In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/06 Report--

Under the cold winter of the car market, both automobile companies and car dealers are faced with great challenges, and even the huge group of car dealers in the past is shrouded in the news of closure. According to data released by the China Automobile Circulation Association, in September 2019, the inventory early warning index of car dealers was 58.6%, and the inventory early warning index was already above the warning line.

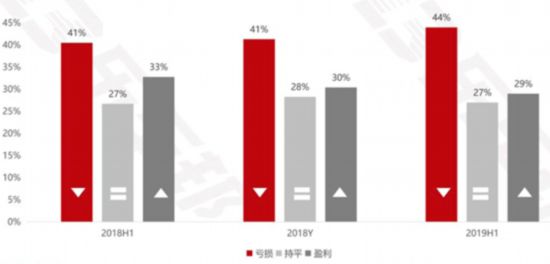

A few days ago, some media released a report on the Operation of Automobile Dealers in China in 2019, which showed that 44% of the car dealers across the country were losing money in the first half of 2019, while the proportion of profitable dealers was only 29%, with a total of less than 9000. It is understood that a total of 2410 valid samples were collected from 82 brands and 320 cities.

Affected by the overall market economy and the environment, the industry has not only experienced the first decline in 28 years, but also the downward trend has not improved. According to the China Association of Automobile Manufacturers, car sales in August were 1.96 million, down 6.9% from the same period last year, and 11% in the first August of this year. So far, sales in the domestic passenger car market have declined for 13 consecutive months.

However, according to the report, in this environment, brands are seriously divided, luxury brands are growing against the trend, Japanese and German brands are still in the lead, legal systems are marginalized, and American, Korean and independent brands are squeezed.

In terms of specific brands, among the first-tier luxury brands, Mercedes-Benz dealers accounted for 67% of the profits, but there was a 3% decline compared with the previous year. BMW brand sales continued to grow in the first half of the year, with profitable dealers accounting for 44%. Audi accounted for 38% of profitable dealers. It hasn't changed much compared with last year.

Lexus accounted for the highest proportion of profits among second-tier brands, with profitable dealers accounting for 79%, even more than first-tier brands. Cadillac, as the second-tier first last year, increased vehicle discounts as a result of a number of products approaching replacement, but 37% of dealers accounted for a decline compared with last year; thanks to a large number of brand concessions, Volvo accounted for 56% of profits. Jaguar Land Rover has ups and downs in luxury brands, with 1/3 of its stores operating at a loss; Infiniti and imported Volkswagen also have more than 40% of their dealers in the loss range.

Among the joint venture brands, there is obvious serious differentiation, with the highest profit proportion of Japanese brands, in which Toyota brand profit distribution accounts for more than 70%, Honda brand profit dealers account for 60%, and Nissan dropped to 33% compared with the same period last year. Followed by German brands FAW-Volkswagen and SAIC-Volkswagen, 45% and 39% respectively; Korean brand losses improved, Beijing Hyundai 42%, Kia 55% The loss of Buick dealers in the United States increased to 52% compared with the same period last year; Changan Ford lost 61%; French brands that continued to lose money accounted for more than 70%. In the first half of the year, Peugeot, DS, Citroen and Renault all withdrew some dealers and closed their stores.

Among independent brands, squeezed by joint venture brands, nearly 60% of dealers lost money. In the first half of the year, only Harvard, Geely, Lecker, Red Flag and BYD made better profits, such as Baojun, Wuling, Roewe, Changan, WEY, BAIC, Dongfeng, Chery and other independent brands, all with losses of more than 50 per cent.

Although it is about to enter the golden age of "Golden Nine and Silver Ten", according to the first three weeks of data released by the Federation, sales still fell sharply in September this year. Average daily sales are down 17% from last year, and the absolute number of vehicles in September will fall by 500000 compared with 2017.

In recent years, China's automobile market is gradually changing from an incremental market to a stock market. This means that the period of rapid growth has passed, and in the future, we can only carry out micro-incremental development on the basis of high stock, differentiation will continue, brands will also face a life-and-death test, and more than 2/3 of car companies are expected to be eliminated.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.