In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/13 Report--

Entering the cold winter of the domestic automobile market, it is not surprising that companies have laid off staff, idle production capacity, declining sales and profits and losses. It is in this environment that an email checking the risk of bankruptcy circulated on the Internet a few days ago, causing an uproar in public opinion.

An email suspected of coming from Ping an Bank said: Cheetah, Zhongtai, Huatai and Lifan will enter bankruptcy proceedings at the end of the year, and it is expected that the industrial chain of upstream and downstream auto parts suppliers will have a total of about 50 billion yuan of bad debts. The management team needs to conduct a risk check on whether the stock customers are involved in the upstream and downstream industrial chains of the four auto companies.

As soon as the news came out, it attracted the attention of the media and netizens. According to the current operation of the four auto companies, most netizens feel that bankruptcy is not unreasonable.

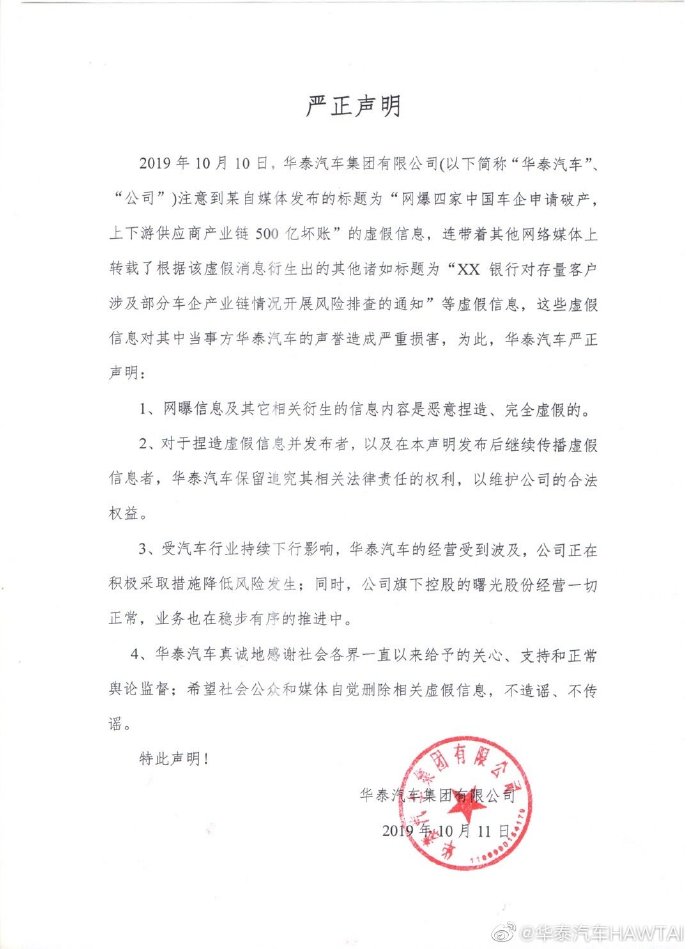

Following three car companies, Huatai Motor also officially issued a statement. Huatai Motors said that the bankruptcy information and content is maliciously fabricated and completely false. Huatai Motor also said that the company is actively taking measures to reduce risks, at the same time, the company's holding dawning shares are operating normally, the business is also in progress.

In fact, although Huatai Motor issued a relevant statement to clarify the bankruptcy rumors, it can not cover up Huatai Motor's current operating difficulties.

Huatai Motors is in an extremely serious situation. At present, Huatai Motor's three major factories have stopped production, due to poor management led to a sharp decline in the number of employees, from thousands of people now only a few dozen, and arrears of wages for on-the-job and former employees. In addition, it faces hundreds of lawsuits in which Huatai Motor, along with several subsidiaries, is listed as an executor of bad faith.

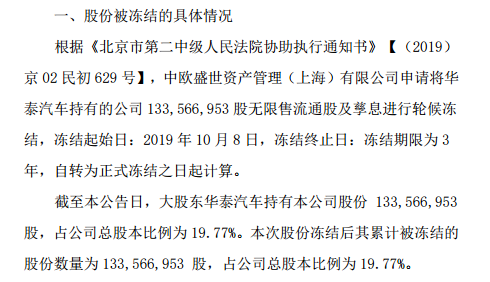

It is worth noting that Huatai Motor announced in the announcement that the operation of its dawning shares is normal, but according to the latest announcement issued by dawning shares on October 9, all shares held by Huatai Motor, the company's major shareholder, have been judicially frozen. Huatai Motor holds 134 million dawning shares, accounting for 19.77% of the company's total share capital. The shares held by Huatai Motor have been frozen many times. Kyushu Securities and LinkedIn Management have all applied to freeze the unlimited sale of 134 million shares held by Huatai Motors and their dividends. On September 27, Changjiang Securities (Shanghai) Asset Management Co., Ltd. made the same application.

Moreover, according to the development of the past year, the current situation of dawning shares is hardly optimistic. On September 25, the Shanghai Stock Exchange issued an inquiry letter to dawning shares, asking for an explanation on the company's operation and assets and liabilities, but so far there has been no reply.

According to the latest data, dawning's production and sales in September were 296 and 493 respectively, down 52.26% and 12.9% from a year earlier to 4933 and 6375 from January to September, down 59.2% and 50.54% from a year earlier. In addition, the operating income of dawning shares in the first half of this year was about 1.142 billion yuan, down about 32.82% from the same period last year; the net profit attributed to the parent company was about 90.5205 million yuan, down about 631.83% from the same period last year.

According to the China Automobile Association, total domestic car sales were 28.08 million in 2018 and 28.88 million in 2017, the first decline in China's auto market since 1990.

At present, China's automobile market is in a downward stage, resulting in a decline in car sales, coupled with the gradual increase in the market share of new energy vehicles, and car companies with backward technology and lack of technology are also gradually marginalized.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.