In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/13 Report--

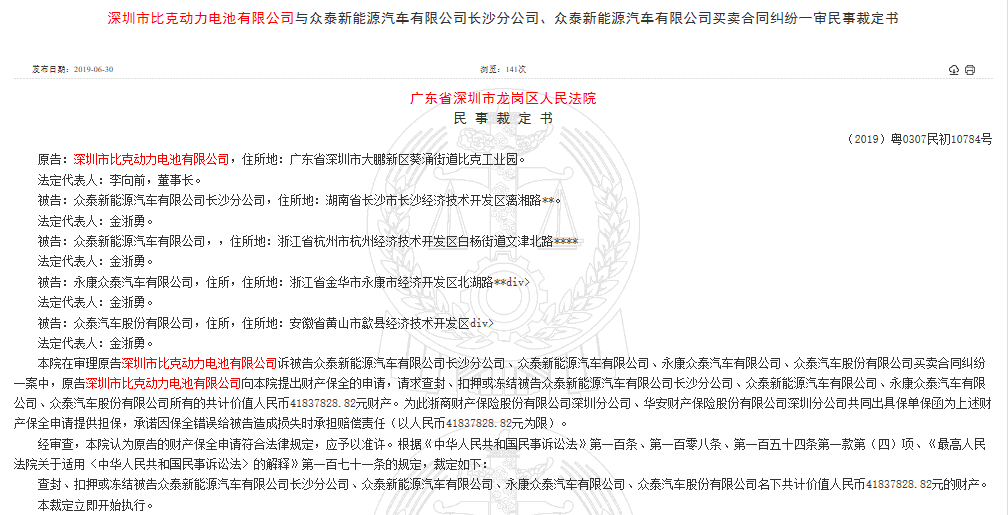

Shenzhen Longgang District people's Court is hearing a dispute over the trading contract between Shenzhen Bic Battery Co., Ltd. and Zhongtai New Energy Automobile Co., Ltd. Changsha Branch and Zhongtai New Energy Automobile Co., Ltd., according to relevant media reports citing people familiar with the matter.

According to people familiar with the matter, Zhongtai Motors eventually appealed to the people's Court of Longgang District of Shenzhen City for defaulting hundreds of millions of yuan on Bic battery, asking Zhongtai Motor to freeze 40 million yuan of property.

According to a civil order on June 11, the plaintiff Bic Battery filed an application for property preservation with the Shenzhen still-named Court, requesting to seal up, detain or freeze the property owned by the defendant Zhongtai New Energy Automobile Co., Ltd., Changsha Branch, Zhongtai New Energy Automobile Co., Ltd., Yongkang Zhongtai Automobile Co., Ltd., Zhongtai Automobile Co., Ltd., with a total value of 41837828.82 yuan.

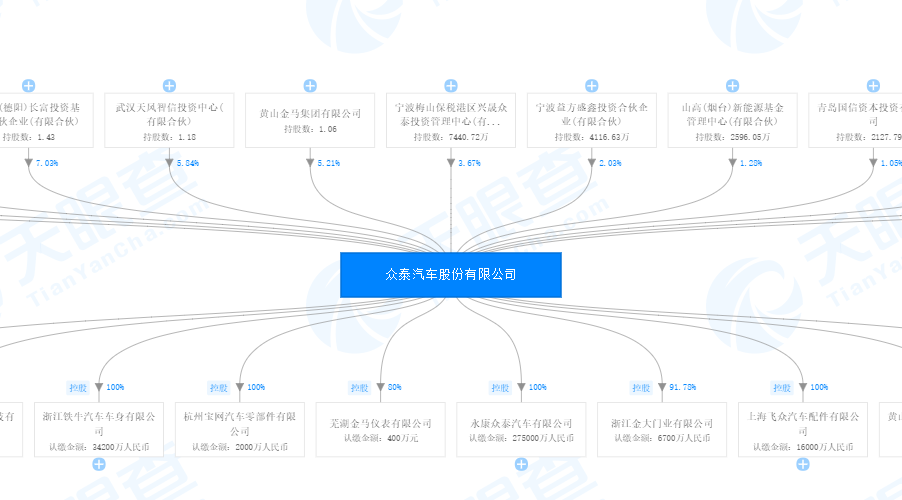

It is understood that Zhongtai Automobile was established in August 1998, and Tieniu Group Co., Ltd. is its largest shareholder, holding 38.78%. In 2008, Zhongtai began to get involved in the research, development, production and sales of new energy vehicles. In March 2011, Zhongtai New Energy vehicle Co., Ltd. was registered in Hangzhou, which is 100% controlled by Yongkang Zhongtai Automobile Co., Ltd.

Bick Battery, founded in 2001, started with 3C batteries and was once a battery supplier to Hewlett-Packard, Dell and other notebook manufacturers. In 2008, Bick batteries began to enter the field of new energy vehicles; in 2014, Bick batteries began to provide new energy vehicle batteries for Zhongtai Automobile, accounting for more than 50% of Zhongtai Automobile's total production.

It is worth noting that on October 8, Ping an Bank released an email saying that Zhongtai Motor would enter bankruptcy proceedings at the end of the year. This news had a great impact on Zhongtai Automobile. Two days later, Zhongtai Automobile issued a clarification announcement denying bankruptcy and said it had reported the case to the public security department.

Although Zhongtai Motor issued a statement denying bankruptcy, the current situation is also fraught with crisis. It is learned from Tianyan that there are legal disputes between Zhongtai Automobile and a number of auto parts suppliers, and a number of suppliers apply to the court for property preservation of different amounts.

Up to now, Zhongtai Motor has a total of 61 referee documents. They include Ningbo Yongxin Automobile parts Manufacturing Co., Ltd., Shenzhen Bic Power Battery Co., Ltd., and Jiaxing Tianxin Electric Wire Co., Ltd., these three enterprises applied to the court this year to seize, seize or freeze the assets of Zhongtai and its subordinate companies, involving about 44.685 million yuan.

Although Zhongtai Motor denies bankruptcy, judging from its current operating conditions, Zhongtai Motor is in a worrying situation.

Data show that Zhongtai Motor sold a total of 63800 vehicles in the first half of the year, down 44.5 per cent from the same period last year. In the first half of the year, Zhongtai Automobile completed sales revenue of 5.04 billion yuan, down 50.83% from the same period last year, and a loss of 290 million yuan, down 195.37% from the same period last year.

It is understood that after the backdoor listing of Zhongtai Automobile in 2017, Tieniu became the largest shareholder of the company. However, as Tieniu Group failed to fulfill its previous performance bet promise, Zhongtai Automobile Board of Directors has approved a plan to buy back 468 million shares held by Tieniu Group at a total price of 1 yuan and cancel them.

According to data, 647 million shares of Zhongtai Motor held by Tieniu Group were pledged, accounting for 82.4% of all shares. Before the repurchase cancellation, Tieniu Group must first unpledge the pledged shares.

In addition, Zhongtai Motor also defaulted on employees' wages and dealer payments. In early August 2019, there were more than 100 dealers protecting their rights at Junma Motor, a subsidiary of Zhongtai Automobile. More than 100 Junma car dealers gathered at Zhongtai Automobile headquarters in Yongkang, Zhejiang Province to safeguard their rights, proposing that Zhongtai Automobile should guarantee the supply of Junma auto parts, after-sale and refund of account balances, and fulfill the subsidies and deposits promised to dealers.

Zhongtai founded Junma Motor in 2017, but it is also in trouble because of low sales. Recently, it has been reported that Sany will buy Junma Motor, and then the relevant person in charge of Sany heavy Industry denied the acquisition of Zhongtai's Junma Motor.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.