In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-23 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/01 Report--

Beijing time on October 1 U.S. stocks closed, Wei Lai (NIO) shares continued to fall, closing at $1.56 hit an all-time low, total market value of only $1.639 billion. NIO shares fell nearly 50% from about 3.04 at the closing price on September 20, and the total market value evaporated by more than $1.5 billion in ten days.

On September 13,2018, NIO Automobile was listed on the New York Stock Exchange, becoming the first Chinese electric vehicle to be listed in the United States, with stock code NIO. The issue price was set at US $6.26 per share and the total market value reached US $6.313 billion. After listing, Wei Lai's share price rose sharply, reaching a maximum of $13.8 per share.

However, within a year of listing, NIO suffered a nightmare. Affected by weak demand, intensified market competition, earnings losses, product recalls, layoffs and other factors, NIO's share price continued to fall, and the new car-making startup ushered in the darkest moment.

Robin Zhu, an analyst at Bernstein, recently lowered his target price for NIO by nearly 50% to 90 cents.

According to NYSE rules, the average closing price of a listed company's stock must be at least $1 in any period of 30 consecutive trading days. If the stock price falls below $1 for 30 consecutive trading days, it fails to meet the NYSE listing criteria and will suspend trading and delist.

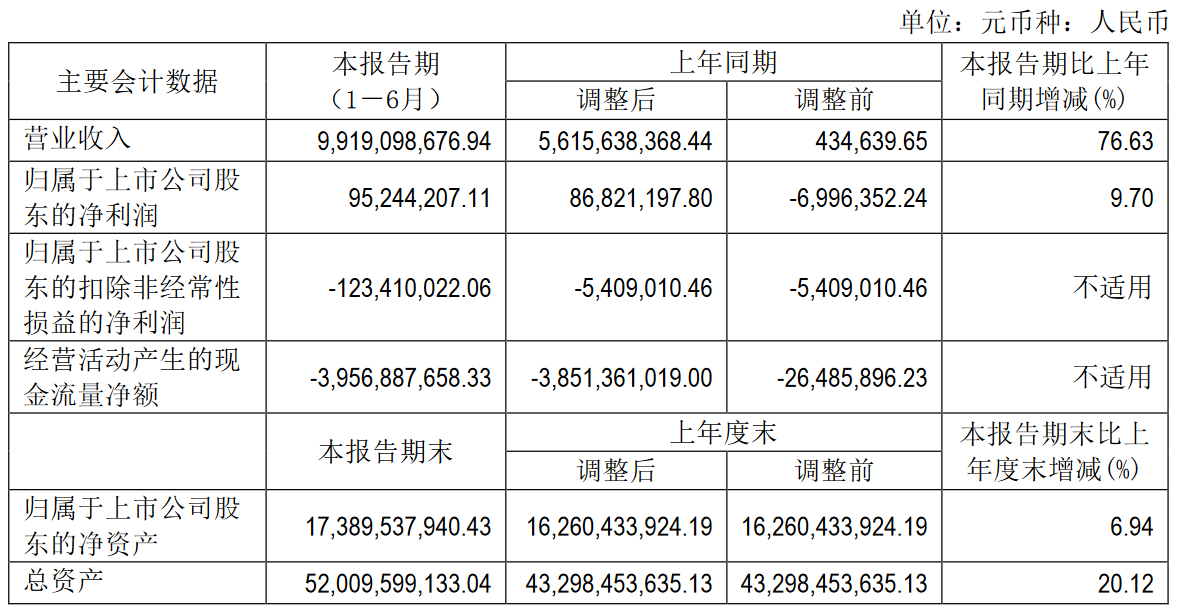

On September 24, NIO announced its second-quarter earnings report. In the second quarter of 2019, NIO Automobile's net loss attributable to shareholders was 3.285 billion yuan, higher than market expectations. Immediately, Wei Lai announced the cancellation of the conference call after the earnings report. According to media statistics, from 2016 to the first half of 2019, the accumulated loss amount of NIO Automobile exceeded RMB 40 billion yuan.

On September 25, NIO suddenly announced a conference call. CEO Li Bin clarified in the conference call that considering dividends and other factors, the actual loss in the past four years was only about RMB 22 billion, of which RMB 10 billion was R & D expenditure.

NIO, which has always been "burning money," expanded wildly at the beginning of its establishment, with the total number of employees approaching 10,000 at its peak. With the decline of market demand, market changes, product quality recall, stock price decline and other factors, NIO has to reduce its scale.

Xie Dongying, chief financial officer of NIO Automobile, said that NIO has begun to implement comprehensive cost reduction measures throughout the company, including layoffs and divestiture of non-core businesses; in terms of sales, it improves the cost-effectiveness of sales network construction by building Nio Space with partners. NIO will continue to lay off employees this year, and the number of employees will be reduced to more than 7000.

NIO Automobile started financing in 2015 and obtained financing from large consortia including Tencent, Jingdong, Baidu and Hillhouse Capital. So far, it has obtained 9 financing times. Among them, Series D financing in 2017 will reach US $1 billion.

NIO's "crazy burning money" mode makes its capital pressure more and more, but now with the upsurge receding, policy changes, capital environment has also undergone great changes, investors for Internet car investment projects become extremely cautious, NIO financing difficulties.

At the beginning of September, NIO Automobile announced that the company had reached a convertible bond subscription agreement with Li Bin and Tencent Holding Company subsidiaries, and NIO Automobile would issue and sell convertible bonds with a total principal amount of US $200 million to Li Bin and Tencent through private placement.

Some analysts said that even if CEO Li Bin and shareholder Tencent Holdings continue to inject new funds into NIO, the funds may only last for a few weeks.

Qin Lihong, co-founder of NIO, said in August that the company still needs $3 billion (about 21.4 billion yuan), which is to reserve food for the next generation of products, layout and technology. As of the second quarter of this year, NIO held only 3.455 billion yuan in cash, cash equivalents, restricted cash and short-term investments.

Li Bin believes that from October, NIO will start to deliver ES6 and ES8 equipped with 84 kWh battery pack, and the comprehensive driving range of vehicles will be increased to 510 km and 430 km respectively, so as to strengthen product competitiveness through technological progress and continuously improve sales.

The cold winter of the new car enterprise, did not expect to come so block. As China's first new energy luxury brand, whether NIO Automobile can turn losses into profits in a short time will determine its fate.

The development direction of NIO basically represents the development of China's Internet car-making group. As subsidies have fallen sharply, many enterprises that rely on subsidies to survive have begun to be eliminated, while most brands are still in the "PPT" stage, and mass production delivery is far away. It can be expected that only more than a year after mass production delivery, Internet car-making has entered the life-and-death knockout competition.

On the evening of October 1, NIO shares hit a new low of $1.34 per share in intraday trading.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.