In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/29 Report--

According to relevant media reports, South Korean Hyundai Motor will fully acquire Sichuan Hyundai by 2020, that is, it will have a 100% stake in Sichuan Hyundai, that is, it will complete the acquisition of all shares in China. If the acquisition is successful, Sichuan Hyundai will become the first wholly foreign-owned commercial vehicle company in China after the deregulation of stock ratio restrictions on foreign car companies.

It is understood that Sichuan Hyundai Automobile Co., Ltd. is a joint venture between China and South Korea, established in 2012 by Sichuan Nanjun Automobile Group Co., Ltd. and Hyundai Motor Co., Ltd. It only began formal operation in January 2013, and its business scope is the production, sales, service, research and development of commercial vehicles, engines and their accessories.

It was originally a 50% joint venture between Sichuan Nanjun Automobile Group Co., Ltd. and Hyundai Automotive Co., Ltd., South Korea. Sichuan Hyundai's business scope includes commercial vehicles, engines and their accessories, and has two major production bases, Ziyang truck Factory and Chengdu bus Factory. Previously, Sichuan Hyundai was the sales headquarters of Korean Hyundai Motor in China.

But in September 2018, media reported a change of equity in Sichuan Hyundai, in which Sichuan Energy Investment Group acquired a 50% stake in Sichuan Hyundai from Nanjun Automobile. In the end, however, the stake acquisition did not succeed.

On August 27 this year, Nanjun Automobile officially withdrew, and its Sichuan Ruiyu Real Estate Co., Ltd. raised its share ratio to 67.27% through capital injection, making it the largest shareholder of Sichuan Hyundai, while South Korea's Hyundai's share ratio in Sichuan Hyundai fell to 32.73%.

In fact, the issue of stock ratio has always been a sensitive topic between local and foreign companies in China's auto market. In 1994, the State Planning Commission issued regulations that Chinese shares in automotive Sino-foreign joint ventures should not be less than 50%.

Until April last year, the National Development and Reform Commission announced that restrictions on foreign equity ratios for special purpose vehicles and new energy vehicles would be lifted in 2018; restrictions on foreign equity ratios for commercial vehicles would be lifted in 2020; and restrictions on foreign equity ratios for passenger vehicles would be lifted in 2022. At the same time, the restrictions on no more than two joint ventures have been lifted. Through the five-year transition period, the automobile industry will completely abolish the restrictions on joint venture stock ratio.

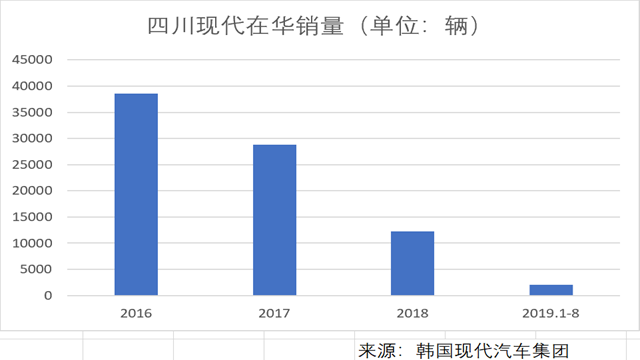

Hearing the news, Hyundai of South Korea made an acquisition plan. According to media reports, this wholly-owned scheme is related to the development difficulties of Sichuan Hyundai. In recent years, Sichuan Hyundai's sales and performance are not satisfactory, and it is difficult for both sides of the Sino-foreign joint venture to reach a consensus on a number of company operation plans. The successful acquisition of Chinese shares will help improve the efficiency of decision-making and respond to market changes more quickly.

According to data, Sichuan Hyundai sold 39600 vehicles in 2016, an increase of 33.7% over the same period last year. In 2017, Sichuan Hyundai increased its sales target to 45000 vehicles, but because of poor sales, Sichuan Hyundai lowered its sales target to 30, 000 in 2018.

With the lifting of the restrictions on joint venture rights issues, many car companies have followed suit. In October 2018, BMW bought a 25 per cent stake in brilliance for 3.6 billion euros, increasing its total stake from 50 per cent to 75 per cent, becoming a major shareholder in brilliance.

With the exception of BMW, international auto giants, including Volkswagen and Daimler, have signalled that they want to adjust the equity ratio of the joint venture. However, due to the interests of all parties involved, in the game of adjusting the stock ratio, there are no other car companies except BMW to achieve the stock ratio adjustment.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.