today. On the basis of a total price reduction of nearly 1.9 billion yuan, new investors can still obtain the position of Chery Holdings 'largest shareholder, but the share ratio has been lowered from 31.4419% to 30.99%.

In eight months 'time, the reserve price for capital increase will be reduced by nearly $1.9 billion. It also shows Chery's demand for capital from the side, hoping to attract investors by lowering prices.

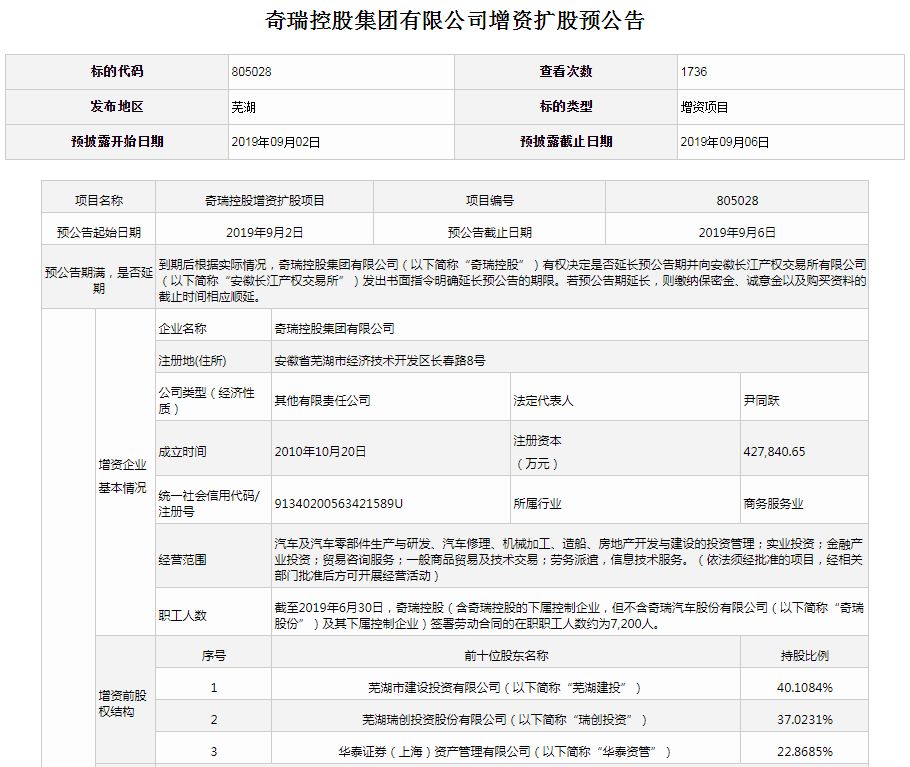

Public information shows that the shareholders of Chery Holdings and Chery shares are relatively stable. At present, the largest shareholder of Chery Holding Group is Wuhu Construction Investment. After the capital increase and share expansion is completed, the shareholding ratio of the capital party will be 30.99%, which will become the largest shareholder of Chery Holdings. Wuhu Construction Investment's shareholding ratio will drop from 40.11 to 27.68%, ranking second largest shareholder. Chery Holdings is still the largest shareholder of Chery shares, with a shareholding ratio of 32.48%. In the future, Wuhu capital will still dominate Chery.

As Chery's sales are recovering, Chery Automobile once again won the gold medal of the International Quality Management Conference (ICQCC), completing the triple crown, which will also help Chery slowly tide over the difficulties. According to the data, from January to August this year, Chery Group sold 439,000 cars accumulatively, with sales of independent brands increasing by 5.9% year-on-year; 65,200 cars were sold in August, with a month-on-month increase of 33.2% and a year-on-year increase of 5.4%. In the industry view, in order to optimize the allocation of state-owned assets in the region and promote the market-oriented transformation of the company, this mixed reform is an opportunity for Chery to lay out a new strategy for 22 years.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

June Automobile Complaints list

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.