In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/11 Report--

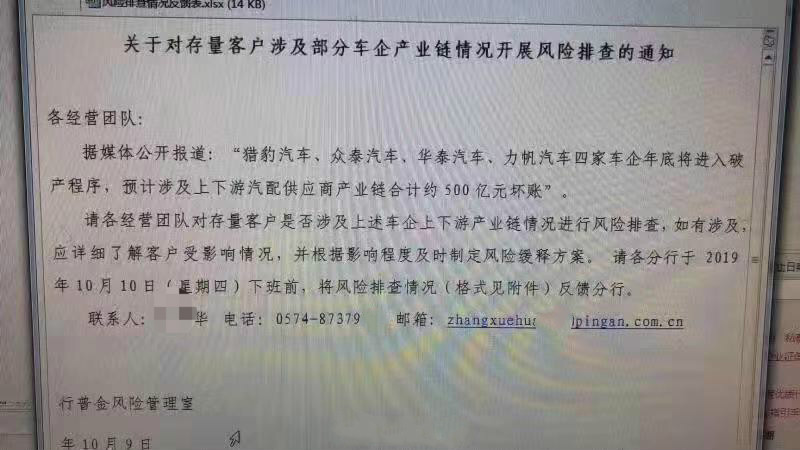

A few days ago, an e-mail examining the risk of bankruptcy circulated on the Internet, which said that according to media reports: Cheetah, Zhongtai, Huatai and Lifan will enter bankruptcy proceedings at the end of the year, and it is estimated that the industrial chain of upstream and downstream auto parts suppliers will have a total of about 50 billion yuan of bad debts.

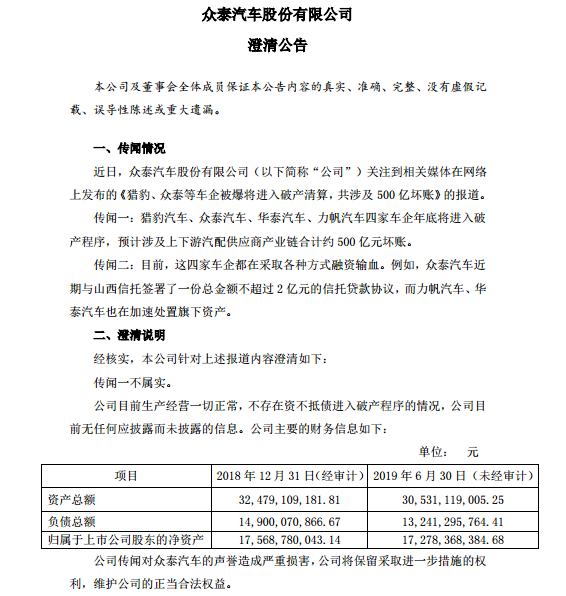

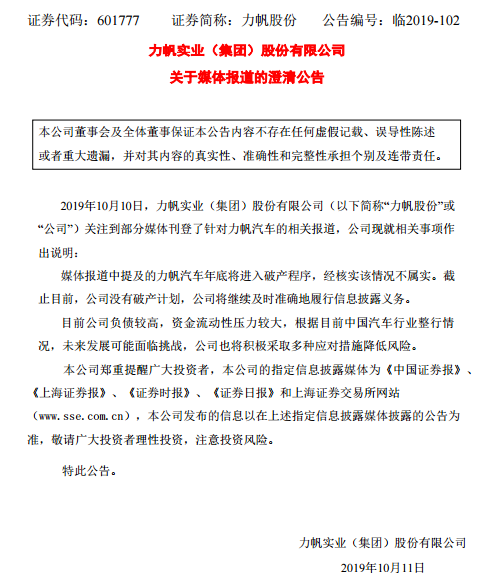

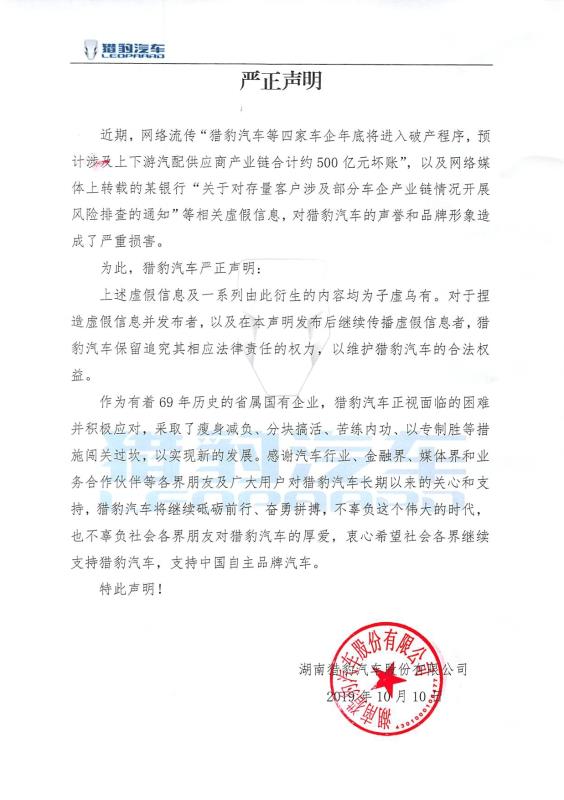

For this news, Zhongtai Motor, Lifan Motor and Cheetah Motor have all responded to bankruptcy rumors.

Zhongtai Automobile issued a clarification notice saying that at present, everything is normal in the company's production and operation, and that there is no case of insolvency going into bankruptcy proceedings, and that the relevant rumors have caused serious reputational damage to the company, and the company will reserve the right to take further measures to safeguard the legitimate interests of the company.

Lifan Motor issued a clarification notice saying that the report is not true, there is no bankruptcy plan, the company has high debt and capital liquidity pressure, according to the current overall situation of China's automobile industry, the future development may face challenges, the company will also actively take a variety of measures to reduce risks.

Cheetah also issued an official statement today, saying that Cheetah is actively dealing with the difficulties it is facing and has taken a variety of measures to deal with them.

It is worth noting that three days after the bankruptcy rumors emerged, the above three car companies all issued clarification announcements, but Huatai Motor did not mention it. Is it true that Huatai Motor is really facing bankruptcy?

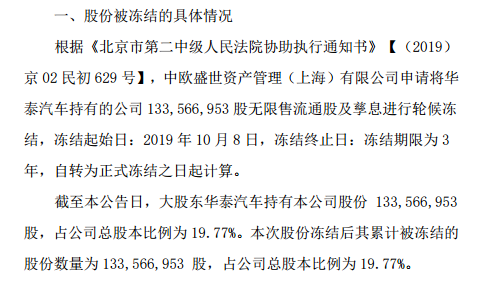

According to the official website of Liaoning Shuguang Automobile Group Co., Ltd., China Europe Shengshi Asset Management Co., Ltd. applied to freeze the dividend of about 134 million of Huatai Automobile, a major shareholder, for a period of three years. This means that Huatai Motor's stake in dawning Group will be judicially frozen.

According to the investigation, this is not the first time that dawning shares held by Huatai Motor have been frozen.

On May 31st, according to the property preservation application and relevant laws filed by the applicant Rongcheng forging Machine tool Co., Ltd., the Rongcheng people's Court froze 20 million yuan of shares in Liaoning Shuguang Automobile Group Co., Ltd. held by the preserved Huatai Automobile Group for a freeze period of three years.

On August 29th, Kyushu Securities Co., Ltd. applied to freeze the unlimited sale and return of 130 million shares held by Huatai Motor for a period of three years.

On September 27th, Changjiang Securities (Shanghai) Asset Management Co., Ltd. applied for a three-year freeze on the unlimited sale and circulation of 130 million shares held by Huatai Motor and its earnings due to a bond trading dispute.

It is worth noting that the day before Huatai Motor's dawning stake was frozen, dawning announced that Gao Huien, the company's chairman, had resigned for personal reasons and would no longer hold any position at dawning.

Judging from the development of the past year, the current situation of dawning is hardly optimistic. On September 25, the Shanghai Stock Exchange issued an inquiry letter to dawning, asking for an explanation on the company's operation and assets and liabilities, but so far there has been no reply.

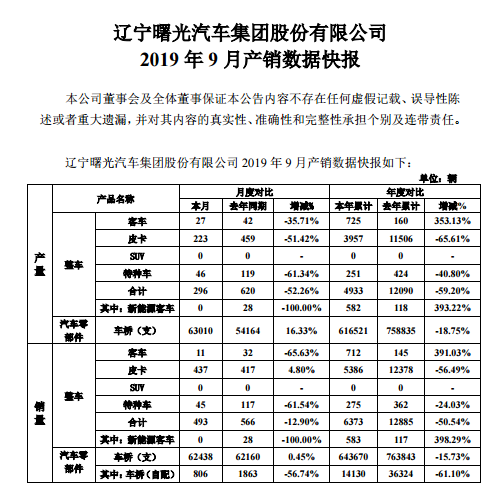

According to the latest data, dawning's production and sales in September were 296 and 493 respectively, down 52.26% and 12.9% from a year earlier to 4933 and 6375 from January to September, down 59.2% and 50.54% from a year earlier. In addition, the operating income of dawning shares in the first half of this year was about 1.142 billion yuan, down about 32.82% from the same period last year; the net profit attributed to the parent company was about 90.5205 million yuan, down about 631.83% from the same period last year.

The freezing of Huatai's dawning stake is actually only a small part of Huatai's debt, more due to the burden of litigation, unpaid wages and factory shutdowns.

It is understood that since last year, Huatai Automobile has been exposed that employees are in arrears with the news, and even internal employees on the Internet posted a "Huatai Automobile employees arrears of wages to help the letter."

Almost a year has passed, Huatai Motor's arrears of wages to employees are still not resolved, not only arrears of wages for on-the-job employees, but also wages for outgoing employees are not paid.

Now Huatai's plight is much more serious than Lifan, Cheetah and Zhongtai. With regard to the revelation of bankruptcy at the end of the year, internal employees said that they did not know the details of the internal affairs of the company. But at present, it is only a matter of time before Huatai Motor goes into bankruptcy liquidation. Huatai Motor has not made a profit for two years, and at present there is no distributor in Beijing. In addition, the factory has stopped production, employees have owed wages, and there are hundreds of lawsuits. The debt ratio is so high that it is almost impossible to raise money in this case.

All bank deposits under Huatai Automobile Group add up to only 132239 yuan, and there is no other property available for execution. Huatai Automobile, together with several subsidiaries, is listed as a breach of trust executor.

According to financial data, Huatai Motor's net cash flow in 2018 is 2.06 billion yuan, the balance of cash and equivalents at the end of the period is 2.9 billion yuan, current liabilities are 26.04 billion yuan, total liabilities are 37.566 billion yuan.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.